With the following given information, please explain each factor with 4-6 sentences:

BACKGROUND INFORMATION:

Please explain each factor with 4-6 sentences:

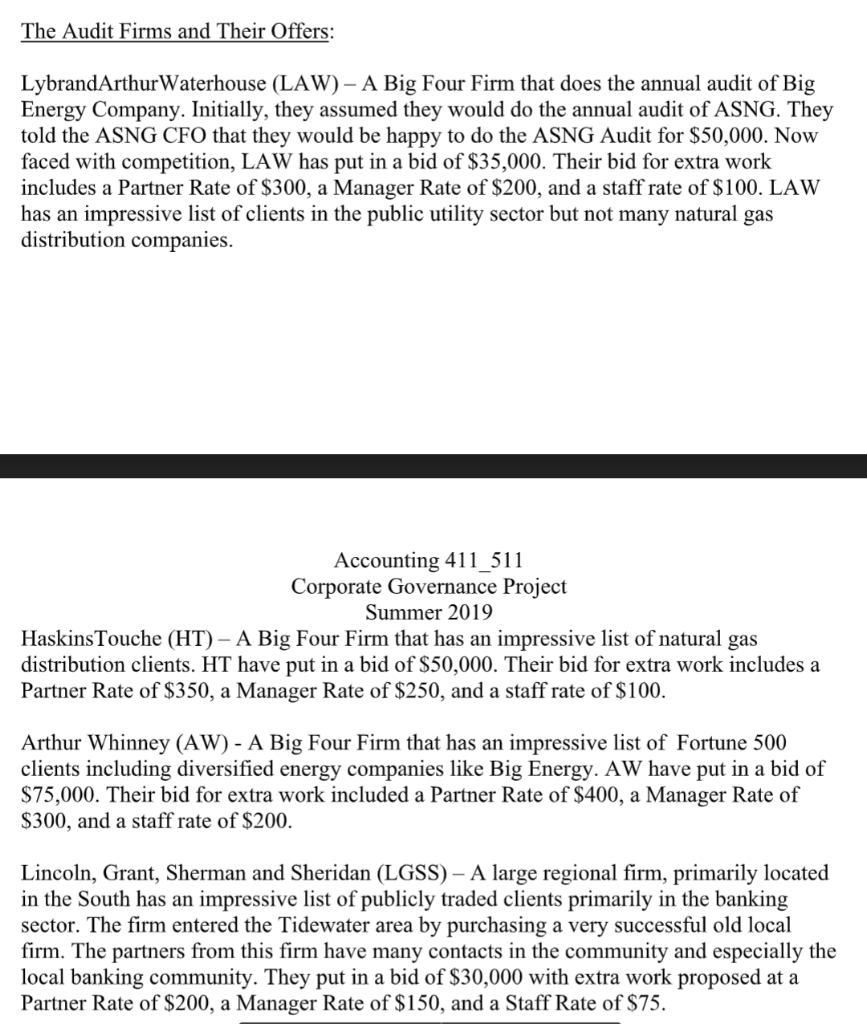

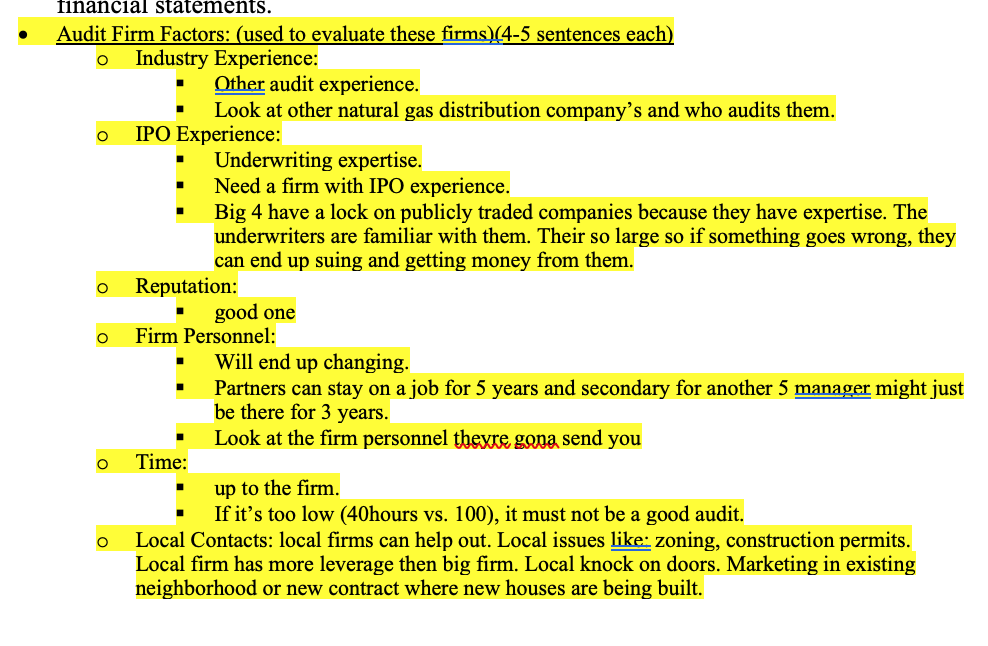

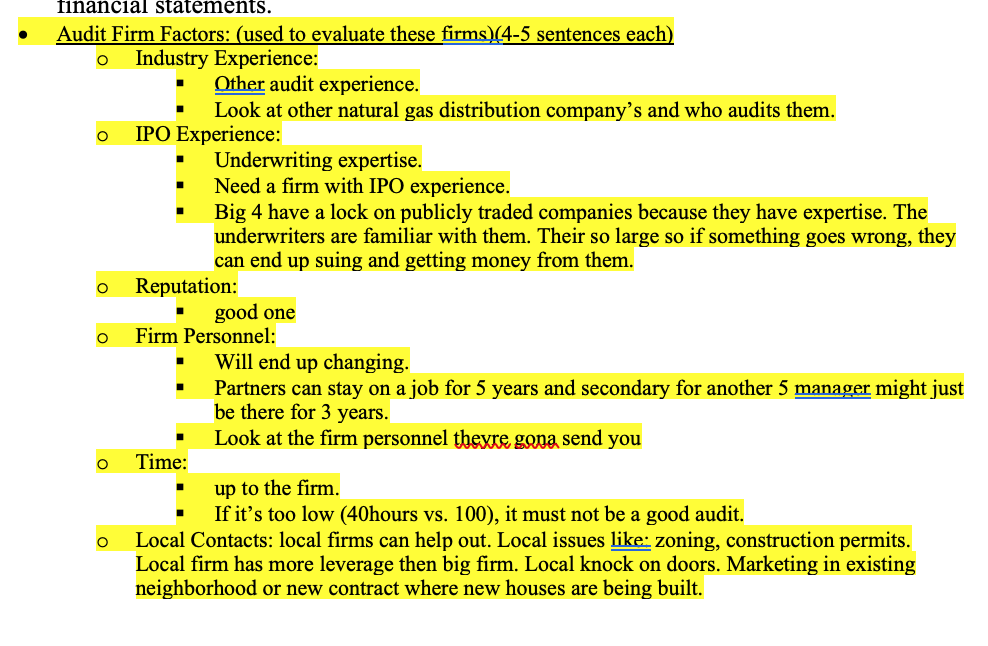

FACTS: I am the ASNG Audit Committee Chair. My task is to lead the Audit Committee in selecting an audit firm to complete ASNG's first financial statement audit. Four firms have submitted bids. gas ISSUES: In completing this case summary, I identify and discuss the following issues: ASNG: AS Nasty Gas (ASNG) is a natural distribution company located in AnyMetro Area AS. It is a wholly owned subsidiary of Big Energy Company, a diversified public traded company located in Sate Capital, AS. ANSG has 400,000 customers and has $750,000,000 in annual revenue and net income of $50,000,000. Previously, ASNG's financial statements were consolidated into those of Big Energy. However, ASNG's current goal is to own its financial statements in order to issue its own debt. What is an audit committee? An audit committee is involved in internal and external audits, internal controls, accounting and financial reporting, regulatory compliance, and risk management. Also, an audit committee plays a major role in corporate governance relating to the organization's direction, control, and accountability. The audit committee is an operating committee of the board of directors charged with oversight of financial reporting and disclosure. The committee member is composed of members of the company's board of directors, with a Chairperson selected by committee members. 1 Why a separate audit? ASNG has never issued their own stocks or bonds. Now ASNG wishes to issue publicly traded debt and must therefore it must issue its own financial statements. ASNG wishes to issue to debt to be able to focus on a bigger project, hold a better credit rating, or plan out next steps if parent company wants to sell them. ASNG will need an underwriting firm to do so. Hence, ASNG is interviewing several audit firms to conduct the first ever annual audit of ASNG' financial statements. RECOMMEDATIONS: Based on the above discussion, I recommend ASNG Audit Committee hire HaskinsTouche (HT). The Audit Firms and Their Offers: LybrandArthur Waterhouse (LAW) A Big Four Firm that does the annual audit of Big Energy Company. Initially, they