Answered step by step

Verified Expert Solution

Question

1 Approved Answer

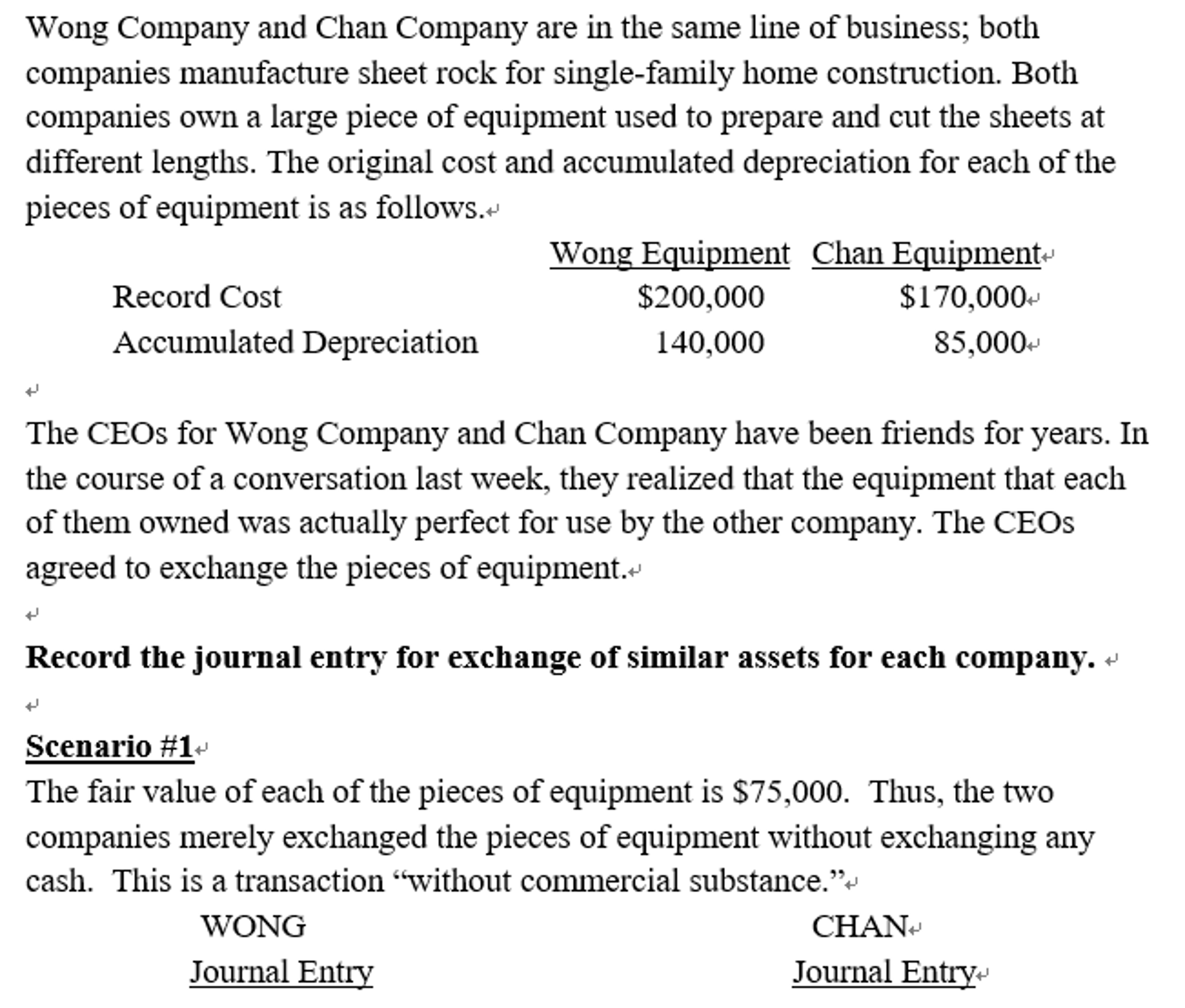

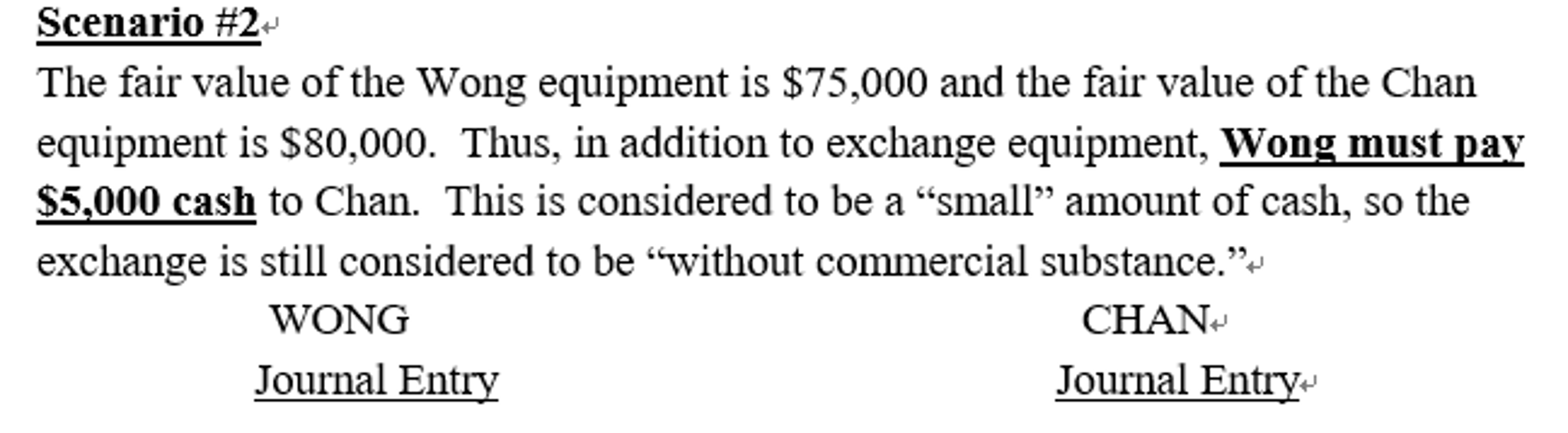

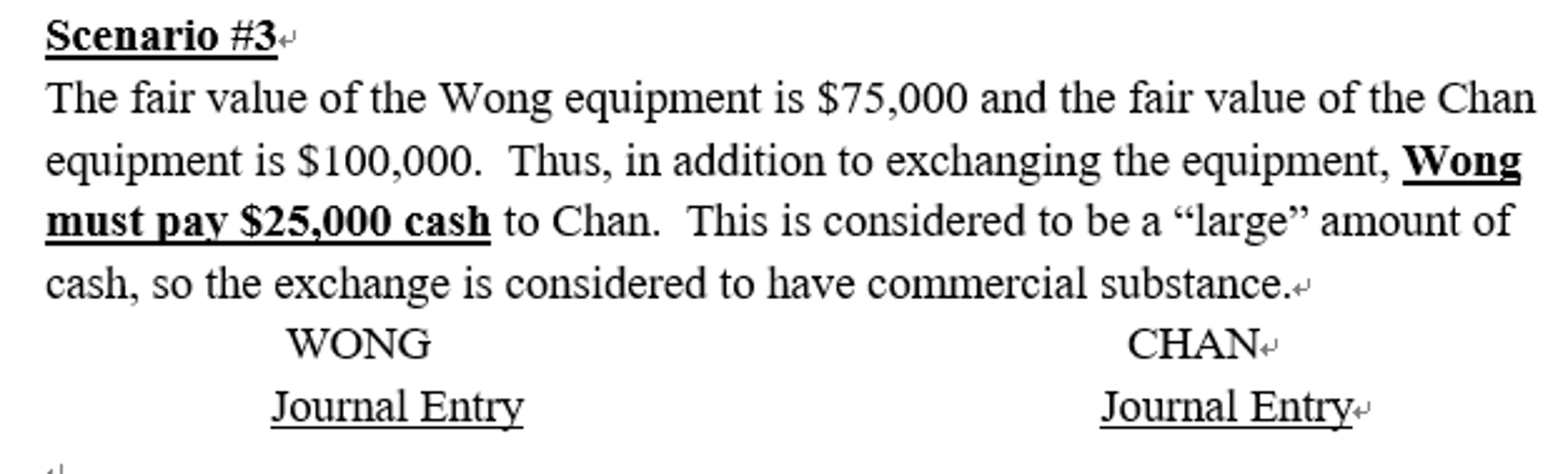

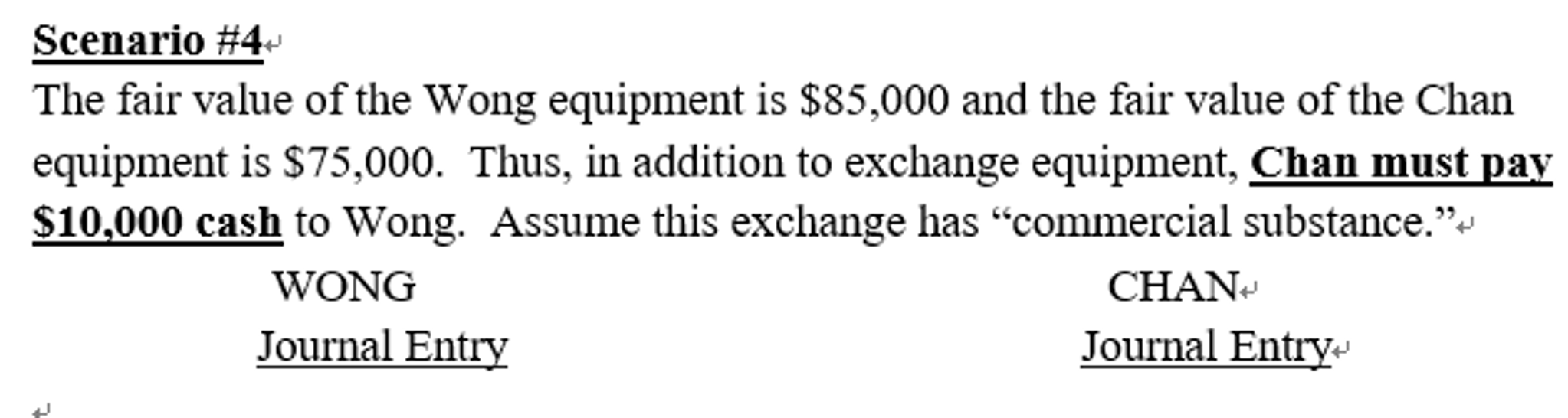

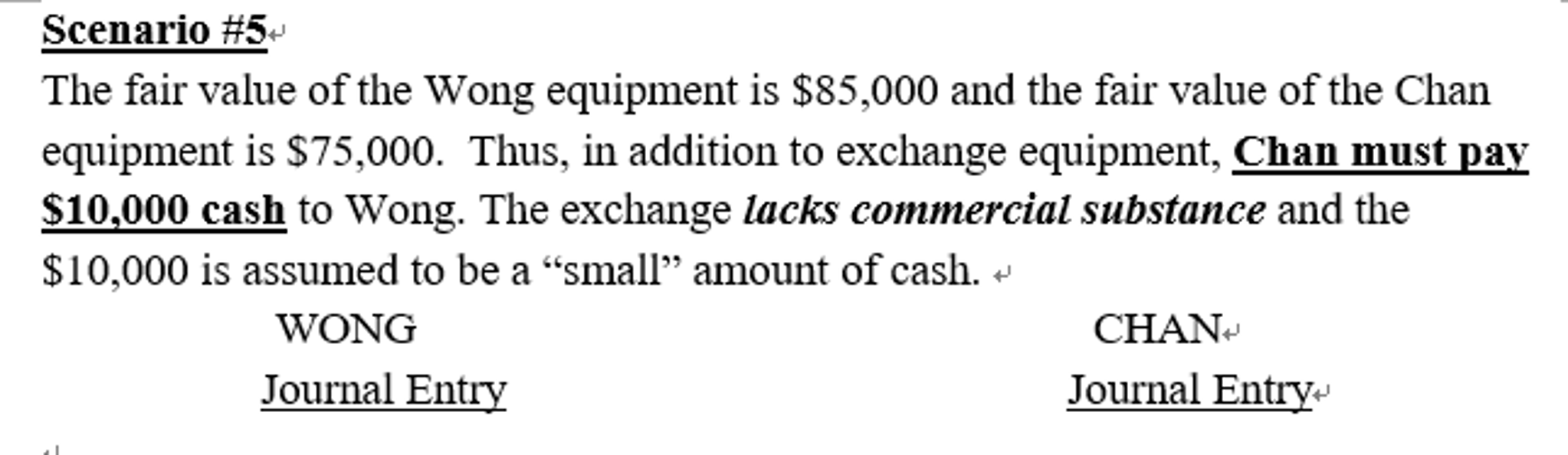

Wong Company and Chan Company are in the same line of business; both companies manufacture sheet rock for single-family home construction. Both companies own a

Wong Company and Chan Company are in the same line of business; both companies manufacture sheet rock for single-family home construction. Both companies own a large piece of equipment used to prepare and cut the sheets at different lengths. The original cost and accumulated depreciation for each of the pieces of equipment is as follows. ?please show process?how to calculate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started