Answered step by step

Verified Expert Solution

Question

1 Approved Answer

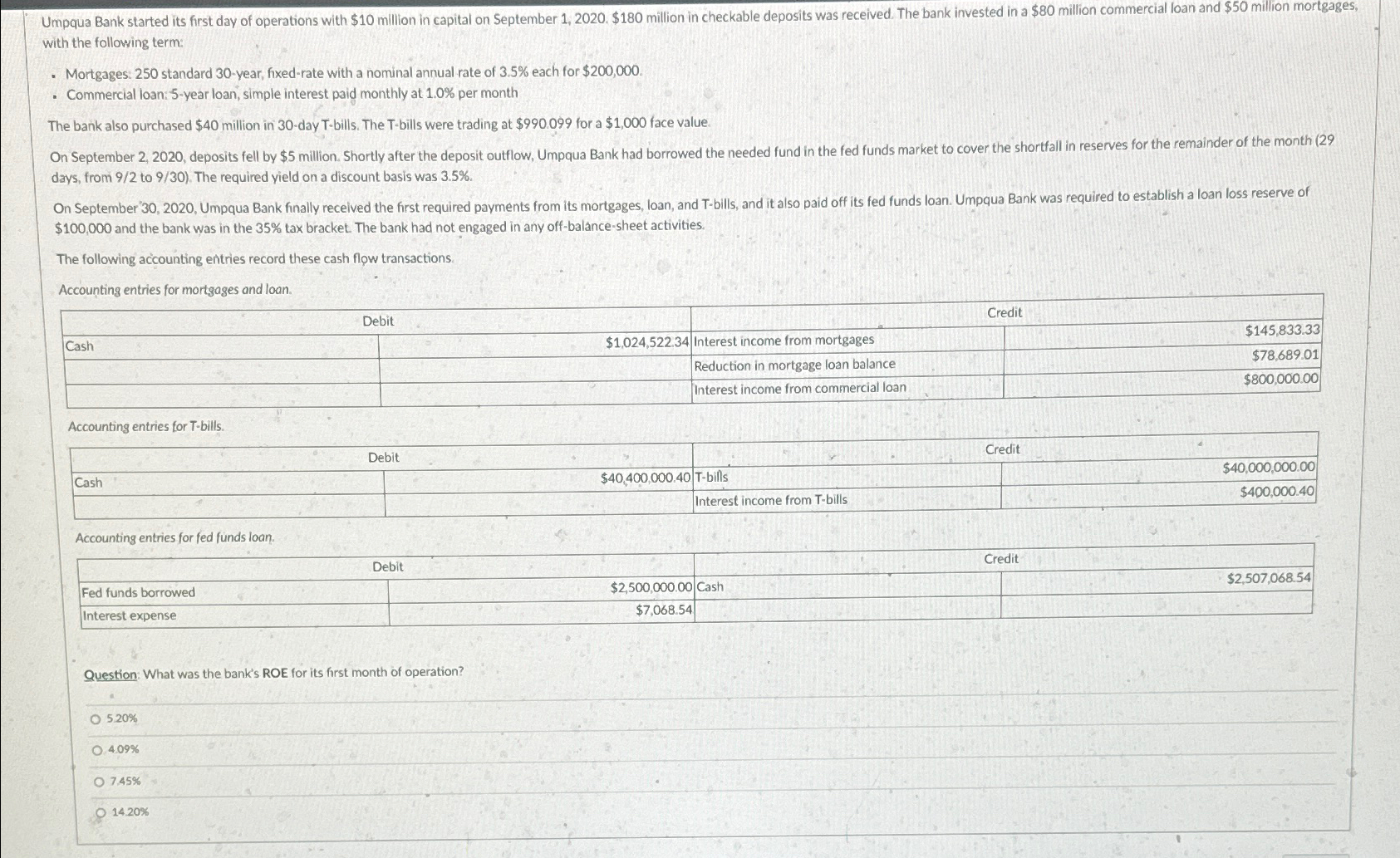

with the following term: Mortgages: 2 5 0 standard 3 0 - year, fixed - rate with a nominal annual rate of 3 . 5

with the following term:

Mortgages: standard year, fixedrate with a nominal annual rate of each for $

Commercial loan: year loan, simple interest paid monthly at per month

The bank also purchased $ million in day Tbills. The Tbills were trading at $ for a $ face value. days, from to The required yield on a discount basis was $ and the bank was in the tax bracket. The bank had not engaged in any offbalancesheet activities.

The following accounting entries record these cash flow transactions.

Accounting entries for mortgages and loan.

Accounting entries for Tbills.

Accounting entries for fed funds loan.

Question: What was the bank's ROE for its first month of operation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started