Answered step by step

Verified Expert Solution

Question

1 Approved Answer

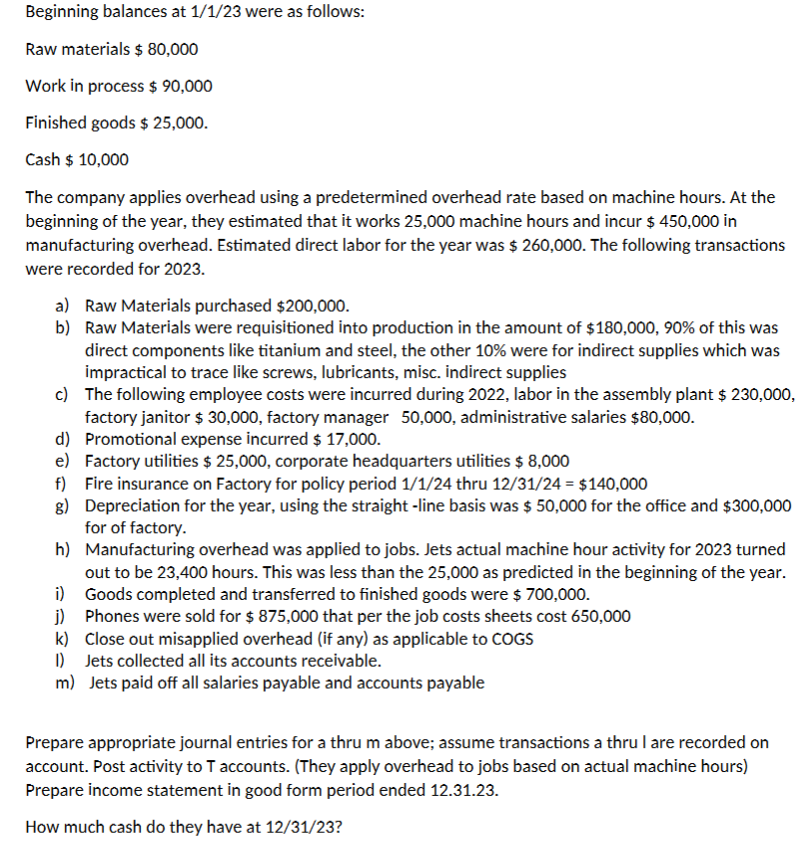

Work in process $90,000 Finished goods $25,000. Cash $10,000 The company applies overhead using a predetermined overhead rate based on machine hours. At the beginning

Work in process $90,000 Finished goods $25,000. Cash $10,000 The company applies overhead using a predetermined overhead rate based on machine hours. At the beginning of the year, they estimated that it works 25,000 machine hours and incur $450,000 in manufacturing overhead. Estimated direct labor for the year was $260,000. The following transactions were recorded for 2023. a) Raw Materials purchased $200,000. b) Raw Materials were requisitioned into production in the amount of $180,000,90% of this was direct components like titanium and steel, the other 10% were for indirect supplies which was impractical to trace like screws, lubricants, misc. indirect supplies c) The following employee costs were incurred during 2022 , labor in the assembly plant $230,000, factory janitor $30,000, factory manager 50,000 , administrative salaries $80,000. d) Promotional expense incurred $17,000. e) Factory utilities $25,000, corporate headquarters utilities $8,000 f) Fire insurance on Factory for policy period 1/1/24 thru 12/31/24 =$140,000 g) Depreciation for the year, using the straight -line basis was $50,000 for the office and $300,000 for of factory. h) Manufacturing overhead was applied to jobs. Jets actual machine hour activity for 2023 turned out to be 23,400 hours. This was less than the 25,000 as predicted in the beginning of the year. i) Goods completed and transferred to finished goods were $700,000. j) Phones were sold for $875,000 that per the job costs sheets cost 650,000 k) Close out misapplied overhead (if any) as applicable to COGS I) Jets collected all its accounts receivable. m) Jets paid off all salaries payable and accounts payable Prepare appropriate journal entries for a thru m above; assume transactions a thru I are recorded on account. Post activity to T accounts. (They apply overhead to jobs based on actual machine hours) Prepare income statement in good form period ended 12.31.23. How much cash do they have at 12/31/23

Work in process $90,000 Finished goods $25,000. Cash $10,000 The company applies overhead using a predetermined overhead rate based on machine hours. At the beginning of the year, they estimated that it works 25,000 machine hours and incur $450,000 in manufacturing overhead. Estimated direct labor for the year was $260,000. The following transactions were recorded for 2023. a) Raw Materials purchased $200,000. b) Raw Materials were requisitioned into production in the amount of $180,000,90% of this was direct components like titanium and steel, the other 10% were for indirect supplies which was impractical to trace like screws, lubricants, misc. indirect supplies c) The following employee costs were incurred during 2022 , labor in the assembly plant $230,000, factory janitor $30,000, factory manager 50,000 , administrative salaries $80,000. d) Promotional expense incurred $17,000. e) Factory utilities $25,000, corporate headquarters utilities $8,000 f) Fire insurance on Factory for policy period 1/1/24 thru 12/31/24 =$140,000 g) Depreciation for the year, using the straight -line basis was $50,000 for the office and $300,000 for of factory. h) Manufacturing overhead was applied to jobs. Jets actual machine hour activity for 2023 turned out to be 23,400 hours. This was less than the 25,000 as predicted in the beginning of the year. i) Goods completed and transferred to finished goods were $700,000. j) Phones were sold for $875,000 that per the job costs sheets cost 650,000 k) Close out misapplied overhead (if any) as applicable to COGS I) Jets collected all its accounts receivable. m) Jets paid off all salaries payable and accounts payable Prepare appropriate journal entries for a thru m above; assume transactions a thru I are recorded on account. Post activity to T accounts. (They apply overhead to jobs based on actual machine hours) Prepare income statement in good form period ended 12.31.23. How much cash do they have at 12/31/23 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started