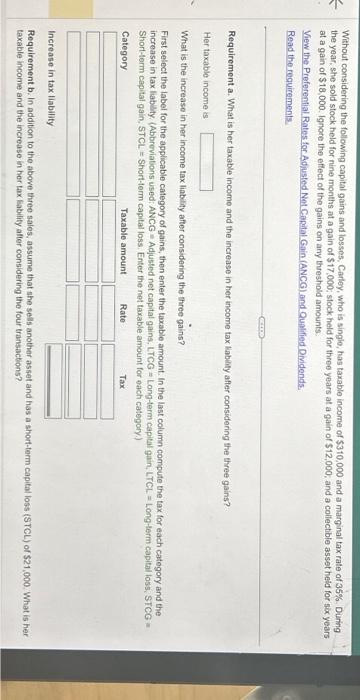

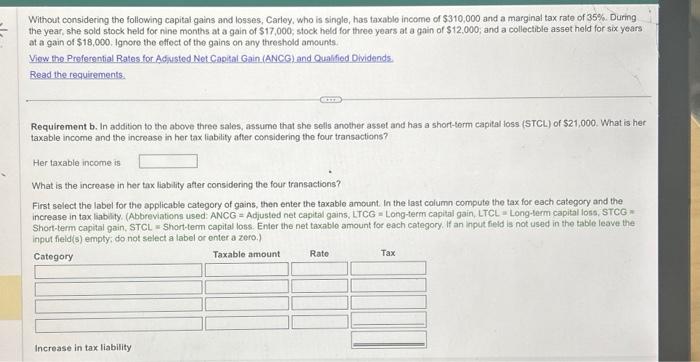

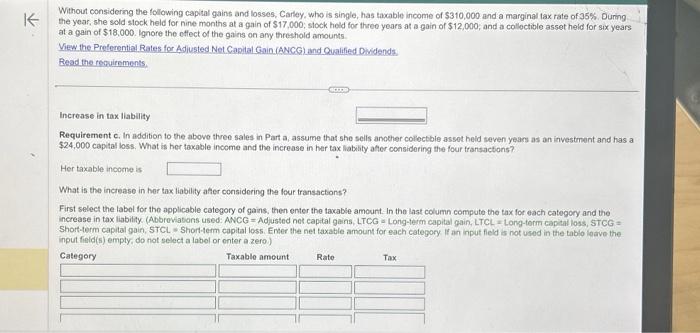

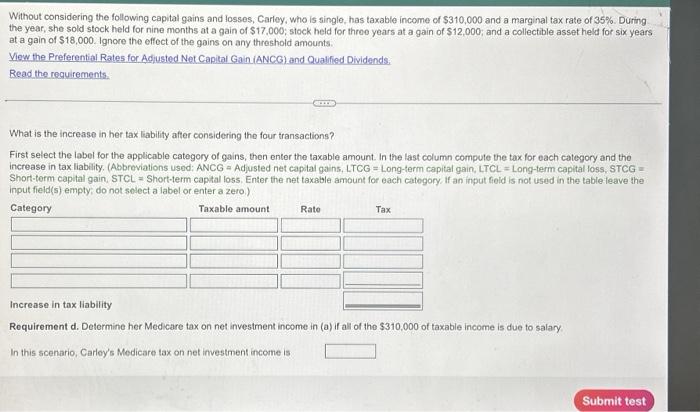

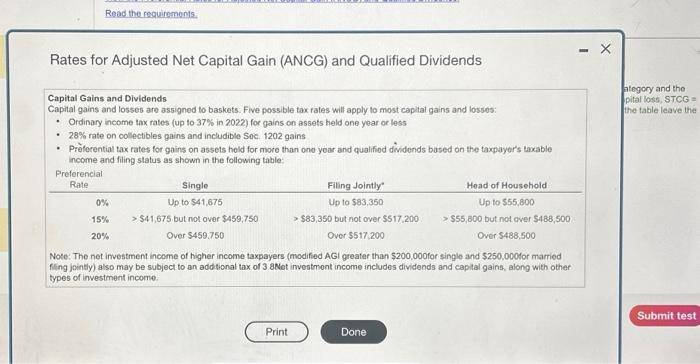

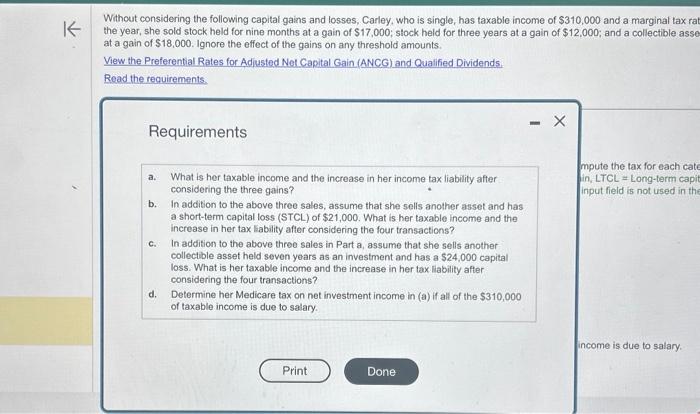

Without considering the following capital gains and losses, Carloy, who is single, has taxable income of $310.000 and a marginal tax rate of 35%. Diring the year, she sold stock held for nine months at a gain of $17,000; slock held for three years at a gain of $12,000, and a collectible asset heid for six years at a gain of $18,000. Ignoce the effect of the gains on any threshold amounts: View the Preferential Rates for Adjusted Nat Cardal Gain (ANCG) and Qualified Dividends. Read the reguirements. Requirement a. What is her taxable income and the increase in her income tax labihty after considering the three gains? Her taxable income is What is the increase in her income tax liability after considering the three gains? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liabily. (Abbreviations used: ANCG = Adjusted net capita! gains, LTCG = Long-term capital gain, LTCL = Long-lerm capital loss, STCG = Short-term capital gain, STCL = Short-term capital loss. Enter the net taxable amount for vach category.) Increase in tax liability Requirement b. In addition to the above threo salos, assume that she sels another asset and has a short-term capital loss (\$TCL) of $21,000. What is her taxable income and the increase in her tax liablify after considering the four transactions? Without considering the following capital gaint and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rate of 35%. During the year, she sold slock held for nine months at a gain of $17,000; slock held for threo years at a gain of $12,000, and a collectible asset held for six years. at a gain of $18,000. Ignore the effect of the gains on any threshold amounts View the Preferential Rates for Adiusted Net Capital Gain (ANCG) and Qualified Dividends. Bead the tenuirements. sin Increase in tax liability Requirement c. In addition to the above three sales in Part a, assume that she sells anocher colloctble assot heid seven years as an investrnent and has a $24,000 capital loss. What is her taxable income and the increase in har tax liability after considering the four transactions? Her taxable income is What is the increase in her tax liability affer considering the leur transactions? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liabilify (Abbreviabons used: ANCG = Adjusted net capital gains, LTCG a Long-term capital gain, LTCL = Long-torm Capidal loss, STCG = Short-term capital gain, STCL. = Shortterm capital loss. Ender the net taxable amount for each category if an input fleld is not used in the tablo loave the input field(s) empty, do not select a label or enter a zero.) Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most ceplat gains and lossos: - Ordinary income tax rates (up to 37% in 2022) for gains on assets held one year or less - 28% rate on collectibles gains and includible Soc. 1202 gains - Prferential tax rates for gains on assets hold for more than one yoar and qualifiod dividends based on the taxpayor's taxable income and filing status as shown in the following table: Note: The net investment income of higher income taxpayers (modified AGI greater than $200,000 for single and $250,000 tor married fiing jointly) also may be subject to an additional tax of 3 8Ret investmont income includes dividends and captal gains, along with other types of investment income. Without considering the following capital gains and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rate of 35%. During the year, she sold stock held for nine months at a gain of $17,000; stock held for throe years at a gain of $12,000; and a collectible asset held for six years at a gain of $18,000. Ignore the effect of the gains on any threshold amounts: View the Preferential Rates for Adiusted Net Capital Gain (ANCG) and Qualified Dividends: Read the reguirements. What is the increase in her tax liability after considering the four transactions? