With using these account titles what would be considered, Operating Assets, Operating Liabilities, Non-Operating Assets, and Non-Operating Liabilities. Also, how and which accounts would you use to Calculate the NOPAT?

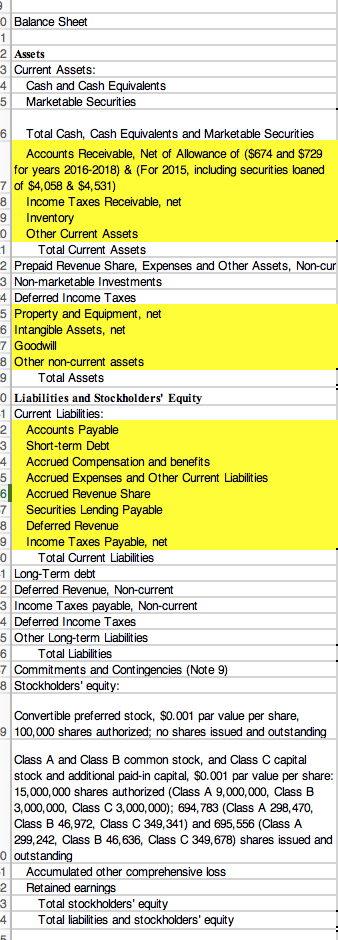

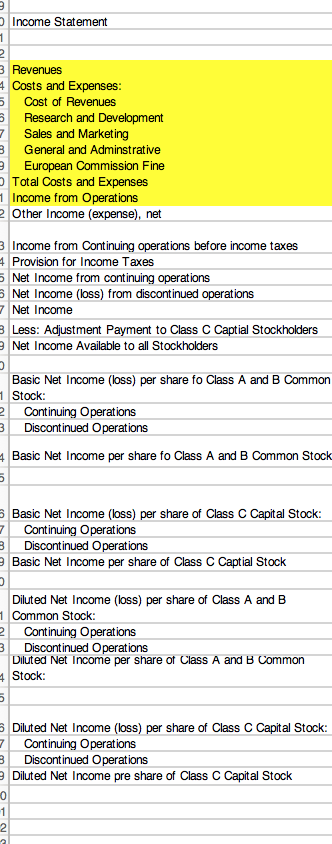

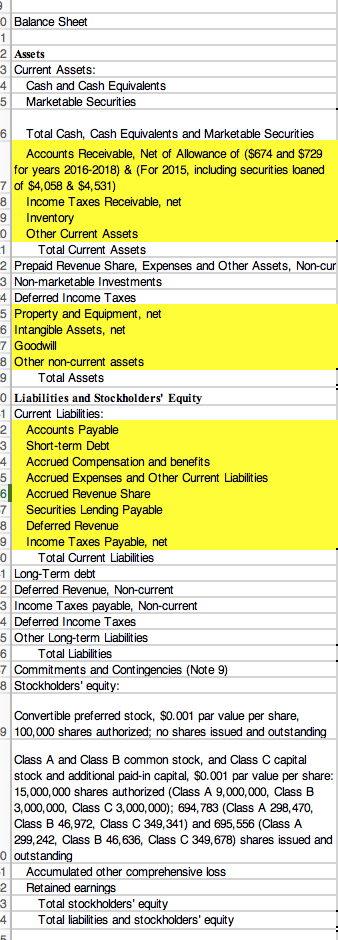

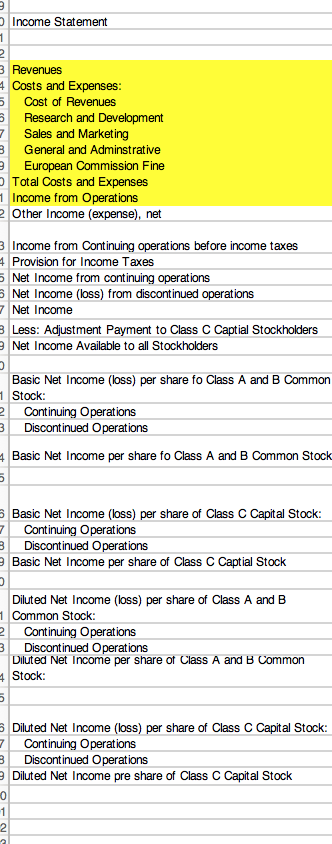

0 Balance Sheet 2 Assets 3 Current Assets 4Cash and Cash Equivalents 5 Marketable Securities 6 Total Cash, Cash Equivalents and Marketable Securities Accounts Receivable, Net of Allowance of ($674 and $729 for years 2016-2018) & (For 2015, including securities loaned 7 of $4,058 & $4,531) 8 Income Taxes Receivable, net 9 Inventory 0 Other Current Assets Total Current Assets 2 Prepaid Revenue Share, Expenses and Other Assets, Non-cur 3 Non-marketable Investments 4Deferred Income Taxes 5 Property and Equipment, net 6 Intangible Assets, net 7 Goodwill 8 Other non-current assets Total Assets 0 Liabilities and Stoc kholders' Equity 1 Current Liabilities 2 Accounts Payable 3 Short-term Debt 4 Accrued Compensation and benefits 5 Accrued Expenses and Other Current Liabilities 6 Accrued Revenue Share 7 Securities Lending Payable 8 Deferred Revenue 9 Income Taxes Payable, net 0 1 Long-Term debt 2 Deferred Revenue, Non-current 3 Income Taxes payable, Non-current 4Deferred Income Taxes 5 Other Long-term Liabilities Total Current Liabilities Total Liabilities 7 Commitments and Contingencies (Note 9 8 Stockholders' equity Convertible preferred stock, $0.001 par value per share, 9 100,000 shares authorized; no shares issued and outstanding Class A and Class B common stock, and Class C capital stock and additional paid-in capital, $0.001 par value per share: 15,000,000 shares authorized (Class A 9,000,000, Class B 3,000,000, Class C 3,000,000); 694,783 (Class A 298,470, Class B 46,972, Class C 349,341) and 695,556 (Class A 299,242, Class B 46,636, Class C 349,678) shares issued and 0 outstanding 1 Accumulat ed ot her comprehensive loss 2Retained earnings 3Total stockholders' equity 4Total liabilities and stockholders' equity 7 Income Statement Costs and Expenses 5 Cost of Revenues Research and Development Sales and Marketing General and Adminstrative European Commission Fine Total Costs and Expenses Income from Operations Other Income (expense), net Income from Continuing operations before income taxes Provision for Income Taxes Net Income from continuing operations Net Income (loss) from discontinued operations 7 Net Income Less: Adjustment Payment to Class C Captial Stockholders Net Income Available to all Stockholders Basic Net Income (loss) per share fo Class A and B Common Stock Continuing Operations Discontinued Operations Basic Net Income per share fo Class A and B Common Stock Basic Net Income (loss) per share of Class C Capital Stock: Continuing Operations Discontinued Operations Basic Net Income per share of Class C Captial Stock Diluted Net Income (loss) per share of Class A and B Common Stock: Continuing Operations Discontinued Operations Diluted Net Income per share of