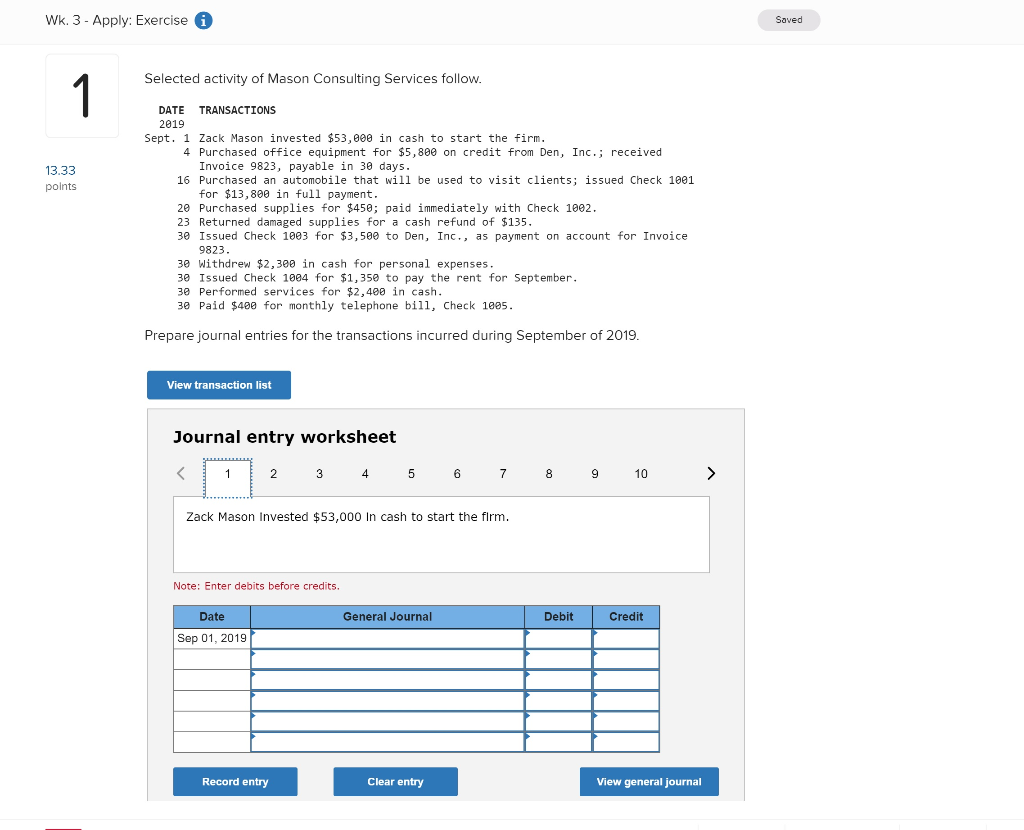

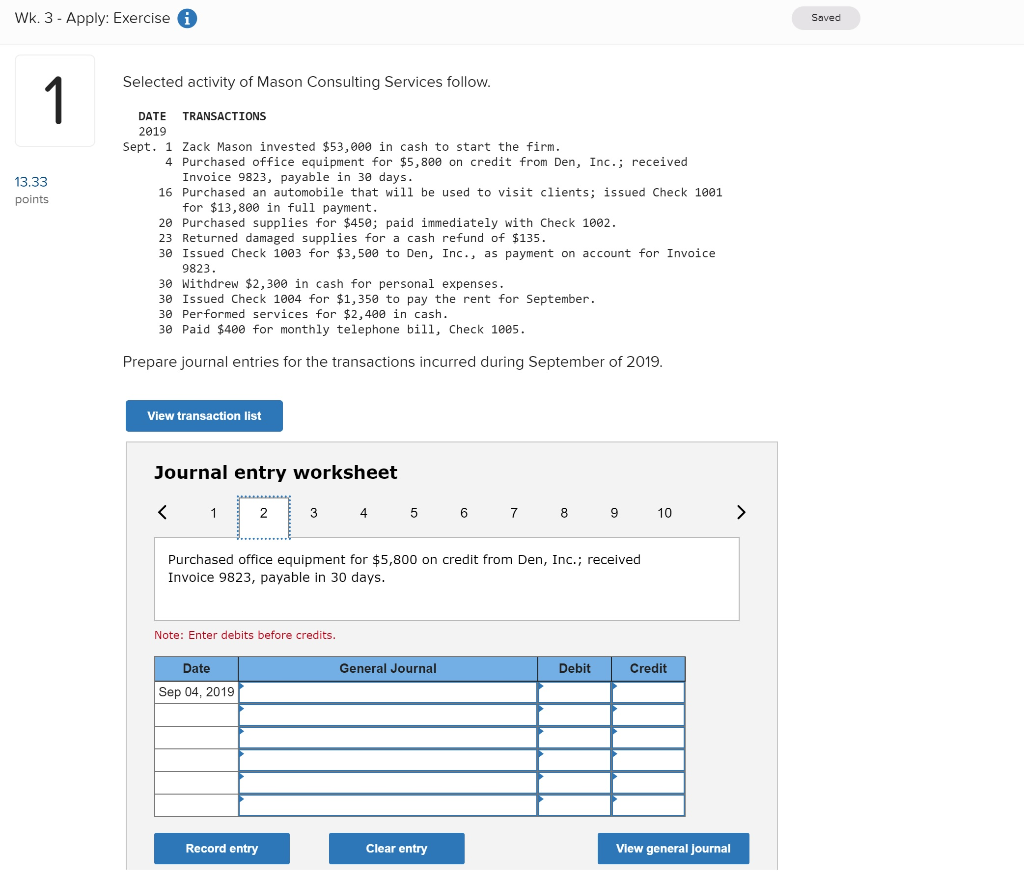

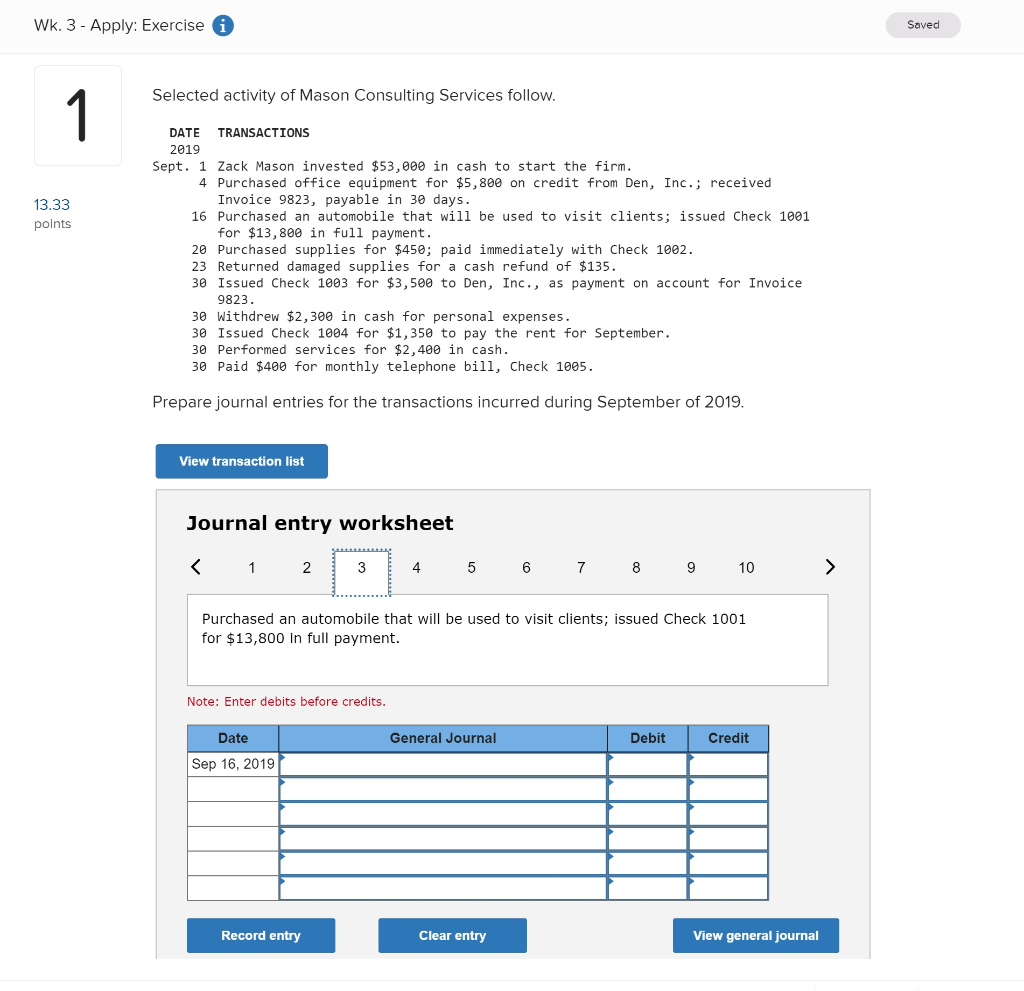

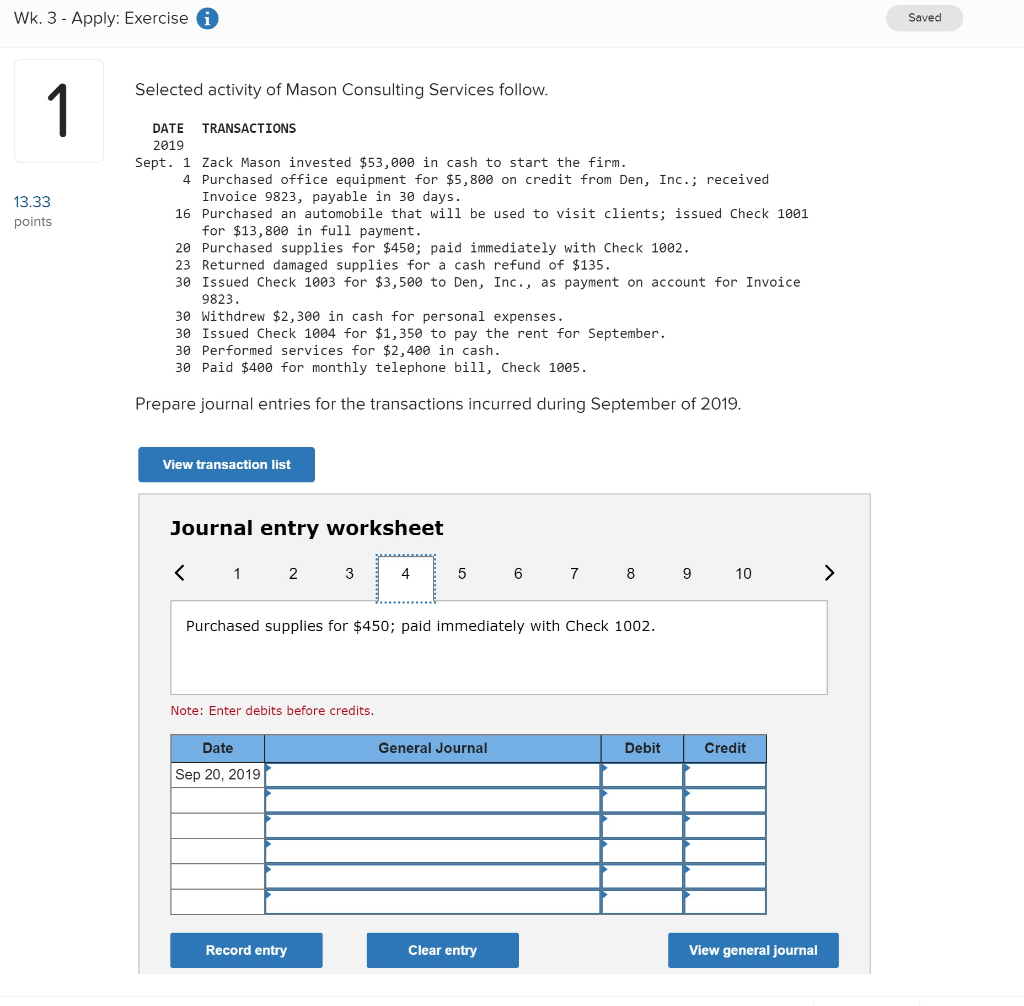

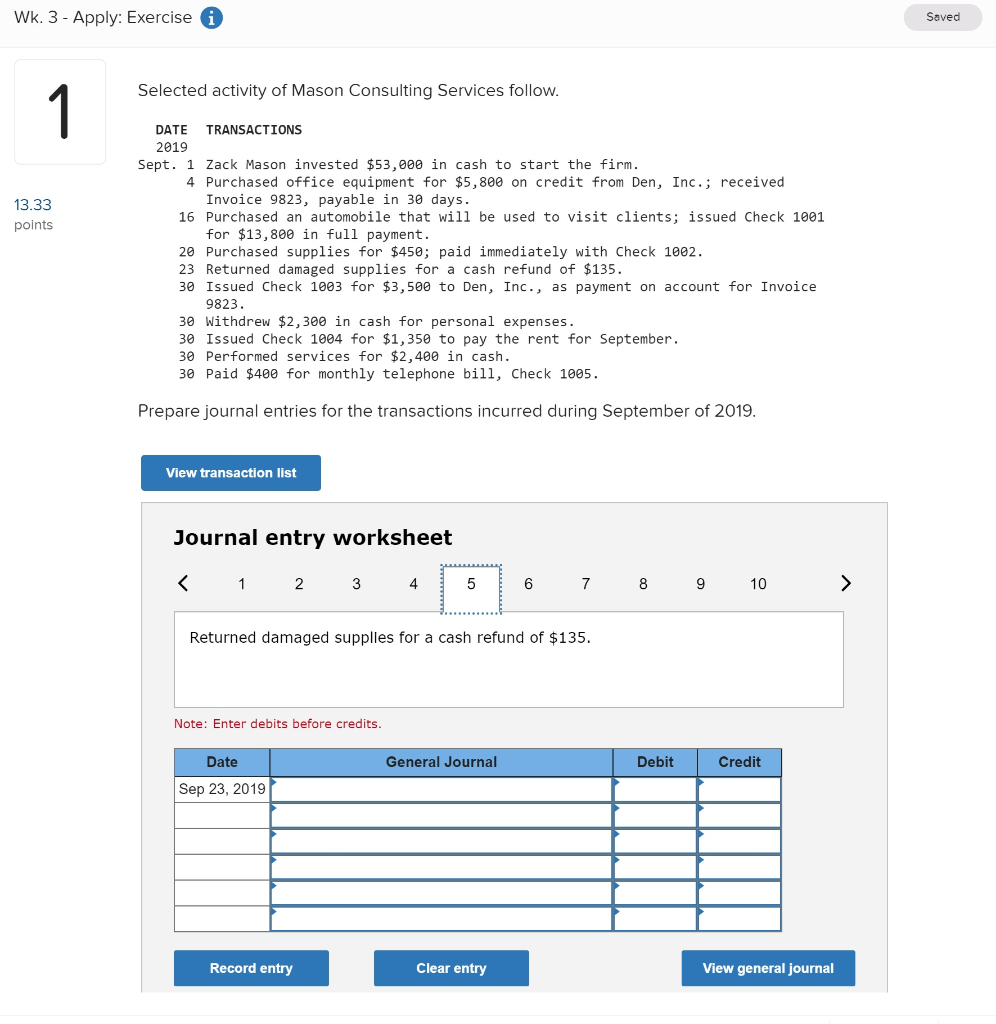

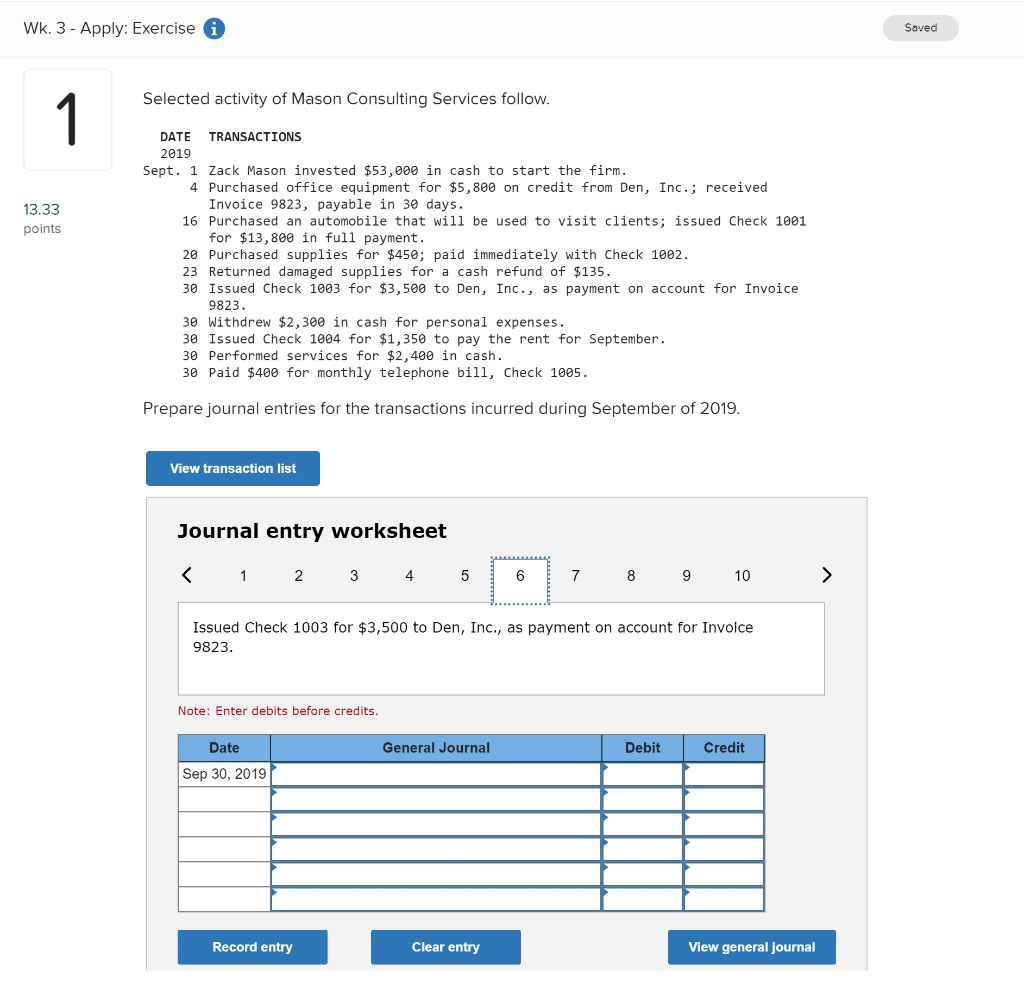

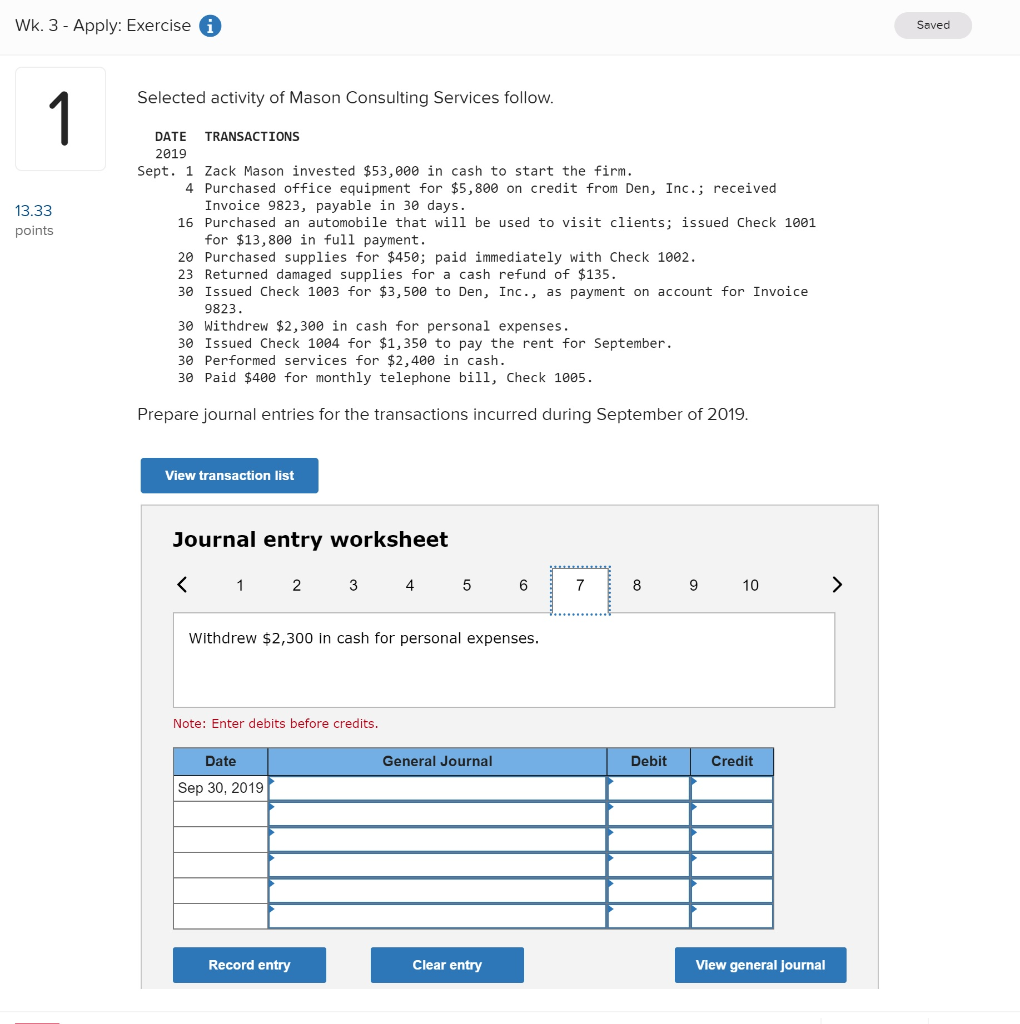

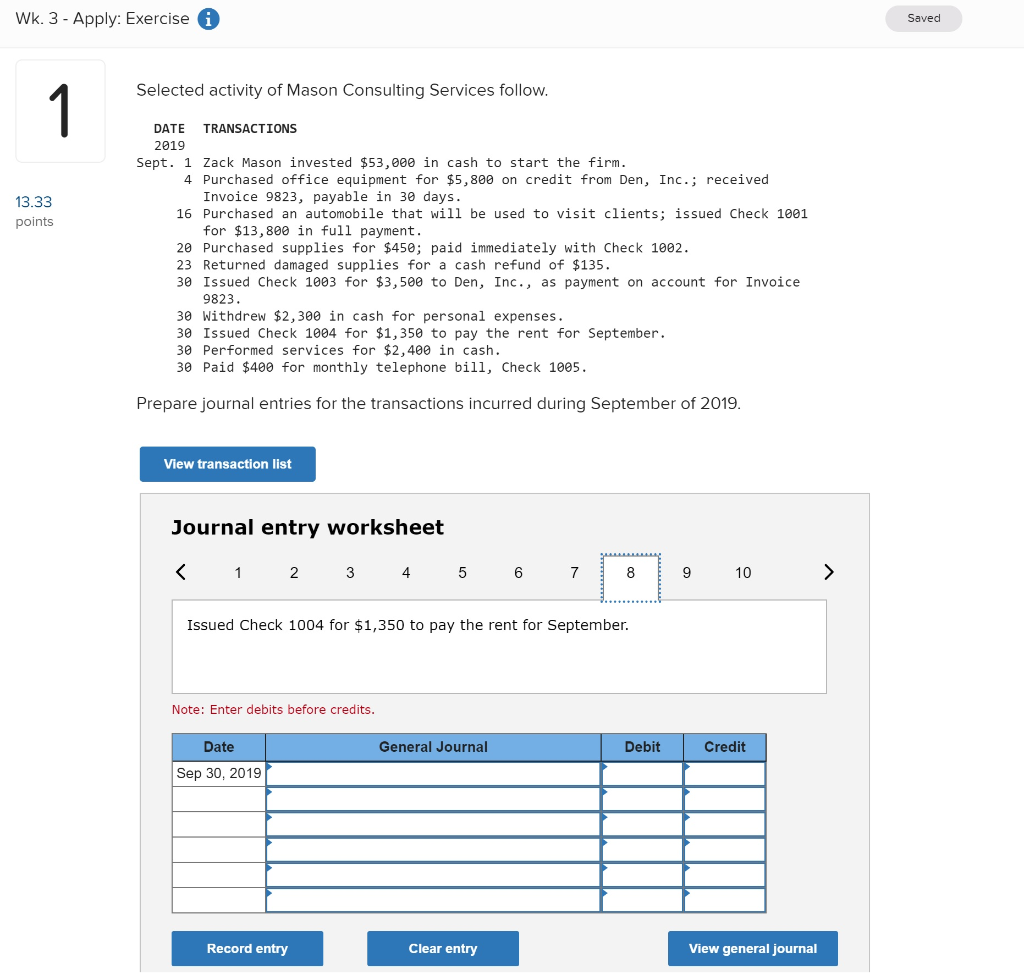

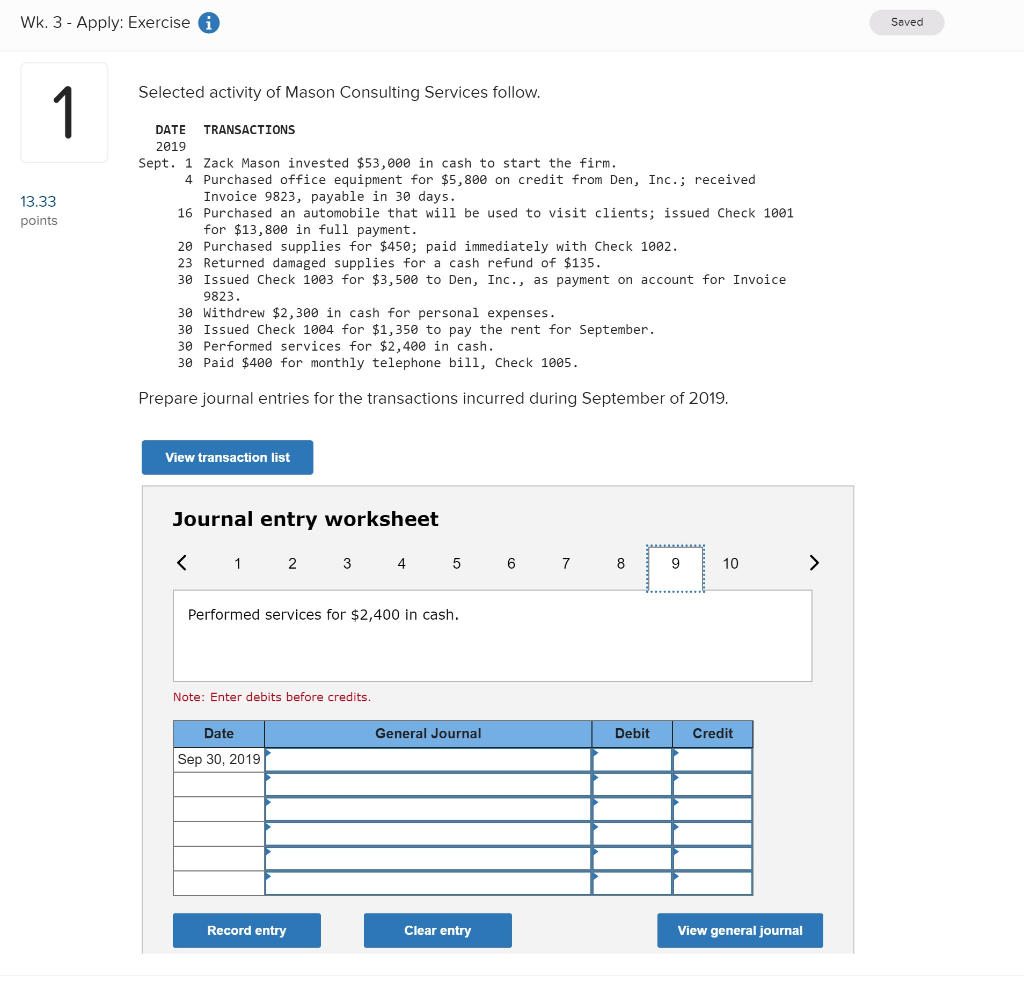

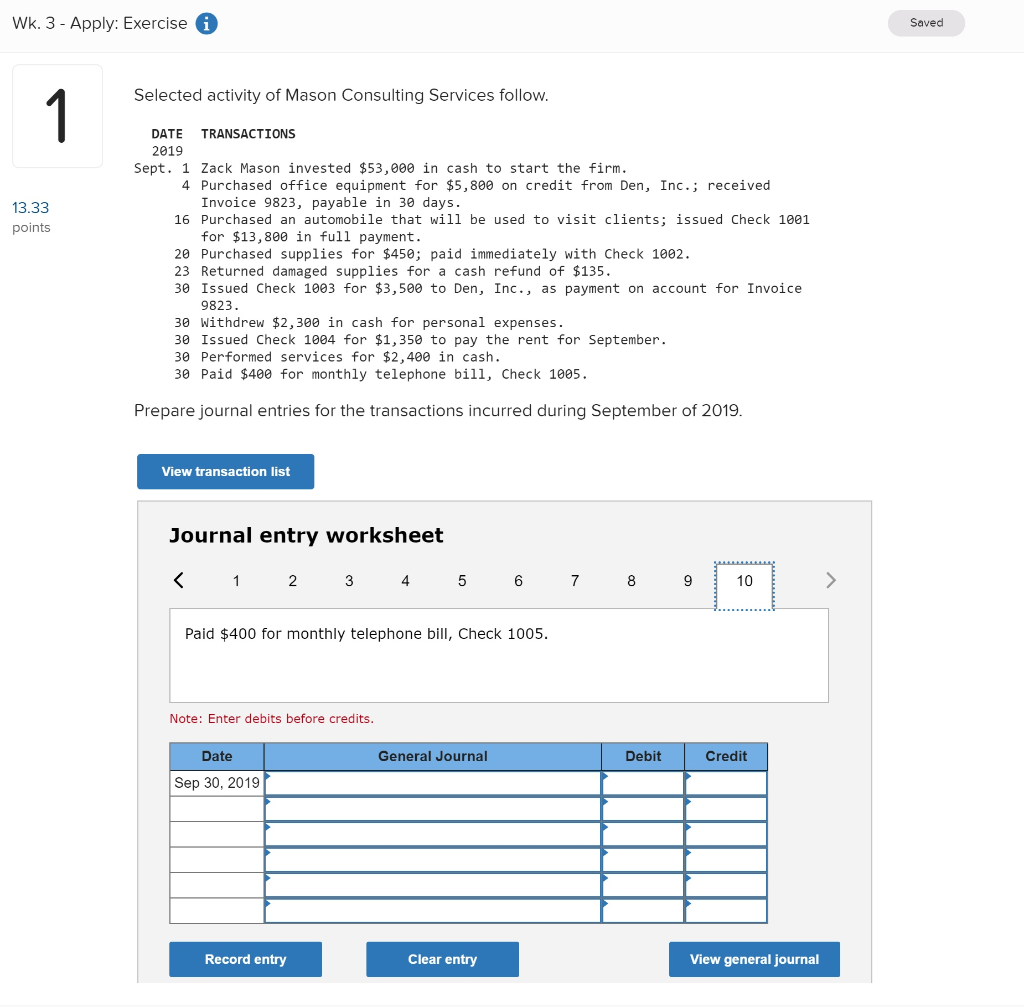

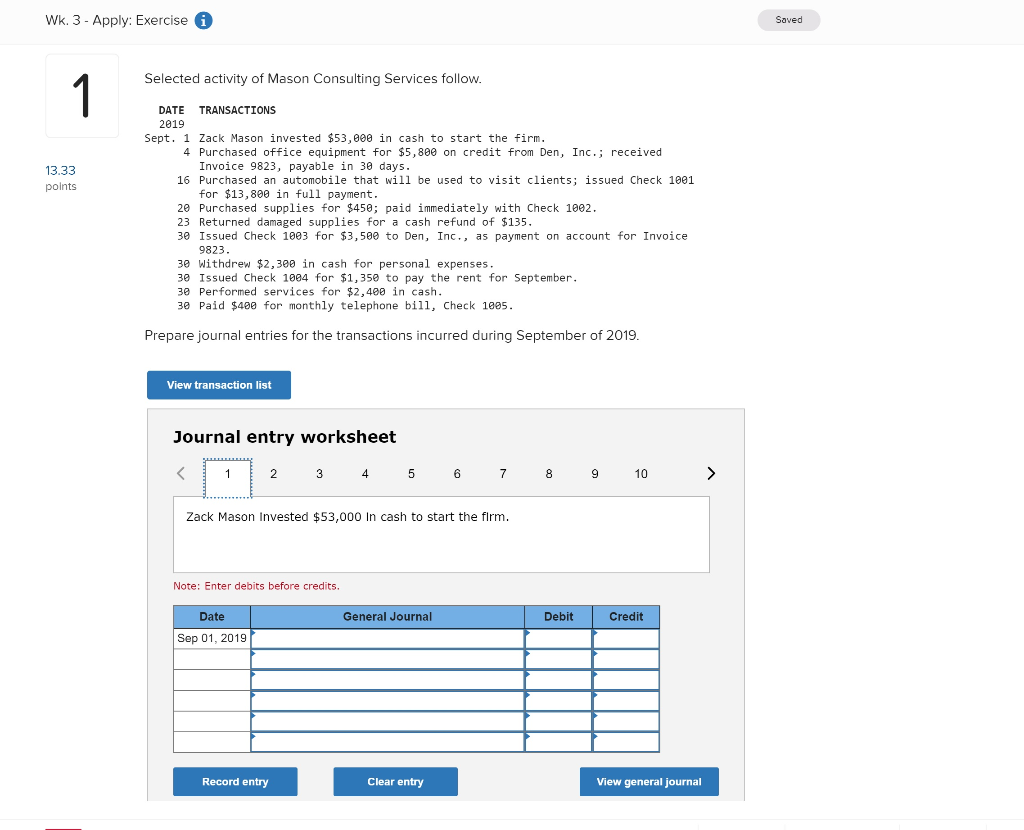

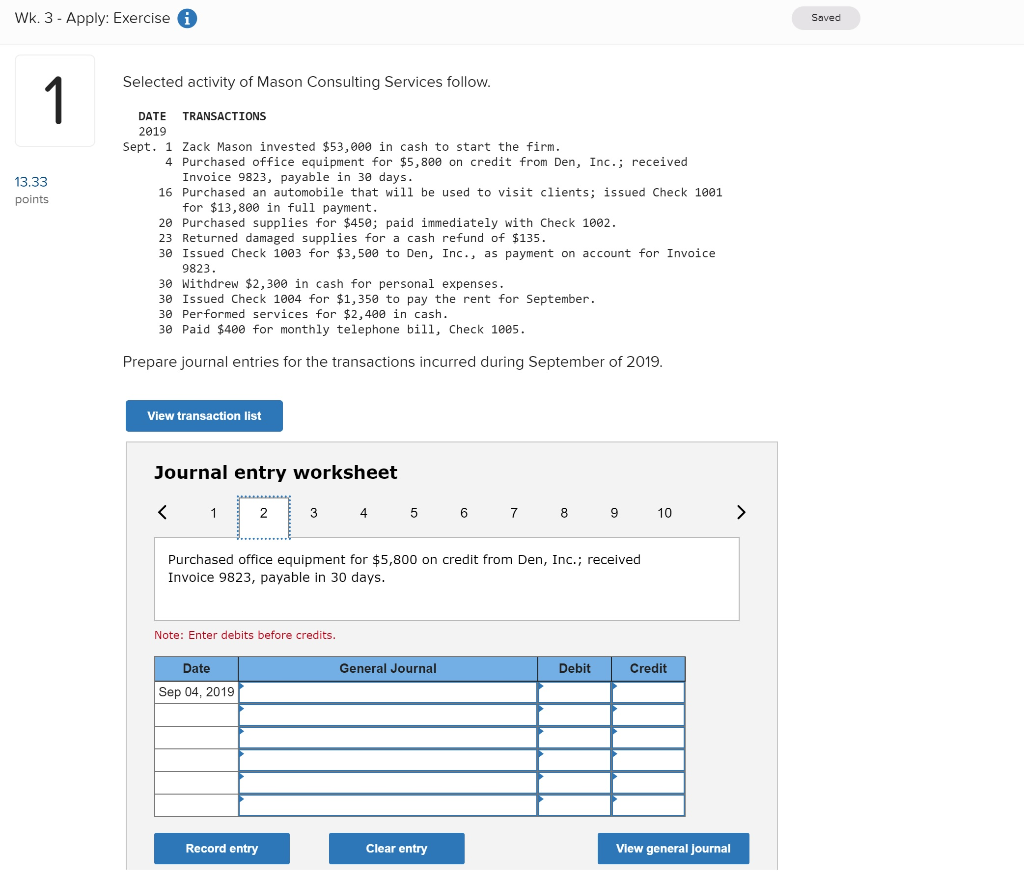

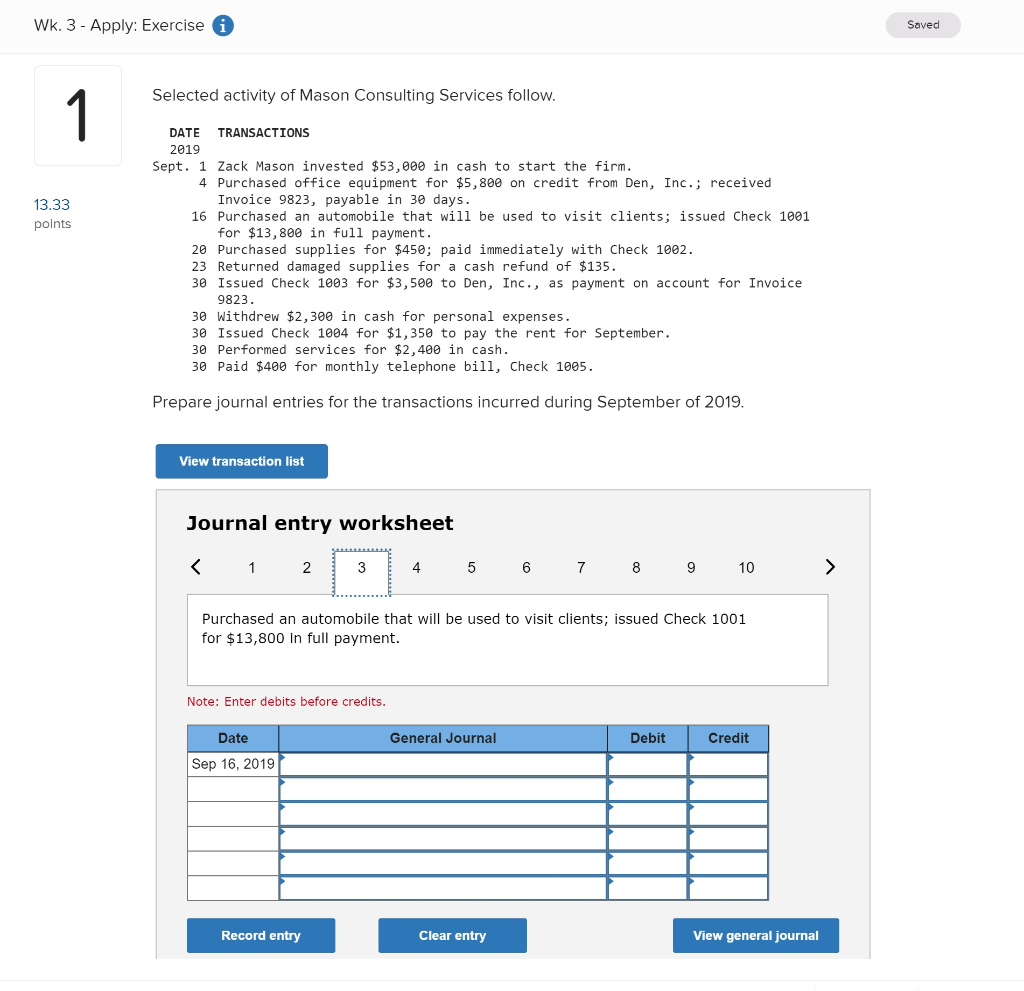

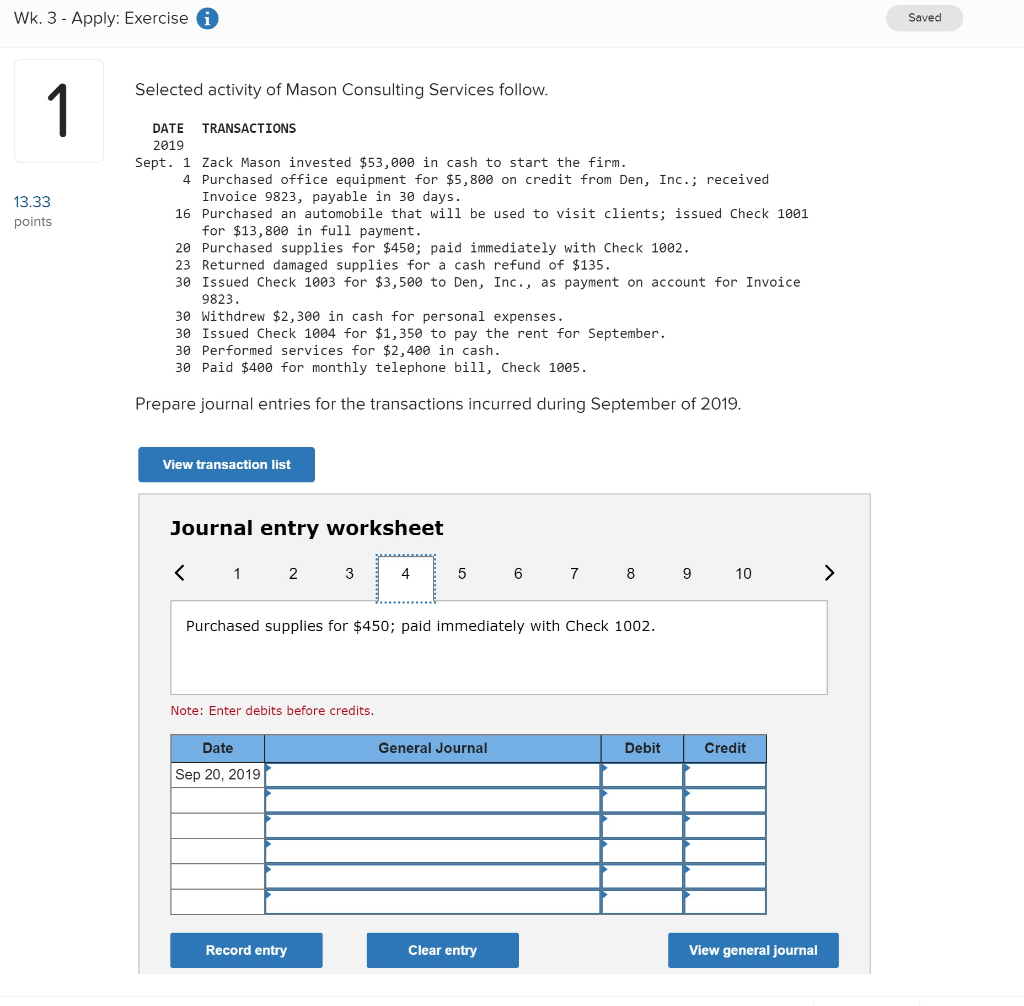

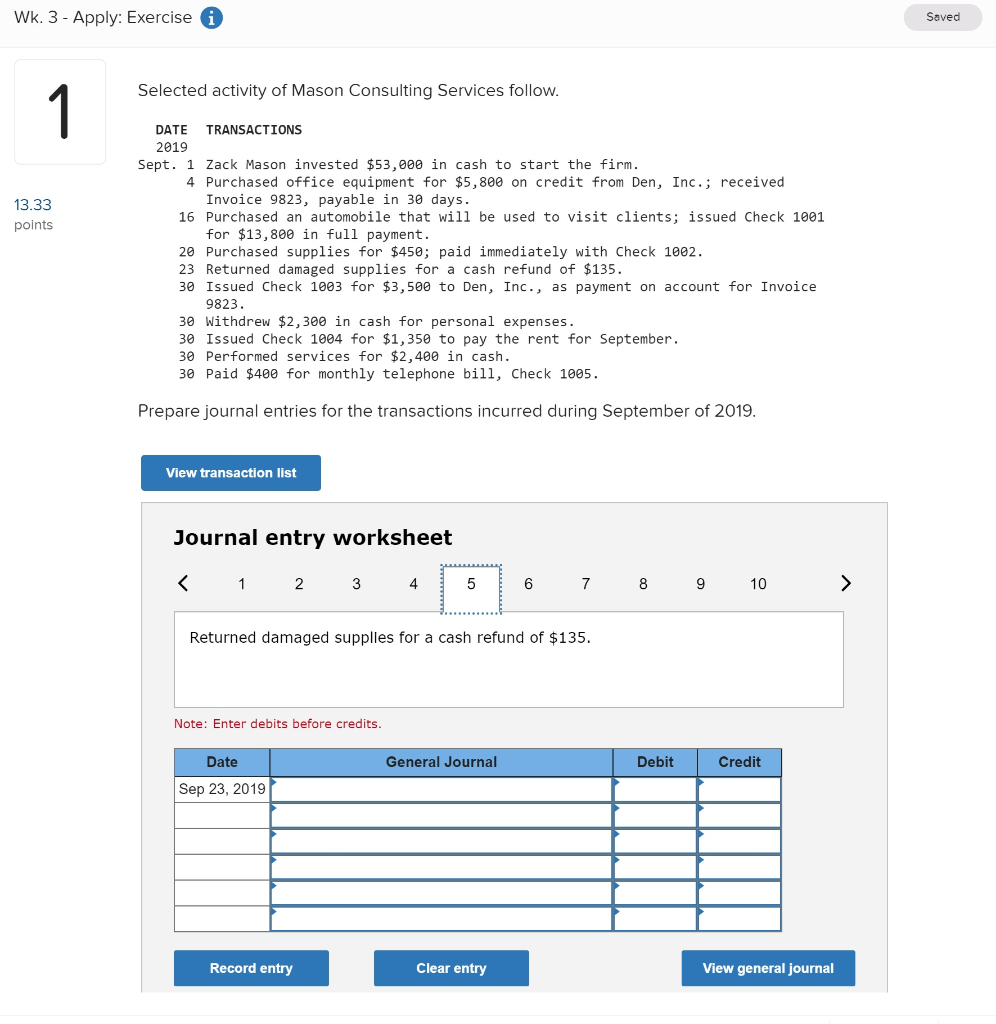

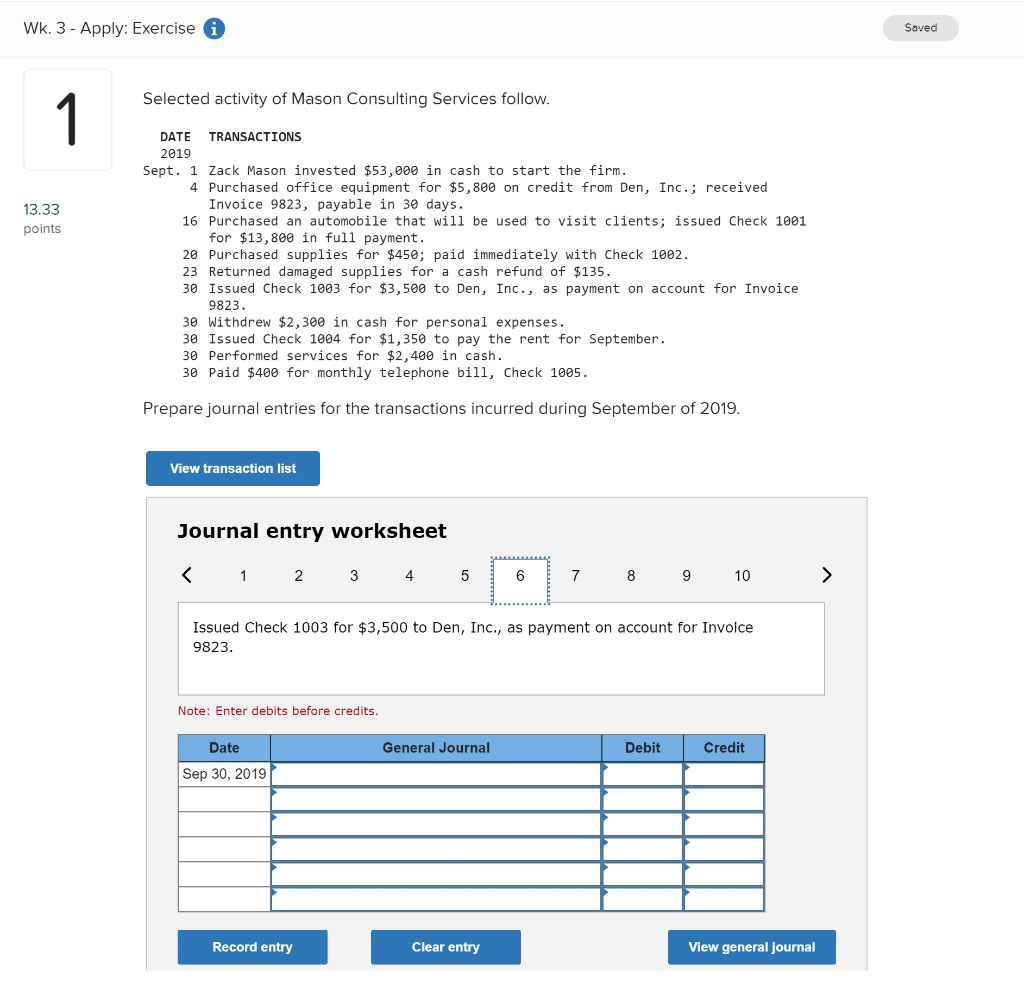

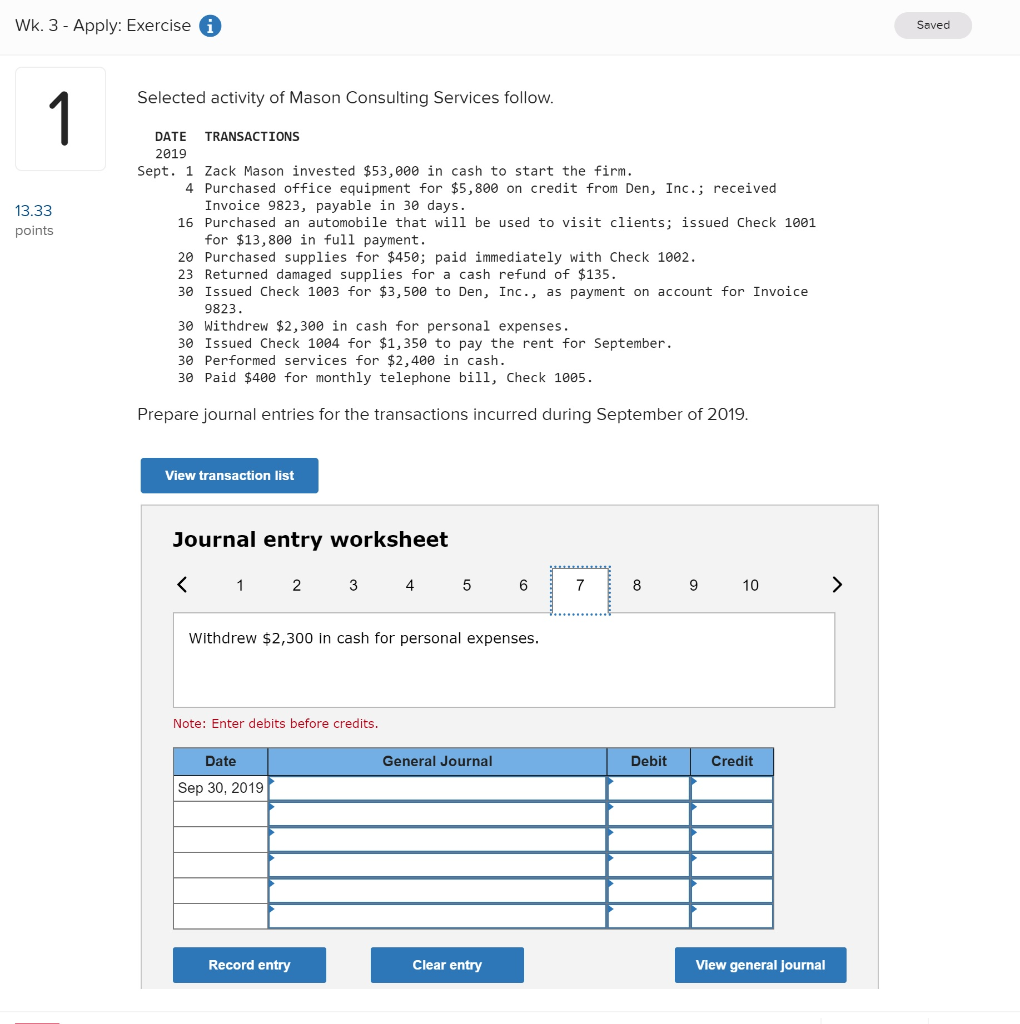

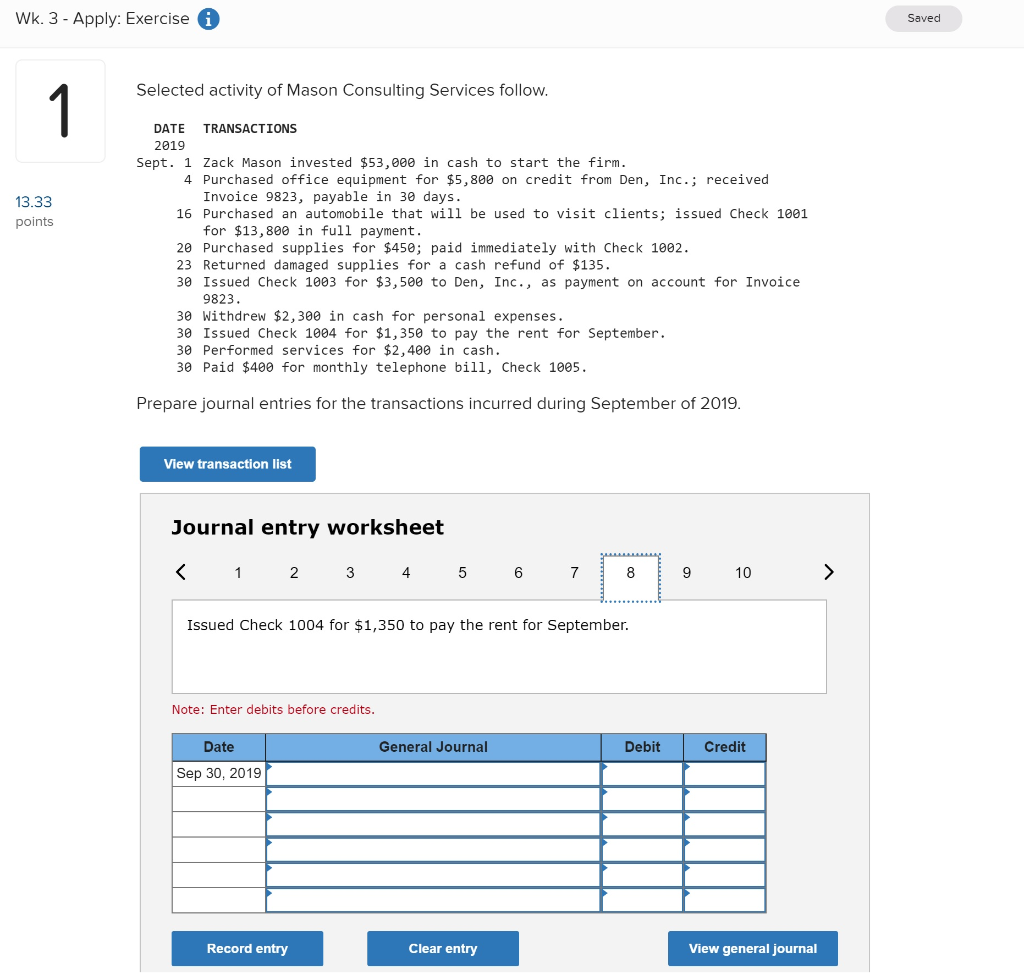

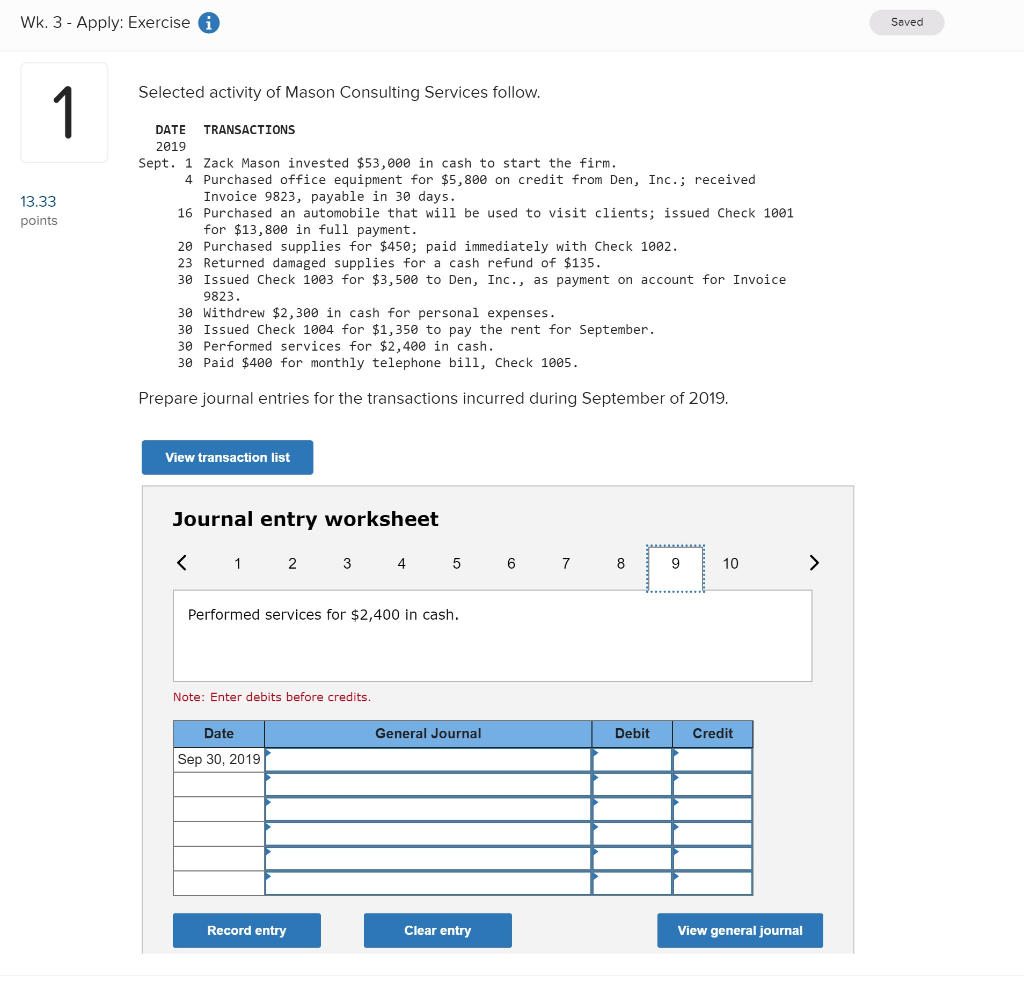

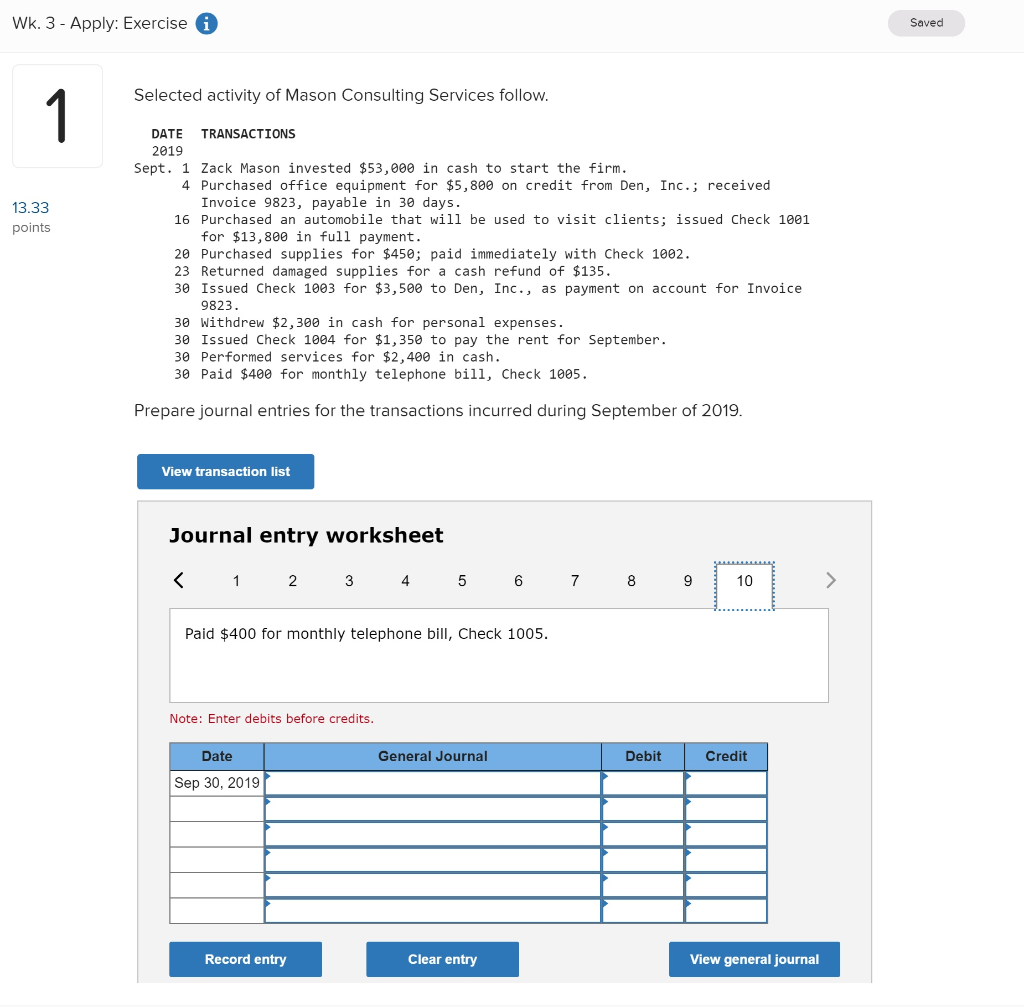

Wk. 3 - Apply: Exercise i Saved Selected activity of Mason Consulting Services follow. 