Answered step by step

Verified Expert Solution

Question

1 Approved Answer

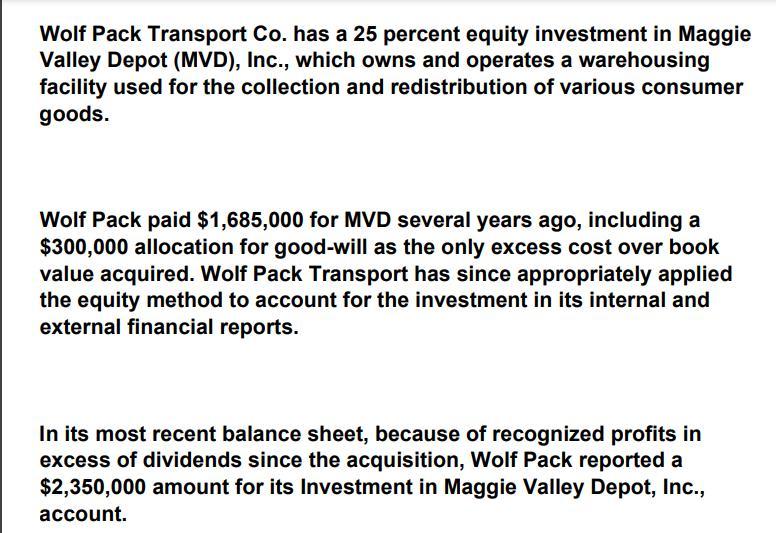

Wolf Pack Transport Co. has a 25 percent equity investment in Maggie Valley Depot (MVD), Inc., which owns and operates a warehousing facility used

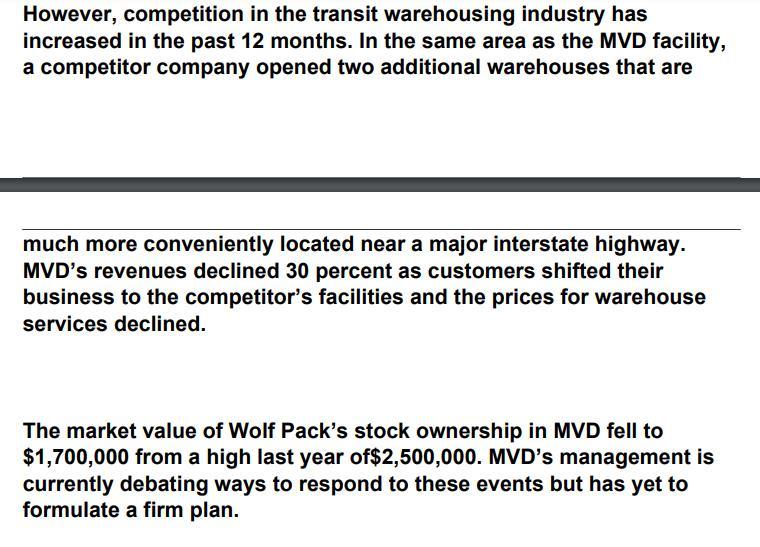

Wolf Pack Transport Co. has a 25 percent equity investment in Maggie Valley Depot (MVD), Inc., which owns and operates a warehousing facility used for the collection and redistribution of various consumer goods. Wolf Pack paid $1,685,000 for MVD several years ago, including a $300,000 allocation for good-will as the only excess cost over book value acquired. Wolf Pack Transport has since appropriately applied the equity method to account for the investment in its internal and external financial reports. In its most recent balance sheet, because of recognized profits in excess of dividends since the acquisition, Wolf Pack reported a $2,350,000 amount for its Investment in Maggie Valley Depot, Inc., account. However, competition in the transit warehousing industry has increased in the past 12 months. In the same area as the MVD facility, a competitor company opened two additional warehouses that are much more conveniently located near a major interstate highway. MVD's revenues declined 30 percent as customers shifted their business to the competitor's facilities and the prices for warehouse services declined. The market value of Wolf Pack's stock ownership in MVD fell to $1,700,000 from a high last year of$2,500,000. MVD's management is currently debating ways to respond to these events but has yet to formulate a firm plan. Required 1. Goodwill is often created or purchased, during a business combination. Why doesn't Goodwill show up on the Parent company's trial balance as a separate account? 2. What are the three departures from SFAS 141 according to SFAS 141(R) Business Combinations? 3. What guidance does APB No. 18, "The Equity Method of Accounting for Investments in Common Stock," provide for equity method investment losses in market value? 4. Given the facts in the case, should Wolf Pack recognize the decline in the market value of its holdings in MVD in its current year financial statements? 5. According to SFAS 142, "Goodwill and Other Intangible Assets," should Wolf Pack test for impairment of the value it had initially assigned to goodwill?

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Goodwill is often created or purchased during a business combination Why doesnt Goodwill show up on the Parent companys trial balance as a separate account We have seen that Wolf Pack Transport Co has ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6329a5fab3162_103939.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started