Class A and B Common Stock: Diluted Net Income (loss) per share of Class C Capital Stock: Continuing Operations Discontinued Operations Diluted Net Income pre share of Class C Capital Stock 0 2 0 Balance Sheet 2 Assets 3 Current Assets 4Cash and Cash Equivalents 5 Marketable Securities 6 Total Cash, Cash Equivalents and Marketable Securities Accounts Receivable, Net of Allowance of ($674 and $729 for years 2016-2018) & (For 2015, including securities loaned 7 of $4,058 & $4,531) 8 Income Taxes Receivable, net 9 Inventory 0 Other Current Assets Total Current Assets 2 Prepaid Revenue Share, Expenses and Other Assets, Non-cur 3 Non-marketable Investments 4Deferred Income Taxes 5 Property and Equipment, net 6 Intangible Assets, net 7 Goodwill 8 Other non-current assets Total Assets 0 Liabilities and Stoc kholders' Equity 1 Current Liabilities 2 Accounts Payable 3 Short-term Debt 4 Accrued Compensation and benefits 5 Accrued Expenses and Other Current Liabilities 6 Accrued Revenue Share 7 Securities Lending Payable 8 Deferred Revenue 9 Income Taxes Payable, net 0 1 Long-Term debt 2 Deferred Revenue, Non-current 3 Income Taxes payable, Non-current 4Deferred Income Taxes 5 Other Long-term Liabilities Total Current Liabilities Total Liabilities 7 Commitments and Contingencies (Note 9 8 Stockholders' equity Convertible preferred stock, $0.001 par value per share, 9 100,000 shares authorized; no shares issued and outstanding Class A and Class B common stock, and Class C capital stock and additional paid-in capital, $0.001 par value per share: 15,000,000 shares authorized (Class A 9,000,000, Class B 3,000,000, Class C 3,000,000); 694,783 (Class A 298,470, Class B 46,972, Class C 349,341) and 695,556 (Class A 299,242, Class B 46,636, Class C 349,678) shares issued and 0 outstanding 1 Accumulat ed ot her comprehensive loss 2Retained earnings 3Total stockholders' equity 4Total liabilities and stockholders' equity 7 Income Statement Costs and Expenses 5 Cost of Revenues Research and Development Sales and Marketing General and Adminstrative European Commission Fine Total Costs and Expenses Income from Operations Other Income (expense), net Income from Continuing operations before income taxes Provision for Income Taxes Net Income from continuing operations Net Income (loss) from discontinued operations 7 Net Income Less: Adjustment Payment to Class C Captial Stockholders Net Income Available to all Stockholders Basic Net Income (loss) per share fo Class A and B Common Stock Continuing Operations Discontinued Operations Basic Net Income per share fo Class A and B Common Stock Basic Net Income (loss) per share of Class C Capital Stock: Continuing Operations Discontinued Operations Basic Net Income per share of Class C Captial Stock Diluted Net Income (loss) per share of Class A and B Common Stock: Continuing Operations Discontinued Operations Diluted Net Income per share of Class A and B Common Stock: Diluted Net Income (loss) per share of Class C Capital Stock: Continuing Operations Discontinued Operations Diluted Net Income pre share of Class C Capital Stock 0 2