Answered step by step

Verified Expert Solution

Question

1 Approved Answer

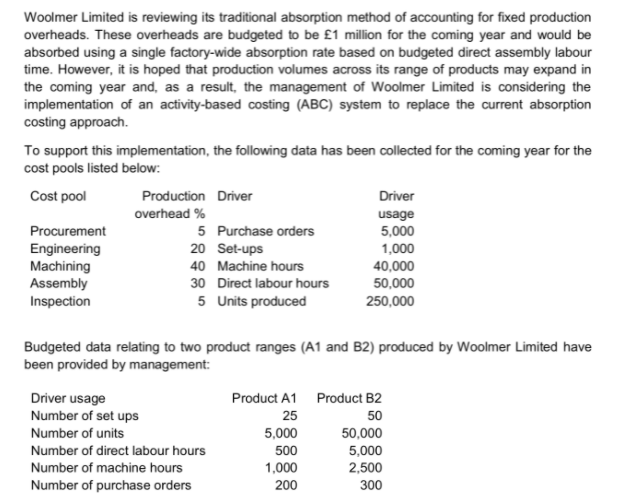

Woolmer Limited is reviewing its traditional absorption method of accounting for fixed production overheads. These overheads are budgeted to be 1 million for the

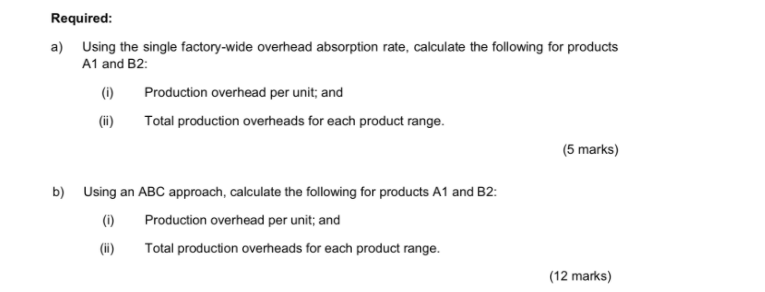

Woolmer Limited is reviewing its traditional absorption method of accounting for fixed production overheads. These overheads are budgeted to be 1 million for the coming year and would be absorbed using a single factory-wide absorption rate based on budgeted direct assembly labour time. However, it is hoped that production volumes across its range of products may expand in the coming year and, as a result, the management of Woolmer Limited is considering the implementation of an activity-based costing (ABC) system to replace the current absorption costing approach. To support this implementation, the following data has been collected for the coming year for the cost pools listed below: Cost pool Production Driver Driver overhead % usage Procurement 5 Purchase orders 5,000 Engineering 20 Set-ups 1,000 Machining 40 Machine hours 40,000 Assembly 30 Direct labour hours 50,000 Inspection 5 Units produced 250,000 Budgeted data relating to two product ranges (A1 and B2) produced by Woolmer Limited have been provided by management: Driver usage Product A1 Product B2 Number of set ups 25 Number of units 5,000 50 50,000 Number of direct labour hours 500 5,000 Number of machine hours 1,000 2,500 Number of purchase orders 200 300 Required: a) Using the single factory-wide overhead absorption rate, calculate the following for products A1 and B2: (i) Production overhead per unit; and (ii) Total production overheads for each product range. (5 marks) (i) b) Using an ABC approach, calculate the following for products A1 and B2: Production overhead per unit; and (ii) Total production overheads for each product range. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Woolmer Limited is reviewing its traditional absorption method of accounting for fixed production ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started