Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with solutions please 55) Moving from one souree of funding to another in a particular order is called the c) Pecking Order Hypothesis. B) Funding

with solutions please

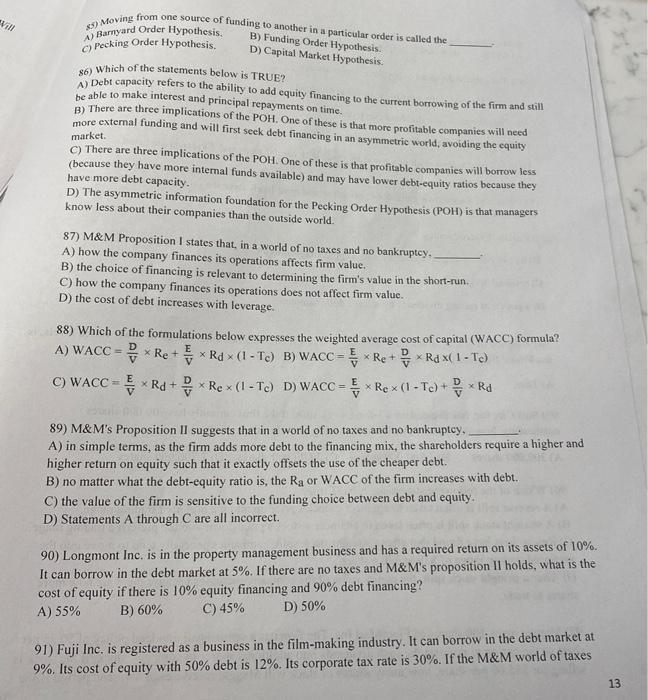

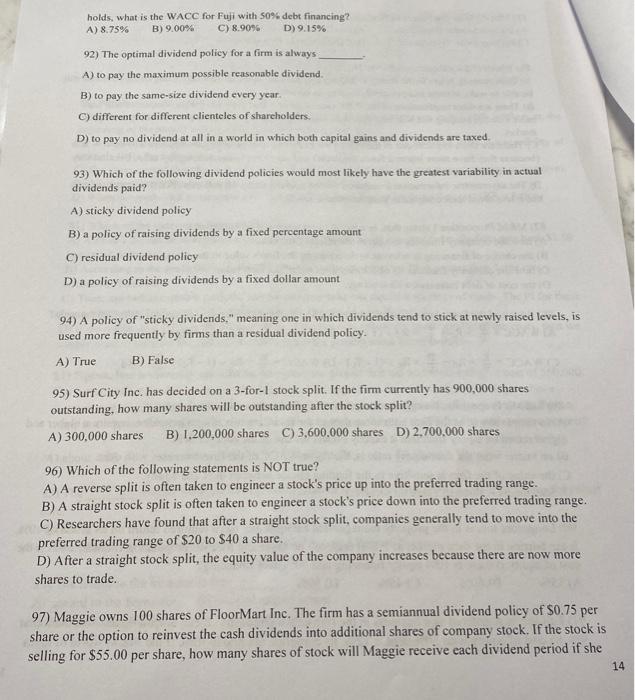

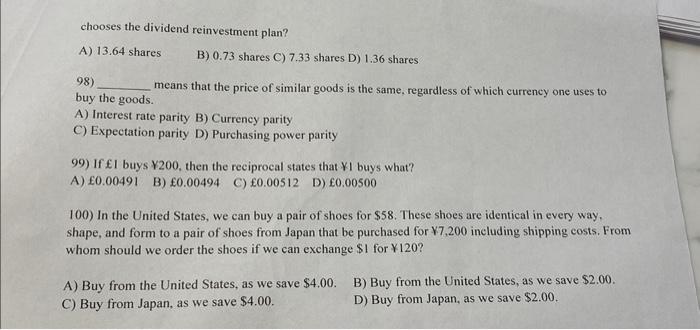

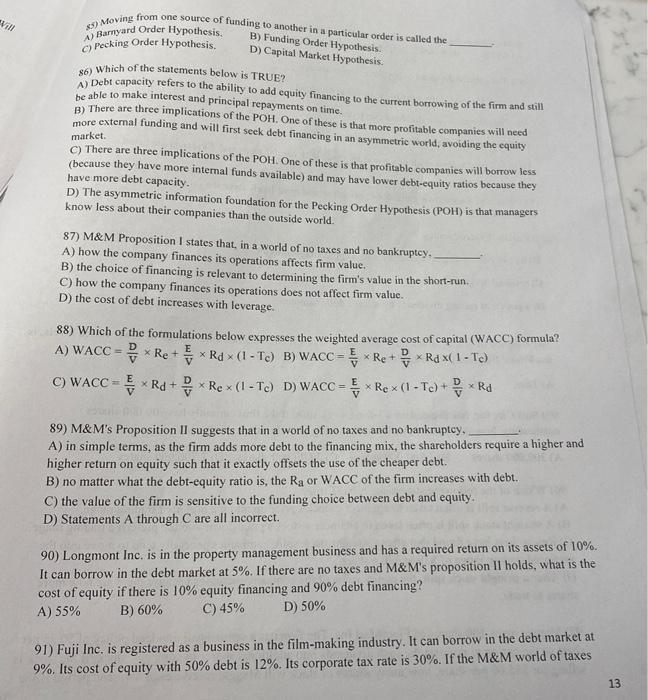

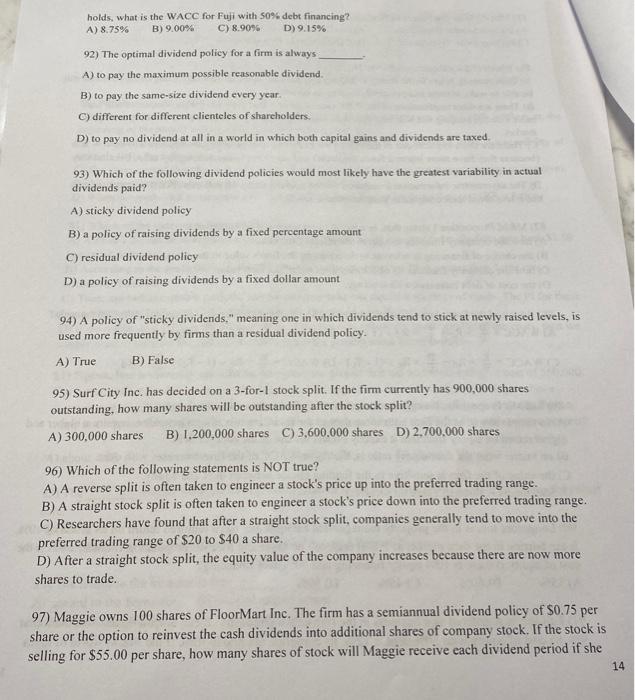

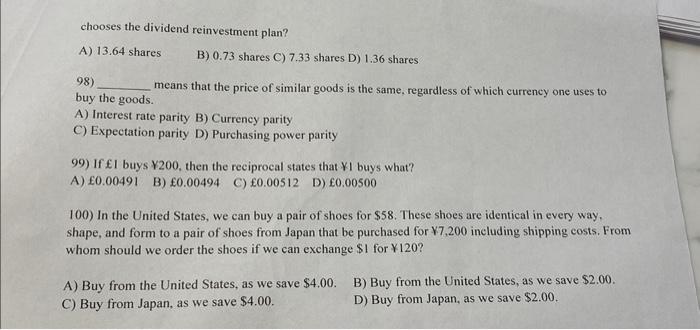

55) Moving from one souree of funding to another in a particular order is called the c) Pecking Order Hypothesis. B) Funding Order Hypothesis. D) Capital Market Hypothesis. 86) Which of the statements below is TRUE? A) Debt capacity refers to the ability to add equity finaneing to the current borrowing of the firm and still be able to make interest and principal repayments on time. B) There are three implications of the POH. One of these is that more profitable companies will need more external funding and will first seek debt financing in an asymmetric world, avoiding the equity market. C) There are three implications of the POH. One of these is that profitable companies will borrow less (because they have more internal funds available) and may have lower debt-equity ratios because they have more debt capacity. D) The asymmetric information foundation for the Pecking Order Hypothesis (POH) is that managers know less about their companies than the outside world. 87) M\&M Proposition I states that, in a world of no taxes and no bankruptey. A) how the company finances its operations affects firm value. B) the choice of financing is relevant to determining the firm's value in the short-run. C) how the company finances its operations does not affect firm value. D) the cost of debt increases with leverage. 