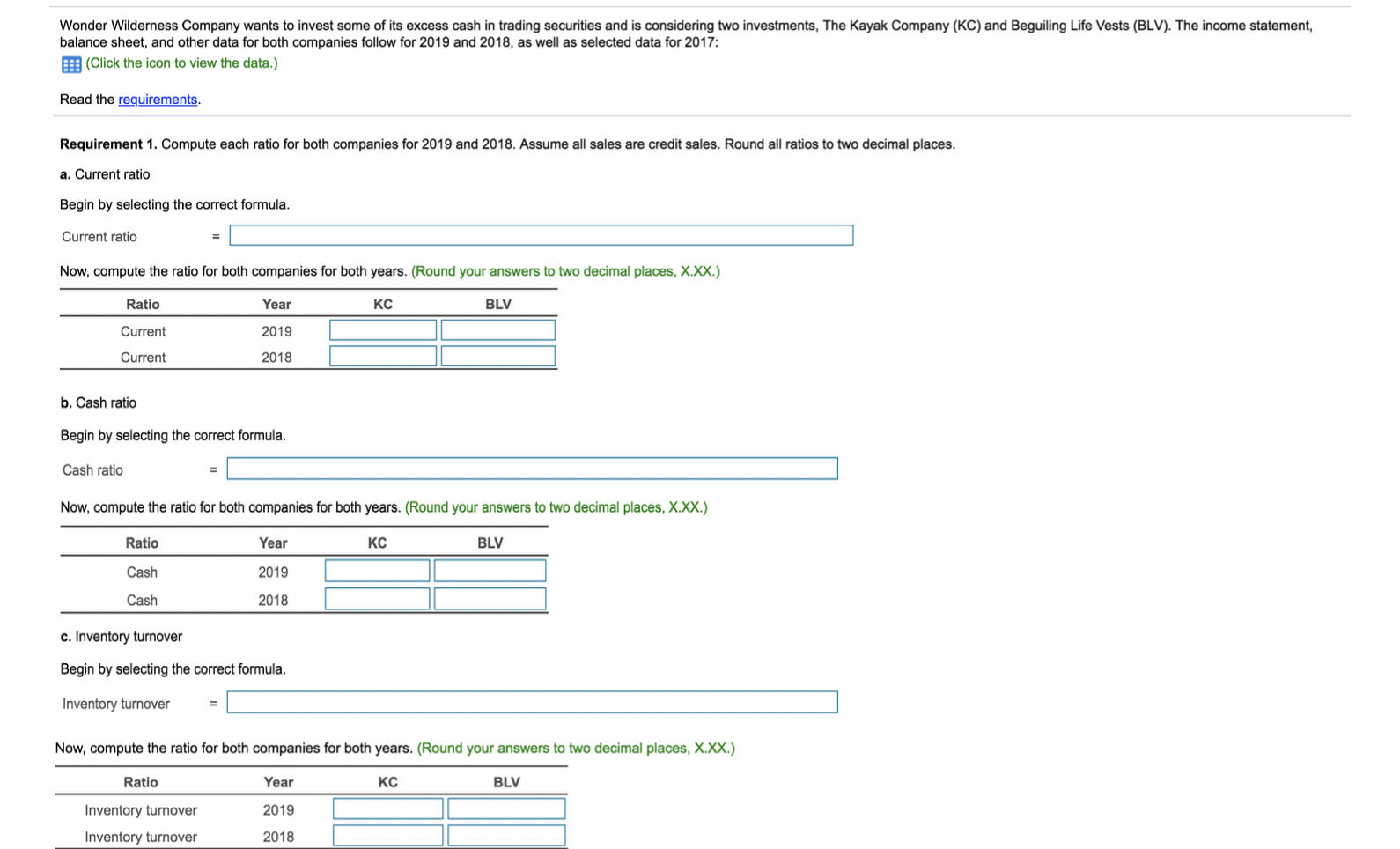

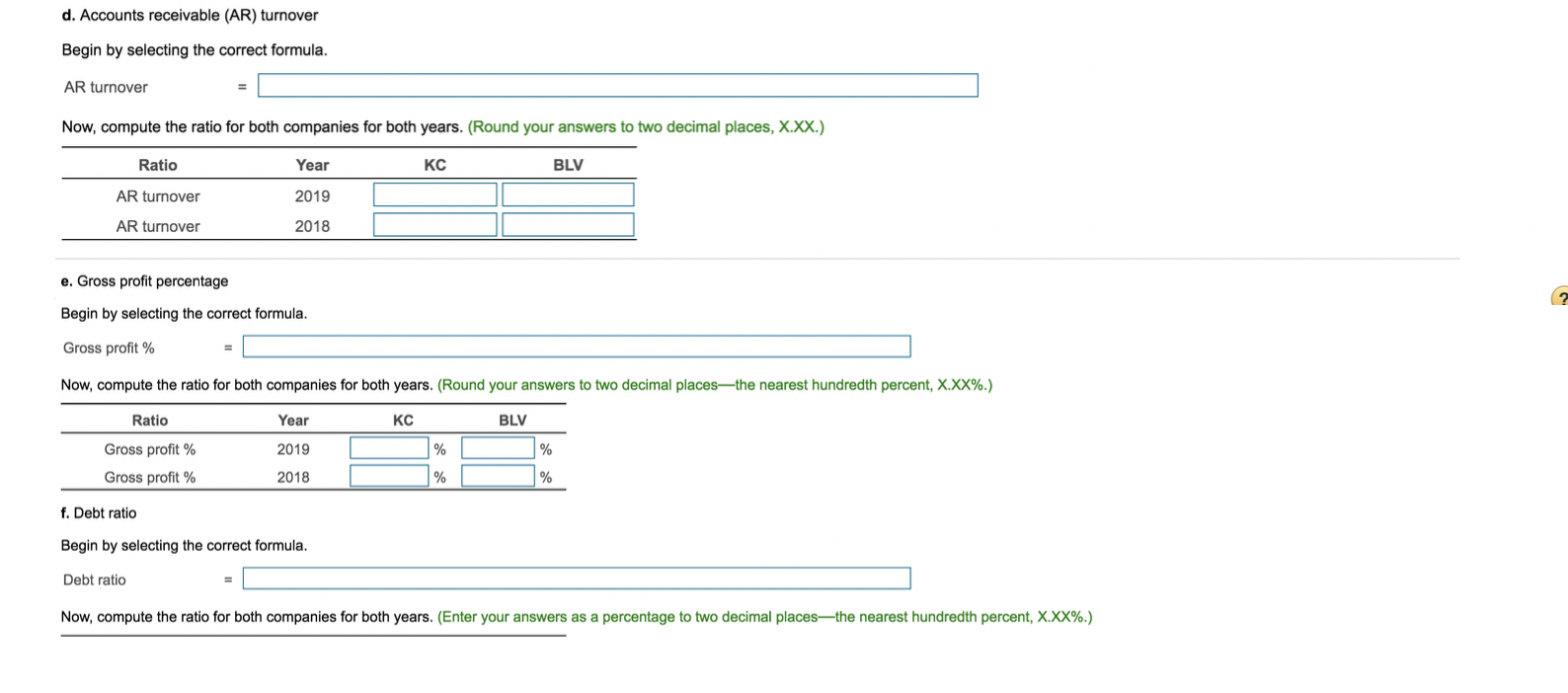

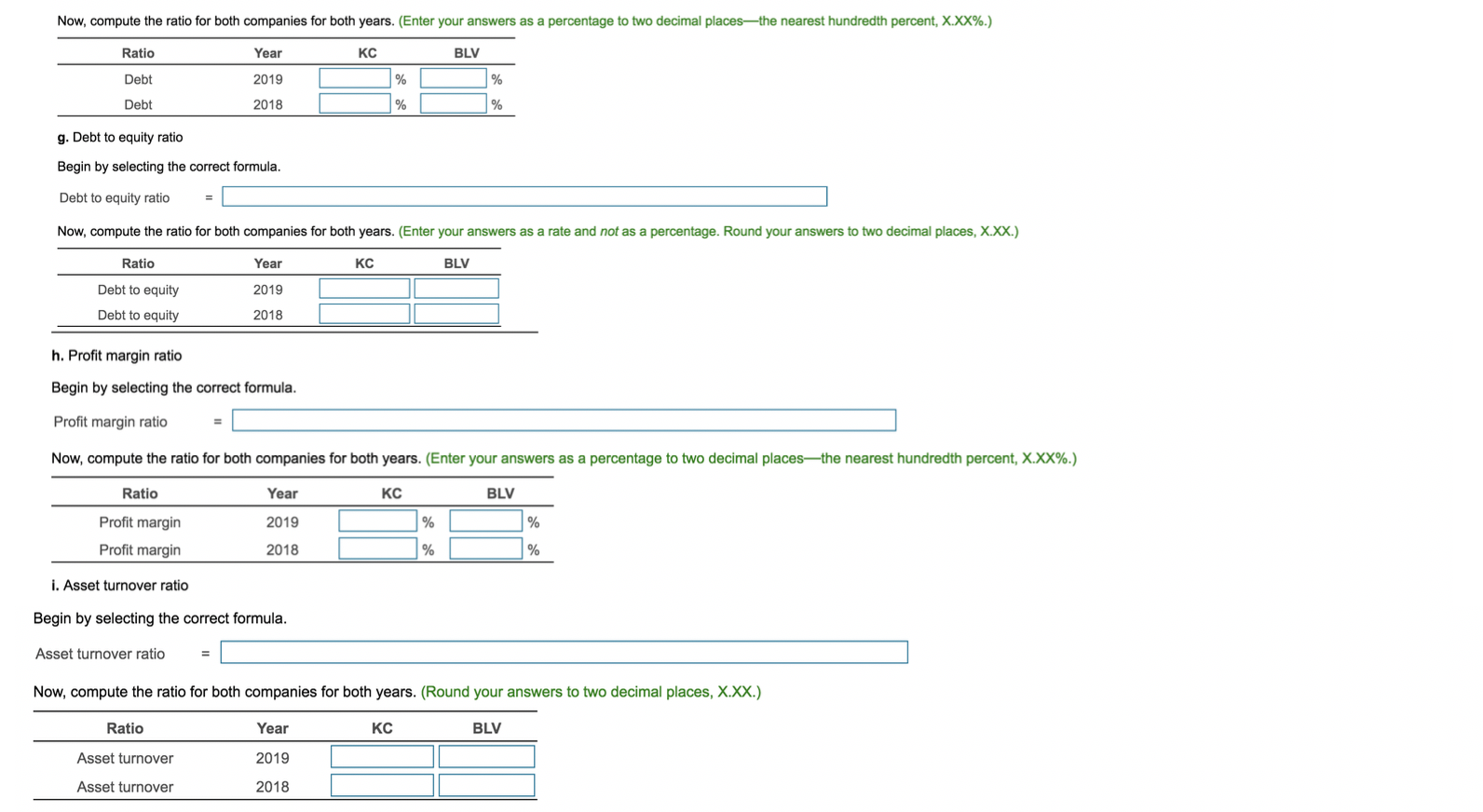

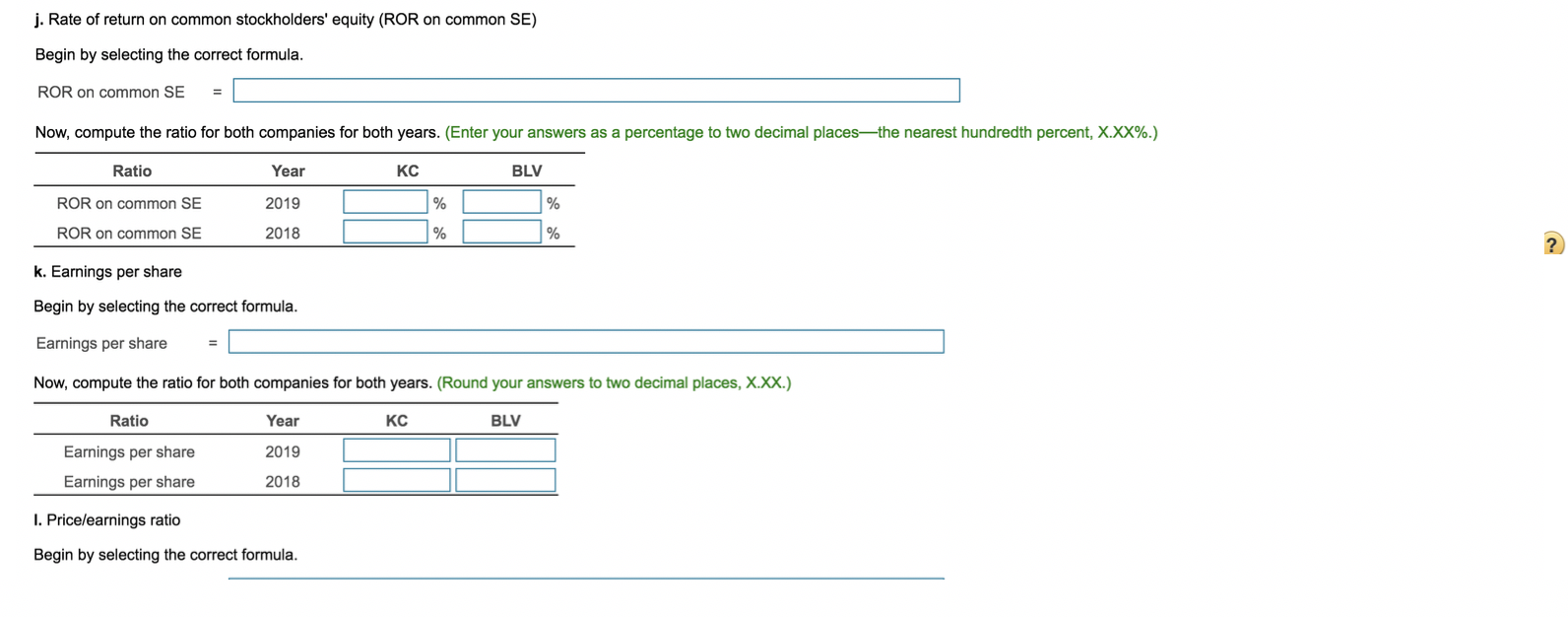

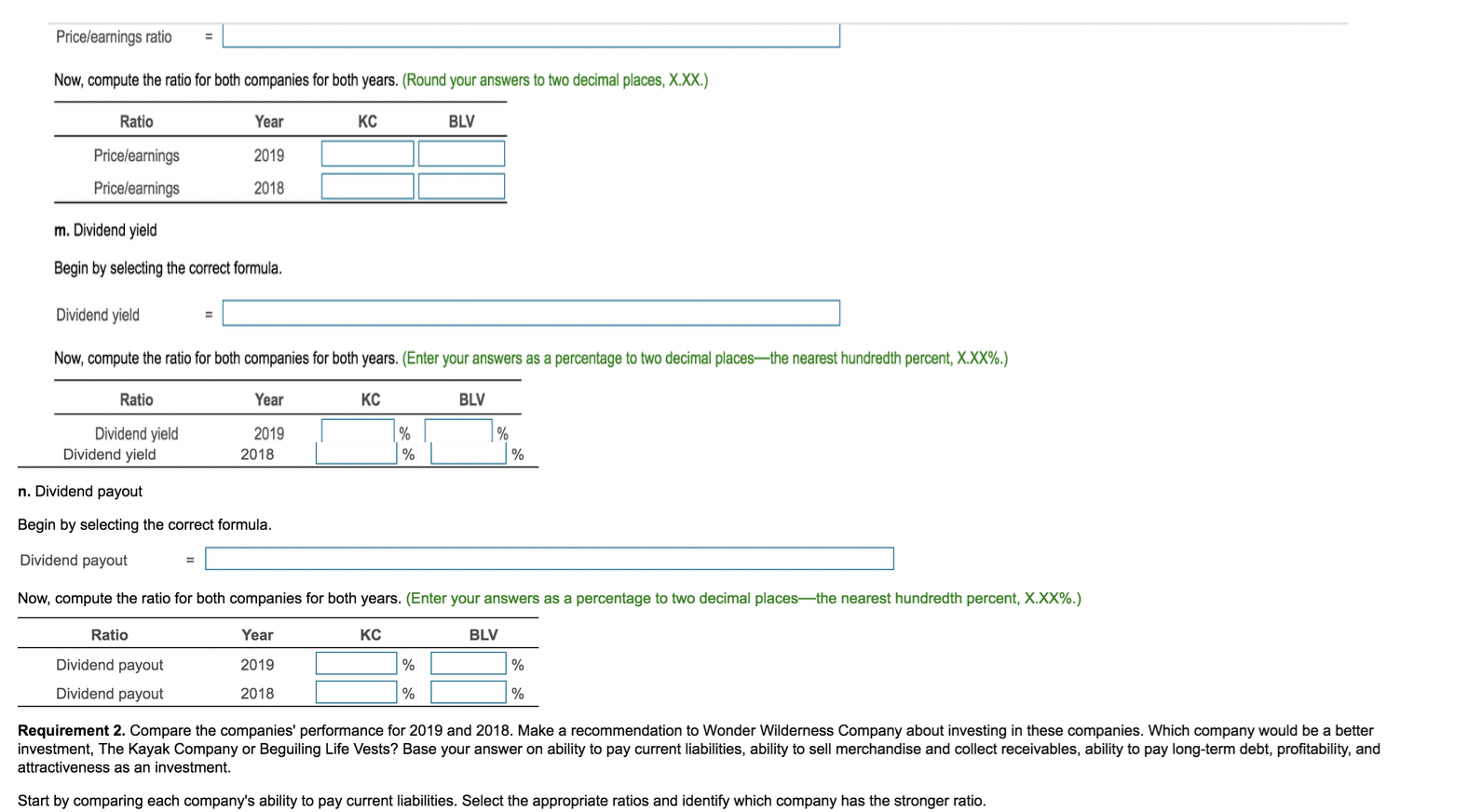

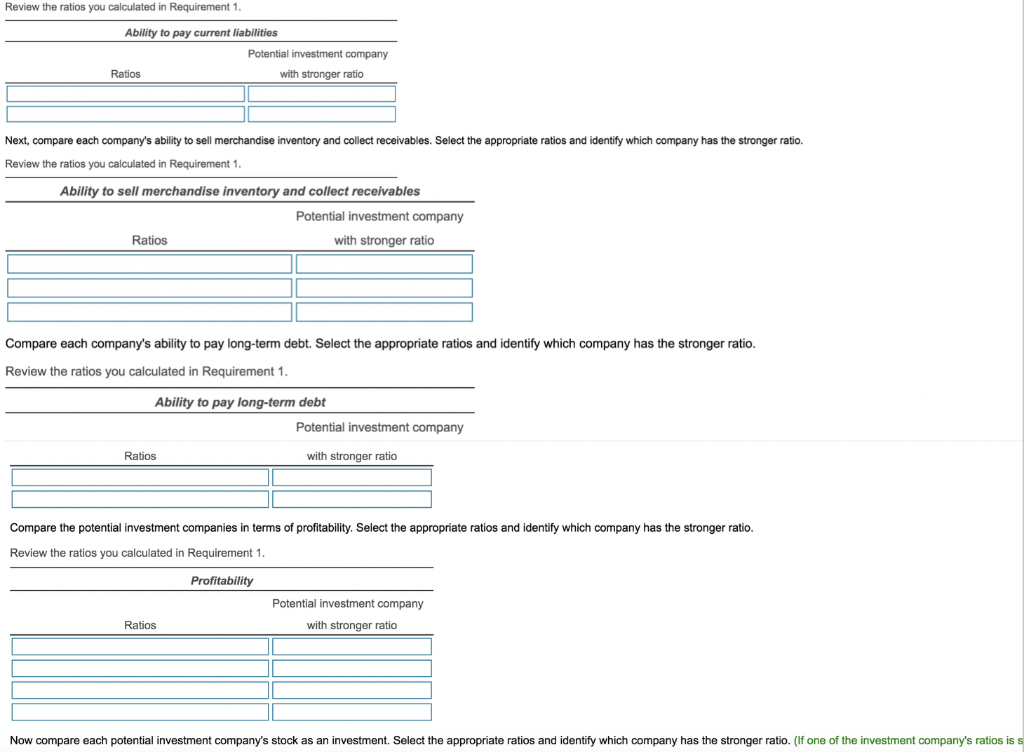

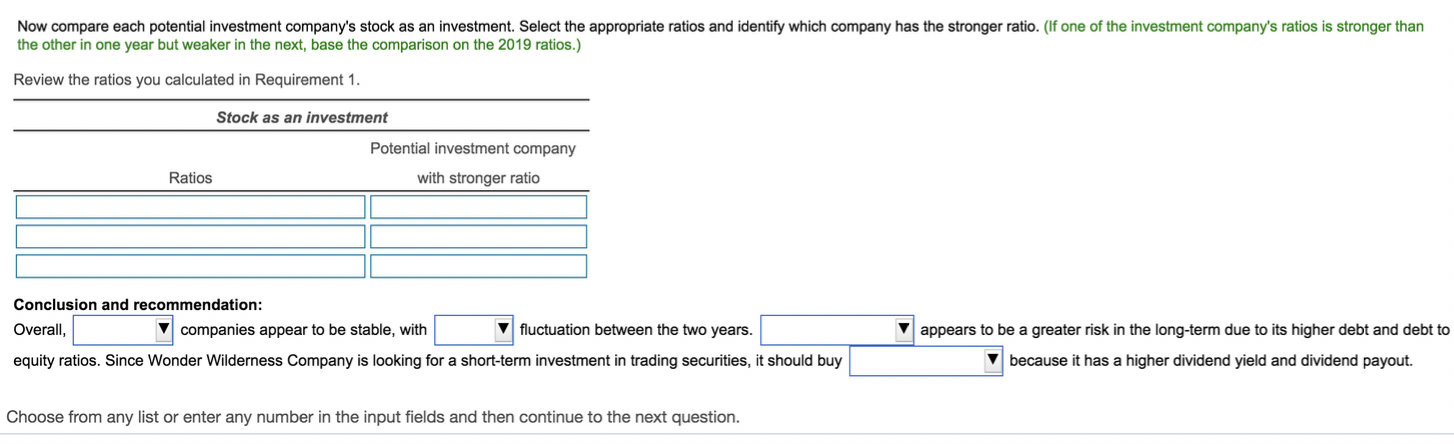

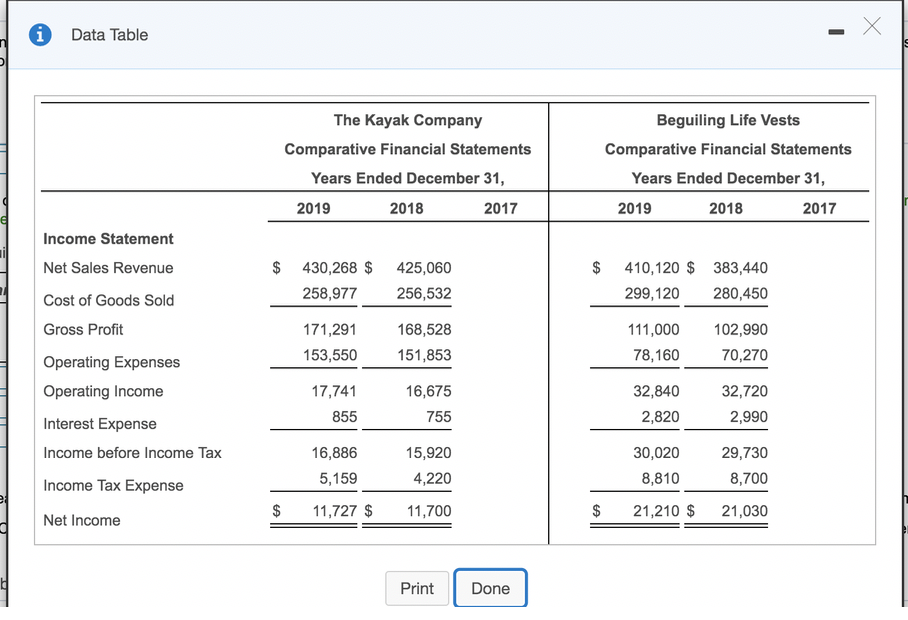

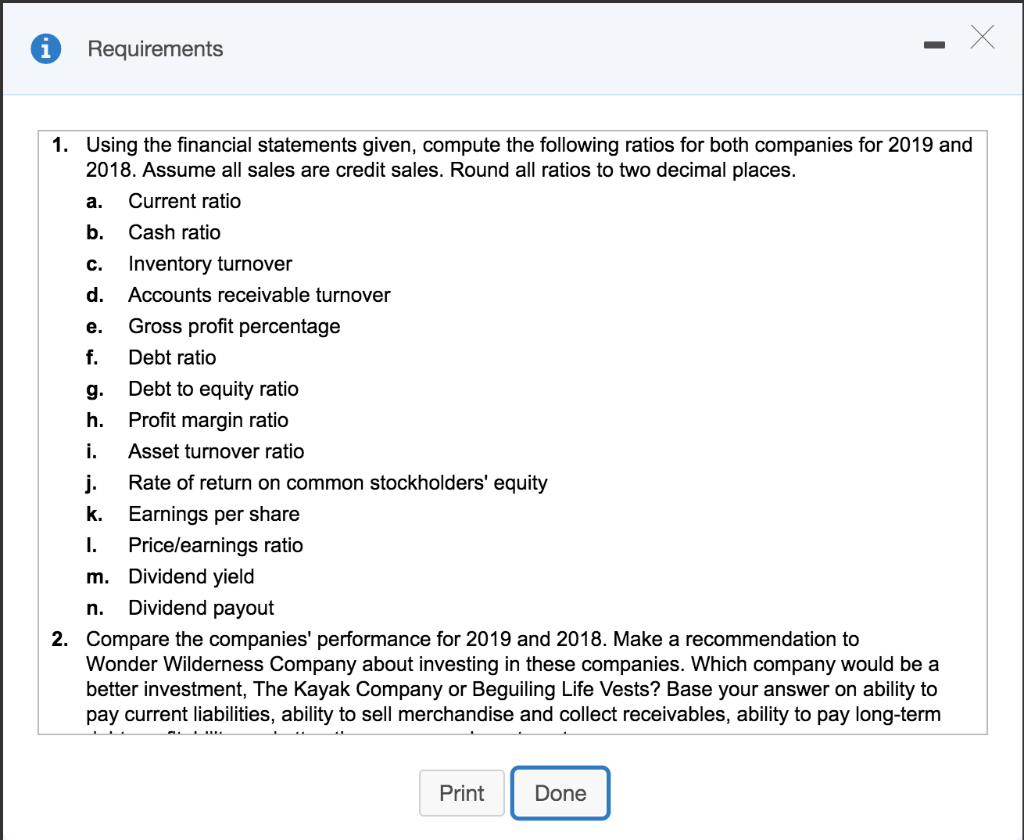

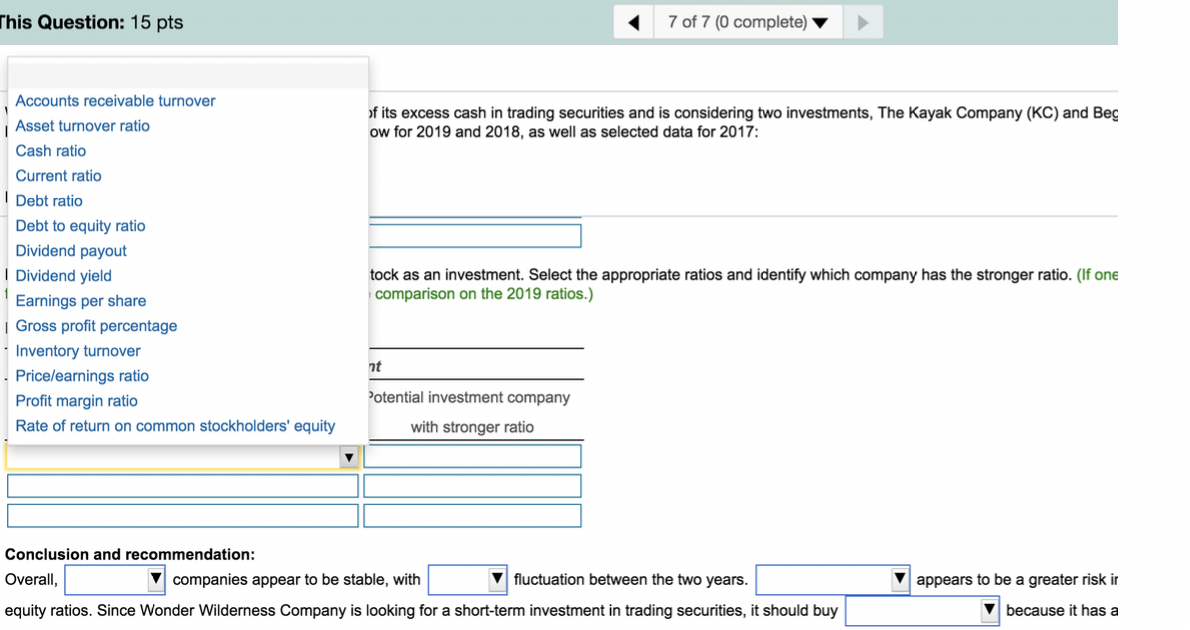

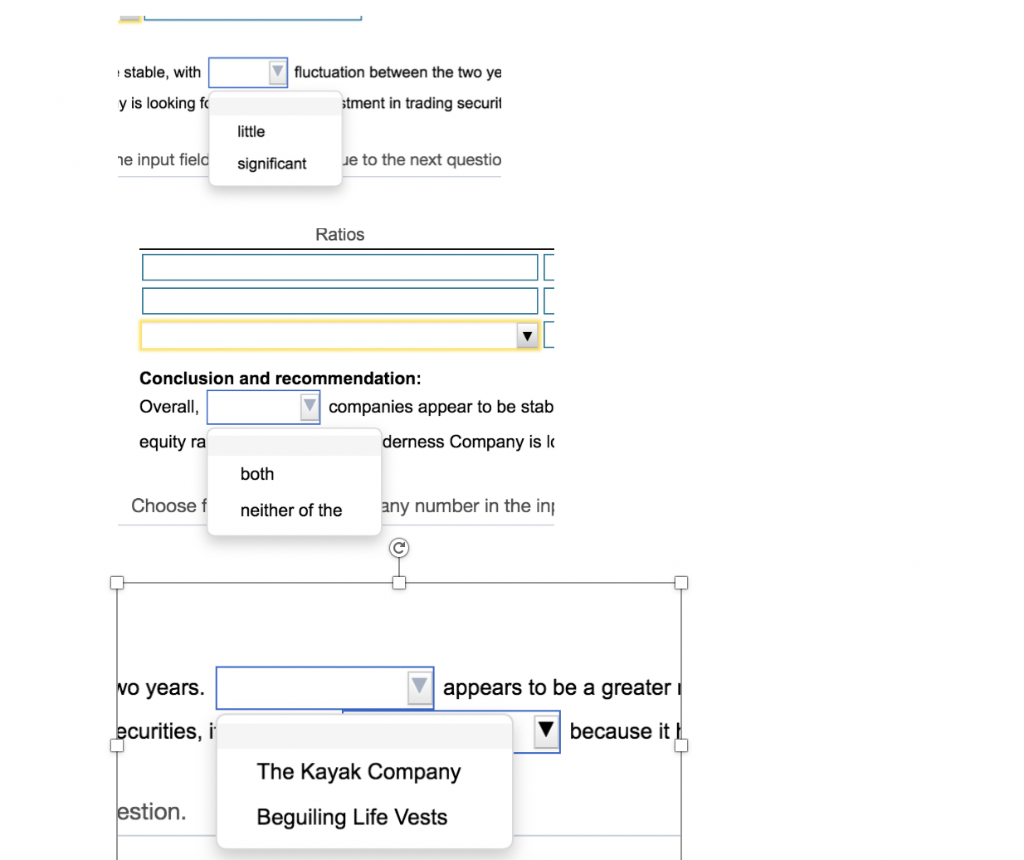

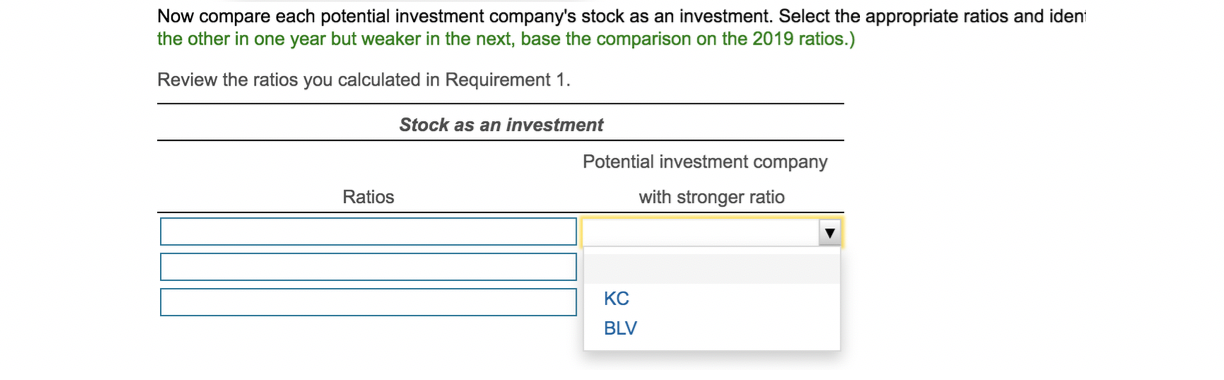

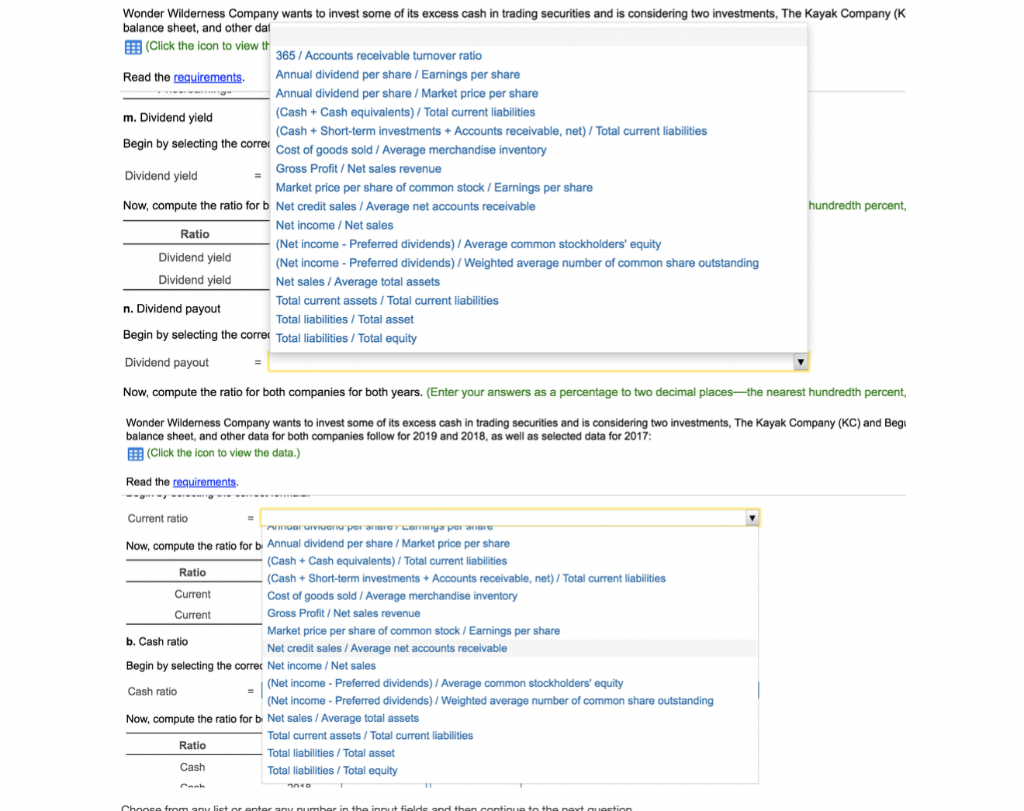

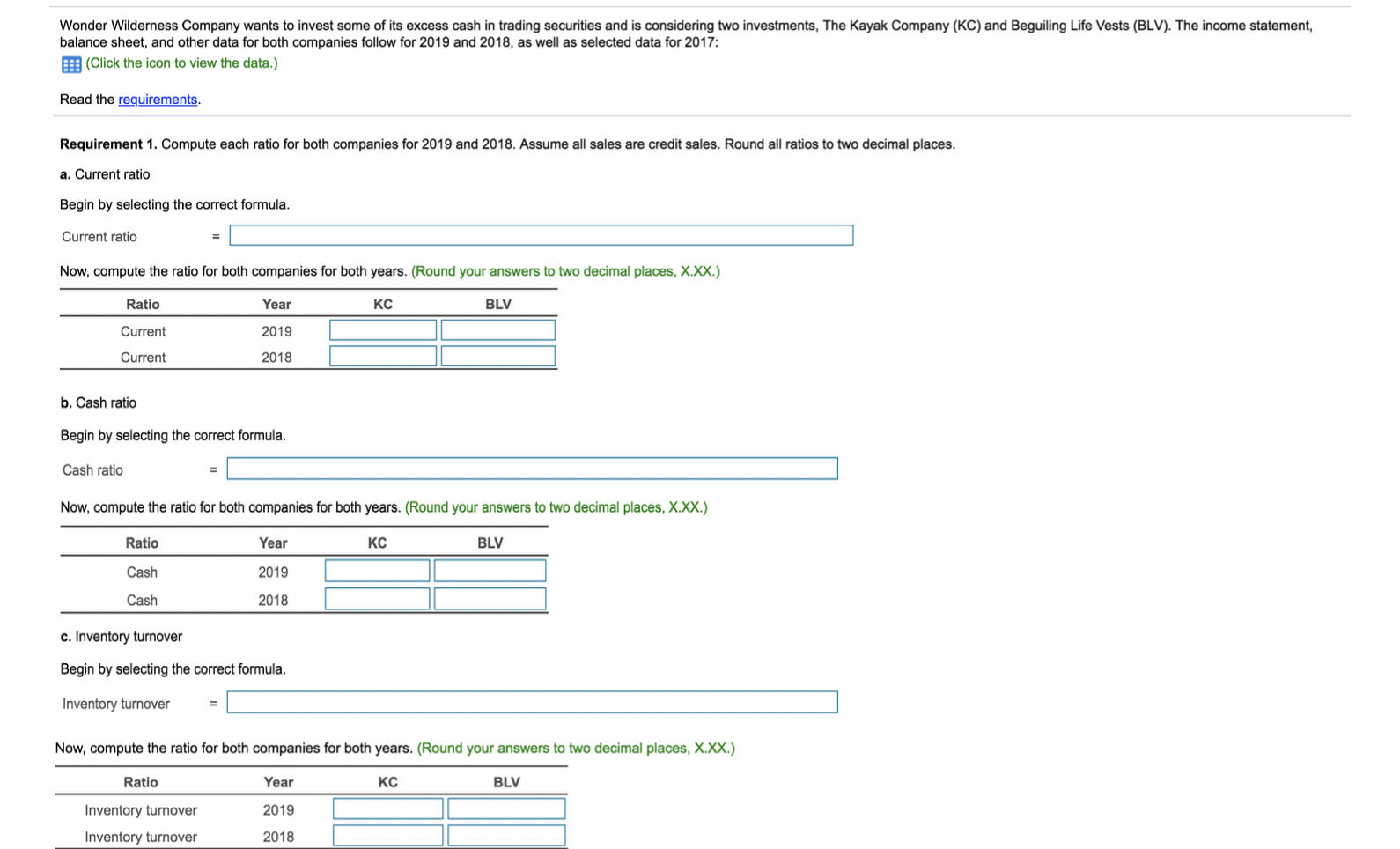

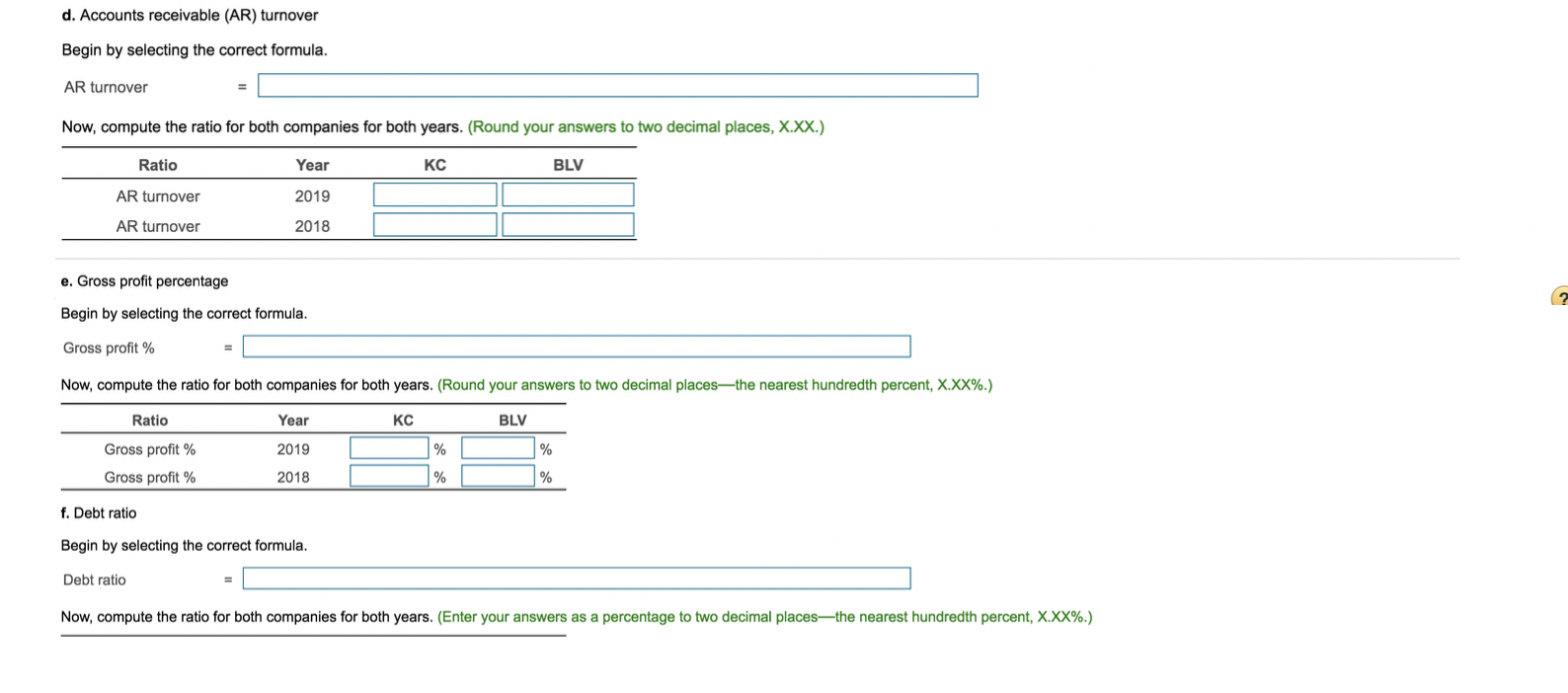

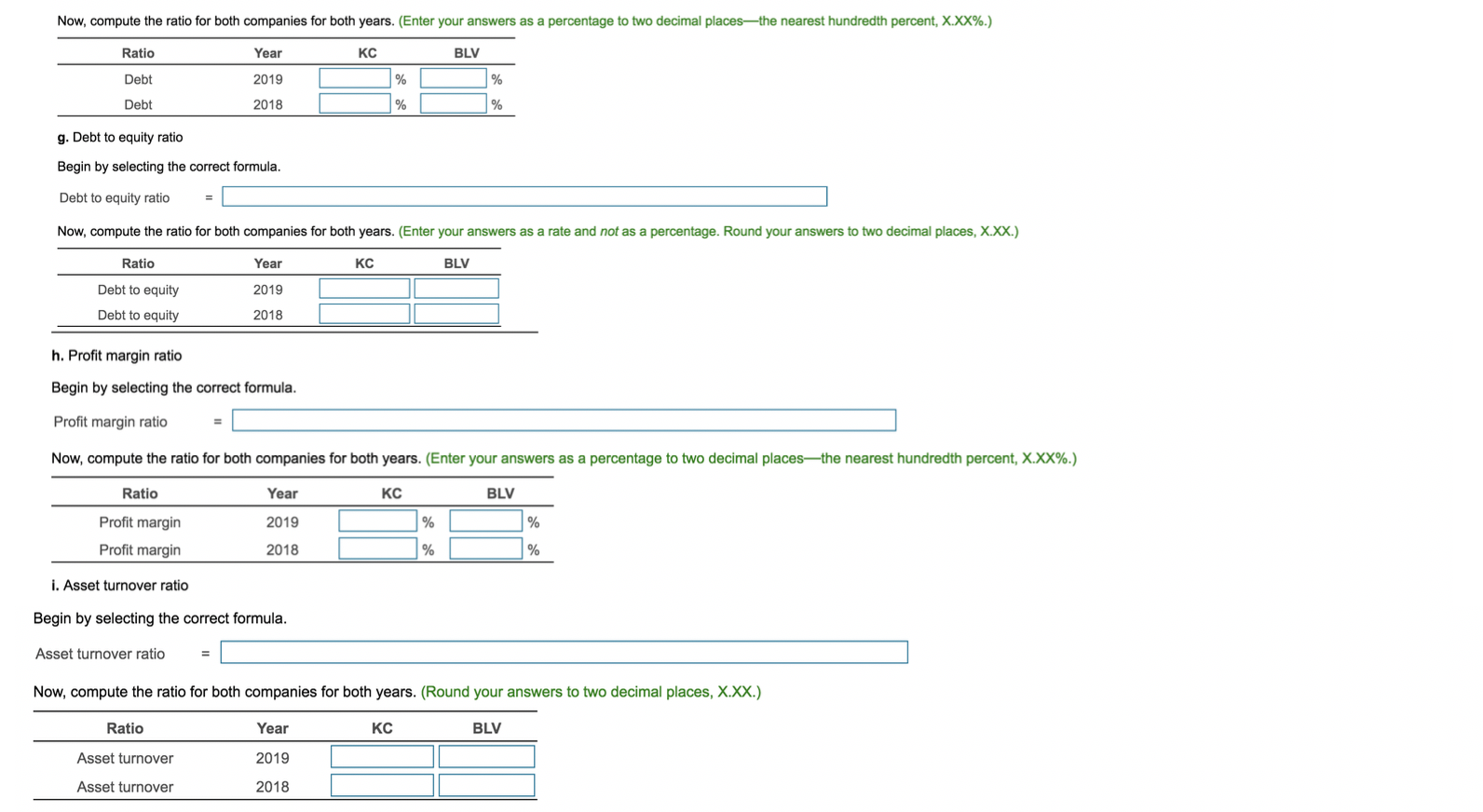

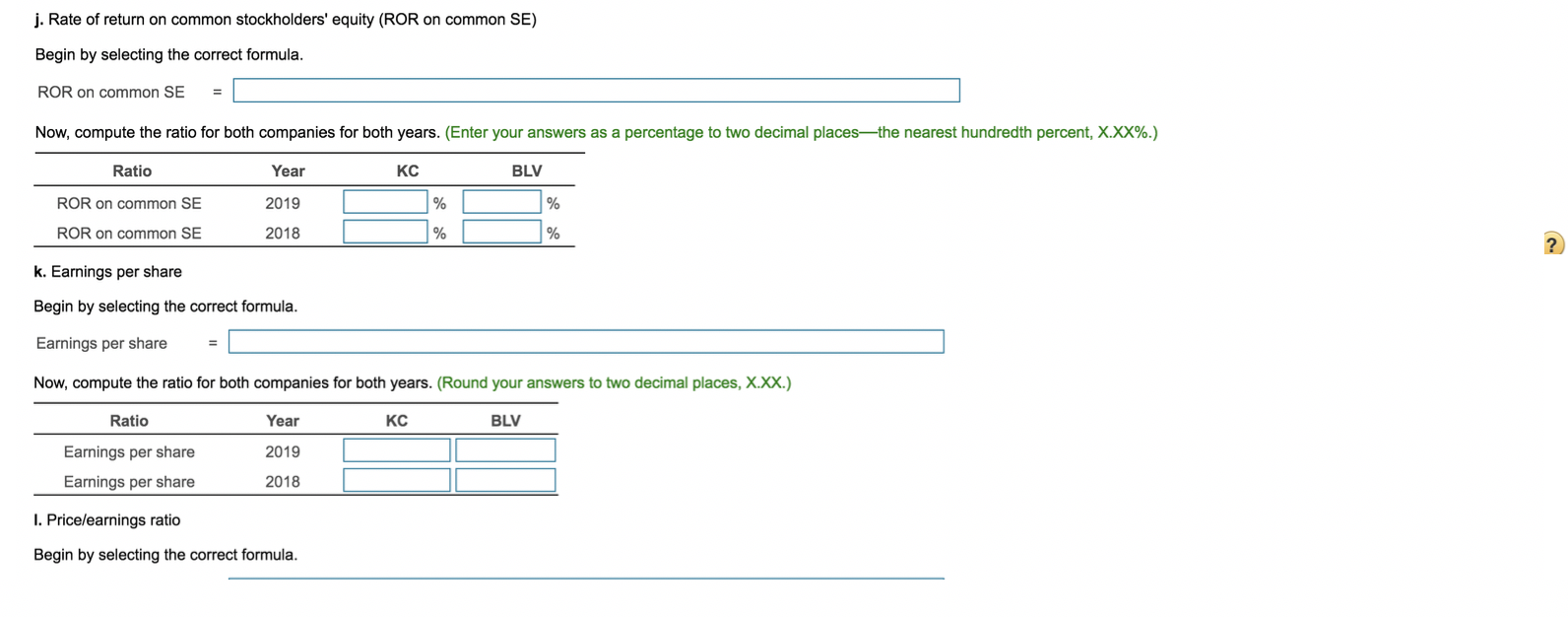

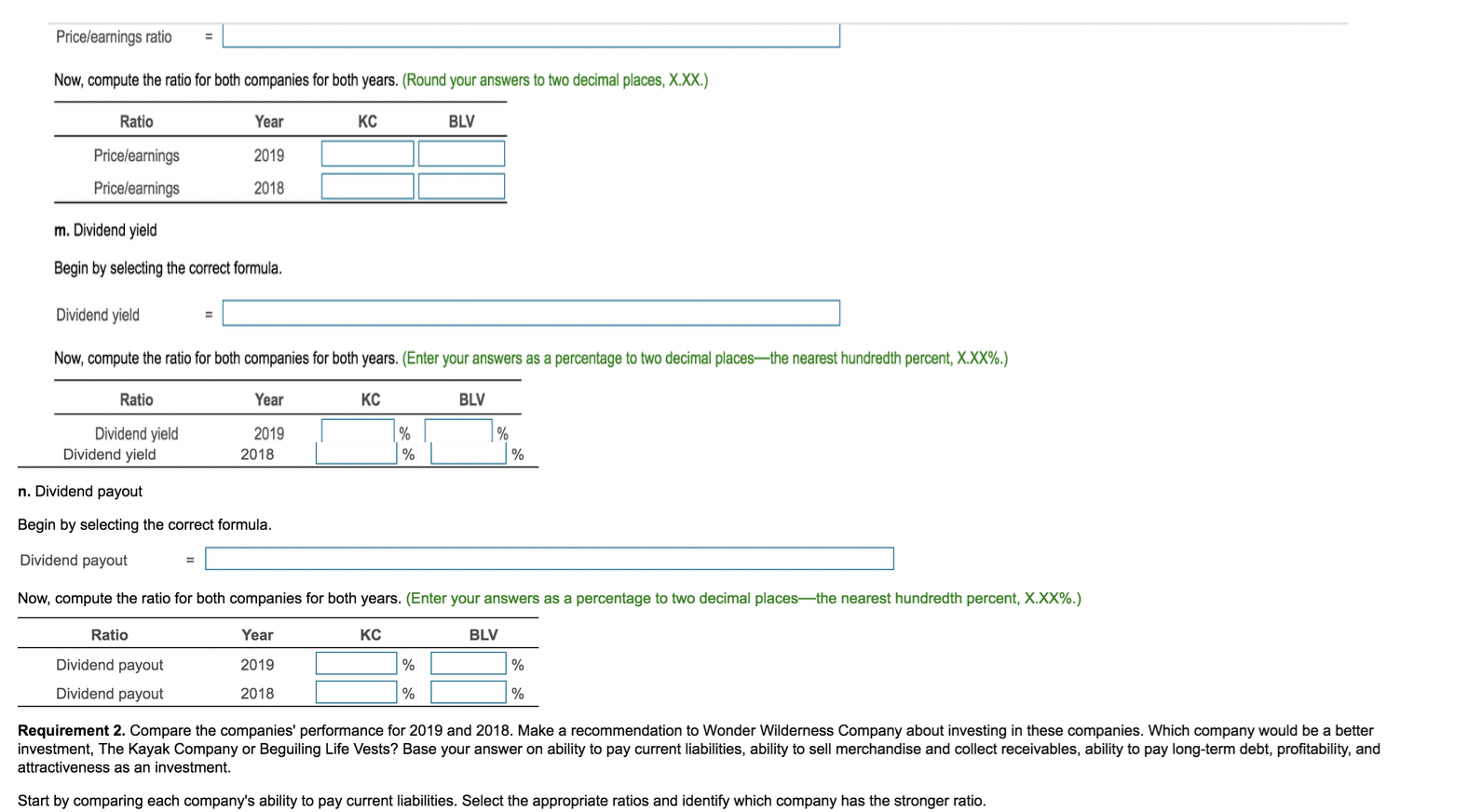

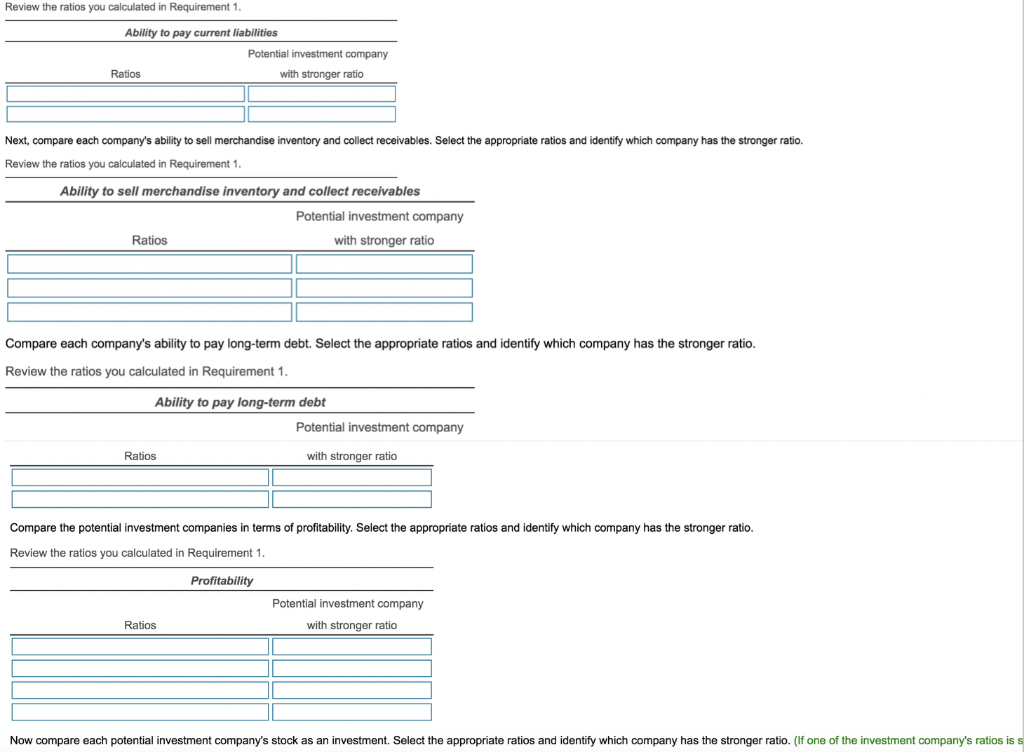

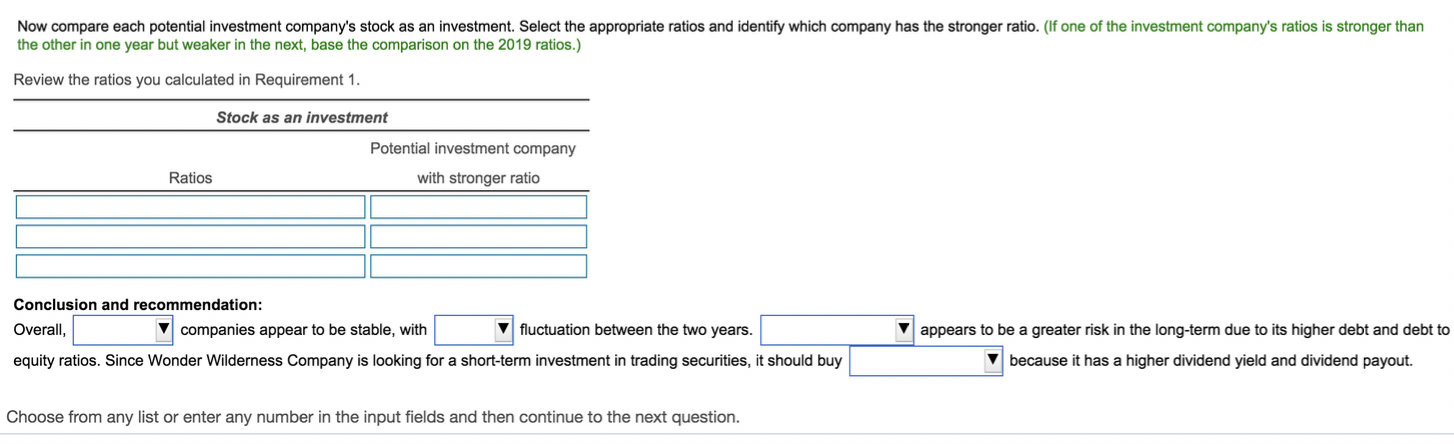

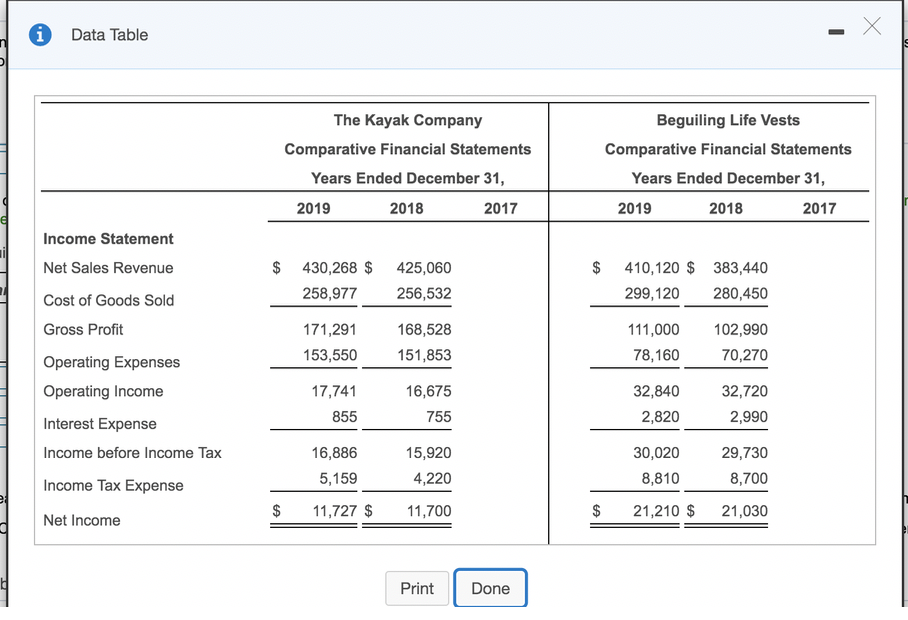

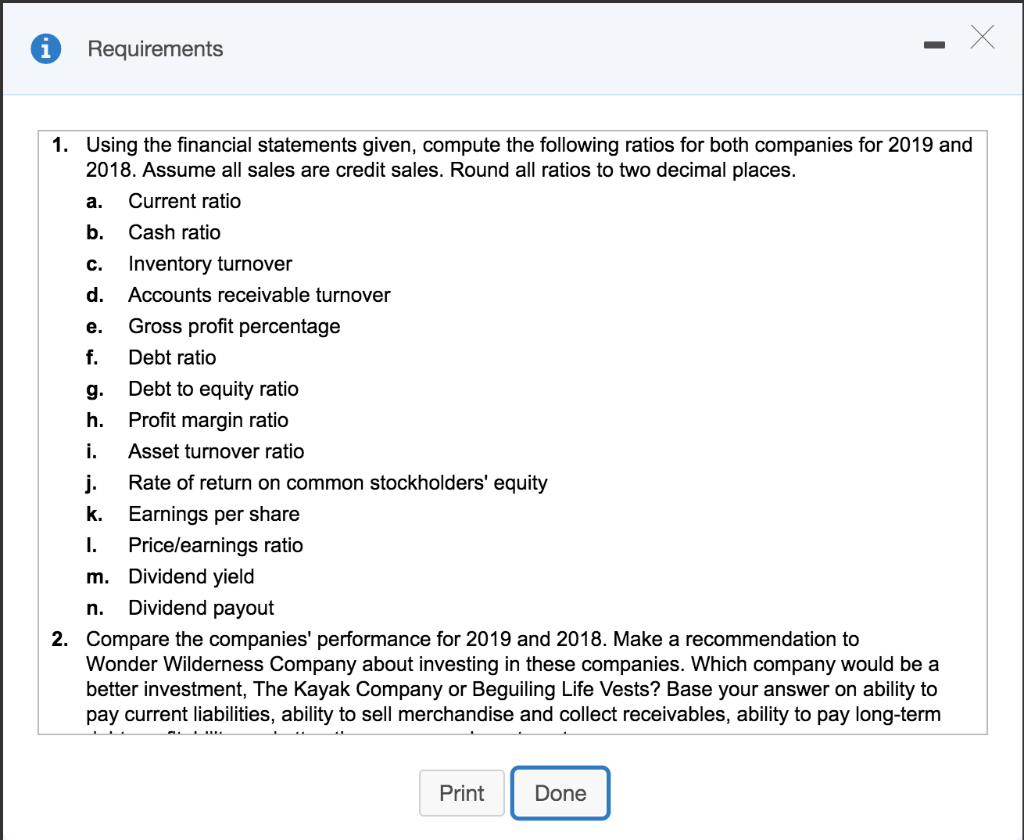

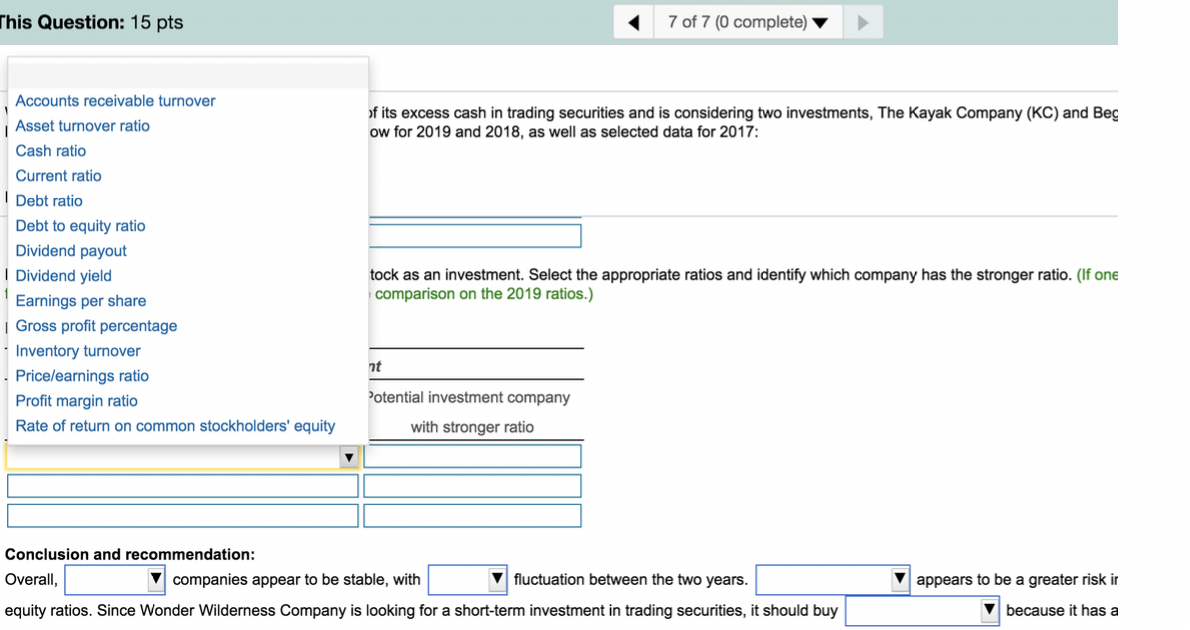

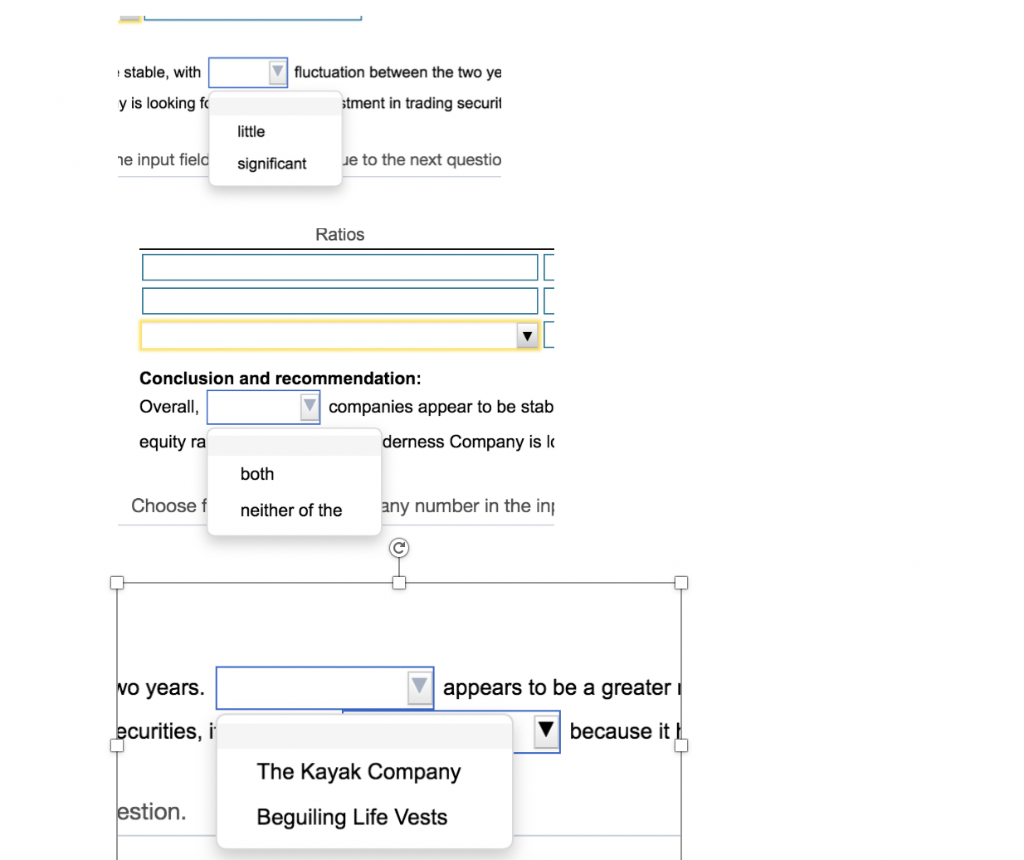

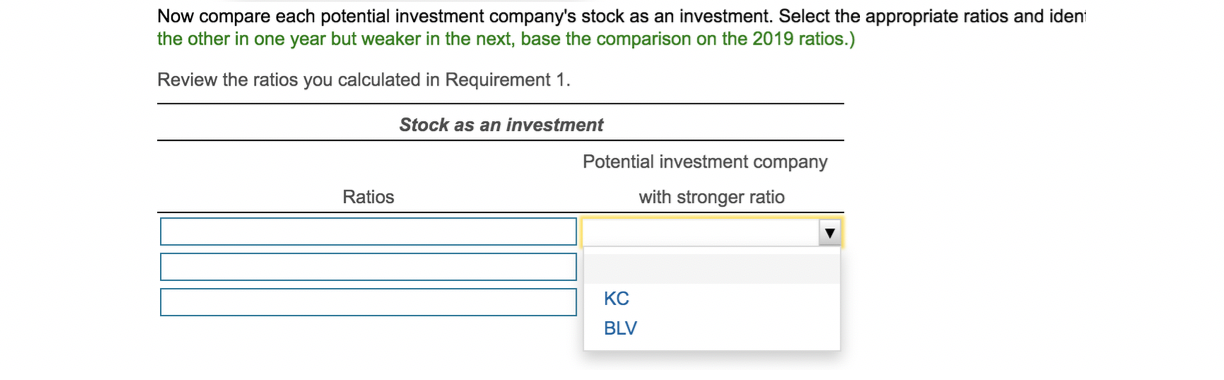

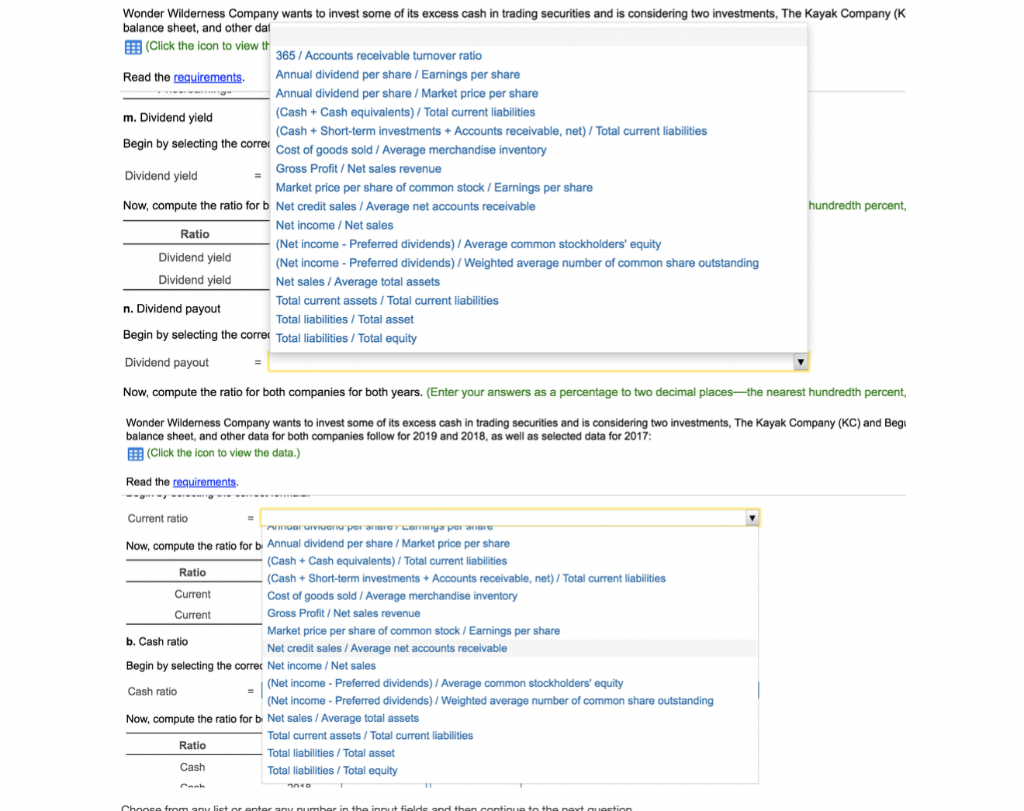

Wonder Wilderness Company wants to invest some of its excess cash in trading securities and is considering two investments, The Kayak Company (KC) and Beguiling Life Vests (BLV). The income statement, balance sheet, and other data for both companies follow for 2019 and 2018, as well as selected data for 2017 E(Click the icon to view the data.) Read the requirements. Requirement 1. Compute each ratio for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio Begin by selecting the correct formula. Current ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Year BLV Ratio Current 2019 Current 2018 b. Cash ratio Begin by selecting the correct formula. Cash ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Cash 2019 Cash 2018 c. Inventory turnover Begin by selecting the correct formula. Inventory turnover Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Year Ratio BLV Inventory turnover 2019 Inventory turnover 2018 d. Accounts receivable (AR) turnover Begin by selecting the correct formula. AR turnover Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV AR turnover 2019 AR turnover 2018 e. Gross profit percentage Begin by selecting the correct formula. Gross profit % Now, compute the ratio for both companies for both years. (Round your answers to two decimal places-the nearest hundredth percent, X.XX%.) Year Ratio BLV Gross profit % 2019 % % Gross profit % % % 2018 f. Debt ratio Begin by selecting the correct formula. Debt ratio Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Year Ratio BLV % Debt 2019 % Debt 2018 g. Debt to equity ratio Begin by selecting the correct formula. Debt to equity ratio Now, compute the ratio for both companies for both years. (Enter your answers as a rate and not as a percentage. Round your answers to two decimal places, X.XX.) Year BLV Ratio Debt to equity 