Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With the following information, prepare a statement of taxable income for Arthur Young Ltd for 31 March 2021. Arthur Young Ltd has a single shareholder,

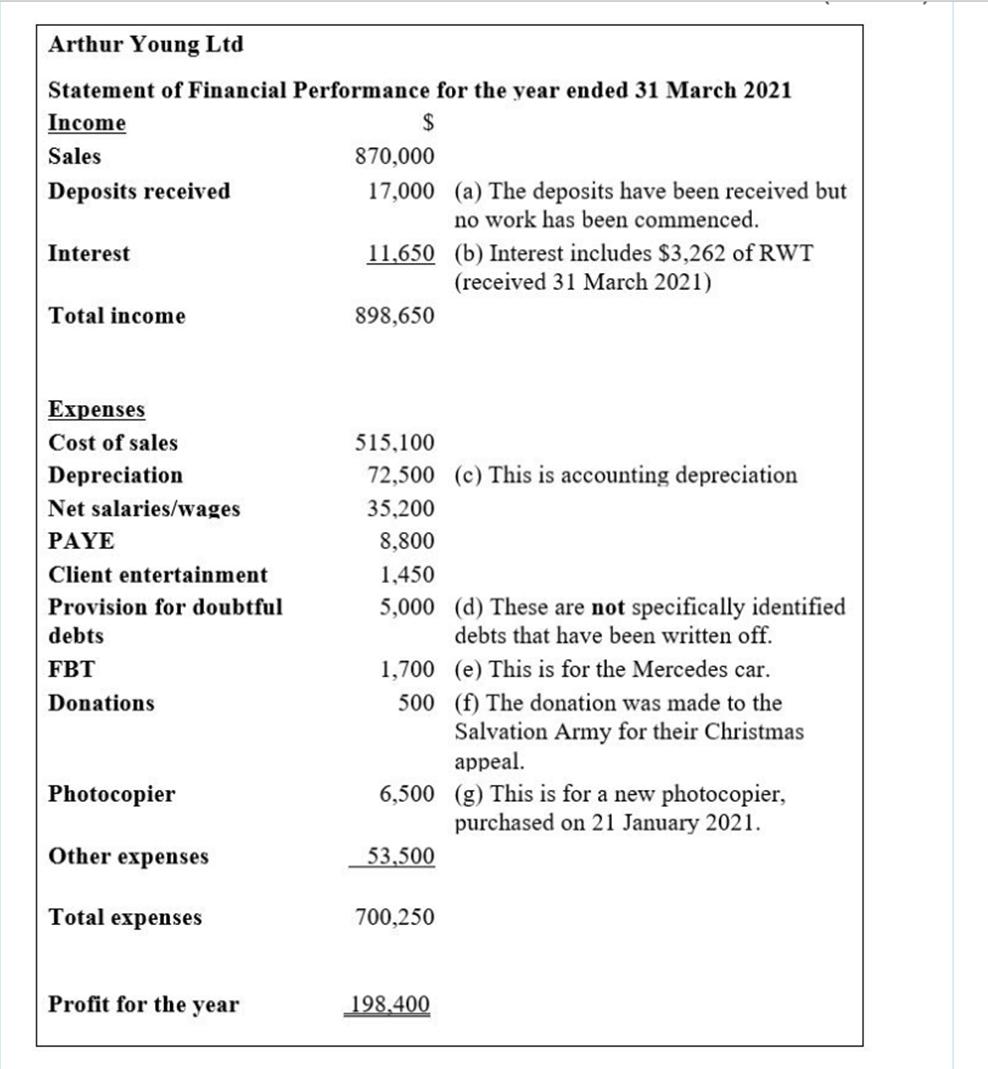

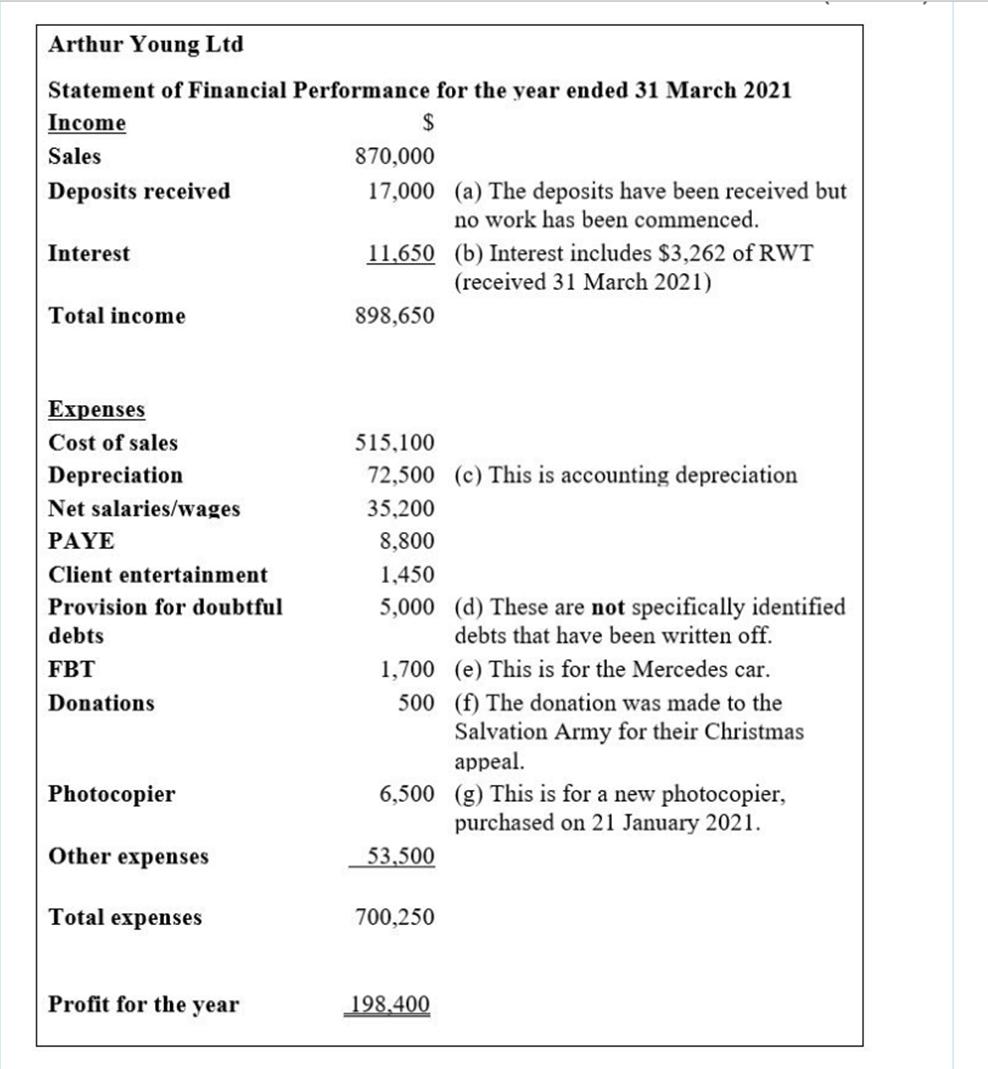

With the following information, prepare a statement of taxable income for Arthur Young Ltd for 31 March 2021. Arthur Young Ltd has a single shareholder, Arthur. Note that: The company is GST registered and all figures are GST exclusive, unless mentioned otherwise. The financial year ends on 31 March.

Arthur Young Ltd Statement of Financial Performance for the year ended 31 March 2021 Income $ Sales Deposits received Interest Total income Expenses Cost of sales Depreciation Net salaries/wages PAYE Client entertainment Provision for doubtful debts FBT Donations Photocopier Other expenses Total expenses Profit for the year 870,000 17,000 (a) The deposits have been received but no work has been commenced. 11,650 (b) Interest includes $3,262 of RWT (received 31 March 2021) 898,650 515,100 72,500 (c) This is accounting depreciation 35,200 8,800 1,450 5,000 1,700 500 6,500 (g) This is for a new photocopier, purchased on 21 January 2021. 53,500 700,250 (d) These are not specifically identified debts that have been written off. (e) This is for the Mercedes car. (f) The donation was made to the Salvation Army for their Christmas appeal. 198.400

Step by Step Solution

★★★★★

3.31 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Arthur Young Ltd Statement of taxable income for the year ended 31 March 2021 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started