with this information i need this question answered ----> prepare a schedule to compute the net cash flows for april,may and june

with this information i need this question answered ----> prepare a schedule to compute the net cash flows for april,may and june

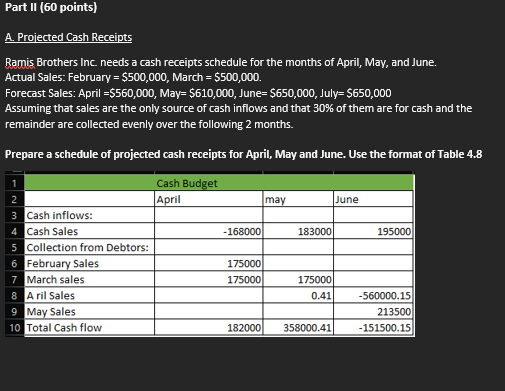

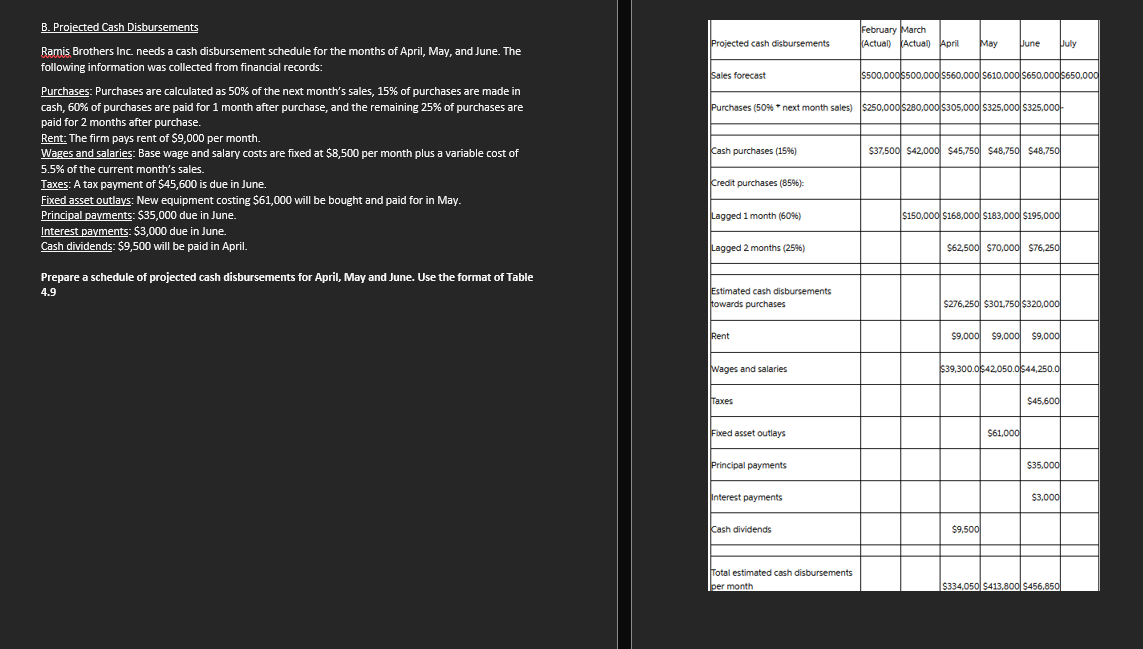

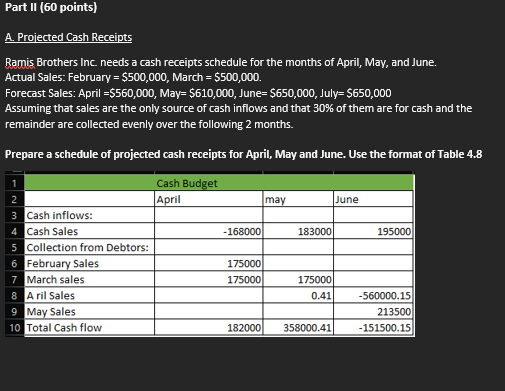

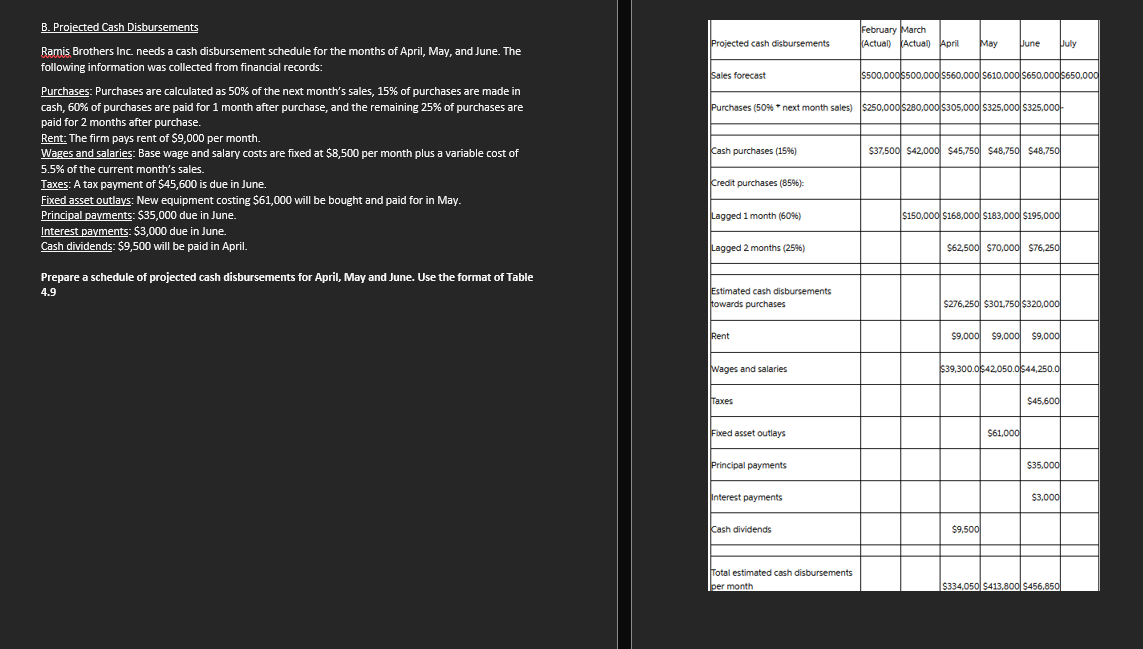

Part II (60 points) A. Projected Cash Receipts Ramis Brothers Inc. needs a cash receipts schedule for the months of April, May, and June. Actual Sales: February =$500,000, March =$500,000. Forecast Sales: April =$560,000,May=$610,000, June =$650,000,July=$650,000 Assuming that sales are the only source of cash inflows and that 30% of them are for cash and the remainder are collected evenly over the following 2 months. Prepare a schedule of projected cash receipts for April, May and June. Use the format of Table 4.8 B. Projected Cash Disbursements Ramis Brothers Inc. needs a cash disbursement schedule for the months of April, May, and June. The following information was collected from financial records: Purchases: Purchases are calculated as 50% of the next month's sales, 15% of purchases are made in cash, 60% of purchases are paid for 1 month after purchase, and the remaining 25% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $9,000 per month. Wages and salaries: Base wage and salary costs are fixed at $8,500 per month plus a variable cost of 5.5% of the current month's sales. Taxes: A tax payment of $45,600 is due in June. Fixed asset outlays: New equipment costing $61,000 will be bought and paid for in May. Principal payments: $35,000 due in June. Interest payments: $3,000 due in June. Cash dividends: $9,500 will be paid in April. Prepare a schedule