2019 Debt to equity 2018 h. Profit margin ratio Begin by selecting the correct formula. Profit margin ratio Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV Profit margin % 2019 Profit margin 2018 % . Asset turnover ratio Begin by selecting the correct formula. Asset turnover ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Asset turnover 2019 2018 Asset turnover j. Rate of return on common stockholders' equity (ROR on common SE) Begin by selecting the correct formula. ROR on common SE Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV ROR on common SE 2019 % % ROR on common SE 2018 % % k. Earnings per share Begin by selecting the correct formula Earnings per share Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Earnings per share 2019 Earnings per share 2018 I. Price/earnings ratio Begin by selecting the correct formula. Price/earnings ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Price/earnings 2019 Price/earnings 2018 m.Dividend yield Begin by selecting the correct formula. Dividend yield Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV Dividend yield Dividend yield 2019 % % % 2018 n. Dividend payout Begin by selecting the correct formula. Dividend payout Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV Dividend payout % 2019 Dividend payout % 2018 Requirement 2. Compare the companies' performance for 2019 and 2018. Make a recommendation to Wonder Wilderness Company about investing in these companies. Which company would be a better investment, The Kayak Company or Beguiling Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. Start by comparing each company's ability to pay current liabilities. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1 Ability to pay current liabilities Potential investment company Ratios with stronger ratio Next, compare each company's ability to sell merchandise inventory and collect receivables. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Ability to sell merchandise inventory and collect receivables Potential investment company Ratios with stronger ratio Compare each company's ability to pay long-term debt. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Ability to pay long-term debt Potential investment company Ratios with stronger ratio Compare the potential investment companies in terms profitability. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Profitability Potential investment company with stronger ratio Ratios Now compare each potential investment company's stock as an investment. Select the appropriate ratios and identify which company has the stronger ratio. (If one of the investment company's ratios is s Now compare each potential investment company's stock as an investment. Select the appropriate ratios and identify which company has the stronger ratio. (If one of the investment company's ratios is stronger than the other in one year but weaker in the next, base the