88) Which of the formulations below expresses the weighted average cost of capital (WACC) formula? A) WACC=VDRe+VERd(1Tc) B) WACC=VERe+VDRd(1Tc) C) WACC=VERd+VDRe(1Tc) D) WACC=VERe(1Tc)+VDRd 89) M\&M's Proposition II suggests that in a world of no taxes and no bankruptcy, A) in simple terms, as the firm adds more debt to the financing mix, the shareholders require a higher and higher return on equity such that it exactly offsets the use of the cheaper debt. B) no matter what the debt-equity ratio is, the Ra or W ACC of the firm increases with debt. C) the value of the firm is sensitive to the funding choice between debt and equity. D) Statements A through C are all incorrect. 90) Longmont Inc. is in the property management business and has a required retum on its assets of 10\%. It can borrow in the debt market at 5%. If there are no taxes and M\&M's proposition II holds, what is the cost of equity if there is 10% equity financing and 90% debt financing? A) 55% B) 60% C) 45% D) 50% 91) Fuji Inc. is registered as a business in the film-making industry. It can borrow in the debt market at 9%. Its cost of equity with 50% debt is 12%. Its corporate tax rate is 30%. If the M\&M world of taxes holds, what is the WACC for Fuji with 50% debt financing? A) 8.75% B) 9.00% C) 8.9095 D) 9.15% 92) The optimal dividend policy for a firm is always A) to pay the maximum possible reasonable dividend. B) to pay the same-size dividend every year. C) different for different elienteles of shareholders. D) to pay no dividend at all in a world in which both capital gains and dividends are taxed. 93) Which of the following dividend policies would most likely have the greatest variability in actual dividends paid? A) sticky dividend policy B) a policy of raising dividends by a fixed percentage amount C) residual dividend policy D) a policy of raising dividends by a fixed dollar amount 94) A policy of "sticky dividends," meaning one in which dividends tend to stick at newly raised levels, is used more frequentiy by fims than a residual dividend policy. A) True B) Faise 95) Surf City Inc. has decided on a 3 -for-1 stock