With this information i need the Bank Reconciliation and the necessary adjusting journal entries

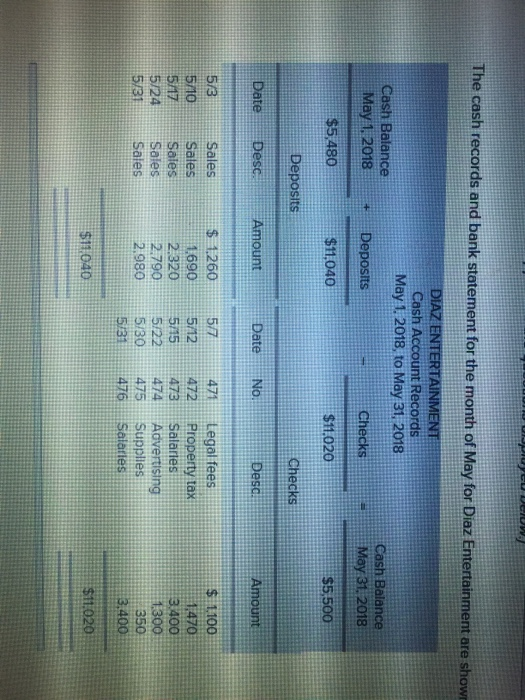

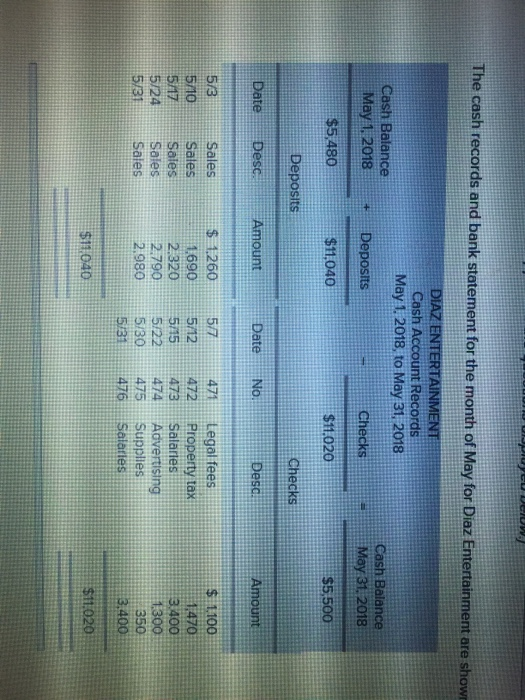

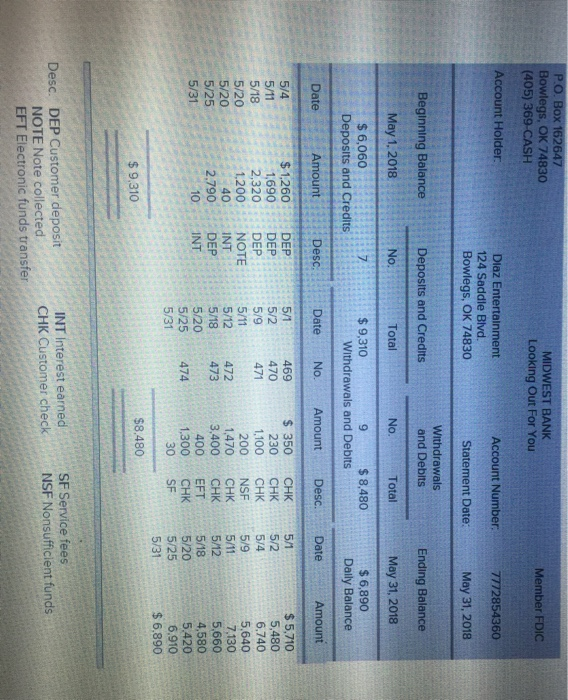

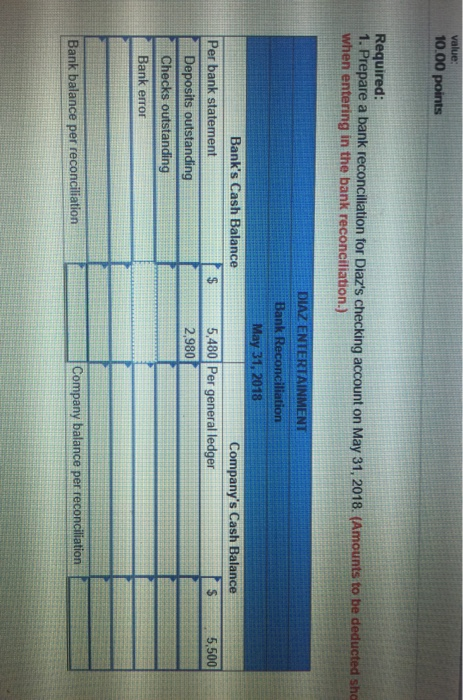

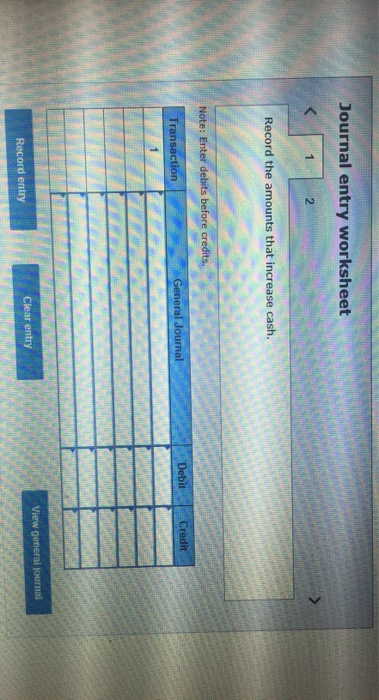

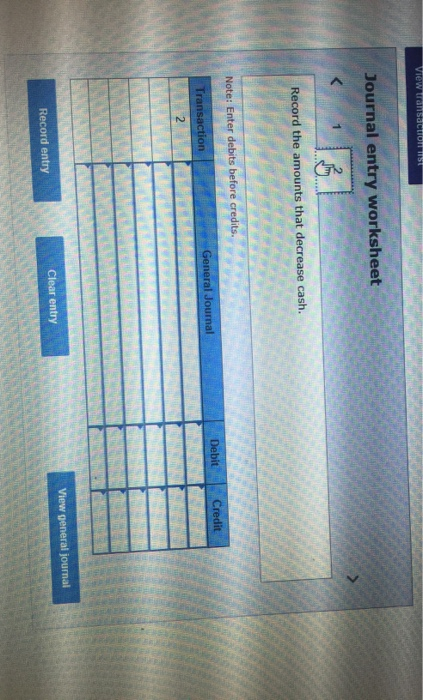

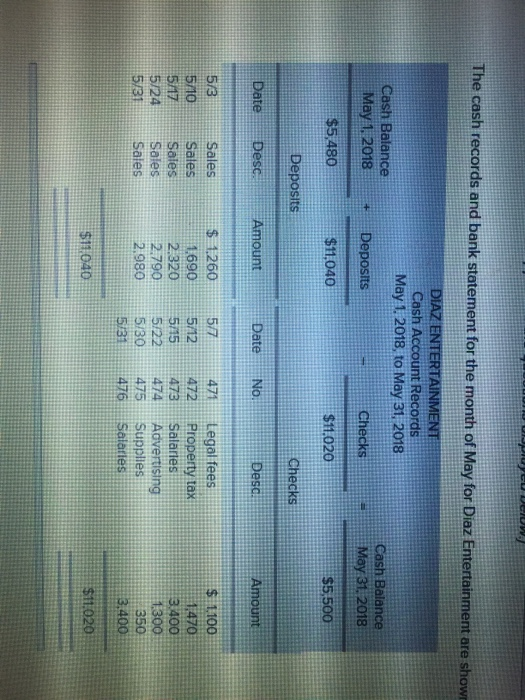

The cash records and bank statement for the month of May for Diaz Entertainment are show DIAZ ENTERTAINMENT Cash Account Records May 1, 2018, to May 31, 2018 Cash Balance May 1, 2018 Deposits Checks Cash Balance May 31, 2018 $5,480 $11,040 $11.020 $5,500 Deposits Checks Date Desc Amount Date No. Desc. Amount Ulu Nga Sales Sales Sales $ 1.260 1690 2.320 2.790 2.980 Legal fees Property tax Salaries Advertising Supplies Salaries WONGAN $ 1,100 1.470 13.400 1.300 350 3.400 Sales Sales $19.040 $11.020 PO Box 162647 Bowlegs, OK 74830 (405) 369-CASH MIDWEST BANK Looking Out For You Member FDIC Account Holder Account Number: 7772854360 Dlaz Entertainment 124 Saddle Blvd. Bowlegs, OK 74830 Statement Date: May 31, 2018 Beginning Balance Deposits and Credits Withdrawals and Debits Ending Balance May 1, 2018 No. Total No. Total May 31, 2018 9 $ 6,060 Deposits and Credits $ 9,310 $8,480 Withdrawals and Debits $ 6,890 Daily Balance Date Amount Desc Date No. Amount Desc. Date Amount DEP 469 DEP 470 5/4 5/11 5/18 5/20 5/20 5/25 5/31 $ 1,260 1,690 2,320 1,200 DEP NOTE INT DEP UT UT UT UT UT $ 350 230 1,100 200 1,470 3,400 400 