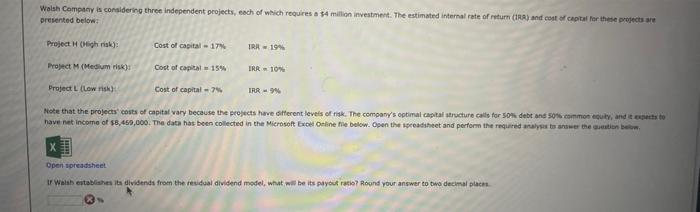

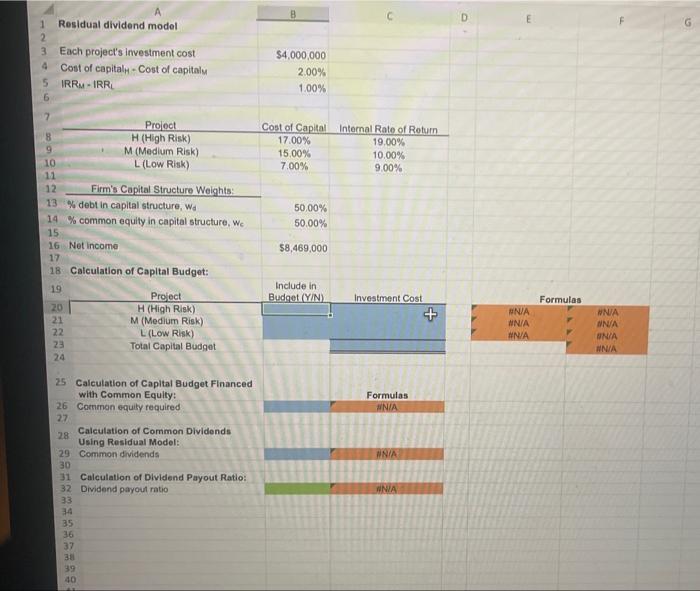

Wolsh Company is considering three independent projects, each of which requires a 34 million investment. The estimated internal rete of mtum (dRa) and ceat of capial for theje projects ave prevented below: \begin{tabular}{|c|c|c|} \hline Project H ofogh riak): & Cost of capital =17T & IRH =19% \\ \hline Frovect M (Messum risk)t & Cost of captal =15% & IRR = 10% \\ \hline Project L (Low rish) & Cost of capital = 7W & PR=9% \\ \hline \end{tabular} Open ipreadsheet 8 Residual dividend model B Each project's investment cost $4,000,000 Cost of capital - Cost of capitaly 2.00% 5 IRRM = IRRL 1.00% 6 c D E G 7 Project Cost of Capital Internal Rate of Rotum 8 9 10 11 H (High Risk) M (Medium Risk) 17.00% 19.00% L. (Low Risk) 15.00% 10.00% 7.00% 9.00% 12 Firm's Capital Structure Weights: 13% debt in capital structure, wa 14% common equily in capital structure, Ws 15 16 Net income 17 18 Calculation of Capltal Budget: 19 \begin{tabular}{l|c|} 19 & Project \\ \cline { 2 - 2 } 21 & H (High Risk) \\ 22 & M (Medium Risk) \\ 23 & L (Low Risk) \\ 24 & Total Capital Budget \\ 25 & Calculation of Capital Budget Financed \end{tabular} with Common Equity: 26 Common equity required 27. 28 Calculation of Common Dividends Using Residual Model: 29 Common dividends 50.00% 50.00% $8,469,000 30 31 Calculation of Dividend Payout Ratio: -32 Dividend payout ratio Include in Budget (YIN) Investment Cost Formulas 33 Formulas 34 35 35 36 37 34 39 40 40 Wolsh Company is considering three independent projects, each of which requires a 34 million investment. The estimated internal rete of mtum (dRa) and ceat of capial for theje projects ave prevented below: \begin{tabular}{|c|c|c|} \hline Project H ofogh riak): & Cost of capital =17T & IRH =19% \\ \hline Frovect M (Messum risk)t & Cost of captal =15% & IRR = 10% \\ \hline Project L (Low rish) & Cost of capital = 7W & PR=9% \\ \hline \end{tabular} Open ipreadsheet 8 Residual dividend model B Each project's investment cost $4,000,000 Cost of capital - Cost of capitaly 2.00% 5 IRRM = IRRL 1.00% 6 c D E G 7 Project Cost of Capital Internal Rate of Rotum 8 9 10 11 H (High Risk) M (Medium Risk) 17.00% 19.00% L. (Low Risk) 15.00% 10.00% 7.00% 9.00% 12 Firm's Capital Structure Weights: 13% debt in capital structure, wa 14% common equily in capital structure, Ws 15 16 Net income 17 18 Calculation of Capltal Budget: 19 \begin{tabular}{l|c|} 19 & Project \\ \cline { 2 - 2 } 21 & H (High Risk) \\ 22 & M (Medium Risk) \\ 23 & L (Low Risk) \\ 24 & Total Capital Budget \\ 25 & Calculation of Capital Budget Financed \end{tabular} with Common Equity: 26 Common equity required 27. 28 Calculation of Common Dividends Using Residual Model: 29 Common dividends 50.00% 50.00% $8,469,000 30 31 Calculation of Dividend Payout Ratio: -32 Dividend payout ratio Include in Budget (YIN) Investment Cost Formulas 33 Formulas 34 35 35 36 37 34 39 40 40