comparison on the 2019 ratios.) Review the ratios you calculated in Requirement 1. Stock as an investment Potential investment company Ratios with stronger ratio Conclusion and recommendation: fluctuation between the two years Overall, companies appear to be stable, with appears to be a greater risk in the long-term due to its higher debt and debt to equity ratios. Since Wonder Wilderness Company is looking for a short-term investment in trading securities, it should buy because it has a higher dividend yield and dividend payout. Choose from any list or enter any number in the input fields and then continue to the next question. i Data Table The Kayak Company Beguiling Life Vests Comparative Financial Statements Comparative Financial Statements Years Ended December 31, Years Ended December 31, 2019 2018 2017 2017 2019 2018 Income Statement i $ 430,268 $ 258,977 Net Sales Revenue 425,060 $ 410,120 $ 383,440 299,120 256,532 280,450 Cost of Goods Sold Gross Profit 168,528 111,000 102,990 171,291 153,550 151,853 78,160 70,270 Operating Expenses Operating Income 17,741 16,675 32,840 32,720 755 2,820 2,990 855 Interest Expense 16,886 15,920 30,020 Income before Income Tax 29,730 5,159 4,220 8,810 8,700 Income Tax Expense $ 11,727 $ $ 11,700 21,210 $ 21,030 Net Income Print Done X Requirements 1. Using the financial statements given, compute the following ratios for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places. Current ratio . Cash ratio b. Inventory turnover . d. Accounts receivable turnover Gross profit percentage . Debt ratio f. Debt to equity ratio g. h. Profit margin ratio i. Asset turnover ratio Rate of return on common stockholders' equity j. k. Earnings per share Price/earnings ratio m. Dividend yield Dividend payout n. 2. Compare the companies' performance for 2019 and 2018. Make a recommendation to Wonder Wilderness Company about investing in these companies. Which company would be a better investment, The Kayak Company or Beguiling Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term Print Done This Question: 15 pts 7 of 7 (0 complete) Accounts receivable turnover of its excess cash in trading securities and is considering two investments, The Kayak Company (KC) and Beg ow for 2019 and 2018, as well as selected data for 2017 Asset turnover ratio Cash ratio Current ratio Debt ratio Debt to equity ratio Dividend payout I Dividend yield tock as an investment. Select the appropriate ratios and identify which company has the stronger ratio. (If one comparison on the 2019 ratios.) Earnings per share Gross profit percentage Inventory turnover Price/earnings ratio nt Potential investment company Profit margin ratio Rate of return on common stockholders' equity with stronger ratio Conclusion and recommendation: Vfluctuation between the two years. Overall, companies appear to be stable, with appears to be a greater risk ir equity ratios. Since Wonder Wilderness