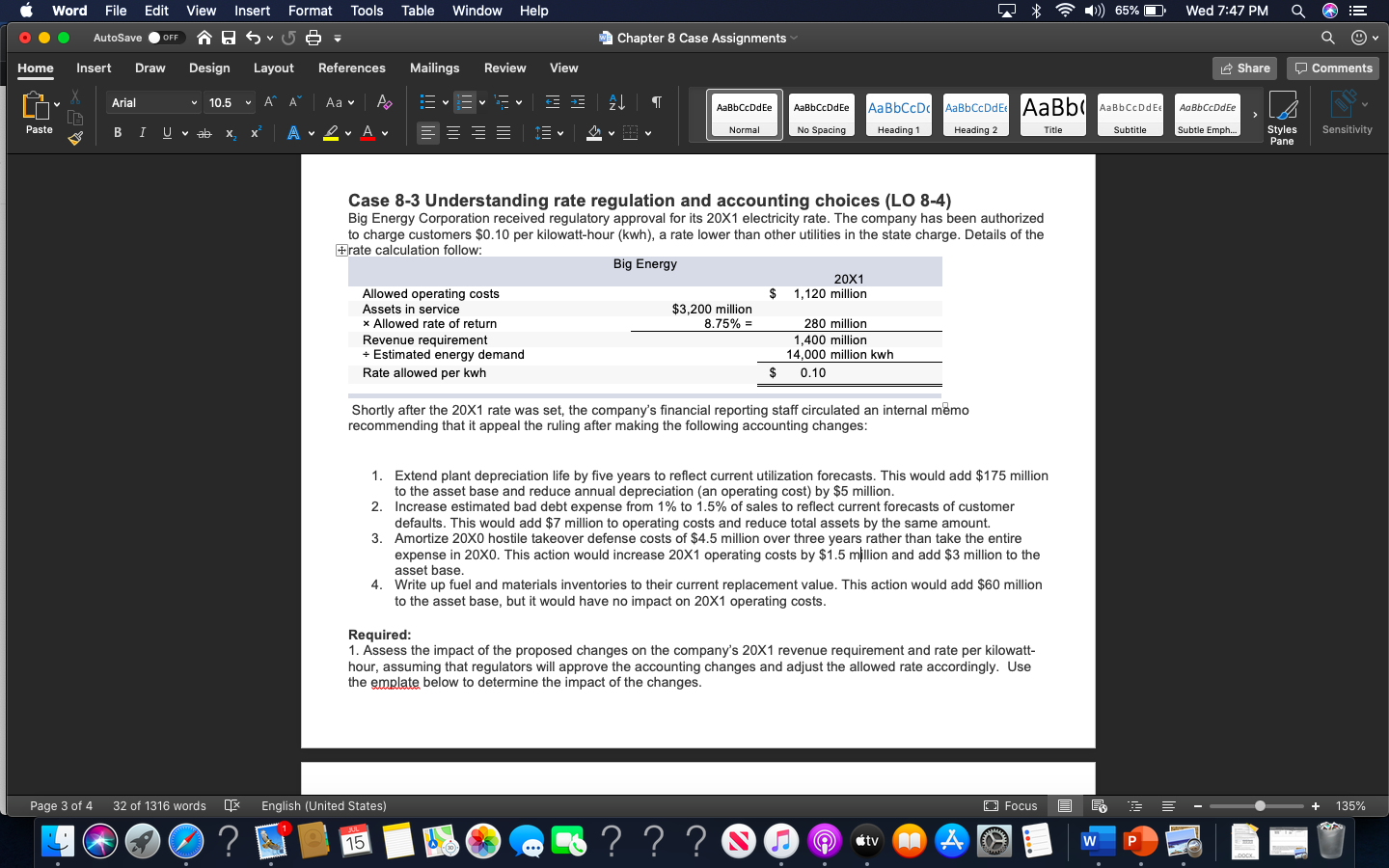

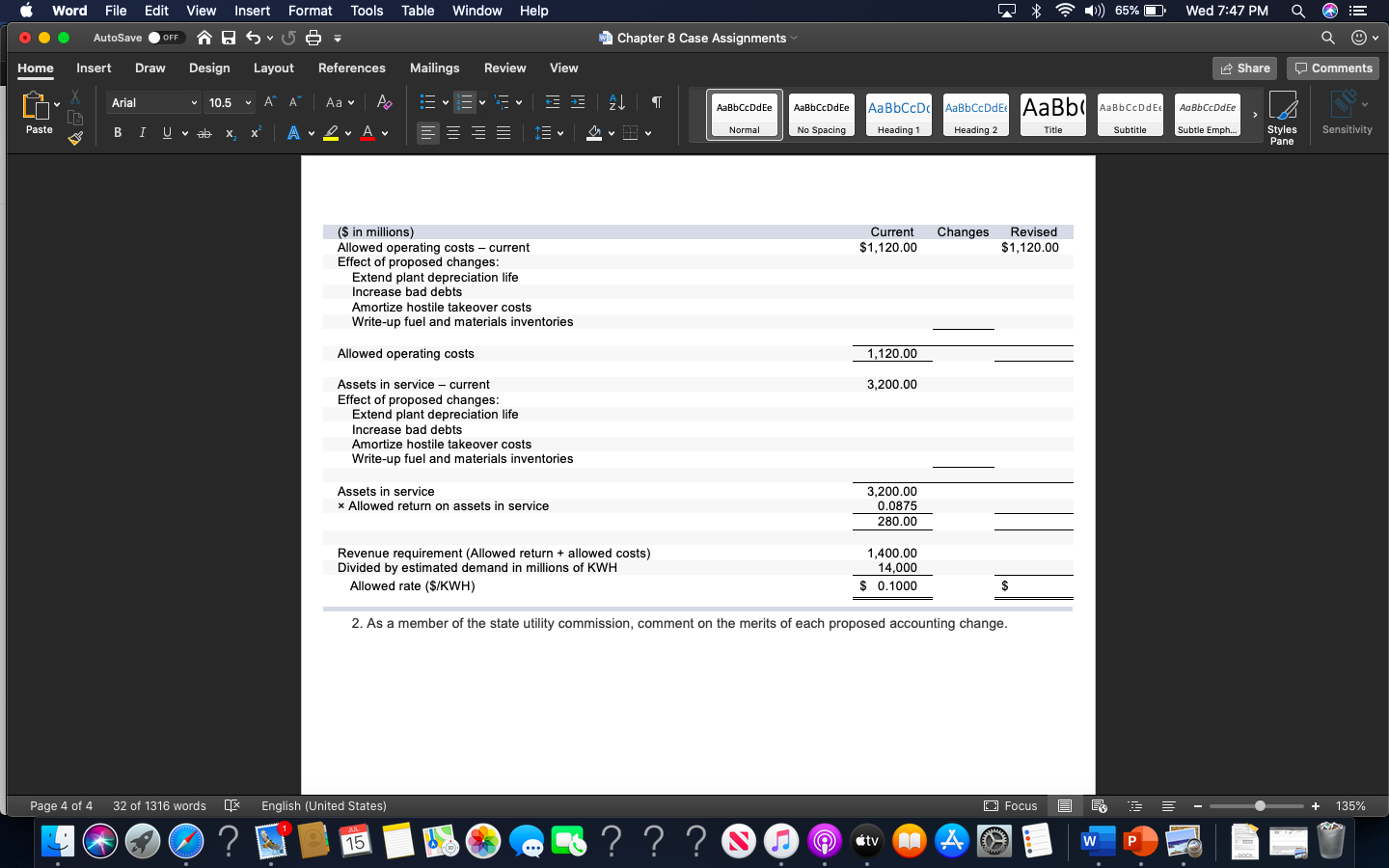

Word File Edit Tools Table Window Help 65% Wed 7:47 PM a View Insert Format Sve = AutoSave OFF w Chapter 8 Case Assignments Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 10.5 A A Aa A I AaBbDdEe AaBbcDdEe Aa BbCcDc AaBbCcDdEt AaBb AaBb CcDdEt Aa Bb CcDdEe Paste I Normal U v ab X X APA No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity Case 8-3 Understanding rate regulation and accounting choices (LO 8-4) Big Energy Corporation received regulatory approval for its 20X1 electricity rate. The company has been authorized to charge customers $0.10 per kilowatt-hour (kwh), a rate lower than other utilities in the state charge. Details of the #rate calculation follow: Big Energy 20x1 Allowed operating costs $ 1,120 million Assets in service $3,200 million * Allowed rate of return 8.75% = 280 million Revenue requirement 1,400 million + Estimated energy demand 14,000 million kwh Rate allowed per kwh $ 0.10 Shortly after the 20X1 rate was set, the company's financial reporting staff circulated an internal memo recommending that it appeal the ruling after making the following accounting changes: 1 Extend plant depreciation life by five years to reflect current utilization forecasts. This would add $175 million to the asset base and reduce annual depreciation (an operating cost) by $5 million. 2. Increase estimated bad debt expense from 1% to 1.5% of sales to reflect current forecasts of customer defaults. This would add $7 million to operating costs and reduce total assets by the same amount. 