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liability. (Abbroviations used: ANCG = Adjusted net capital gains, LTCG = Long-term capital gain, LTCL = Long-term capital loss, STCG = Short-term capial gain, STCL = Short-term captal loss. Enter the net taxable amount for each catogory if an input field is not used in the table leave the input field(s) empty; do not solect a label or enter a zero) increase in tax uabuity Requirement d. Determine her Medicare tax on net investment income in (a) if all of the $310,000 of taxable income is due to salary. In this scenario, Carley's Medicare tax on net investment income is Without considering the following capitat gains and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rate of 35%. During the year, she sold stock held for nine months at a gain of $17,000; stock held for three years at a gain of $12,000; and a collectible asset held for six years at a gain of $18,000. Ignore the effect of the gains on any threshold amounts. View the Preferential Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends. Read the requinements. Requirement b. In addition to the above three sales, assume that she sells another asset and has a short-term capital loss ( $7CL) of $21,000. What is her taxable income and the increase in her tax liability after considering the four transactions? Her taxable income is What is the increase in her tax liability after considering the four transactions? First select the label for the applicable category of gains, then enter the taxable amount In the last column compute the tax for each category and the increase in tax liablity. (Abbrevations used: ANCG = Adjusted net captal gains, LTCG = Long-term capital gain, LTCL = Long-lerm capital loss, STCG * Shott-term capital gain, STCL = Short-term capital loss. Enter the net taxablo amount foc each category. If an input field is not used in the table leave the input field(s) empty; do not select a label or onter a zero.) Without considering the following capital gains and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rat the year, she sold stock held for nine months at a gain of $17,000; stock held for three years at a gain of $12,000; and a collectible asse at a gain of $18,000. Ignore the effect of the gains on any threshold amounts. View the Preferential Rates for Adjusted Nel Capital Gain (ANCG) and Qualified Dividends. Read the requirements. Requirements a. What is her taxable income and the increase in her income tax liability after considering the three gains? b. In addition to the above three sales, assume that she sells another asset and has a short-term capital loss (STCL) of $21,000. What is her taxable income and the increase in her tax liability after considering the four transactions? c. In addition to the above three sales in Part a, assume that she sells another collectible asset held seven years as an investment and has a $24,000 capital loss. What is her taxable income and the increase in her tax liability after considering the four transactions? d. Determine her Medicare tax on net investment income in (a) if all of the $310,000 of taxable income is due to