1 DATE TRANSACTIONS 2019 Sept. 1 Zack Mason invested $53,000 in cash to start the firm. 4 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days 13.33 16 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,800 in full payment 20 Purchased supplies for $450; paid immed:iately with Check 1002 23 Returned damaged supplies for a cash refund of $135 30 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice points 9823 30 Withdrew $2,300 in cash for personal expenses 30 Issued Check 1004 for $1,350 to pay the rent for September 30 Performed services for $2,400 in cash 30 Paid $400 for monthly telephone bill, Check 1005 Prepare journal entries for the transactions incurred during September of 2019 View transaction list Journal entry worksheet 2 3 4 5 > 1 6 7 8 10 Zack Mason Invested $53,000 In cash to start the flrm Note: Enter debits before credits General Journal Date Debit Credit Sep 01, 2019 Record entry Clear entry View general journal Wk. 3 - Apply: Exercise Saved 1 Selected activity of Mason Consulting Services follow. DATE TRANSACTIONS 2019 Sept. 1 Zack Mason invested $53,000 in cash to start the firm 4 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days 16 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,800 in full payment. 20 Purchased supplies for $450; paid immediately with Check 1002. 23 Returned damaged supplies for a cash refund of $135 30 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice 9823 30 Withdrew $2,300 in cash for personal expenses. 30 Issued Check 1004 for $1,350 to pay the rent for September. 30 Performed services for $2,400 in cash 30 Paid $400 for monthly telephone bill, Check 1005. 13.33 points Prepare journal entries for the transactions incurred during September of 2019. View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days Note: Enter debits before credits. Debit Date General Journal Credit Sep 04, 2019 Record entry Clear entry View general journal Wk.3 - Apply: Exercise Saved Selected activity of Mason Consulting Services follow. 