Company is looking for a short-term investment in trading securities, it should buy because it has a fluctuation between the two ye stable, with y is looking f tment in trading securit little e to the next questio e input field significant Ratios Conclusion and recommendation: Overall, companies appear to be stab derness Company is l equity ra both Choose f any number in the in neither of the o years appears to be a greater because it H ecurities, i The Kayak Company estion. Beguiling Life Vests Now compare each potential investment company's stock as an investment. Select the appropriate ratios and iden the other in one year but weaker in the next, base the comparison on the 2019 ratios.) Review the ratios you calculated in Requirement 1 Stock as an investment Potential investment company with stronger ratio Ratios KC BLV Wonder Wilderness Company wants to invest some of its excess cash in trading securities and is considering two investments, The Kayak Company (K balance sheet, and other da (Click the icon to view t 365/Accounts receivable tunover ratio Read the reguirements Annual dividend per share / Eanings per share wwwww Annual dividend per share/ Market price per share (Cash+ Cash equivalents)/ Total current liabilities m. Dividend yield (Cash+Short-term investments + Accounts receivable, net)/ Total current liabilities Begin by selecting the corre Cost of goods sold /l Average merchandise inventory Gross Profit/Net sales revenue Dividend yield Market price per share of common stock / Earnings per share Now, compute the ratio for b Net credit sales/ Average net accounts receiva ble hundredth percent, Net income/ Net sales Ratio (Net income - Preferred dividends) / Average common stockholders' equity Dividend yield (Net income -Preferred dividends)/Weighted average number of common share outstanding Net sales / Average total assets Dividend yield Total current assets /Total current liabilities n. Dividend payout Total liabilities /Total asset Begin by selecting the corre Total liabilities/ Total equity Dividend payout Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, Wonder Wilderness Company wants to invest some of its excess cash in trading securities and is considering two investments, The Kayak Company (KC) and Beg balance sheet, and other data for both companies follow for 2019 and 2018, as well as selected data for 2017: (Click the icon to view the data.) Read the requirements Current ratio uaruviuannu per anareTcamngaper anare Now, compute the ratio for b Annual dividend per share / Market price per share (Cash+Cash equivalents) / Total current liabilities Ratio (Cash+Short-term investments + Accounts receivable, net)/ Total current liabilities Current Cost of goods sold / Average merchandise inventory Gross Profit/Net sales revenue Current Market price per share of common stock / Earnings per share b. Cash ratio Net credit sales / Average net