Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with solutions Life Cycle of a Deferred Tax Item Black Kitty Company recorded certain revenues of $10,000 and $20,000 on its books in 2017 and

with solutions

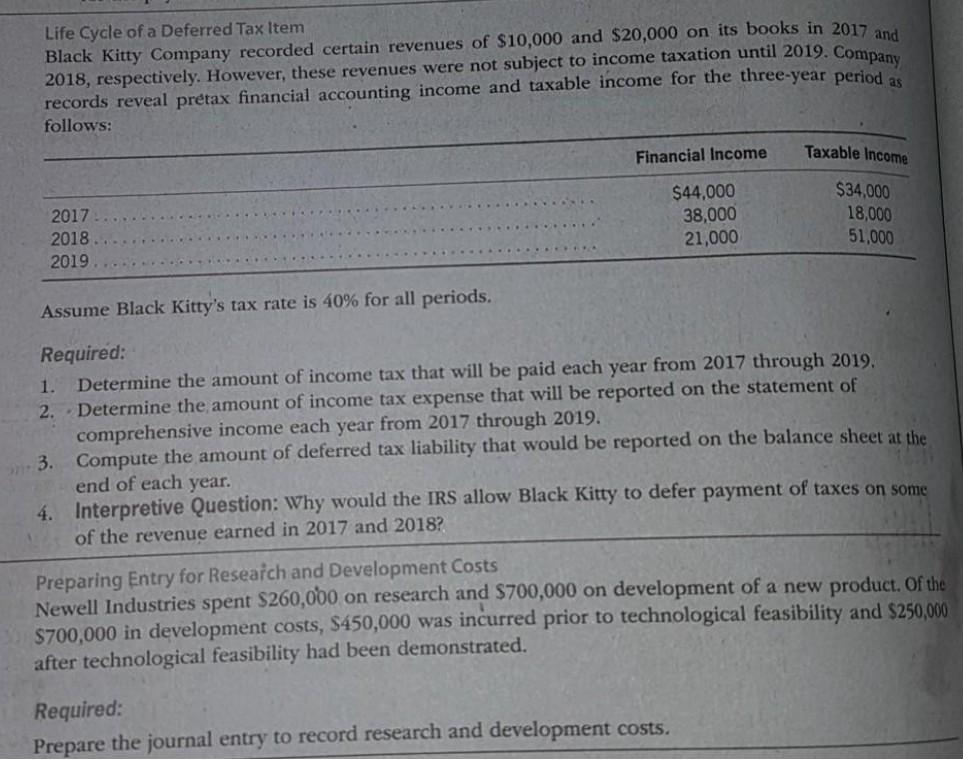

Life Cycle of a Deferred Tax Item Black Kitty Company recorded certain revenues of $10,000 and $20,000 on its books in 2017 and 2018, respectively. However, these revenues were not subject to income taxation until 2019. Company records reveal pretax financial accounting income and taxable income for the three-year period as follows: Financial Income Taxable income 2017 2018 2019 $44,000 38,000 21,000 $34,000 18,000 51,000 Assume Black Kitty's tax rate is 40% for all periods. 3. Required: 1. Determine the amount of income tax that will be paid each year from 2017 through 2019. 2. Determine the amount of income tax expense that will be reported on the statement of comprehensive income each year from 2017 through 2019. Compute the amount of deferred tax liability that would be reported on the balance sheet at the end of each year. 4. Interpretive Question: Why would the IRS allow Black Kitty to defer payment of taxes on some of the revenue earned in 2017 and 2018? Preparing Entry for Research and Development Costs Newell Industries spent $260,000 on research and $700,000 on development of a new product. Of the $700,000 in development costs, $450,000 was incurred prior to technological feasibility and $250,000 after technological feasibility had been demonstrated. Required: Prepare the journal entry to record research and development costsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started