Question

Work out the premium for the following Credit Default Swap, using the pattern in the note FIN 362 CDS VALUATION and the Excel document CDS

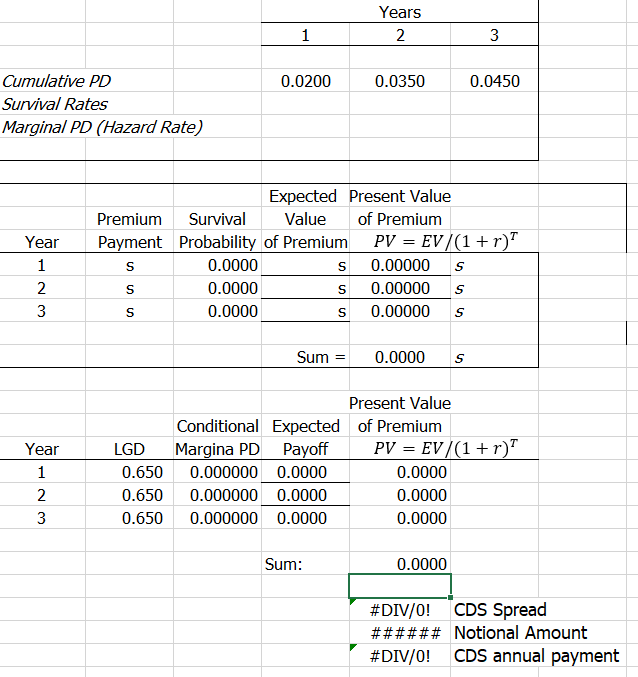

Work out the premium for the following Credit Default Swap, using the pattern in the note FIN 362 CDS VALUATION and the Excel document CDS Pricing Illustration:

Notional Value: $1,000,000: Recovery Rate: 0.35; Discount rate: 2.5%

Suppose X is a protection buyer and Y is the protection seller for the 3-year credit default swap in question #6. Using the CDS premium you calculated in #6, assuming premiums are quoted on annual basis but paid quarterly, describe who pays how much (i.e. how many dollars) to whom in any quarter

a. if there is no credit event:

b. if there is a credit event:

Years 0.0200 0.0350 0.0450 Cumulative PD Survival Rates Marginal PD (Hazard Rate) Year Expected Present Value Premium Survival Value of Premium Payment Probability of Premium PV = EV/(1+r) 0.0000 s 0.00000 s 0.0000 S 0.00000 S 0.0000 s 0.00000 S Sum = 0.0000 Year Present Value Conditional Expected of Premium Margina PD Payoff PV = EV/(1+r) 0.000000 0.0000 0.0000 0.000000 0.0000 0.0000 0.000000 0.0000 0.0000 LGD 0.650 0.650 0.650 1 2 Sum: 0.0000 #DIV/0! CDS Spread ###### Notional Amount #DIV/0! CDS annual payment Years 0.0200 0.0350 0.0450 Cumulative PD Survival Rates Marginal PD (Hazard Rate) Year Expected Present Value Premium Survival Value of Premium Payment Probability of Premium PV = EV/(1+r) 0.0000 s 0.00000 s 0.0000 S 0.00000 S 0.0000 s 0.00000 S Sum = 0.0000 Year Present Value Conditional Expected of Premium Margina PD Payoff PV = EV/(1+r) 0.000000 0.0000 0.0000 0.000000 0.0000 0.0000 0.000000 0.0000 0.0000 LGD 0.650 0.650 0.650 1 2 Sum: 0.0000 #DIV/0! CDS Spread ###### Notional Amount #DIV/0! CDS annual payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started