Answered step by step

Verified Expert Solution

Question

1 Approved Answer

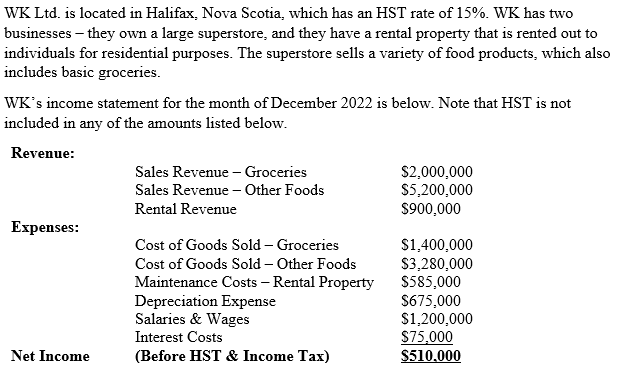

WK Ltd. is located in Halifax, Nova Scotia, which has an HST rate of 15%. WK has two businesses - they own a large

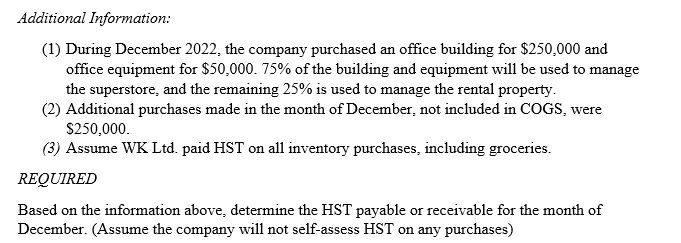

WK Ltd. is located in Halifax, Nova Scotia, which has an HST rate of 15%. WK has two businesses - they own a large superstore, and they have a rental property that is rented out to individuals for residential purposes. The superstore sells a variety of food products, which also includes basic groceries. WK's income statement for the month of December 2022 is below. Note that HST is not included in any of the amounts listed below. Revenue: Expenses: Net Income Sales Revenue - Groceries Sales Revenue - Other Foods Rental Revenue $2,000,000 $5,200,000 $900,000 Cost of Goods Sold - Groceries Cost of Goods Sold - Other Foods Maintenance Costs - Rental Property $1,400,000 $3,280,000 $585,000 Depreciation Expense $675,000 Salaries & Wages $1,200,000 Interest Costs (Before HST & Income Tax) $75,000 $510,000 Additional Information: (1) During December 2022, the company purchased an office building for $250,000 and office equipment for $50,000. 75% of the building and equipment will be used to manage the superstore, and the remaining 25% is used to manage the rental property. (2) Additional purchases made in the month of December, not included in COGS, were $250,000. (3) Assume WK Ltd. paid HST on all inventory purchases, including groceries. REQUIRED Based on the information above, determine the HST payable or receivable for the month of December. (Assume the company will not self-assess HST on any purchases)

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine the HST payable or receivable for the month of December we need to calculate the HST co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started