Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With respect to exchange rates, which of the following statements is true? O a. A floating exchange rate is the market rate resulting from the

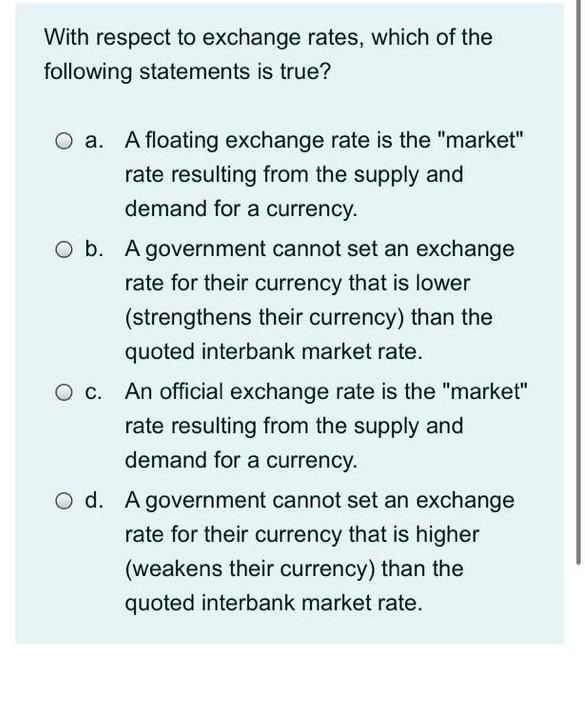

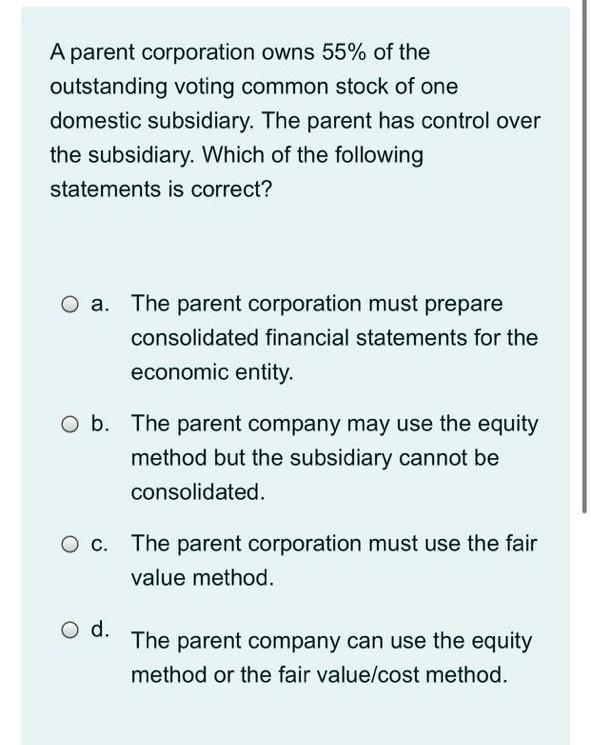

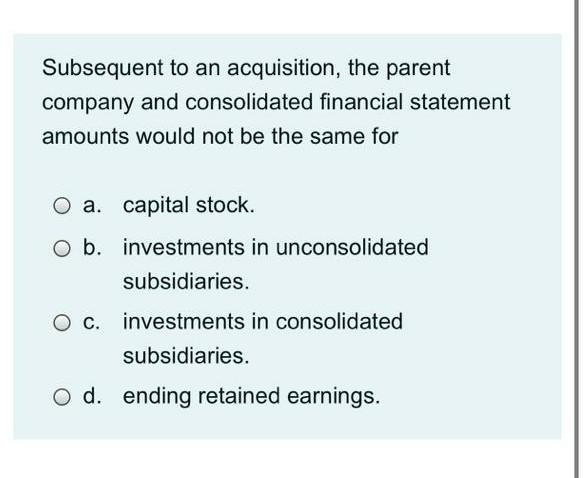

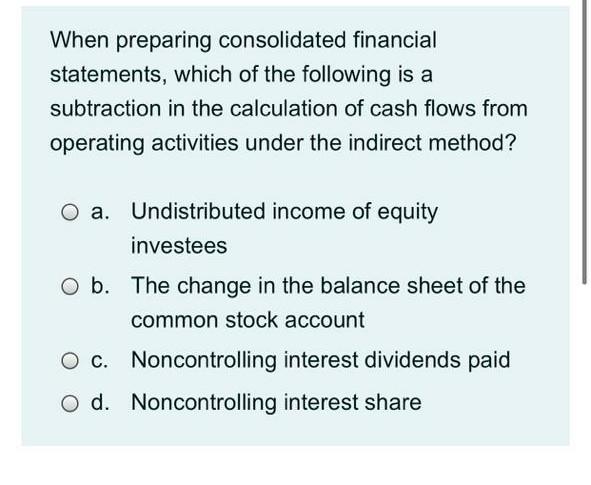

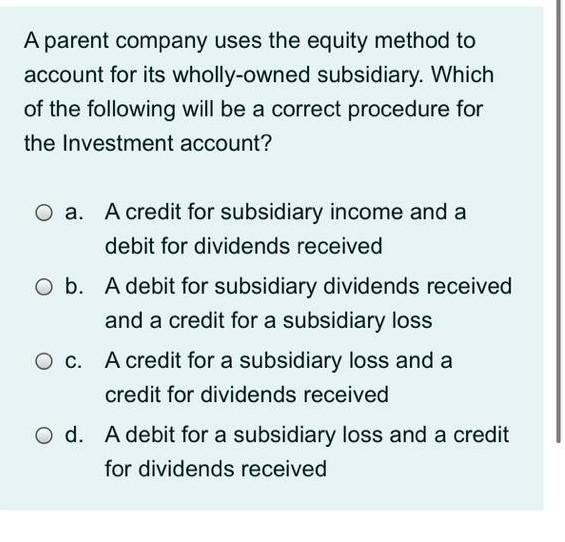

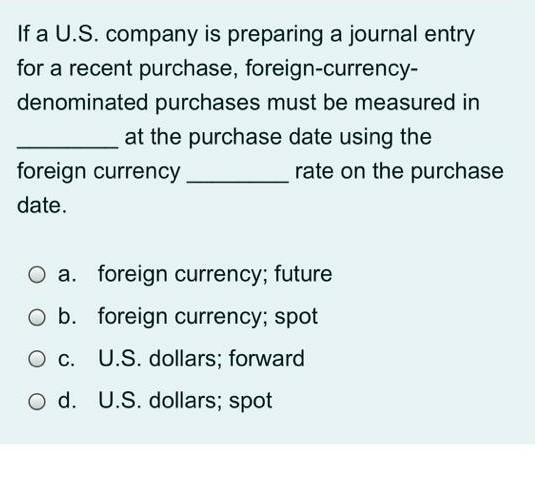

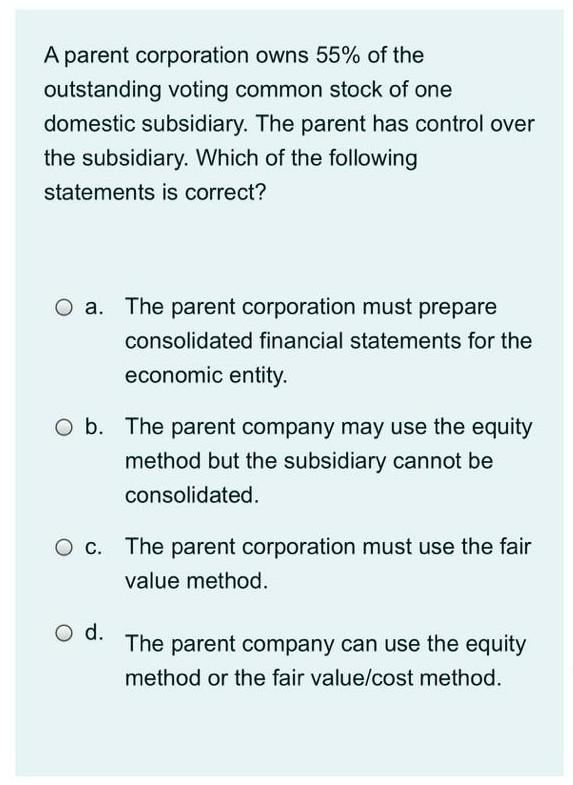

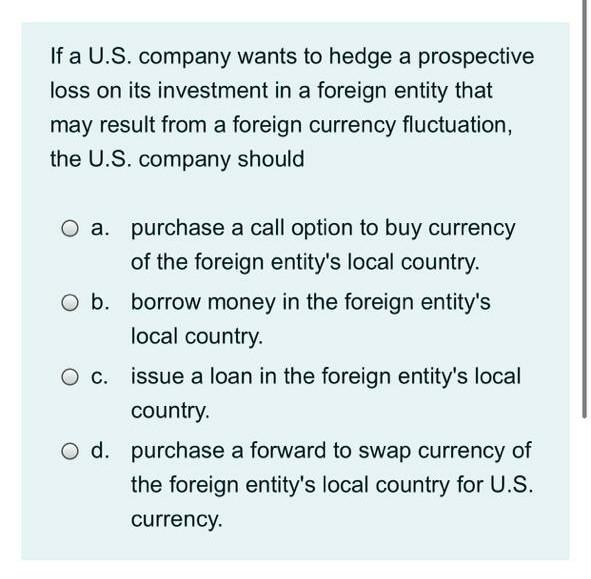

With respect to exchange rates, which of the following statements is true? O a. A floating exchange rate is the "market" rate resulting from the supply and demand for a currency. O b. A government cannot set an exchange rate for their currency that is lower (strengthens their currency) than the quoted interbank market rate. O c. An official exchange rate is the "market" rate resulting from the supply and demand for a currency. Od. A government cannot set an exchange rate for their currency that is higher (weakens their currency) than the quoted interbank market rate. A parent corporation owns 55% of the outstanding voting common stock of one domestic subsidiary. The parent has control over the subsidiary. Which of the following statements is correct? a. The parent corporation must prepare consolidated financial