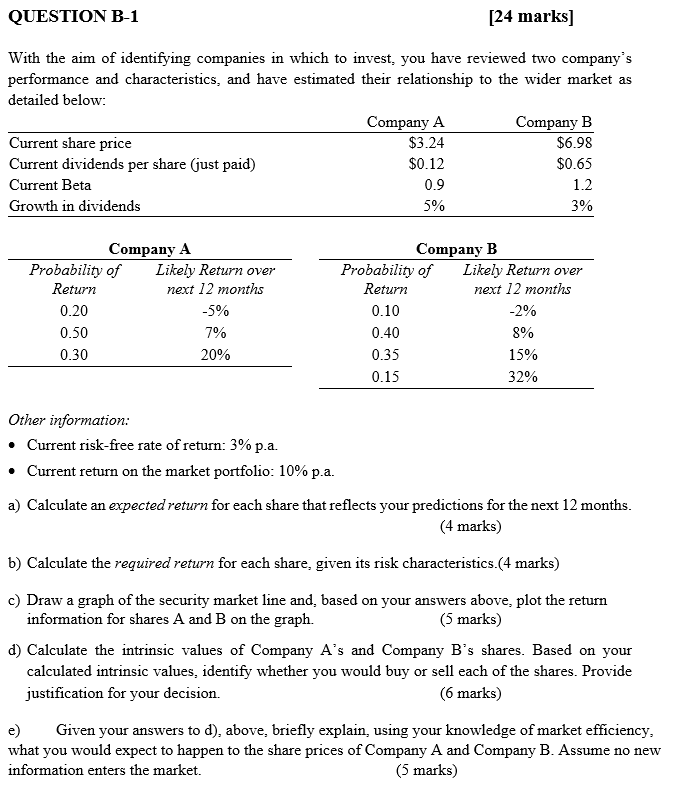

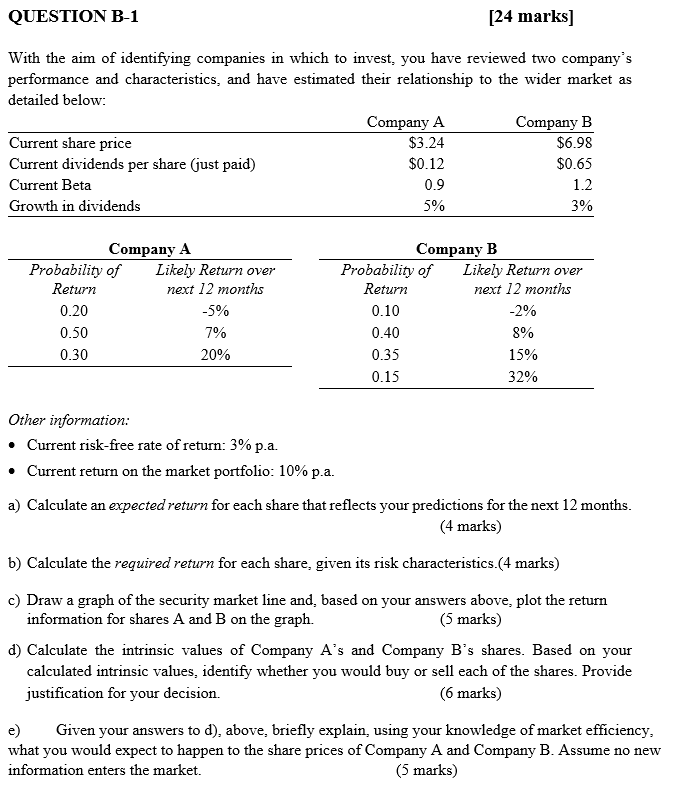

With the aim of identifying companies in which to invest, you have reviewed two company's performance and characteristics, and have estimated their relationship to the wider market as detailed below: Other information: - Current risk-free rate of return: 3% p.a. - Current return on the market portfolio: 10% p.a. a) Calculate an expected return for each share that reflects your predictions for the next 12 months. (4 marks) b) Calculate the required return for each share, given its risk characteristics. (4 marks) c) Draw a graph of the security market line and, based on your answers above, plot the return information for shares A and B on the graph. (5 marks) d) Calculate the intrinsic values of Company A's and Company B's shares. Based on your calculated intrinsic values, identify whether you would buy or sell each of the shares. Provide justification for your decision. (6 marks) e) Given your answers to d), above, briefly explain, using your knowledge of market efficiency, what you would expect to happen to the share prices of Company A and Company B. Assume no new information enters the market. (5 marks) With the aim of identifying companies in which to invest, you have reviewed two company's performance and characteristics, and have estimated their relationship to the wider market as detailed below: Other information: - Current risk-free rate of return: 3% p.a. - Current return on the market portfolio: 10% p.a. a) Calculate an expected return for each share that reflects your predictions for the next 12 months. (4 marks) b) Calculate the required return for each share, given its risk characteristics. (4 marks) c) Draw a graph of the security market line and, based on your answers above, plot the return information for shares A and B on the graph. (5 marks) d) Calculate the intrinsic values of Company A's and Company B's shares. Based on your calculated intrinsic values, identify whether you would buy or sell each of the shares. Provide justification for your decision. (6 marks) e) Given your answers to d), above, briefly explain, using your knowledge of market efficiency, what you would expect to happen to the share prices of Company A and Company B. Assume no new information enters the market