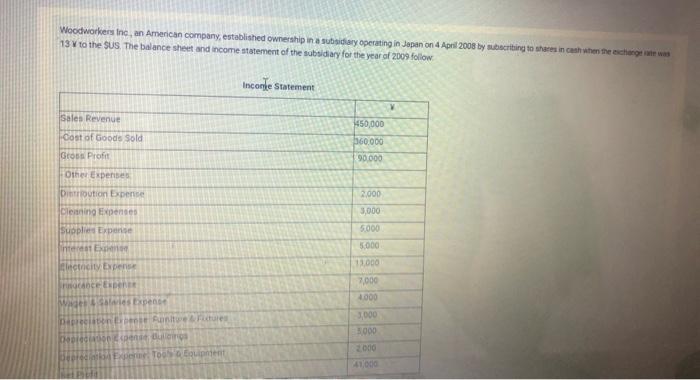

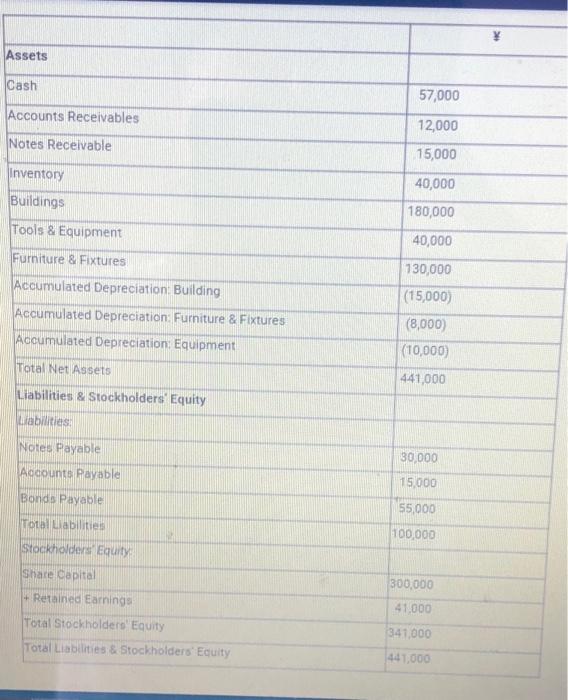

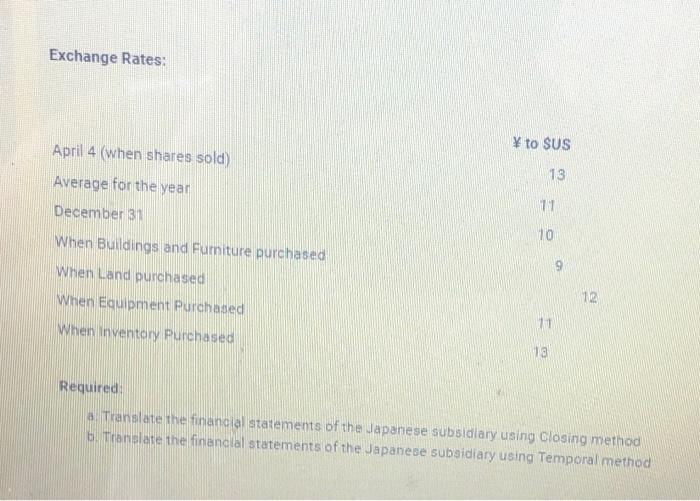

Woodworkers in an American company, established ownership in a subsidiary operating in Japan on 4 April 2008 by subscribing to shares in cash when the change was 13 to the SUS The balance sheet and income statement of the subsidiary for the year of 2009 Follow Inconle Statement 450,000 Sales Revenue Cost of Goods Sold Gross Profit Other Expenses 60.000 90.000 2,000 3,000 Dition Experte Cleaning Expenses Supplies Experts interest lectricity Expense 5.000 SODO 13000 Face Expert 7,000 4.000 Miesten present ontwedures Dopo la EXTOS Entert 3000 3000 2000 41000 Assets Cash 57,000 Accounts Receivables 12,000 Notes Receivable 15,000 Inventory Buildings Tools & Equipment 40,000 180,000 40,000 Furniture & Fixtures Accumulated Depreciation Building Accumulated Depreciation: Furniture & Fixtures Accumulated Depreciation Equipment 730,000 (15,000) (8,000) (10,000) Total Net Assets 441,000 Liabilities & Stockholders' Equity Liabilities 30,000 Notes Payable Accounts Payable Bonds Payable 15.000 Total Liabilities Stockholders Equity 55,000 100,000 Share Capital + Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 300,000 41,000 341,000 441,000 Exchange Rates: to SUS 13 11 April 4 when shares sold) Average for the year December 31 When Buildings and Furniture purchased When Land purchased When Equipment Purchased 10 12 When Inventory Purchased 10 13 Required: a. Translate the financial statements of the Japanese subsidiary using closing method 6. Translate the financial statements of the Japanese subsidiary using Temporal method Woodworkers in an American company, established ownership in a subsidiary operating in Japan on 4 April 2008 by subscribing to shares in cash when the change was 13 to the SUS The balance sheet and income statement of the subsidiary for the year of 2009 Follow Inconle Statement 450,000 Sales Revenue Cost of Goods Sold Gross Profit Other Expenses 60.000 90.000 2,000 3,000 Dition Experte Cleaning Expenses Supplies Experts interest lectricity Expense 5.000 SODO 13000 Face Expert 7,000 4.000 Miesten present ontwedures Dopo la EXTOS Entert 3000 3000 2000 41000 Assets Cash 57,000 Accounts Receivables 12,000 Notes Receivable 15,000 Inventory Buildings Tools & Equipment 40,000 180,000 40,000 Furniture & Fixtures Accumulated Depreciation Building Accumulated Depreciation: Furniture & Fixtures Accumulated Depreciation Equipment 730,000 (15,000) (8,000) (10,000) Total Net Assets 441,000 Liabilities & Stockholders' Equity Liabilities 30,000 Notes Payable Accounts Payable Bonds Payable 15.000 Total Liabilities Stockholders Equity 55,000 100,000 Share Capital + Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 300,000 41,000 341,000 441,000 Exchange Rates: to SUS 13 11 April 4 when shares sold) Average for the year December 31 When Buildings and Furniture purchased When Land purchased When Equipment Purchased 10 12 When Inventory Purchased 10 13 Required: a. Translate the financial statements of the Japanese subsidiary using closing method 6. Translate the financial statements of the Japanese subsidiary using Temporal method