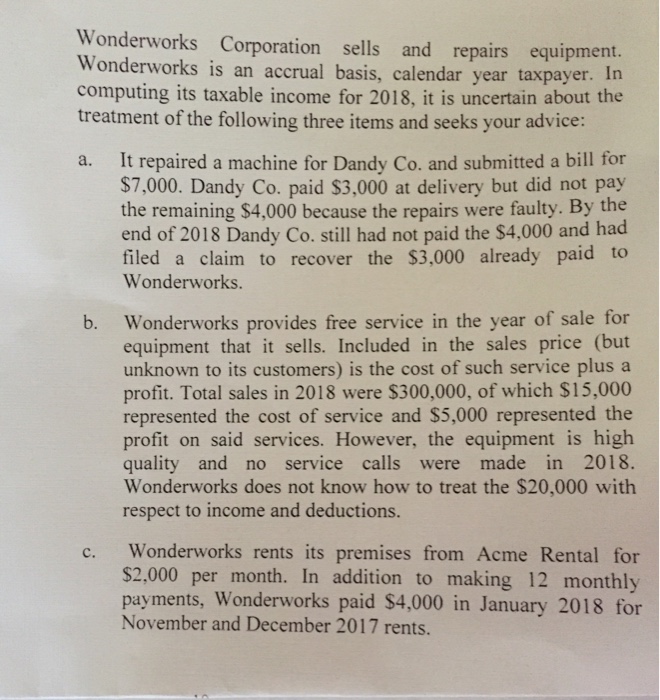

Wonderworks Corporation sells and repairs equipment. Wonderworks is an accrual basis, calendar year taxpayer. In computing its taxable income for 2018, it is uncertain about the treatment of the following three items and seeks your advice: a. It repaired a machine for Dandy Co. and submitted a bill for $7,000. Dandy Co. paid $3,000 at delivery but did not pay the remaining $4,000 because the repairs were faulty. By the end of 2018 Dandy Co. still had not paid the $4,000 and had filed a claim to recover the $3,000 already paid to Wonderworks. b. Wonderworks provides free service in the year of sale for equipment that it sells. Included in the sales price (but unknown to its customers) is the cost of such service plus a profit. Total sales in 2018 were $300,000, of which $15,000 represented the cost of service and $5,000 represented the profit on said services. However, the equipment is high quality and no service calls were made in 2018. Wonderworks does not know how to treat the $20,000 with respect to income and deductions. Wonderworks rents its premises from Acme Rental for $2,000 per month. In addition to making 12 monthly payments, Wonderworks paid $4,000 in January 2018 for November and December 2017 rents. C. Wonderworks Corporation sells and repairs equipment. Wonderworks is an accrual basis, calendar year taxpayer. In computing its taxable income for 2018, it is uncertain about the treatment of the following three items and seeks your advice: a. It repaired a machine for Dandy Co. and submitted a bill for $7,000. Dandy Co. paid $3,000 at delivery but did not pay the remaining $4,000 because the repairs were faulty. By the end of 2018 Dandy Co. still had not paid the $4,000 and had filed a claim to recover the $3,000 already paid to Wonderworks. b. Wonderworks provides free service in the year of sale for equipment that it sells. Included in the sales price (but unknown to its customers) is the cost of such service plus a profit. Total sales in 2018 were $300,000, of which $15,000 represented the cost of service and $5,000 represented the profit on said services. However, the equipment is high quality and no service calls were made in 2018. Wonderworks does not know how to treat the $20,000 with respect to income and deductions. Wonderworks rents its premises from Acme Rental for $2,000 per month. In addition to making 12 monthly payments, Wonderworks paid $4,000 in January 2018 for November and December 2017 rents. C