Answered step by step

Verified Expert Solution

Question

1 Approved Answer

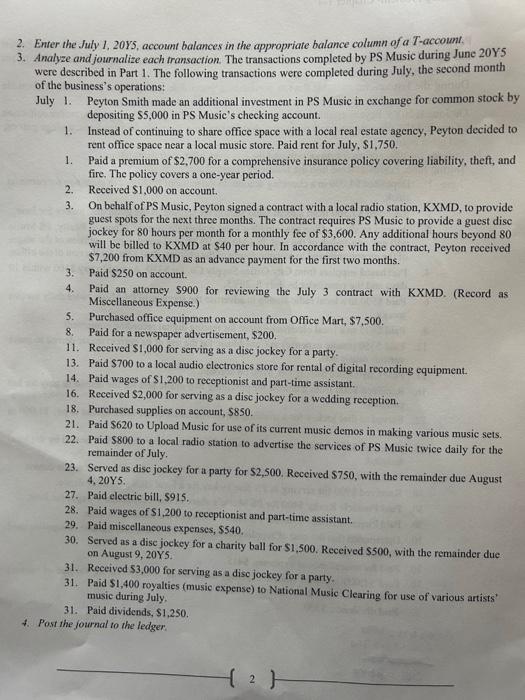

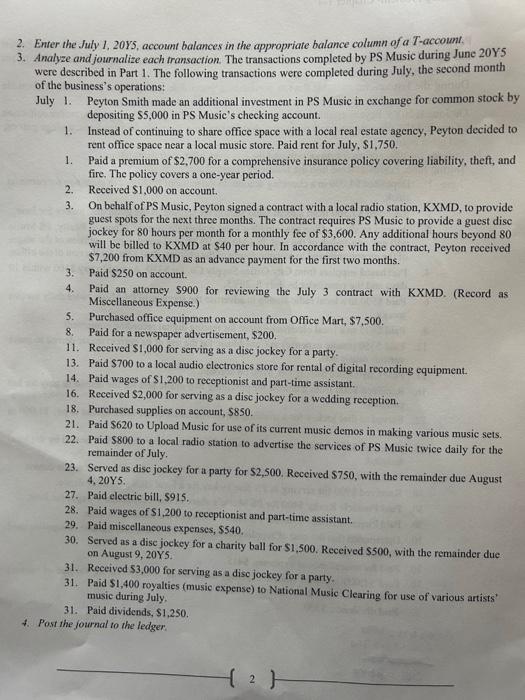

With the following starting balances from the previosu month for each account: Cash ($3900) Accounts Receivable ($1000) Supplies ($170) Accounts Payable ($250) Common Stock ($4000)

With the following starting balances from the previosu month for each account: Cash ($3900) Accounts Receivable ($1000) Supplies ($170) Accounts Payable ($250) Common Stock ($4000) Dividends (-$500) Fees Earned ($6200) Music Expenses (-$1590) Office Rent Expenses (-$800) Equipment Rent Expenses (-$675) Advertising Expenses (-$500) Wages Expenses (-$400) Utilities Expenses (-$300) Supplies Expenses (-$180) and Misc. Expenses (-$415)  and then prepare an unadjusted trial balance as of july 31st

and then prepare an unadjusted trial balance as of july 31st

Enter the July 1,20Y5, account balances in the appropriate balance column of a T-account. Analyze and journalize each transaction. The transactions completed by PS Music during June 20Y5 were described in Part 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing \$5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, \$1,750. 1. Paid a premium of $2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received $1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest dise jockey for 80 hours per month for a monthly fee of $3,600. Any additional hours beyond 80 will be billed to KXMD at $40 per hour. In accordance with the contract, Peyton received $7,200 from KXMD as an advance payment for the first two months. 3. Paid $250 on account. 4. Paid an attorney $900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, $7,500. 8. Paid for a newspaper advertisement, $200. 11. Received $1,000 for serving as a disc jockey for a party. 13. Paid $700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of $1,200 to receptionist and part-time assistant. 16. Received $2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, $850. 21. Paid $620 to Upload Music for use of its current music demos in making various music sets. 22. Paid $800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for $2,500. Received $750, with the remainder due August 4,20Y5. 27. Paid electric bill, $915. 28. Paid wages of $1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, $540. 30. Served as a disc jockey for a charity ball for $1,500. Received $500, with the remainder due on August 9, 20Y5. 31. Reeeived $3,000 for serving as a disc jockey for a party. 31. Paid $1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Paid dividends, $1,250. Post the fournal to the ledger. Enter the July 1,20Y5, account balances in the appropriate balance column of a T-account. Analyze and journalize each transaction. The transactions completed by PS Music during June 20Y5 were described in Part 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing \$5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, \$1,750. 1. Paid a premium of $2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received $1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest dise jockey for 80 hours per month for a monthly fee of $3,600. Any additional hours beyond 80 will be billed to KXMD at $40 per hour. In accordance with the contract, Peyton received $7,200 from KXMD as an advance payment for the first two months. 3. Paid $250 on account. 4. Paid an attorney $900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, $7,500. 8. Paid for a newspaper advertisement, $200. 11. Received $1,000 for serving as a disc jockey for a party. 13. Paid $700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of $1,200 to receptionist and part-time assistant. 16. Received $2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, $850. 21. Paid $620 to Upload Music for use of its current music demos in making various music sets. 22. Paid $800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for $2,500. Received $750, with the remainder due August 4,20Y5. 27. Paid electric bill, $915. 28. Paid wages of $1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, $540. 30. Served as a disc jockey for a charity ball for $1,500. Received $500, with the remainder due on August 9, 20Y5. 31. Reeeived $3,000 for serving as a disc jockey for a party. 31. Paid $1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Paid dividends, $1,250. Post the fournal to the ledger 1. Enter the account balances in the appropriate balance column of a T-account

and then prepare an unadjusted trial balance as of july 31st

and then prepare an unadjusted trial balance as of july 31stStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started