Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wondering if these multiple choice answers are correct 18 Which of the following methods of evaluating investment opportunities is based on annual accounting income rather

Wondering if these multiple choice answers are correct

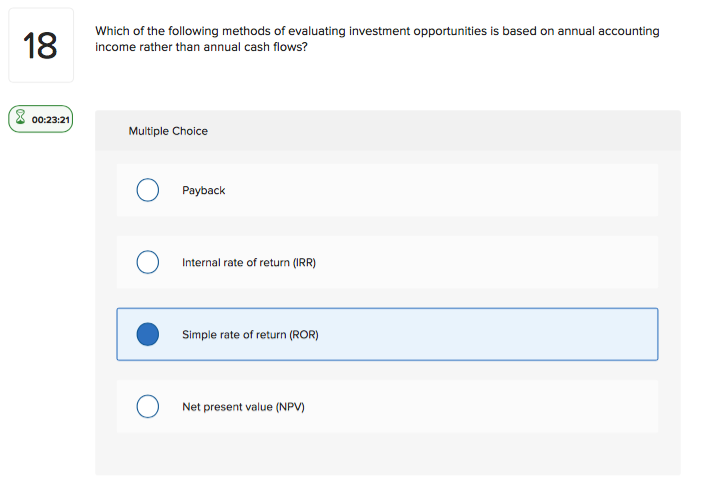

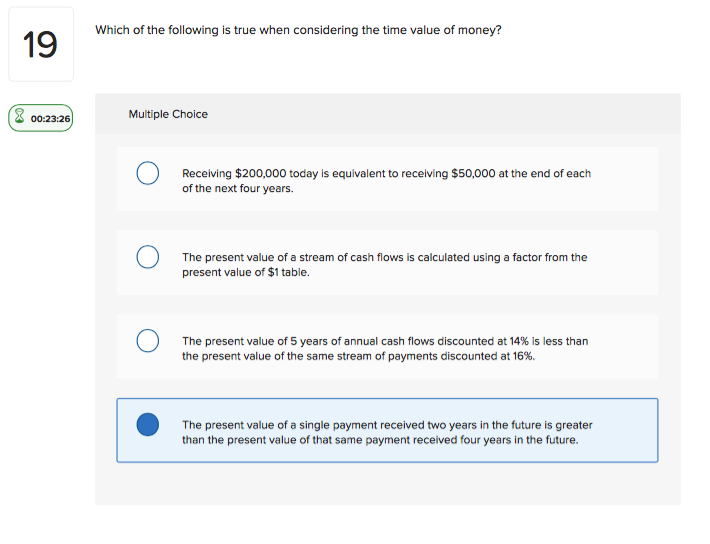

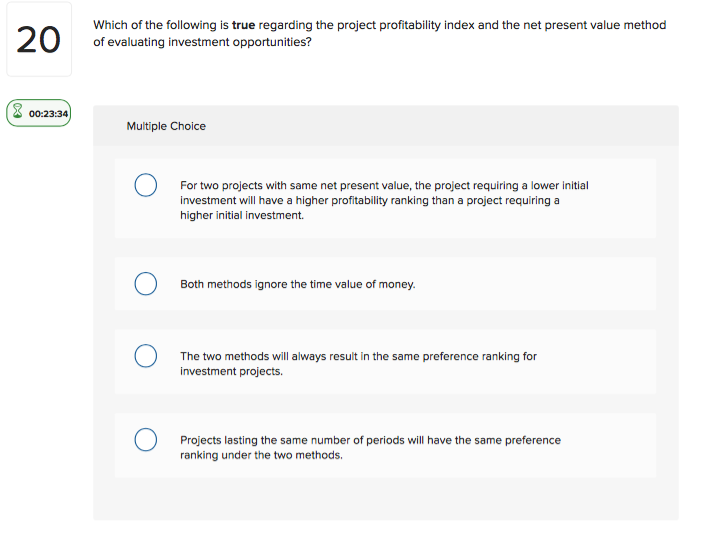

18 Which of the following methods of evaluating investment opportunities is based on annual accounting income rather than annual cash flows? 8 00:23:21 Multiple Choice O Payback o Internal rate of return (IRR) Simple rate of return (ROR) O Net present value (NPV) Which of the following is true when considering the time value of money? 19 2 00:23:26 Multiple Choice Receiving $200,000 today is equivalent to receiving $50,000 at the end of each of the next four years. O The present value of a stream of cash flows is calculated using a factor from the present value of $1 table. The present wealus The present value of 5 years of annual cash flows discounted at 14% is less than the present value of the same stream of payments discounted at 16%. The present value of a single payment received two years in the future is greater than the present value of that same payment received four years in the future. 20 Which of the following is true regarding the project profitability index and the net present value method of evaluating investment opportunities? (2 00:23:34 Multiple Choice For two projects with same net present value, the project requiring a lower initial investment will have a higher profitability ranking than a project requiring a higher initial investment O Both methods ignore the time value of money. o The two methods will always result in the same preference ranking for investment projects. o o Projects lasting the same number of periods will have the same preference ranking under the two methodsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started