Question

Wolverine World Wide, Inc., manufactures military, work, sport, and casual footwear and leather accessories under a variety of brand names, such as Hush Puppies, Wolverine,

Wolverine World Wide, Inc., manufactures military, work, sport, and casual footwear and leather accessories under a variety of brand names, such as Hush Puppies, Wolverine, Merrell, Stride Rite, and Bates, to a global market. The following transactions occurred during a recent year. Dollars are in millions.

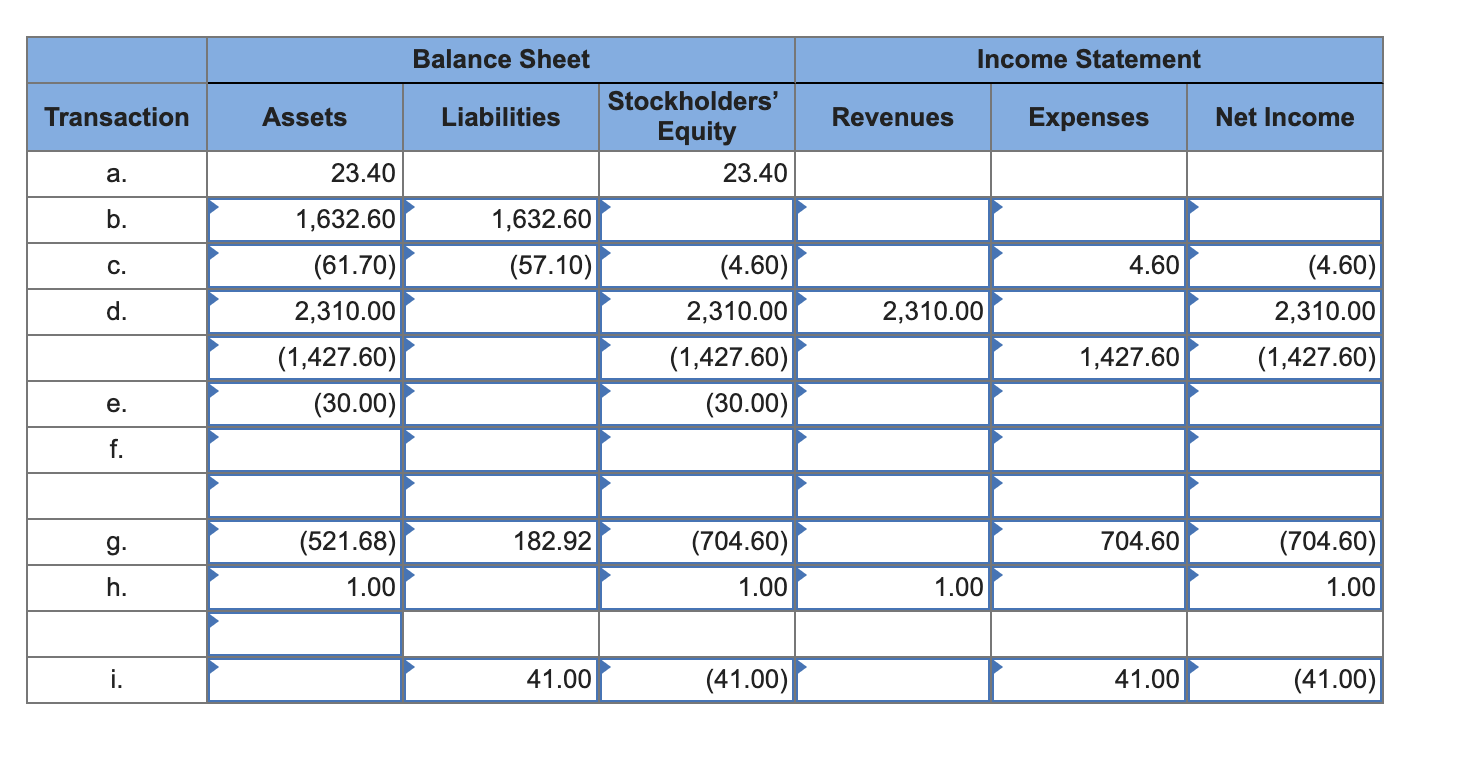

- Issued common stock to investors for $23.4 cash (example).

- Purchased $1,632.6 of additional inventory on account.

- Paid $57.1 on long-term debt principal and $4.6 in interest on the debt.

- Sold $2,310 of products to customers on account; cost of the products sold was $1,427.6. (Hint: There are two separate effects needed for (d): one for earning revenue and one for incurring an expense.)

- Paid cash dividends of $30 to shareholders.

- Purchased for cash $35.4 in additional property, plant, and equipment.

- Incurred $704.6 in selling expenses, paying three-fourths in cash and owing the rest on account.

- Earned $1 of interest on investments, receiving 80 percent in cash.

- Incurred $41 in interest expense to be paid at the beginning of next year.

Required:

For each of the transactions, complete the tabulation, indicating the effect (+ for increase and for decrease) of each transaction. (Remember that A = L + SE; R E = NI; and NI affects SE through Retained Earnings.) The first transaction is provided as an example. (Enter the revenue side and the cost of goods sold side of the transaction on separate lines in the table. Do not net the effects on Assets, Stockholders' Equity or Net Income. Enter your answers in millions.)

THE CHART I FILLED OUT INDICATED THAT IT IS INCOMPLETE, WHAT MORE SHOULD I ADD?

THE CHART I FILLED OUT INDICATED THAT IT IS INCOMPLETE, WHAT MORE SHOULD I ADD?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started