accounts receivable Begin by selecting the correc Net income / Net sales (Net income - Preferred dividends) / Average common stockholders' equity Cash ratio (Net income - Preferred dividends) / Weighted average number of common share outstand ing Now, compute the ratio for b Net sales/ Average total assets Total current assets/Total current liabilities Ratio Total liabilities /Total asset Cash Total liabilities/Total equity Choose from anv liet or enter anv Dumber in the innut fielde and then continue to the nevt aLIOetion Wonder Wilderness Company wants to invest some of its excess cash in trading securities and is considering two investments, The Kayak Company (KC) and Beguiling Life Vests (BLV). The income statement, balance sheet, and other data for both companies follow for 2019 and 2018, as well as selected data for 2017 E(Click the icon to view the data.) Read the requirements. Requirement 1. Compute each ratio for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio Begin by selecting the correct formula. Current ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Year BLV Ratio Current 2019 Current 2018 b. Cash ratio Begin by selecting the correct formula. Cash ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Cash 2019 Cash 2018 c. Inventory turnover Begin by selecting the correct formula. Inventory turnover Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Year Ratio BLV Inventory turnover 2019 Inventory turnover 2018 d. Accounts receivable (AR) turnover Begin by selecting the correct formula. AR turnover Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV AR turnover 2019 AR turnover 2018 e. Gross profit percentage Begin by selecting the correct formula. Gross profit % Now, compute the ratio for both companies for both years. (Round your answers to two decimal places-the nearest hundredth percent, X.XX%.) Year Ratio BLV Gross profit % 2019 % % Gross profit % % % 2018 f. Debt ratio Begin by selecting the correct formula. Debt ratio Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Year Ratio BLV % Debt 2019 % Debt 2018 g. Debt to equity ratio Begin by selecting the correct formula. Debt to equity ratio Now, compute the ratio for both companies for both years. (Enter your answers as a rate and not as a percentage. Round your answers to two decimal places, X.XX.) Year BLV Ratio Debt to equity 2019 Debt to equity 2018 h. Profit margin ratio Begin by selecting the correct formula. Profit margin ratio Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV Profit margin % 2019 Profit margin 2018 % . Asset turnover ratio Begin by selecting the correct formula. Asset turnover ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Asset turnover 2019 2018 Asset turnover j. Rate of return on common stockholders' equity (ROR on common SE) Begin by selecting the correct formula. ROR on common SE Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV ROR on common