1,300 30 40 CHK CHK CHK NSF CHK CHK EFT CHK SF $5,710 5,480 6,740 5,640 7,130 5,660 4,580 5.420 6.910 $ 6,890 2.790 473 10. INT UT 474 5/18 5/20 5/25 5/31 UT $ 9,310 $8.480 SF Service fees NSF Nonsufficient funds Desc. DEP Customer deposit NOTE Note collected EFT Electronic funds transfer INT Interest earned CHK Customer check Additional information 0. The difference in the beginning balances in the company's records and the bank statement relates to checks 1469 and 470, which are outstanding as of April 30, 2018 (prior month). b. The bank made the EFT on May 20 in error. The bank accidentally charged Diaz for payment that should have been made on another account value 10.00 points Required: 1. Prepare a bank reconciliation for Diaz's checking account on May 31, 2018. (Amounts to be deducted she when entering in the bank reconciliation.) DIAZ ENTERTAINMENT Bank Reconciliation May 31, 2018 Company's Cash Balance 5,480 Per general ledger 2,980 5,500 Bank's Cash Balance Per bank statement Deposits outstanding Checks outstanding Bank error Bank balance per reconciliation Company balance per reconciliation Journal entry worksheet Record the amounts that increase cash. "crease cash Note: Enter debits before credits. Transaction General Journal Debit Credit View general journal Clear entry Record entry View transaction St Journal entry worksheet Record the amounts that decrease cash. Note: Enter debits before credits. Debit Transaction General Journal 2 View general journal Clear entry Record entry