3. Amortize 20x0 hostile takeover defense costs of $4.5 million over three years rather than take the entire expense in 20X0. This action would increase 20X1 operating costs by $1.5 million and add $3 million to the asset base. 4. Write up fuel and materials inventories to their current replacement value. This action would add $60 million to the asset base, but it would have no impact on 20X1 operating costs. Required: 1. Assess the impact of the proposed changes on the company's 20X1 revenue requirement and rate per kilowatt- hour, assuming that regulators will approve the accounting changes and adjust the allowed rate accordingly. Use the emplate below to determine the impact of the changes. Page 3 of 4 32 of 1316 words English (United States) O Focus 135% ( . ? 15 ? ? ? tv W P Word File Edit Tools Table Window Help 65% 1 Wed 7:47 PM a View Insert Format Sve = AutoSave OFF w Chapter 8 Case Assignments Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 10.5 A A Aa v A v T. AaBbCcDdEP AaBbcDdEe Aa BbCcDc AaBbCcDdEt AaBb AaBb CcDdEt Aa Bb CcDdEe Paste I U v ab X X AvvA Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity Changes Current $1,120.00 Revised $1,120.00 ($ in millions) Allowed operating costs current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Allowed operating costs 1,120.00 3,200.00 Assets in service - current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Assets in service * Allowed return on assets service 3,200.00 0.0875 280.00 Revenue requirement (Allowed return + allowed costs) Divided by estimated demand in millions of KWH Allowed rate ($/KWH) 1,400.00 14,000 $ 0.1000 2. As a member of the state utility commission, comment on the merits of each proposed accounting change. Page 4 of 4 32 of 1316 words English (United States) O Focus 135% ? 15 ? ? ? tv W P