of projected cash disbursements for April, May and June. Use the format of Table Part II (60 points) A. Projected Cash Receipts Ramis Brothers Inc. needs a cash receipts schedule for the months of April, May, and June. Actual Sales: February =$500,000, March =$500,000. Forecast Sales: April =$560,000,May=$610,000, June =$650,000,July=$650,000 Assuming that sales are the only source of cash inflows and that 30% of them are for cash and the remainder are collected evenly over the following 2 months. Prepare a schedule of projected cash receipts for April, May and June. Use the format of Table 4.8 B. Projected Cash Disbursements Ramis Brothers Inc. needs a cash disbursement schedule for the months of April, May, and June. The following information was collected from financial records: Purchases: Purchases are calculated as 50% of the next month's sales, 15% of purchases are made in cash, 60% of purchases are paid for 1 month after purchase, and the remaining 25% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $9,000 per month. Wages and salaries: Base wage and salary costs are fixed at $8,500 per month plus a variable cost of 5.5% of the current month's sales. Taxes: A tax payment of $45,600 is due in June. Fixed asset outlays: New equipment costing $61,000 will be bought and paid for in May. Principal payments: $35,000 due in June. Interest payments: $3,000 due in June. Cash dividends: $9,500 will be paid in April. Prepare a schedule of projected cash disbursements for April, May and June. Use the format of Table

with this information i need this question answered ----> prepare a schedule to compute the net cash flows for april,may and june

with this information i need this question answered ----> prepare a schedule to compute the net cash flows for april,may and june