salary. mpute the tax for each cate in, LTCL= Long-term capit input field is not used in the income is due to salary. Without considering the following capital gains and losses, Carloy, who is single, has taxable income of $310.000 and a marginal tax rate of 35%. Diring the year, she sold stock held for nine months at a gain of $17,000; slock held for three years at a gain of $12,000, and a collectible asset heid for six years at a gain of $18,000. Ignoce the effect of the gains on any threshold amounts: View the Preferential Rates for Adjusted Nat Cardal Gain (ANCG) and Qualified Dividends. Read the reguirements. Requirement a. What is her taxable income and the increase in her income tax labihty after considering the three gains? Her taxable income is What is the increase in her income tax liability after considering the three gains? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liabily. (Abbreviations used: ANCG = Adjusted net capita! gains, LTCG = Long-term capital gain, LTCL = Long-lerm capital loss, STCG = Short-term capital gain, STCL = Short-term capital loss. Enter the net taxable amount for vach category.) Increase in tax liability Requirement b. In addition to the above threo salos, assume that she sels another asset and has a short-term capital loss (\$TCL) of $21,000. What is her taxable income and the increase in her tax liablify after considering the four transactions? Without considering the following capital gaint and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rate of 35%. During the year, she sold slock held for nine months at a gain of $17,000; slock held for threo years at a gain of $12,000, and a collectible asset held for six years. at a gain of $18,000. Ignore the effect of the gains on any threshold amounts View the Preferential Rates for Adiusted Net Capital Gain (ANCG) and Qualified Dividends. Bead the tenuirements. sin Increase in tax liability Requirement c. In addition to the above three sales in Part a, assume that she sells anocher colloctble assot heid seven years as an investrnent and has a $24,000 capital loss. What is her taxable income and the increase in har tax liability after considering the four transactions? Her taxable income is What is the increase in her tax liability affer considering the leur transactions? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liabilify (Abbreviabons used: ANCG = Adjusted net capital gains, LTCG a Long-term capital gain, LTCL = Long-torm Capidal loss, STCG = Short-term capital gain, STCL. = Shortterm capital loss. Ender the net taxable amount for each category if an input fleld is not used in the tablo loave the input field(s) empty, do not select a label or enter a zero.) Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most ceplat gains and lossos: - Ordinary income tax rates (up to 37% in 2022) for gains on assets held one year or less - 28% rate on collectibles gains and includible Soc. 1202 gains - Prferential tax rates for gains on assets hold for more than one yoar and qualifiod dividends based on the taxpayor's taxable income and filing status as shown in the following table: Note: The net investment income of higher income taxpayers (modified AGI greater than $200,000 for single and $250,000 tor married fiing jointly) also may be subject to an additional tax of 3 8Ret investmont income includes dividends and captal gains, along with other types of investment income. Without considering the following capital gains and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rate of 35%. During the year, she sold stock held for nine months at a gain of $17,000; stock held for throe years at a gain of $12,000; and a collectible asset held for six years at a gain of $18,000. Ignore the effect of the gains on any threshold amounts: View the Preferential Rates for Adiusted Net Capital Gain (ANCG) and Qualified Dividends: Read the reguirements. What is the increase in her tax liability after considering the four transactions? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liability. (Abbroviations used: ANCG = Adjusted net capital gains, LTCG = Long-term capital gain, LTCL = Long-term capital loss, STCG = Short-term capial gain, STCL = Short-term captal loss. Enter the net taxable amount for each catogory if an input field is not used in the table leave the input field(s) empty; do not solect a label or enter a zero) increase in tax uabuity Requirement d. Determine her Medicare tax on net investment income in (a) if all of the $310,000 of taxable income is due to salary. In this scenario, Carley's Medicare tax on net investment income is Without considering the following capitat gains and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rate of 35%. During the year, she sold stock held for nine months at a gain of $17,000; stock held for three years at a gain of $12,000; and a collectible asset held for six years at a gain of $18,000. Ignore the effect of the gains on any threshold amounts. View the Preferential Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends. Read the requinements. Requirement b. In addition to the above three sales, assume that she sells another asset and has a short-term capital loss ( $7CL) of $21,000. What is her taxable income and the increase in her tax liability after considering the four transactions? Her taxable income is What is the increase in her tax liability after considering the four transactions? First select the label for the applicable category of gains, then enter the taxable amount In the last column compute the tax for each category and the increase in tax liablity. (Abbrevations used: ANCG = Adjusted net captal gains, LTCG = Long-term capital gain, LTCL = Long-lerm capital loss, STCG * Shott-term capital gain, STCL = Short-term capital loss. Enter the net taxablo amount foc each category. If an input field is not used in the table leave the input field(s) empty; do not select a label or onter a zero.) Without considering the following capital gains and losses, Carley, who is single, has taxable income of $310,000 and a marginal tax rat the year, she sold stock held for nine months at a gain of $17,000; stock held for three years at a gain of $12,000; and a collectible asse at a gain of $18,000. Ignore the effect of the gains on any threshold amounts. View the Preferential Rates for Adjusted Nel Capital Gain (ANCG) and Qualified Dividends. Read the requirements. Requirements a. What is her taxable income and the increase in her income tax liability after considering the three gains? b. In addition to the above three sales, assume that she sells another asset and has a short-term capital loss (STCL) of $21,000. What is her taxable income and the increase in her tax liability after considering the four transactions? c. In addition to the above three sales in Part a, assume that she sells another collectible asset held seven years as an investment and has a $24,000 capital loss. What is her taxable income and the increase in her tax liability after considering the four transactions? d. Determine her Medicare tax on net investment income in (a) if all of the $310,000 of taxable income is due to salary. mpute the tax for each cate in, LTCL= Long-term capit input field is not used in the income is due to salary