SE 2019 % % ROR on common SE 2018 % % k. Earnings per share Begin by selecting the correct formula Earnings per share Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Earnings per share 2019 Earnings per share 2018 I. Price/earnings ratio Begin by selecting the correct formula. Price/earnings ratio Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) Ratio Year BLV Price/earnings 2019 Price/earnings 2018 m.Dividend yield Begin by selecting the correct formula. Dividend yield Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV Dividend yield Dividend yield 2019 % % % 2018 n. Dividend payout Begin by selecting the correct formula. Dividend payout Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX%.) Ratio Year BLV Dividend payout % 2019 Dividend payout % 2018 Requirement 2. Compare the companies' performance for 2019 and 2018. Make a recommendation to Wonder Wilderness Company about investing in these companies. Which company would be a better investment, The Kayak Company or Beguiling Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. Start by comparing each company's ability to pay current liabilities. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1 Ability to pay current liabilities Potential investment company Ratios with stronger ratio Next, compare each company's ability to sell merchandise inventory and collect receivables. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Ability to sell merchandise inventory and collect receivables Potential investment company Ratios with stronger ratio Compare each company's ability to pay long-term debt. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Ability to pay long-term debt Potential investment company Ratios with stronger ratio Compare the potential investment companies in terms profitability. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Profitability Potential investment company with stronger ratio Ratios Now compare each potential investment company's stock as an investment. Select the appropriate ratios and identify which company has the stronger ratio. (If one of the investment company's ratios is s Now compare each potential investment company's stock as an investment. Select the appropriate ratios and identify which company has the stronger ratio. (If one of the investment company's ratios is stronger than the other in one year but weaker in the next, base the comparison on the 2019 ratios.) Review the ratios you calculated in Requirement 1. Stock as an investment Potential investment company Ratios with stronger ratio Conclusion and recommendation: fluctuation between the two years Overall, companies appear to be stable, with appears to be a greater risk in the long-term due to its higher debt and debt to equity ratios. Since Wonder Wilderness Company is looking for a short-term investment in trading securities, it should buy because it has a higher dividend yield and dividend