1 DATE TRANSACTIONS 2019 Sept. 1 Zack Mason invested $53,000 in cash to start the firm. 4 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days 16 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,800 in full payment. 20 Purchased supplies for $450; paid immediately with Check 1002 23 Returned damaged supplies for a cash refund of $135 30 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice 9823 13.33 polnts 30 Withdrew $2,300 in cash for personal expenses. 30 Issued Check 1004 for $1,350 to pay the rent for September 30 Performed services for $2,400 in cash. 30 Paid $400 for monthly telephone bill, Check 1005. Prepare journal entries for the transactions incurred during September of 2019. View transaction list Journal entry worksheet 2 3 4 6 7 8 10 Returned damaged supplies for a cash refund of $135 Note: Enter debits before credits. Date General Journal Debit Credit Sep 23, 2019 Record entry Clear entry View general journal Wk. 3 - Apply: Exercise i Saved 1 Selected activity of Mason Consulting Services follow. DATE TRANSACTIONS 2019 Sept. 1 Zack Mason invested $53,000 in cash to start the firm. 4 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days 16 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,800 in full payment. 20 Purchased supplies for $450; paid immediately with Check 1002 23 Returned damaged supplies for a cash refund of $135 30 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice 13.33 points 9823 30 Withdrew $2,300 in cash for personal expenses 30 Issued Check 1004 for $1,350 to pay the rent for September 30 Performed services for $2,400 in cash. 30 Paid $400e for monthly telephone bill, Check 1005. Prepare journal entries for the transactions incurred during September of 2019. View transaction list Journal entry worksheet K1 2 3 4 5 6 7 8 9 10 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice 9823. Note: Enter debits before credits. Date General Journal Debit Credit Sep 30, 2019 Record entry Clear entry View general journal Wk.3-Apply: Exercise i Saved 1 Selected activity