Answered step by step

Verified Expert Solution

Question

1 Approved Answer

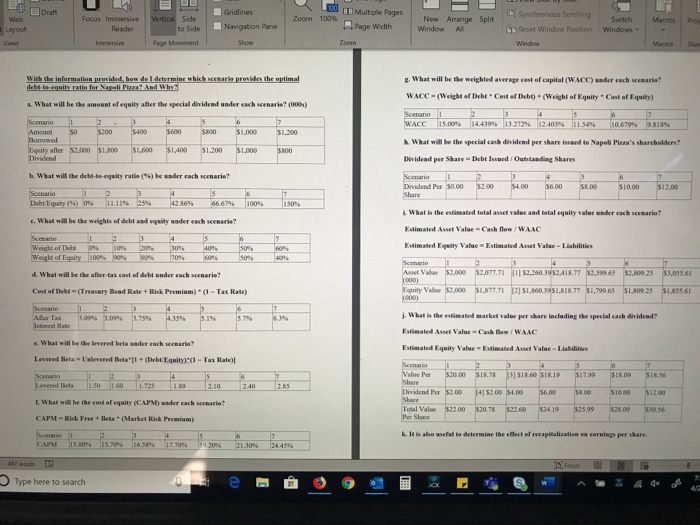

With the information provided, how do I determine which scenario provides the optimal debt-to-equity ratio and why? E E B B Verts side Zoom Gridlines

With the information provided, how do I determine which scenario provides the optimal debt-to-equity ratio and why?

E E B B Verts side Zoom Gridlines Navigation Pane 100% Focus Immersive - Reader Web - Layout Multiple Pages Page Width New Window Arrange Al Split b Synchronous scrolling Reset Window Position I switch Windows Morros Prop to Side Page Movement With the information proided, how da determine which senario provides the optimal debt te equity ratio for Napoli P a? And Why a. What will be the amount ofequity after the wypcial dividend under ach scenarie? (0 ) Scenario 1 Amount What will be the weighted average cost of capital ( WACC) der each scenario? WACC (Weight of Debt Cost of Debo +(Weight of Equity Cast of Equity) Scenario 1 2 WACC 15.00% 4.419% 13.2729 12.40 1 .54% 10.67999.818% What will be the special cash dividend per share inued to Napoli Pizza's shareholders! Dividend per Share - Debted/Outstanding Shares $0 $200 $400 S1,200 Equity after Dividend $2,000 $1,800 $1,600 $1,400 $1,200 $1,000 b. What will the det aily ratio (6) bewer each senario? Scenario Dividend Per 50.00 52.00 54.00 6.00 $8.00 510.00 $12.00 Scenario Debul quity ) 0% 11.1139 What is the estimated total asset value and total equity value ad cach scenario? c. What will be the weights of debt degully under each are? Estimated Asset Value - Cash flow / WAAC Scenario Weight of Debt 0% Weight of Equity 100% 3 20% 0% 30% 40% 10% 0% Estimated Equity Value = Estimated Asset Value - Liabilities L What will be the after-tax cost of debt under each snarie! Asset Value $2,000 $2,077.71 1.52,260.3952,418.77 82.59.65 6035 $3.0025 $1.877.71 251.860 1951,818.77 $1,799.65 $1.809.95 $1,085.61 Cost of Debt-Treasury Bad Rate + Risk Premium) (1 - Tax Rate) Equity Value $2.000 $1.855.61 Scenario Afer Tax Interest Rate 1 309% 2 3.09% 3 3.75% 4 4.35% 1. What is the estimated market value pershare including the special cash didend Estimated Asset Value Chow/WAAC What will be the levered beta under each w aria? Estimated Equity Value Estimated Anet Value -Liabilities Lared Betaalveredeta! (Dubuquity1 - Tax Rate) Scenario Value Per $20.00 SIR.783 S # 60 SIR.19 $17.99 Lesered Beta 150 DividendPer $2.00 1452.00 54.00 56.00 What will be the cost of equity (CAPM) erach w arto? Total Value Per Share $22.00 20.78 592.60 $34.19 $25.99 CAPM Risk Freeleta Market Ink Premium) k. It is ahe useful to determine the effect of recapitalization ca earnings per share focus Type here to search Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started