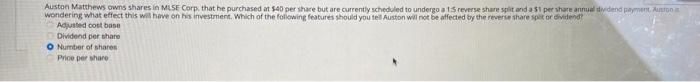

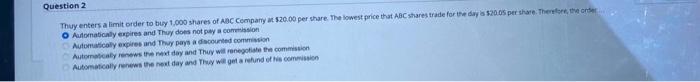

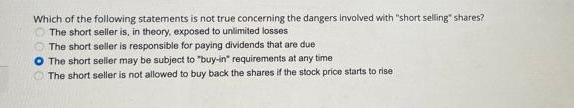

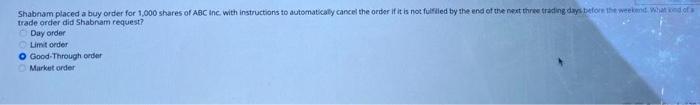

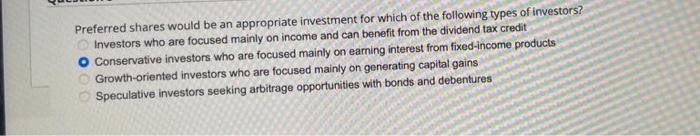

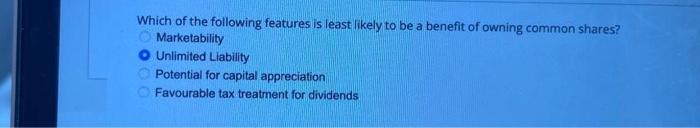

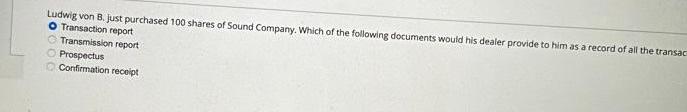

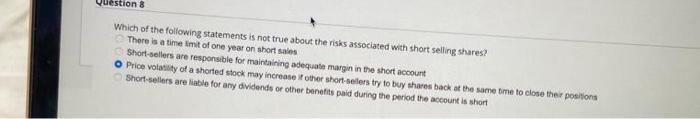

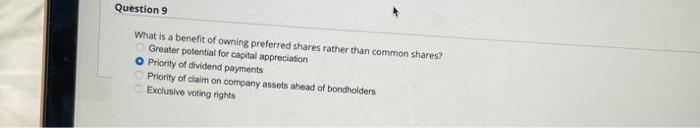

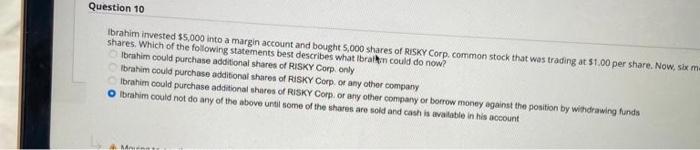

wondering witst effect this wat have on his investment. Which of the foliowing features sthould you teil Auston wall not be atfected by the reverie share sper or ovitend? Adiusted cont basn Dividend per tharo Nurnter of sharen Price per share Aulomaticaly expires and Thuy does not pay a comersion Automaticaly expires and Thuy pays a docounted commision Automeleaby renews the rakt dey and They will renegotisen the commstion Automatealy renews the nect day and They wit get a refund of tis comeisien Which of the following statements is not true concerning the dangers Involved with "short selling" shares? The short seller is, in theory, exposed to unlimited losses The short seller is responsible for paying dividends that are due The short seller may be subject to "buy-in" requirements at any time The short seller is not allowed to buy back the shares if the stock price starts to rise trade order did Shabnam request? Day order Limit order Good-Through oever Market order Preferred shares would be an appropriate investment for which of the following types of investors? Investors who are focused mainly on income and can benefit from the dividend tax credit Conservative investors who are focused mainly on earning interest from fixed-income products Growth-oriented investors who are focused mainly on generating capital gains Speculative investors seeking arbitrage opportunities with bonds and debentures Which of the following features is least likely to be a benefit of owning common shares? Marketability Unlimited Llability Potential for capital appreciation Favourable tax treatment for dividends Ludwig von B. just purchased 100 shares of Sound Company. Which of the following documents would his dealer provide to him as a record of all the transac Transaction report Transmission report Prospectus Confirmation recolipt Which of the following statements is not true about the risks associated with short selling shares? There is a time Imit of one year on short saies Short-sellers are responsible for mairinining asequate margin in the short acoount Price volasuly of a shorted slock may increase if other short-selers try to buy shares back at the same tme to close ther positions Short-sellers are liable for any dividends or other benefits paid during the period the account is short What is a benefit of owning preferred shares rather than common shares? Greater potential for capital appreciation Prionity of dividend payments Priority of claim on company assets a ahead of bondholders Exclusive voting rights Wrahim invested $5,000 into a margin account and bought 5,000 shares of Risky Corp. common stock that was trading at 51 . OD per share. Now, slax in shares. Which of the following statements best describes what ibralkin could do now? Ibrahim could purchase additional shares of RiSkY Corp. only lbrahim could purchase additional shares of RuSiFY Corp. of any othor company Ibrahim could purchase additional shares of RisKy Cop or aty other compamy or borrow money egainst the position by withdrawing funds Ibrahim could not do any of the above until tome of the shares are sold and cash is a eralable in his aocount