Question

With the triplets now in high school, Jamie Lee and Ross have made good decisions so far concerning their financial and investment strategies. They budgeted

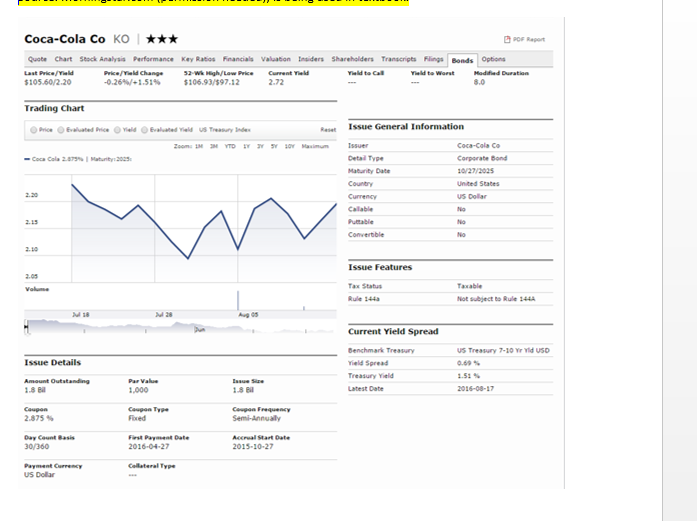

With the triplets now in high school, Jamie Lee and Ross have made good decisions so far concerning their financial and investment strategies. They budgeted throughout the years and are right on track to reaching their long-term investment goals of paying the triplets college tuition and accumulating enough to purchase a beach house to enjoy when Jamie Lee and Ross retire. The pair are still researching where to best invest the $50,000 that Ross had recently inherited from his uncles estate. Ross and Jamie Lee would like to invest in several varieties of stocks, bonds, or other investment instruments to supplement their retirement income goals. Jamie Lee and Ross have been researching stock investment opportunities that my offer lucrative returns, but they know there is plenty of risk involved. They are aware that they must develop a firm plan to assess the risk of the various investment types so they may have the proper balance between high, moderate, and low risk investment options. They decided that at this stage of their lives, it may be wise to speak to an investment counselor. They contact Mr. Jay Hall, who has been highly recommended by a trusted colleague and friend of Ross throughout the years. Mr. Hall assesses their risk for investment and recommends two different corporate bonds. One of those companies he suggested is The Coca-Cola Company. Use Addendum D Coca-Cola Company to complete the corporate bond evaluation below.

1.)What type of bond is this?

2.)What is the face value for this bond?

3.)What is the interest rate for this bond?

4.) wHAT IS THE DOLLAR AMOUNT OF ANNUAL INTEREST FOR THIS BOND?

5.) When are interest payments made to bondholders?

6.) What is the maturity date for this bond?

7.) What is Morningstar's rating for this bond?

8.)What was the original issue date?

9.) What are the firm's basic earnings per share for the last year?

Coca-Cola Co KO *** POF Report Stock Analysis Performance Key Ratios Financials Valuation insiders Quote Chart Last Prica/Vield $105.60/2.20 Shareholders Transcripts Yield te Call e flings Bonds Options d to Worst Modified Duration Current Tied Price/Yild change -0.26%/+1.51% 52-wk High/Low Price $106.93/597.12 Trading Chart Price E d ice Vield Evaluated via US T rys Issue General Information Zoom M YTOY SY BOY asimum - Coca Cola 2.879 Maturity 2005 Detail Type Maturity Date Country Currency Callable Peable Convertible Coca-Cola Co Corporate Bond 10/27/2025 United States US Dollar Issue Features 2.09 Volume Tax Status Taxable Not Subject to Rule 144A Current Yield Spread US Treasury 7.10 Yr Yid USD Issue Details Benchmark Treasury Yield Spread Treasury Yield Latest Date Amount Outstanding Par Value 1.000 1.51 2016-08-17 2.875% Coupon Type Fixed Coupon Frequency Semi-annual Day Count Basis 30/360 First Payment Date 2016-04-27 Accrual Start Data 2015-10-27 Collateral Type Payment Currency US Dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started