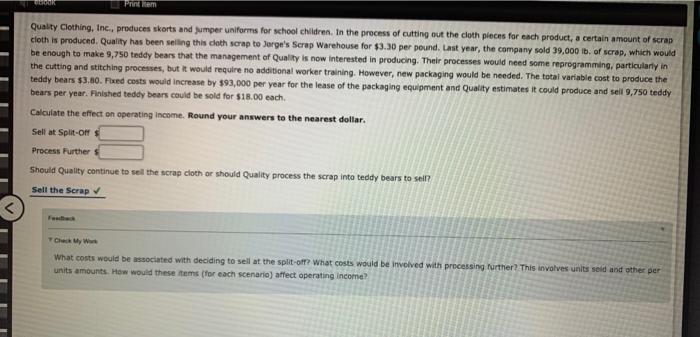

WOOR Printem Quality Clothing, Inc., produces skorts and jumper uniforms for school children. In the process of cutting out the cloth places for each product, a certain amount of scrap cloth is produced. Quality has been selling this doth scrap to Jorge's Scrap Warehouse for $3.30 per pound. Last year, the company sold 39,000 lbs of scrap, which would be enough to make 9,750 teddy bears that the management of Quality is now interested in producing. Their processes would need some reprogramming, particularly in the cutting and stitching processes, but it would require no additional worker training. However, new packaging would be needed. The total variable cost to produce the teddy bears $3.00. Fixed costs would increase by $93,000 per year for the lease of the packaging equipment and Quality estimates it could produce and sell 9,750 teddy bears per year. Finished teddy bears could be sold for $18.00 each Calculate the effect on operating income. Round your answers to the nearest dollar. Sell at Split-Off Process Further Should Quality continue to sell the scrap cloth or should Quality process the scrap into teddy bears to sell? Sell the Scrap Check My War What costs would be associated with deciding to sell at the split-off? What costs would be involved with processing further? This involves units seld and other per units amounts. How would these tems (for each scenario) affect operating Income? WOOR Printem Quality Clothing, Inc., produces skorts and jumper uniforms for school children. In the process of cutting out the cloth places for each product, a certain amount of scrap cloth is produced. Quality has been selling this doth scrap to Jorge's Scrap Warehouse for $3.30 per pound. Last year, the company sold 39,000 lbs of scrap, which would be enough to make 9,750 teddy bears that the management of Quality is now interested in producing. Their processes would need some reprogramming, particularly in the cutting and stitching processes, but it would require no additional worker training. However, new packaging would be needed. The total variable cost to produce the teddy bears $3.00. Fixed costs would increase by $93,000 per year for the lease of the packaging equipment and Quality estimates it could produce and sell 9,750 teddy bears per year. Finished teddy bears could be sold for $18.00 each Calculate the effect on operating income. Round your answers to the nearest dollar. Sell at Split-Off Process Further Should Quality continue to sell the scrap cloth or should Quality process the scrap into teddy bears to sell? Sell the Scrap Check My War What costs would be associated with deciding to sell at the split-off? What costs would be involved with processing further? This involves units seld and other per units amounts. How would these tems (for each scenario) affect operating Income