statements for the economic entity. O b. The parent company may use the equity method but the subsidiary cannot be consolidated. O c. The parent corporation must use the fair value method. O d. The parent company can use the equity method or the fair value/cost method. Subsequent to an acquisition, the parent company and consolidated financial statement amounts would not be the same for O a. capital stock. O b. investments in unconsolidated subsidiaries. O c. investments in consolidated subsidiaries. O d. ending retained earnings. When preparing consolidated financial statements, which of the following is a subtraction in the calculation of cash flows from operating activities under the indirect method? O a. Undistributed income of equity investees O b. The change in the balance sheet of the common stock account O c. Noncontrolling interest dividends paid O d. Noncontrolling interest share A parent company uses the equity method to account for its wholly-owned subsidiary. Which of the following will be a correct procedure for the Investment account? O a. A credit for subsidiary income and a debit for dividends received O b. A debit for subsidiary dividends received and a credit for a subsidiary loss O c. A credit for a subsidiary loss and a credit for dividends received O d. A debit for a subsidiary loss and a credit for dividends received If a U.S. company is preparing a journal entry for a recent purchase, foreign-currency- denominated purchases must be measured in at the purchase date using the foreign currency rate on the purchase date. O a. foreign currency; future O b. foreign currency; spot O c. U.S. dollars; forward O d. U.S. dollars; spot A parent corporation owns 55% of the outstanding voting common stock of one domestic subsidiary. The parent has control over the subsidiary. Which of the following statements is correct? The parent corporation must prepare consolidated financial statements for the economic entity. O b. The parent company may use the equity method but the subsidiary cannot be consolidated. The parent corporation must use the fair value method. O d. The parent company can use the equity method or the fair value/cost method. If a U.S. company wants to hedge a prospective loss on its investment in a foreign entity that may result from a foreign currency fluctuation, the U.S. company should O a. purchase a call option to buy currency of the foreign entity's local country. O b. borrow money in the foreign entity's local country O c. issue a loan in the foreign entity's local country. O d. purchase a forward to swap currency of the foreign entity's local country for U.S. currency

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started