split. If the firm currently has 900,000 shares outstanding, how many shares will be outstanding after the stock split? A) 300,000 shares B) 1,200,000 shares C) 3,600,000 shares D) 2,700,000 shares 96) Which of the following statements is NOT true? A) A reverse split is often taken to engineer a stock's price up into the preferred trading range. B) A straight stock split is often taken to engineer a stock's price down into the preferred trading range. C) Researchers have found that after a straight stock split, companies generally tend to move into the preferred trading range of $20 to $40 a share. D) After a straight stock split, the equity value of the company increases because there are now more shares to trade. 97) Maggie owns 100 shares of FloorMart Inc. The firm has a semiannual dividend policy of $0.75 per share or the option to reinvest the cash dividends into additional shares of company stock. If the stock is selling for $55.00 per share, how many shares of stock will Maggie receive each dividend period if she chooses the dividend reinvestment plan? A) 13.64 shares B) 0.73 shares C) 7.33 shares D) 1.36 shares 98) means that the price of similar goods is the same, regardless of which currency one uses to buy the goods. A) Interest rate parity C) Expectation parity B) Currency parity D) Purchasing power parity 99) If 1 buys Y200, then the reciprocal states that \( \Varangle I \) buys what? A) \pm 0.00491 B) 0.00494 C) 0.00512 D) 0.00500 100) In the United States, we can buy a pair of shoes for $58. These shoes are identical in every way. shape, and form to a pair of shoes from Japan that be purchased for $7,200 including shipping costs. From whom should we order the shoes if we can exchange $1 for 120 ? A) Buy from the United States, as we save $4,00. B) Buy from the United States, as we save $2.00. C) Buy from Japan, as we save $4.00. D) Buy from Japan, as we save $2.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started