payout. Choose from any list or enter any number in the input fields and then continue to the next question. i Data Table The Kayak Company Beguiling Life Vests Comparative Financial Statements Comparative Financial Statements Years Ended December 31, Years Ended December 31, 2019 2018 2017 2017 2019 2018 Income Statement i $ 430,268 $ 258,977 Net Sales Revenue 425,060 $ 410,120 $ 383,440 299,120 256,532 280,450 Cost of Goods Sold Gross Profit 168,528 111,000 102,990 171,291 153,550 151,853 78,160 70,270 Operating Expenses Operating Income 17,741 16,675 32,840 32,720 755 2,820 2,990 855 Interest Expense 16,886 15,920 30,020 Income before Income Tax 29,730 5,159 4,220 8,810 8,700 Income Tax Expense $ 11,727 $ $ 11,700 21,210 $ 21,030 Net Income Print Done X Requirements 1. Using the financial statements given, compute the following ratios for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places. Current ratio . Cash ratio b. Inventory turnover . d. Accounts receivable turnover Gross profit percentage . Debt ratio f. Debt to equity ratio g. h. Profit margin ratio i. Asset turnover ratio Rate of return on common stockholders' equity j. k. Earnings per share Price/earnings ratio m. Dividend yield Dividend payout n. 2. Compare the companies' performance for 2019 and 2018. Make a recommendation to Wonder Wilderness Company about investing in these companies. Which company would be a better investment, The Kayak Company or Beguiling Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term Print Done This Question: 15 pts 7 of 7 (0 complete) Accounts receivable turnover of its excess cash in trading securities and is considering two investments, The Kayak Company (KC) and Beg ow for 2019 and 2018, as well as selected data for 2017 Asset turnover ratio Cash ratio Current ratio Debt ratio Debt to equity ratio Dividend payout I Dividend yield tock as an investment. Select the appropriate ratios and identify which company has the stronger ratio. (If one comparison on the 2019 ratios.) Earnings per share Gross profit percentage Inventory turnover Price/earnings ratio nt Potential investment company Profit margin ratio Rate of return on common stockholders' equity with stronger ratio Conclusion and recommendation: Vfluctuation between the two years. Overall, companies appear to be stable, with appears to be a greater risk ir equity ratios. Since Wonder Wilderness Company is looking for a short-term investment in trading securities, it should buy because it has a fluctuation between the two ye stable, with y is looking f tment in trading securit little e to the next questio e input field significant Ratios Conclusion and recommendation: Overall, companies appear to be stab derness Company is l equity ra both Choose f any number in the in neither of the o years appears to be a greater because it H ecurities, i The Kayak Company estion. Beguiling Life Vests Now compare each