assumed they would do the annual audit of ASNG. They told the ASNG CFO that they would be happy to do the ASNG Audit for $50,000. Now faced with competition, LAW has put in a bid of $35,000. Their bid for extra work includes a Partner Rate of $300, a Manager Rate of $200, and a staff rate of $100. LAW has an impressive list of clients in the public utility sector but not many natural gas distribution companies. Accounting 411_511 Corporate Governance Project Summer 2019 HaskinsTouche (HT) A Big Four Firm that has an impressive list of natural gas distribution clients. HT have put in a bid of $50,000. Their bid for extra work includes a Partner Rate of $350, a Manager Rate of $250, and a staff rate of $100. Arthur Whinney (AW) - A Big Four Firm that has an impressive list of Fortune 500 clients including diversified energy companies like Big Energy. AW have put in a bid of $75,000. Their bid for extra work included a Partner Rate of $400, a Manager Rate of $300, and a staff rate of $200. Lincoln, Grant, Sherman and Sheridan (LGSS) A large regional firm, primarily located in the South has an impressive list of publicly traded clients primarily in the banking sector. The firm entered the Tidewater area by purchasing a very successful old local firm. The partners from this firm have many contacts in the community and especially the local banking community. They put in a bid of $30,000 with extra work proposed at a Partner Rate of $200, a Manager Rate of $150, and a Staff Rate of $75. O 1 O O financial statements. Audit Firm Factors: (used to evaluate these firms. 4-5 sentences each) Industry Experience: Other audit experience. Look at other natural gas distribution company's and who audits them. IPO Experience: Underwriting expertise. Need a firm with IPO experience. Big 4 have a lock on publicly traded companies because they have expertise. The underwriters are familiar with them. Their so large so if something goes wrong, they can end up suing and getting money from them. Reputation: good one o Firm Personnel: Will end up changing. Partners can stay on a job for 5 years and secondary for another 5 manager might just be there for 3 years. Look at the firm personnel theyre gopa send you Time: up to the firm. If it's too low (40hours vs. 100), it must not be a good audit. o Local Contacts: local firms can help out. Local issues like: zoning, construction permits. Local firm