Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With the following information, calculate the following ratios: Debt Ratio: Long-term Debt to Total Capitalization: Debt to Equity: Financial Leverage: Times Interest Earned: Cash Interest

With the following information, calculate the following ratios:

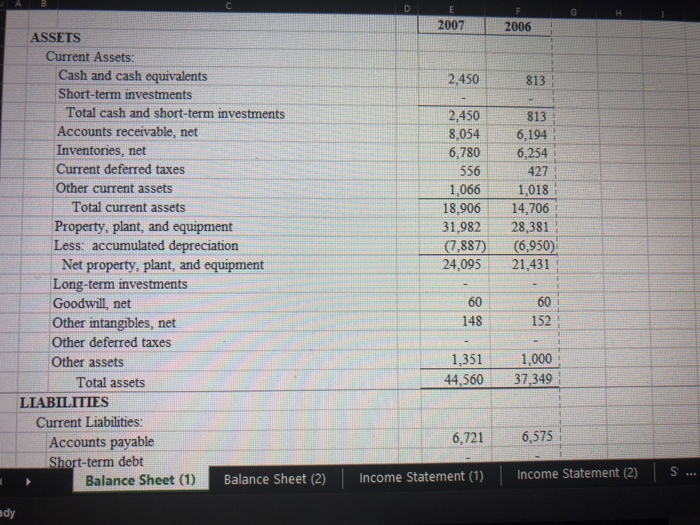

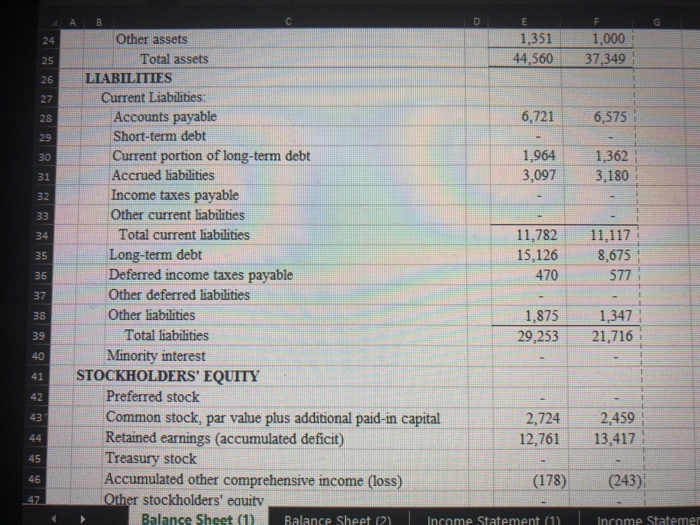

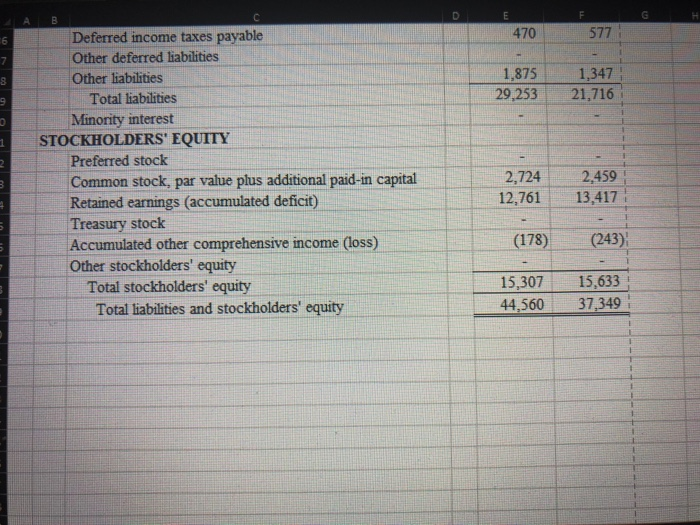

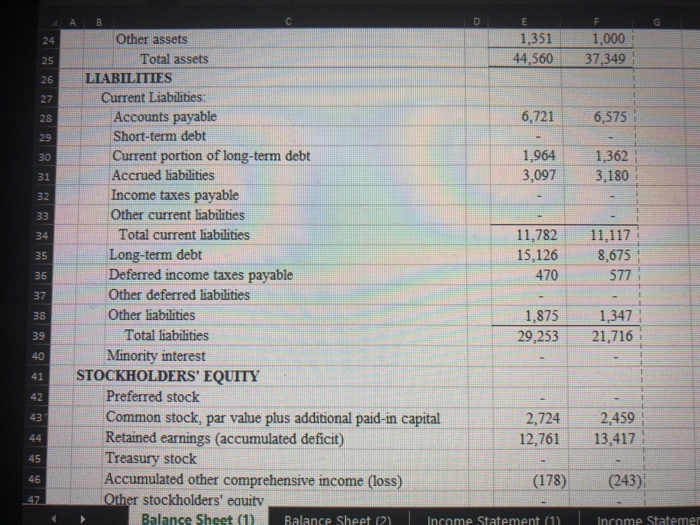

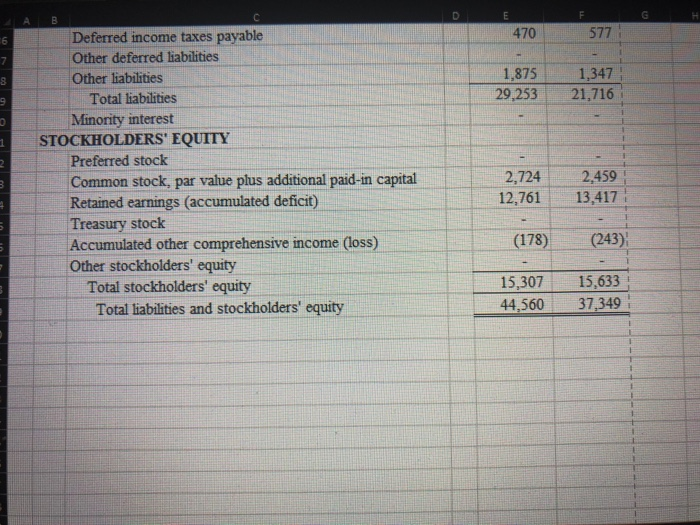

2007 2006 2.450 813 813 6,194 6,254 427 ASSETS Current Assets: Cash and cash equivalents Short-term investments Total cash and short-term investments Accounts receivable, net Inventories, net Current deferred taxes Other current assets Total current assets Property, plant, and equipment Less: accumulated depreciation Net property, plant, and equipment Long-term investments Goodwill, net Other intangibles, net Other deferred taxes Other assets Total assets LIABILITIES Current Liabilities: Accounts payable Short-term debt Balance Sheet (1) Balance Sheet (2) 2,450 8,054 6,780 556 1,066 18,906 31.982 (7,887) 24,095 1,018 14,706 28,381 (6,950) 21,431 60 60 148 152 1,351 44,560 1,000 37,349 6,721 _6,575 Income Statement (1) Income Statement (2) S. ady F G 470 577 1.875 29,253 1.347 21,716 00 00 m Deferred income taxes payable Other deferred liabilities Other liabilities Total liabilities Minority interest STOCKHOLDERS' EQUITY Preferred stock Common stock, par value plus additional paid-in capital Retained earnings (accumulated deficit) Treasury stock Accumulated other comprehensive income (loss) Other stockholders' equity Total stockholders' equity Total liabilities and stockholders' equity 2,724 12,761 13.417 in in (178) (243) 15,307 44,560 15,633 37,349 Debt Ratio:

Long-term Debt to Total Capitalization:

Debt to Equity:

Financial Leverage:

Times Interest Earned:

Cash Interest Coverage:

Fixed Charge Coverage:

Cash Flow Adequacy:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started