Question

With the following information: Spot price 50 Strike price 50 Effective annual risk-free rate 1% Continuous Dividend yield 0 Time to maturity 1 year u

With the following information:

| Spot price | 50 |

| Strike price | 50 |

| Effective annual risk-free rate | 1% |

| Continuous Dividend yield | 0 |

| Time to maturity | 1 year |

| u | 1.2 |

| d | 0.8 |

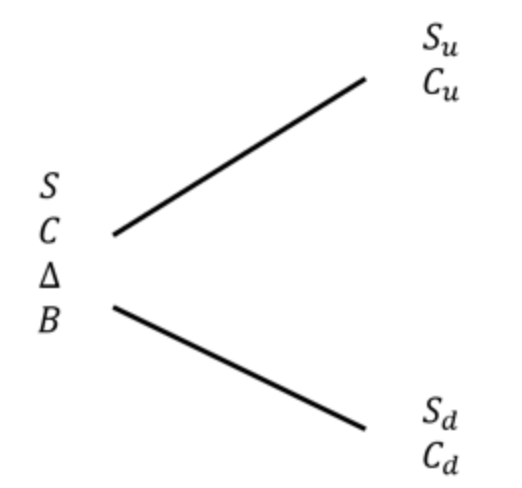

Construct a 1-step binomial tree for a European call option.

(a) What is Su for the European call option?

(b) What is Sd for the European call option?

(c) What is Cu for the European call option?

(d) What is Cd for the European call option?

(e) What is for the European call option?

(f) What is B for the European call option? (Leave 2 d.p. for the answer)

(g) What is the premium for the European call option? (Leave 2 d.p. for the answer)

(h) What is the premium for the European put option? (Leave 2 d.p. for the answer)

(i) Suppose you observe a call price of $5.50. How can you arbitrage?

a. Long call, long stock and borrow money.

b. Short call, long stock and borrow money.

c. Long call, short stock and lend money.

d. Short call, short stock and lend money.

(j) What is the present value of the arbitrage profit? (Leave 2 d.p. for the answer)

G GStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started