Answered step by step

Verified Expert Solution

Question

1 Approved Answer

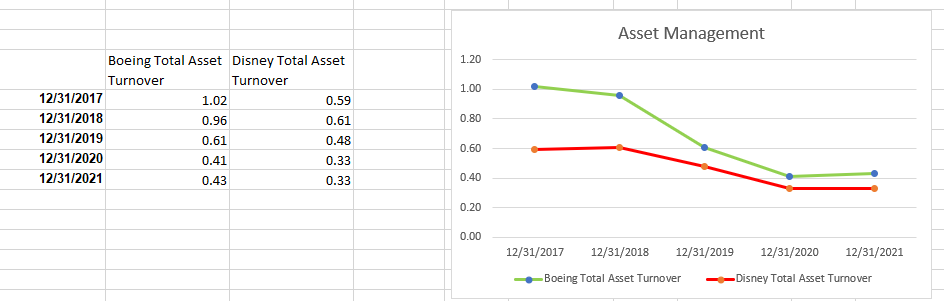

With the information from the Asset Management chart provided: Are there economic or end-market influences that explain why the ratios differ? What might they be?

With the information from the Asset Management chart provided:

Are there economic or end-market influences that explain why the ratios differ? What might they be?

Over time, is each companys overall financial performance improving, declining, or is something strange going on?

Would evaluating financial statements is a good idea? What do you regard as some of the shortcomings of financial ratio analysis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started