has more leverage then big firm. Local knock on doors. Marketing in existing neighborhood or new contract where new houses are being built. O FACTS: I am the ASNG Audit Committee Chair. My task is to lead the Audit Committee in selecting an audit firm to complete ASNG's first financial statement audit. Four firms have submitted bids. gas ISSUES: In completing this case summary, I identify and discuss the following issues: ASNG: AS Nasty Gas (ASNG) is a natural distribution company located in AnyMetro Area AS. It is a wholly owned subsidiary of Big Energy Company, a diversified public traded company located in Sate Capital, AS. ANSG has 400,000 customers and has $750,000,000 in annual revenue and net income of $50,000,000. Previously, ASNG's financial statements were consolidated into those of Big Energy. However, ASNG's current goal is to own its financial statements in order to issue its own debt. What is an audit committee? An audit committee is involved in internal and external audits, internal controls, accounting and financial reporting, regulatory compliance, and risk management. Also, an audit committee plays a major role in corporate governance relating to the organization's direction, control, and accountability. The audit committee is an operating committee of the board of directors charged with oversight of financial reporting and disclosure. The committee member is composed of members of the company's board of directors, with a Chairperson selected by committee members. 1 Why a separate audit? ASNG has never issued their own stocks or bonds. Now ASNG wishes to issue publicly traded debt and must therefore it must issue its own financial statements. ASNG wishes to issue to debt to be able to focus on a bigger project, hold a better credit rating, or plan out next steps if parent company wants to sell them. ASNG will need an underwriting firm to do so. Hence, ASNG is interviewing several audit firms to conduct the first ever annual audit of ASNG' financial statements. RECOMMEDATIONS: Based on the above discussion, I recommend ASNG Audit Committee hire HaskinsTouche (HT). The Audit Firms and Their Offers: LybrandArthur Waterhouse (LAW) A Big Four Firm that does the annual audit of Big Energy Company. Initially, they assumed they would do the annual audit of ASNG. They told the ASNG CFO that they would be happy to do the ASNG Audit for $50,000. Now faced with