Answered step by step

Verified Expert Solution

Question

1 Approved Answer

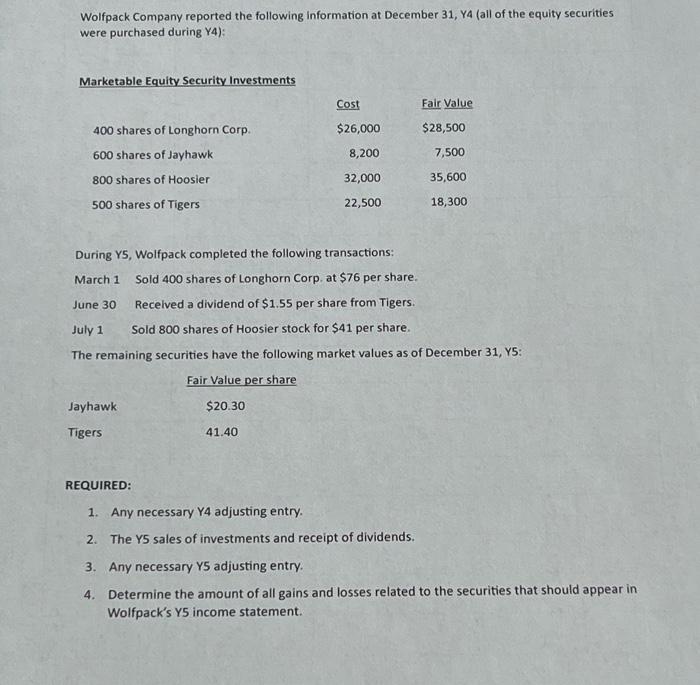

Wolfpack Company reported the following information at December 31, Y4 (all of the equity securities were purchased during Y4): Marketable Equity Security Investments 400 shares

Wolfpack Company reported the following information at December 31, Y4 (all of the equity securities were purchased during Y4): Marketable Equity Security Investments 400 shares of Longhorn Corp. 600 shares of Jayhawk 800 shares of Hoosier 500 shares of Tigers June 30 Jayhawk Tigers REQUIRED: Cost $26,000 41.40 8,200 During Y5, Wolfpack completed the following transactions: March 1 Sold 400 shares of Longhorn Corp. at $76 per share. Received a dividend of $1.55 per share from Tigers. Sold 800 shares of Hoosier stock for $41 per share. July 1 The remaining securities have the following market values as of December 31, Y5: Fair Value per share $20.30 32,000 22,500 Fair Value $28,500 7,500 35,600 18,300 1. Any necessary Y4 adjusting entry. 2. The Y5 sales of investments and receipt of dividends. 3. Any necessary Y5 adjusting entry. 4. Determine the amount of all gains and losses related to the securities that should appear in Wolfpack's Y5 income statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started