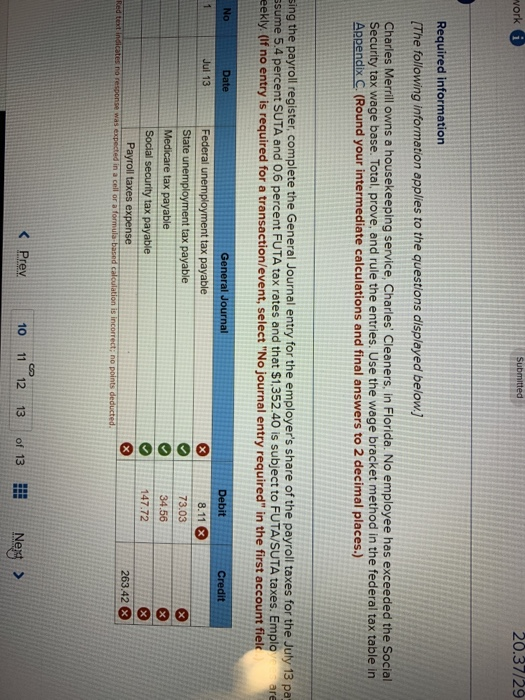

work i Submitted 20.37/29 Required information (The following information applies to the questions displayed below.] Charles Merrill owns a housekeeping service, Charles' Cleaners, in Florida. No employee has exceeded the Social Security tax wage base. Total, prove, and rule the entries. Use the wage bracket method in the federal tax table in Appendix C. (Round your intermediate calculations and final answers to 2 decimal places.) sing the payroll register, complete the General Journal entry for the employer's share of the payroll taxes for the July 13 pa ssume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $1,352.40 is subject to FUTA/SUTA taxes. Emplo a re eekly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account fiele Credit No Date General Journal Jul 13 Federal unemployment tax payable State unemployment tax payable Medicare tax payable Social security tax payable Payroll taxes expense Red text indicates no response was expected in a cell or a formula based calculation is incorrect; no points deducted Debit 8.11 73.03 34.56 147.72 000 263.42 work i Submitted 20.37/29 Required information (The following information applies to the questions displayed below.] Charles Merrill owns a housekeeping service, Charles' Cleaners, in Florida. No employee has exceeded the Social Security tax wage base. Total, prove, and rule the entries. Use the wage bracket method in the federal tax table in Appendix C. (Round your intermediate calculations and final answers to 2 decimal places.) sing the payroll register, complete the General Journal entry for the employer's share of the payroll taxes for the July 13 pa ssume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $1,352.40 is subject to FUTA/SUTA taxes. Emplo a re eekly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account fiele Credit No Date General Journal Jul 13 Federal unemployment tax payable State unemployment tax payable Medicare tax payable Social security tax payable Payroll taxes expense Red text indicates no response was expected in a cell or a formula based calculation is incorrect; no points deducted Debit 8.11 73.03 34.56 147.72 000 263.42