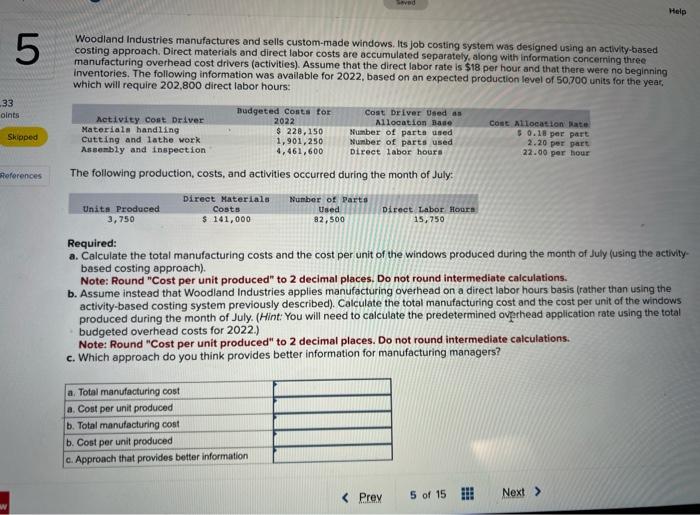

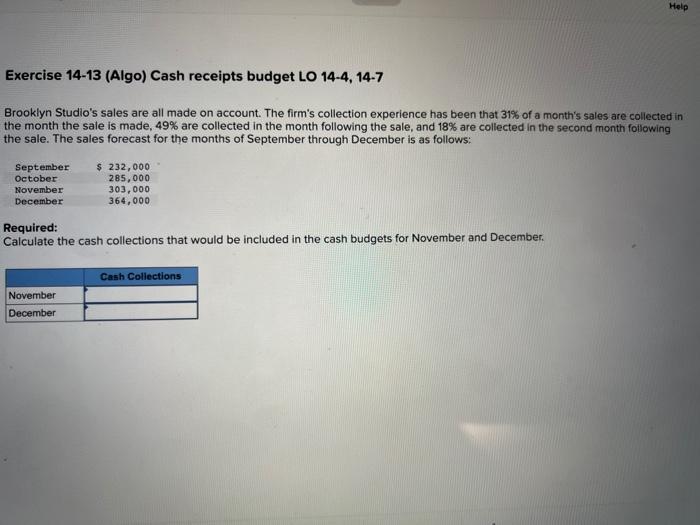

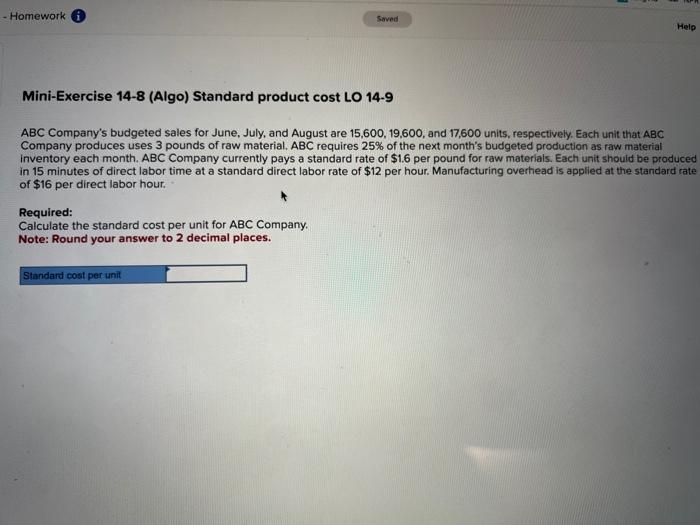

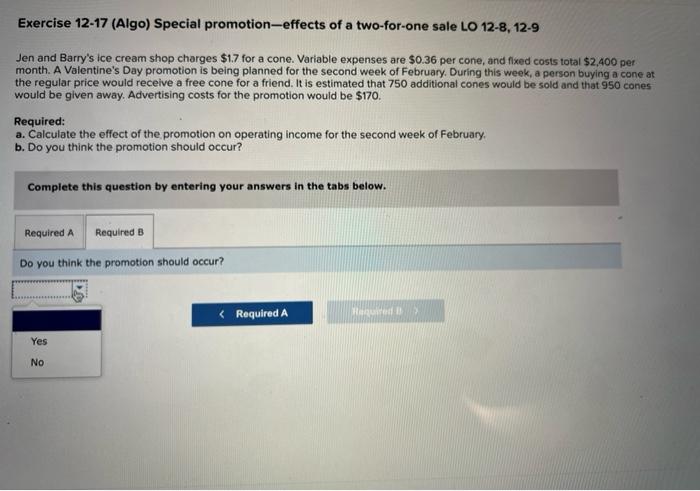

Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $18 per hour and that there were no beginning inventories. The following information was avallable for 2022, based on an expected production level of 50.700 units for the year, which will require 202,800 direct labor hours: The following production, costs, and activities occurred during the month of July: Required: a. Calculate the total manufacturing costs and the cost per unit of the windows produced during the month of July (using the activitybased costing approach). Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. b. Assume instead that Woodland Industries applies manufacturing overhead on a direct labor hours basis (rather than using the activity-based costing system previously described). Calculate the total manufacturing cost and the cost per unit of the windows produced during the month of July. (Hint:You will need to calculate the predetermined overhead application rate using the total budgeted overhead costs for 2022 .) Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. c. Which approach do you think provides better information for manufacturing managers? Brooklyn Studio's sales are all made on account. The firm's collection experience has been that 31% of a month's sales are collected in the month the sale is made, 49% are collected in the month following the sale, and 18% are collected in the second month following the sale. The sales forecast for the months of September through December is as follows: Required: Calculate the cash collections that would be included in the cash budgets for November and December. Mini-Exercise 14-8 (Algo) Standard product cost LO 14-9 ABC Company's budgeted sales for June, July, and August are 15,600, 19,600, and 17,600 units, respectively. Each unit that ABC Company produces uses 3 pounds of raw material. ABC requires 25% of the next month's budgeted production as raw material inventory each month. ABC Company currently pays a standard rate of $1.6 per pound for raw materials. Each unit should be produced in 15 minutes of direct labor time at a standard direct labor rate of $12 per hour. Manufacturing overhead is applied at the standard rate of $16 per direct labor hour. Required: Calculate the standard cost per unit for ABC Company. Note: Round your answer to 2 decimal places. Exercise 12-17 (Algo) Special promotion-effects of a two-for-one sale LO 12-8,12-9 Jen and Barry's ice cream shop charges \$1.7 for a cone. Variable expenses are \$0.36 per cone, and fixed costs total \$2,400 per month. A Valentine's Day promotion is being planned for the second week of February. During this week, a person buying a cone at the regular price would receive a free cone for a friend. It is estimated that 750 additional cones would be sold and that 950 cones would be given away. Advertising costs for the promotion would be $170. Required: a. Calculate the effect of the promotion on operating income for the second week of February. b. Do you think the promotion should occur? Complete this question by entering your answers in the tabs below. Do you think the promotion should occur? Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $18 per hour and that there were no beginning inventories. The following information was avallable for 2022, based on an expected production level of 50.700 units for the year, which will require 202,800 direct labor hours: The following production, costs, and activities occurred during the month of July: Required: a. Calculate the total manufacturing costs and the cost per unit of the windows produced during the month of July (using the activitybased costing approach). Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. b. Assume instead that Woodland Industries applies manufacturing overhead on a direct labor hours basis (rather than using the activity-based costing system previously described). Calculate the total manufacturing cost and the cost per unit of the windows produced during the month of July. (Hint:You will need to calculate the predetermined overhead application rate using the total budgeted overhead costs for 2022 .) Note: Round "Cost per unit produced" to 2 decimal places. Do not round intermediate calculations. c. Which approach do you think provides better information for manufacturing managers? Brooklyn Studio's sales are all made on account. The firm's collection experience has been that 31% of a month's sales are collected in the month the sale is made, 49% are collected in the month following the sale, and 18% are collected in the second month following the sale. The sales forecast for the months of September through December is as follows: Required: Calculate the cash collections that would be included in the cash budgets for November and December. Mini-Exercise 14-8 (Algo) Standard product cost LO 14-9 ABC Company's budgeted sales for June, July, and August are 15,600, 19,600, and 17,600 units, respectively. Each unit that ABC Company produces uses 3 pounds of raw material. ABC requires 25% of the next month's budgeted production as raw material inventory each month. ABC Company currently pays a standard rate of $1.6 per pound for raw materials. Each unit should be produced in 15 minutes of direct labor time at a standard direct labor rate of $12 per hour. Manufacturing overhead is applied at the standard rate of $16 per direct labor hour. Required: Calculate the standard cost per unit for ABC Company. Note: Round your answer to 2 decimal places. Exercise 12-17 (Algo) Special promotion-effects of a two-for-one sale LO 12-8,12-9 Jen and Barry's ice cream shop charges \$1.7 for a cone. Variable expenses are \$0.36 per cone, and fixed costs total \$2,400 per month. A Valentine's Day promotion is being planned for the second week of February. During this week, a person buying a cone at the regular price would receive a free cone for a friend. It is estimated that 750 additional cones would be sold and that 950 cones would be given away. Advertising costs for the promotion would be $170. Required: a. Calculate the effect of the promotion on operating income for the second week of February. b. Do you think the promotion should occur? Complete this question by entering your answers in the tabs below. Do you think the promotion should occur