with this trial balance answer e

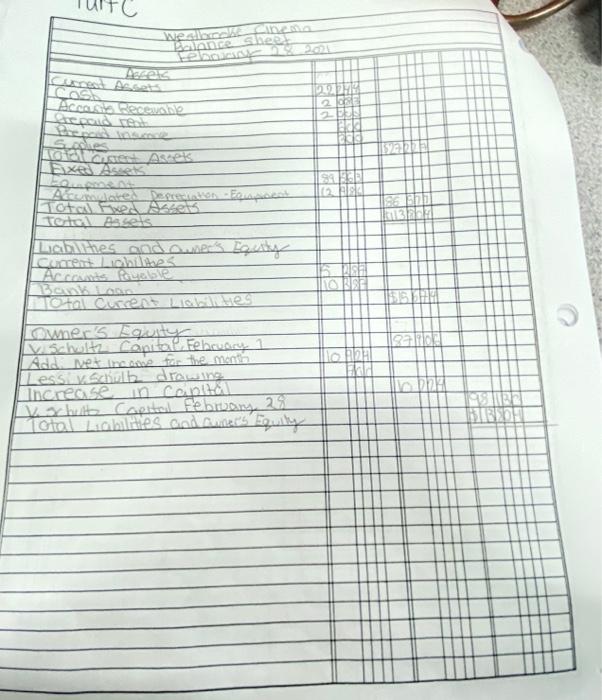

Wire Balance sheet Ares CU ASGAR COS ACCS Recease Ce pod mene Sophes AGB As ek . 2 DE 2 ET SARI OBAL RE NSE -404 Aceae Degregation Forest Total Assets To esser Lahirhes poders Deutty Current Lichilibes Account Royable Bank Corrent Liabilities owner's Equity V. Schultz Capital February 1 Add. wet income for the month Lessive Schulb drowing Increase in cop vs bulbs Capital February 29 Total Liables and Code Fully sa NAI 12A! a: PERE BO Part D On behalf of the owner, V. Schultz, prepare a short written report answering the following questions: a) Is the business profitable at this time? b) Is the profitability increasing or decreasing? If the business were to apply for a $20 000 bank loan to purchase further equipment, would it be approved? Concentrate your response on the ability to repay the loan and the bank's chance of recovering its money if the cinema cannot meet its loan payments. d) Has the value of the business increased or decreased over the first two months of operation? e) Should the present method of operating the confectionery be changed? G. Jones has submitted a proposal to V. Schultz to take over operation of the confectionery in the theatre and to pay Westbrooke Cinema 25% of sales. At present, the salary for the booth operator is $500 per week and the cost of the merchandise sold represents approximately 50% of the sales revenue. (Example: Sales 300 x 0.05 = 150 cost of merchandise sold). Based on this information and the confectionery income for the first two months, Schultz would like an opinion on whether it would be more profitable to run the booth or lease it to Jones. Wire Balance sheet Ares CU ASGAR COS ACCS Recease Ce pod mene Sophes AGB As ek . 2 DE 2 ET SARI OBAL RE NSE -404 Aceae Degregation Forest Total Assets To esser Lahirhes poders Deutty Current Lichilibes Account Royable Bank Corrent Liabilities owner's Equity V. Schultz Capital February 1 Add. wet income for the month Lessive Schulb drowing Increase in cop vs bulbs Capital February 29 Total Liables and Code Fully sa NAI 12A! a: PERE BO Part D On behalf of the owner, V. Schultz, prepare a short written report answering the following questions: a) Is the business profitable at this time? b) Is the profitability increasing or decreasing? If the business were to apply for a $20 000 bank loan to purchase further equipment, would it be approved? Concentrate your response on the ability to repay the loan and the bank's chance of recovering its money if the cinema cannot meet its loan payments. d) Has the value of the business increased or decreased over the first two months of operation? e) Should the present method of operating the confectionery be changed? G. Jones has submitted a proposal to V. Schultz to take over operation of the confectionery in the theatre and to pay Westbrooke Cinema 25% of sales. At present, the salary for the booth operator is $500 per week and the cost of the merchandise sold represents approximately 50% of the sales revenue. (Example: Sales 300 x 0.05 = 150 cost of merchandise sold). Based on this information and the confectionery income for the first two months, Schultz would like an opinion on whether it would be more profitable to run the booth or lease it to Jones

with this trial balance answer e

with this trial balance answer e