potential investment company's stock as an investment. Select the appropriate ratios and iden the other in one year but weaker in the next, base the comparison on the 2019 ratios.) Review the ratios you calculated in Requirement 1 Stock as an investment Potential investment company with stronger ratio Ratios KC BLV Wonder Wilderness Company wants to invest some of its excess cash in trading securities and is considering two investments, The Kayak Company (K balance sheet, and other da (Click the icon to view t 365/Accounts receivable tunover ratio Read the reguirements Annual dividend per share / Eanings per share wwwww Annual dividend per share/ Market price per share (Cash+ Cash equivalents)/ Total current liabilities m. Dividend yield (Cash+Short-term investments + Accounts receivable, net)/ Total current liabilities Begin by selecting the corre Cost of goods sold /l Average merchandise inventory Gross Profit/Net sales revenue Dividend yield Market price per share of common stock / Earnings per share Now, compute the ratio for b Net credit sales/ Average net accounts receiva ble hundredth percent, Net income/ Net sales Ratio (Net income - Preferred dividends) / Average common stockholders' equity Dividend yield (Net income -Preferred dividends)/Weighted average number of common share outstanding Net sales / Average total assets Dividend yield Total current assets /Total current liabilities n. Dividend payout Total liabilities /Total asset Begin by selecting the corre Total liabilities/ Total equity Dividend payout Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, Wonder Wilderness Company wants to invest some of its excess cash in trading securities and is considering two investments, The Kayak Company (KC) and Beg balance sheet, and other data for both companies follow for 2019 and 2018, as well as selected data for 2017: (Click the icon to view the data.) Read the requirements Current ratio uaruviuannu per anareTcamngaper anare Now, compute the ratio for b Annual dividend per share / Market price per share (Cash+Cash equivalents) / Total current liabilities Ratio (Cash+Short-term investments + Accounts receivable, net)/ Total current liabilities Current Cost of goods sold / Average merchandise inventory Gross Profit/Net sales revenue Current Market price per share of common stock / Earnings per share b. Cash ratio Net credit sales / Average net accounts receivable Begin by selecting the correc Net income / Net sales (Net income - Preferred dividends) / Average common stockholders' equity Cash ratio (Net income - Preferred dividends) / Weighted average number of common share outstand ing Now, compute the ratio for b Net sales/ Average total assets Total current assets/Total current liabilities Ratio Total liabilities /Total asset Cash Total liabilities/Total equity Choose from anv liet or enter anv Dumber in the innut fielde and then continue to the nevt aLIOetion