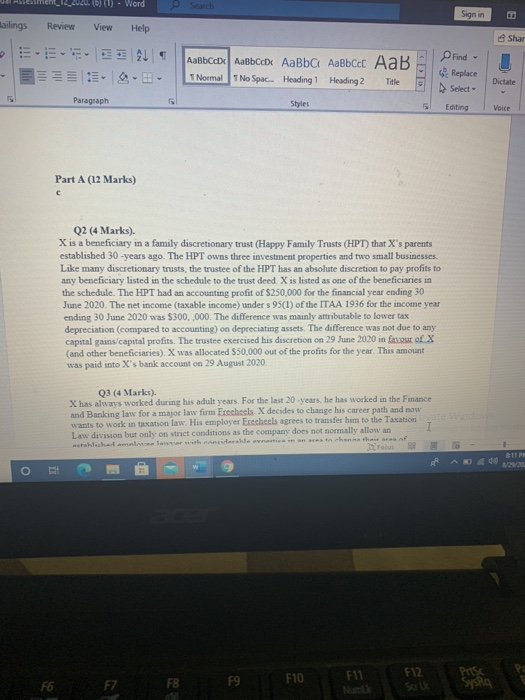

Word Search Sign in Lailings Review View Help Shar Aabbcc AaBbccb AaBbci AaBbcc AaB T No Spac. Heading 1 Heading 2 Find Replace Select- 1 Normal Title Dictate Paragraph Styles Editing Voice Part A (12 Marks) C Q2 (4 Marks). X is a beneficiary in a family discretionary trust (Happy Family Trusts (HPT) that X's parents established 30-years ago. The HPT owns three investment properties and two small businesses Like many discretionary trusts, the trustee of the HPT has an absolute discretion to pay profits to any beneficiary listed in the schedule to the trust deed. X is listed as one of the beneficiaries in the schedule. The HPT had an accounting profit of $250,000 for the financial year ending 30 June 2020. The net income taxable income) under s 95(1) of the ITAA 1936 for the income year ending 30 June 2020 was $300,000. The difference was mainly attributable to lower tax depreciation (compared to accounting) on depreciating assets. The difference was not due to any capital gains capital profits. The trustee exercised his discretion on 29 June 2020 in fasugur of X (and other beneficiaries). X was allocated $50,000 out of the profits for the year. This amount was paid into X's bank account on 29 August 2020 Q3 (4 Marks). X has always worked during his adult years. For the last 20 years, he has worked in the Finance and Banking law for a major law firm Frecheels X decides to change his career path and now wants to work in nation law. His employer Exechcels agrees to transfer him to the Taxation Law division but only on strict conditions as the company does not normally allow an hich with ashleinsten the area groove BIP PC Prisc F11 F12 F10 .F6 F8 F9 Syska Word Search Sign in Lailings Review View Help Shar Aabbcc AaBbccb AaBbci AaBbcc AaB T No Spac. Heading 1 Heading 2 Find Replace Select- 1 Normal Title Dictate Paragraph Styles Editing Voice Part A (12 Marks) C Q2 (4 Marks). X is a beneficiary in a family discretionary trust (Happy Family Trusts (HPT) that X's parents established 30-years ago. The HPT owns three investment properties and two small businesses Like many discretionary trusts, the trustee of the HPT has an absolute discretion to pay profits to any beneficiary listed in the schedule to the trust deed. X is listed as one of the beneficiaries in the schedule. The HPT had an accounting profit of $250,000 for the financial year ending 30 June 2020. The net income taxable income) under s 95(1) of the ITAA 1936 for the income year ending 30 June 2020 was $300,000. The difference was mainly attributable to lower tax depreciation (compared to accounting) on depreciating assets. The difference was not due to any capital gains capital profits. The trustee exercised his discretion on 29 June 2020 in fasugur of X (and other beneficiaries). X was allocated $50,000 out of the profits for the year. This amount was paid into X's bank account on 29 August 2020 Q3 (4 Marks). X has always worked during his adult years. For the last 20 years, he has worked in the Finance and Banking law for a major law firm Frecheels X decides to change his career path and now wants to work in nation law. His employer Exechcels agrees to transfer him to the Taxation Law division but only on strict conditions as the company does not normally allow an hich with ashleinsten the area groove BIP PC Prisc F11 F12 F10 .F6 F8 F9 Syska