Answered step by step

Verified Expert Solution

Question

1 Approved Answer

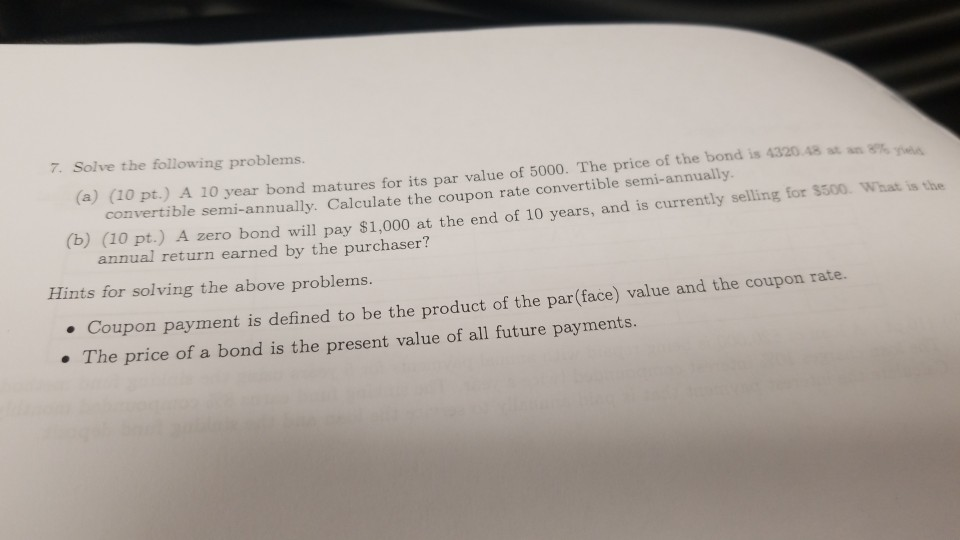

Work please 7. Solve the following problems. (a) (10 pt.) A bon 10 year bond matures for its par value of 5000. The price of

Work please

7. Solve the following problems. (a) (10 pt.) A bon 10 year bond matures for its par value of 5000. The price of the bond is 4320.48 e semi-annually. Calculate the coupon rate convertible semi-annually. zero bond will pay $1,000 at the end of 10 years, and is currently selling for $500. What is the annual return earned by the purchaser? Hints for solving the above problems. Coupon payment is defined to be the product of the par(face) value and the coupon rate. . The price of a bond is the present value of all future paymentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started