of Mason Consulting Services follow. DATE TRANSACTIONS 2019 Sept. 1 Zack Mason invested $53,000 in cash to start the firm. 4 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days 16 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,800 in full payment. 20 Purchased supplies for $450; paid immediately with Check 1002 23 Returned damaged supplies for a cash refund of $135 30 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice 9823 13.33 points 30 Withdrew $2,300 in cash for personal expenses. 30 Issued Check 1004 for $1,350 to pay the rent for September 30 Performed services for $2,400 in cash 30 Paid $40e for monthly telephone bill, Check 1005 Prepare journal entries for the transactions incurred during September of 2019. View transaction list Journal entry worksheet 2 3 5 6 7 8 9 10 1 4 Withdrew $2,300 in cash for personal expenses Note: Enter debits before credits General Journal Debit Date Credit Sep 30, 2019 Record entry View general journal Clear entry Wk. 3 - Apply: Exercisei Saved Selected activity of Mason Consulting Services follow. 1 DATE TRANSACTIONS 2019 Sept. 1 Zack Mason invested $53,000 in cash to start the firm. 4 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days 16 Purchased an automobile that will be used to visit clients; issued Check 1001 for $13,800 in full payment 20 Purchased supplies for $450; paid immediately with Check 1002 23 Returned damaged supplies for a cash refund of $135 30 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice 13.33 points 9823 30 Withdrew $2,300 in cash for personal expenses 30 Issued Check 1004 for $1,350 to pay the rent for September 30 Performed services for $2,400 in cash. 30 Paid $400 for monthly telephone bill, Check 1005. Prepare journal entries for the transactions incurred during September of 2019 View transaction list Journal entry worksheet 1 2 4 5 6 7 O 10 Issued Check 1004 for $1,350 to pay the rent for September. Note: Enter debits before credits. General Journal Date Debit Credit Sep 30, 2019 Record entry Clear entry View general journal Wk.3- Apply: Exercise i Saved 1 Selected activity of Mason Consulting Services follow. DATE TRANSACTIONS 2019 Sept. 1 Zack Mason invested $53,000 in cash to start the firm 4 Purchased office equipment for $5,800 on credit from Den, Inc.; received Invoice 9823, payable in 30 days 16 Purchased an automobile that wil1 be used to visit clients; issued Check 1001 for $13,800 in full payment. 20 Purchased supplies for $450; paid immediately with Check 1002 23 Returned damaged supplies for a cash refund of $135 30 Issued Check 1003 for $3,500 to Den, Inc., as payment on account for Invoice 9823 13.33 points 30 Withdrew $2,300 in cash for personal expenses. 30 Issued Check 1004 for $1,350 to pay the rent for September. 30 Performed services for $2,400 in cash 30 Paid $400e for monthly telephone bill, Check 1005. Prepare journal entries for the transactions incurred during September of 2019. View transaction list Journal entry worksheet