Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wivenhoe Ltd wants to expand its market and is considering two mutually exclusive projects as follows: Project A: This project requires an initial investment

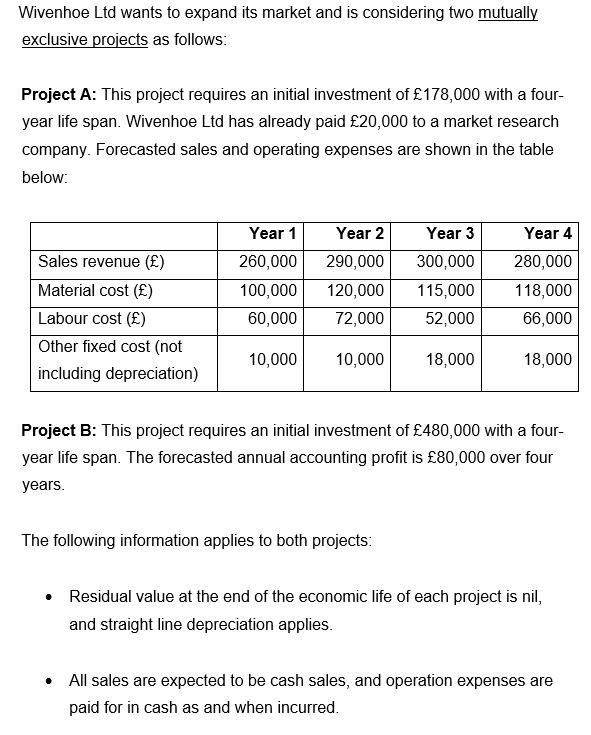

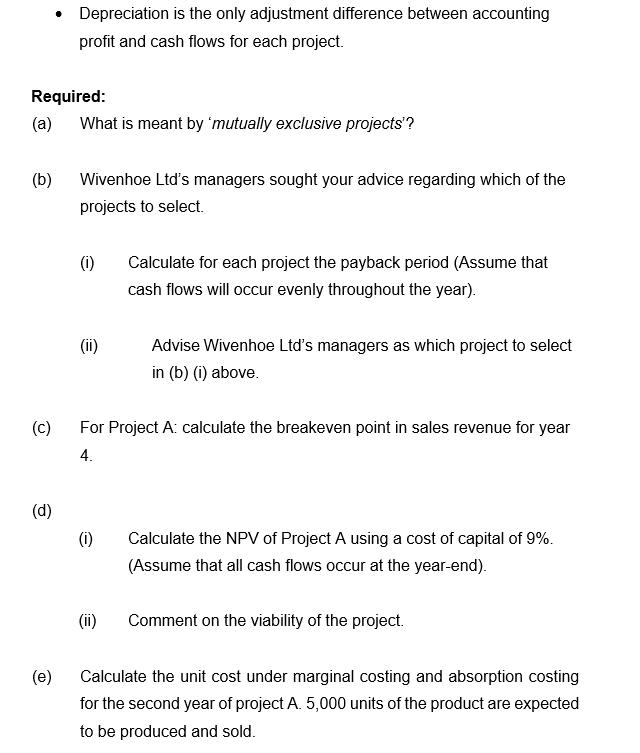

Wivenhoe Ltd wants to expand its market and is considering two mutually exclusive projects as follows: Project A: This project requires an initial investment of 178,000 with a four- year life span. Wivenhoe Ltd has already paid 20,000 to a market research company. Forecasted sales and operating expenses are shown in the table below: Sales revenue () Material cost () Labour cost () Other fixed cost (not including depreciation) Year 1 Year 2 260,000 290,000 100,000 120,000 60,000 72,000 10,000 10,000 Year 3 300,000 115,000 52,000 18,000 The following information applies to both projects: Year 4 280,000 118,000 66,000 18,000 Project B: This project requires an initial investment of 480,000 with a four- year life span. The forecasted annual accounting profit is 80,000 over four years. Residual value at the end of the economic life of each project is nil, and straight line depreciation applies. . All sales are expected to be cash sales, and operation expenses are paid for in cash as and when incurred. Required: (a) (b) (C) (d) Depreciation is the only adjustment difference between accounting profit and cash flows for each project. (e) What is meant by 'mutually exclusive projects'? Wivenhoe Ltd's managers sought your advice regarding which of the projects to select. (1) (ii) (1) Calculate for each project the payback period (Assume that cash flows will occur evenly throughout the year). For Project A: calculate the breakeven point in sales revenue for year 4. (ii) Advise Wivenhoe Ltd's managers as which project to select in (b) (i) above. Calculate the NPV of Project A using a cost of capital of 9%. (Assume that all cash flows occur at the year-end). Comment on the viability of the project. Calculate the unit cost under marginal costing and absorption costing for the second year of project A. 5,000 units of the product are expected to be produced and sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a Mutually exclusive projects refer to a situation where a company has to choose between two or more projects that serve similar purposes or compete for the same resources In this case Wivenh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started