Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with solutions Panys Calculating and Commenting on Asset Turnover Champagne Ltd. and Ardenne Ltd., two corporations of roughly the same size, are both involved in

with solutions

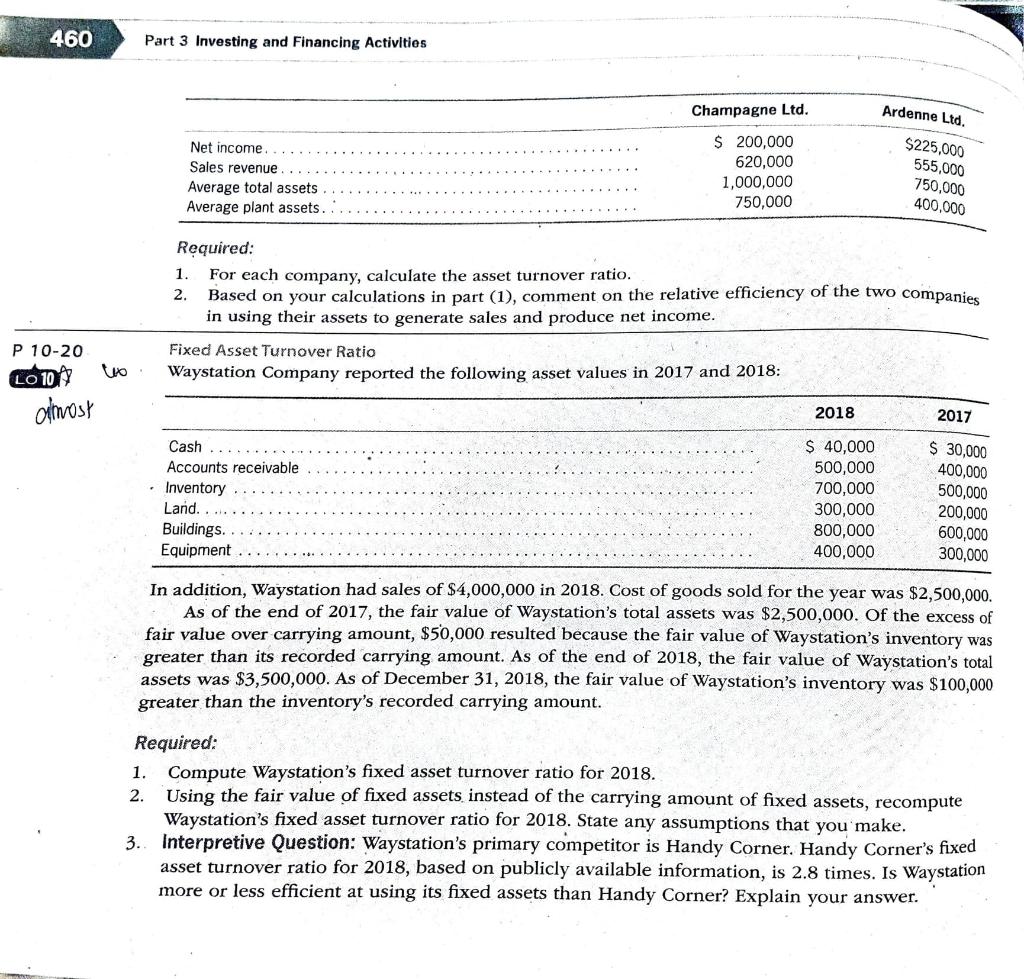

Panys Calculating and Commenting on Asset Turnover Champagne Ltd. and Ardenne Ltd., two corporations of roughly the same size, are both involved in the manufacture of in-line skates. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the following information. 460 Part 3 Investing and Financing Activities Champagne Ltd. Ardenne Ltd. Net income Sales revenue Average total assets Average plant assets. $ 200,000 620,000 1,000,000 750,000 $225,000 555,000 750,000 400,000 1 2. Required: For each company, calculate the asset turnover ratio. Based on your calculations in part (1), comment on the relative efficiency of the two companies in using their assets to generate sales and produce net income. Fixed Asset Turnover Ratio Waystation Company reported the following asset values in 2017 and 2018: P 10-20 wo LODY almost 2018 2017 Cash Accounts receivable Inventory Land. $ 40,000 500,000 700,000 300,000 800,000 400,000 $ 30,000 400,000 500,000 200,000 600,000 300,000 Buildings. Equipment In addition, Waystation had sales of $4,000,000 in 2018. Cost of goods sold for the year was $2,500,000. As of the end of 2017, the fair value of Waystation's total assets was $2,500,000. Of the excess of fair value over carrying amount, $50,000 resulted because the fair value of Waystation's inventory was greater than its recorded carrying amount. As of the end of 2018, the fair value of Waystation's total assets was $3,500,000. As of December 31, 2018, the fair value of Waystation's inventory was $100,000 greater than the inventory's recorded carrying amount. Required: 1. Compute Waystation's fixed asset turnover ratio for 2018. 2. Using the fair value of fixed assets instead of the carrying amount of fixed assets, recompute Waystation's fixed asset turnover ratio for 2018. State any assumptions that you make. 3. Interpretive Question: Waystation's primary competitor is Handy Corner. Handy Corner's fixed asset turnover ratio for 2018, based on publicly available information, is 2.8 times. Is Waystation more or less efficient at using its fixed assets than Handy Corner? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started