Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With solutions please Questions 50 - 52 refer to the FI that has financial assets of $800 mln. and equity of $50 mln. The duration

With solutions please

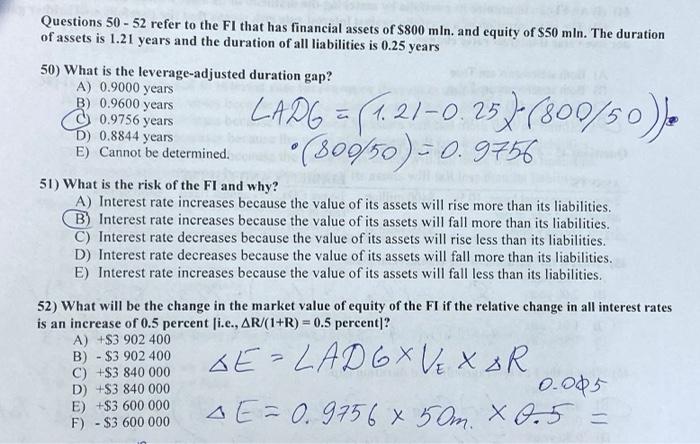

Questions 50 - 52 refer to the FI that has financial assets of $800 mln. and equity of $50 mln. The duration of assets is 1.21 years and the duration of all liabilities is 0.25 years 50) What is the leverage-adjusted duration gap? A) 0.9000 years B) 0.9600 years 0.9756 years D) 0.8844 years E) Cannot be determined. LADG = (1.21-0.25)-(800/50)), (800/50) = 0.9756 51) What is the risk of the FI and why? A) Interest rate increases because the value of its assets will rise more than its liabilities. B) Interest rate increases because the value of its assets will fall more than its liabilities. C) Interest rate decreases because the value of its assets will rise less than its liabilities. D) Interest rate decreases because the value of its assets will fall more than its liabilities. E) Interest rate increases because the value of its assets will fall less than its liabilities. 52) What will be the change in the market value of equity of the FI if the relative change in all interest rates is an increase of 0.5 percent [i.e., AR/(1+R) = 0.5 percent]? GE=LAD GX VE X DR A) +$3 902 400 B) - $3 902 400 C) +$3 840 000 D) +$3 840 000 E) +$3 600 000 F) - $3 600 000 0.005 AE=0.9756 x 50m. X 0.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started