competition, LAW has put in a bid of $35,000. Their bid for extra work includes a Partner Rate of $300, a Manager Rate of $200, and a staff rate of $100. LAW has an impressive list of clients in the public utility sector but not many natural gas distribution companies. Accounting 411_511 Corporate Governance Project Summer 2019 HaskinsTouche (HT) A Big Four Firm that has an impressive list of natural gas distribution clients. HT have put in a bid of $50,000. Their bid for extra work includes a Partner Rate of $350, a Manager Rate of $250, and a staff rate of $100. Arthur Whinney (AW) - A Big Four Firm that has an impressive list of Fortune 500 clients including diversified energy companies like Big Energy. AW have put in a bid of $75,000. Their bid for extra work included a Partner Rate of $400, a Manager Rate of $300, and a staff rate of $200. Lincoln, Grant, Sherman and Sheridan (LGSS) A large regional firm, primarily located in the South has an impressive list of publicly traded clients primarily in the banking sector. The firm entered the Tidewater area by purchasing a very successful old local firm. The partners from this firm have many contacts in the community and especially the local banking community. They put in a bid of $30,000 with extra work proposed at a Partner Rate of $200, a Manager Rate of $150, and a Staff Rate of $75. O 1 O O financial statements. Audit Firm Factors: (used to evaluate these firms. 4-5 sentences each) Industry Experience: Other audit experience. Look at other natural gas distribution company's and who audits them. IPO Experience: Underwriting expertise. Need a firm with IPO experience. Big 4 have a lock on publicly traded companies because they have expertise. The underwriters are familiar with them. Their so large so if something goes wrong, they can end up suing and getting money from them. Reputation: good one o Firm Personnel: Will end up changing. Partners can stay on a job for 5 years and secondary for another 5 manager might just be there for 3 years. Look at the firm personnel theyre gopa send you Time: up to the firm. If it's too low (40hours vs. 100), it must not be a good audit. o Local Contacts: local firms can help out. Local issues like: zoning, construction permits. Local firm has more leverage then big firm. Local knock on doors. Marketing in existing neighborhood or new contract where new houses are being built. O