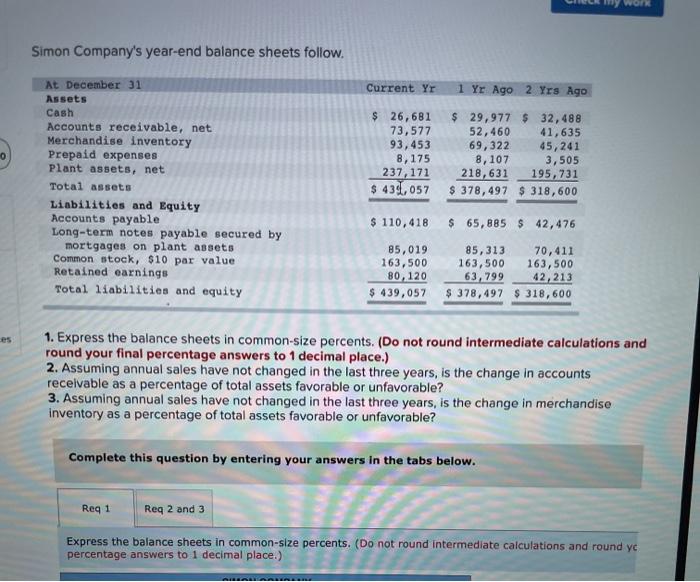

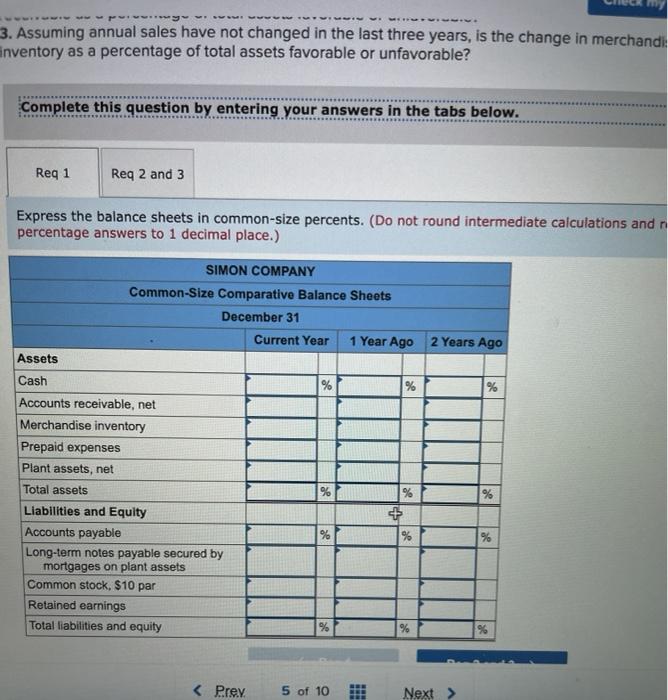

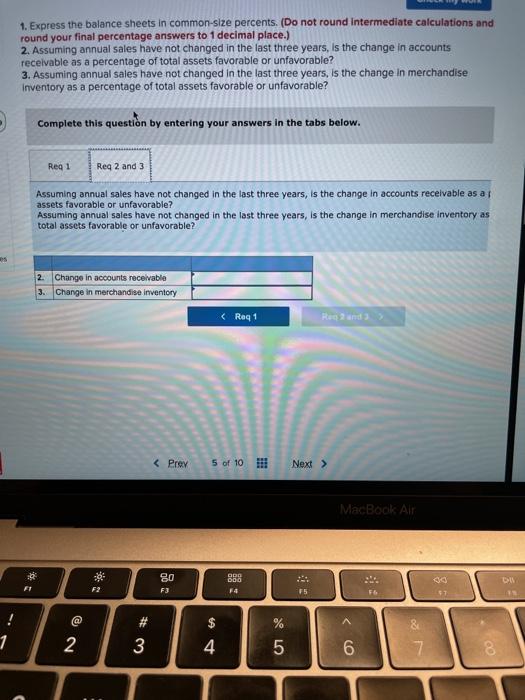

WOR Simon Company's year-end balance sheets follow, Current Yr 1 Yr Ago 2 Yrs Ago 0 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 26,681 73,577 93,453 8,175 237,171 $ 439.057 $ 29,977 $ 32,488 52,460 41,635 69,322 45,241 8,107 3,505 218,631 195,731 $ 378,497 $ 318,600 $ 110,418 $ 65,885 $ 42, 476 85,019 163,500 80,120 $ 439,057 85,313 70,411 163,500 163,500 63,799 42,213 $ 378,497 $ 318,600 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round yc percentage answers to 1 decimal place.) 3. Assuming annual sales have not changed in the last three years, is the change in merchandi inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets % % % % % % Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity + % % % 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise Inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as total assets favorable or unfavorable? 2. Change in accounts receivable 3. Change in merchandise inventory MacBook Air OD 80 060 1 F3 F4 75 F6 97 ! @ $ 1 # 3 2 % 5 4 6 o N 8