Answered step by step

Verified Expert Solution

Question

1 Approved Answer

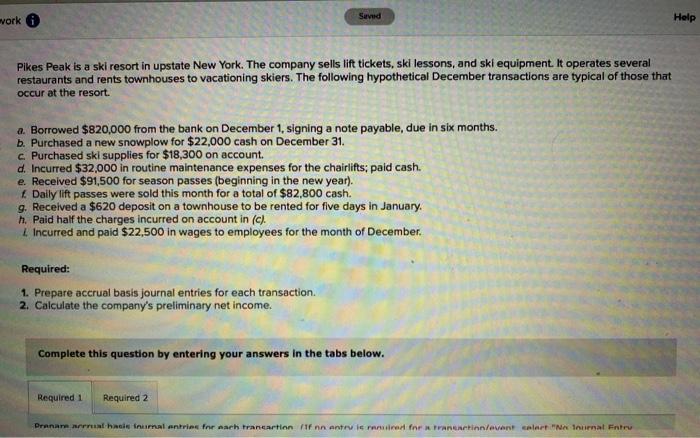

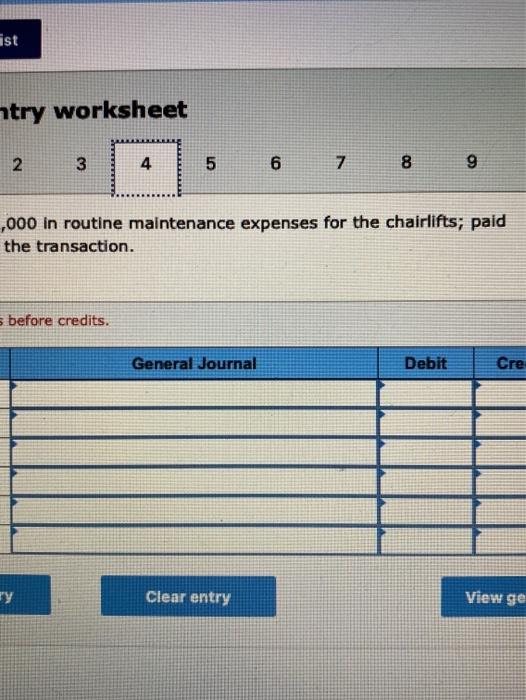

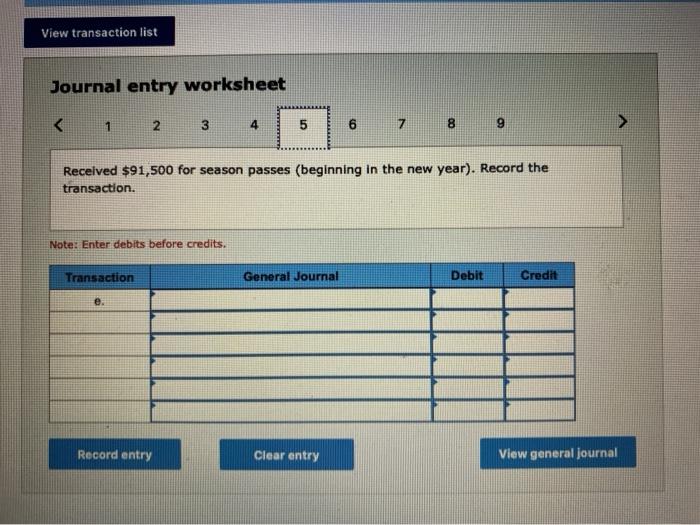

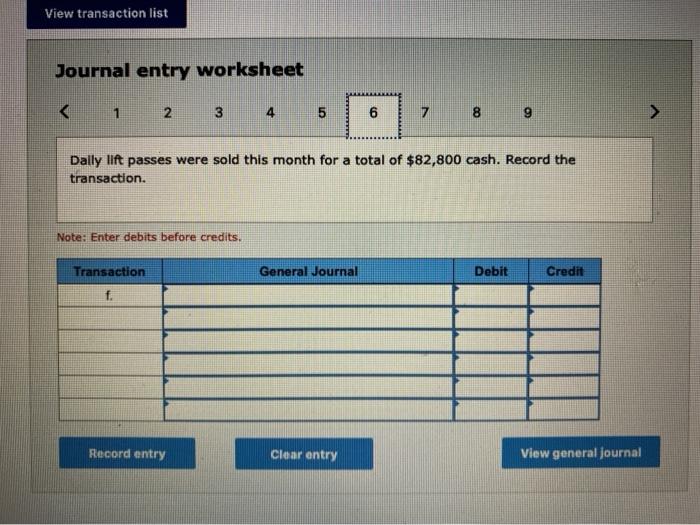

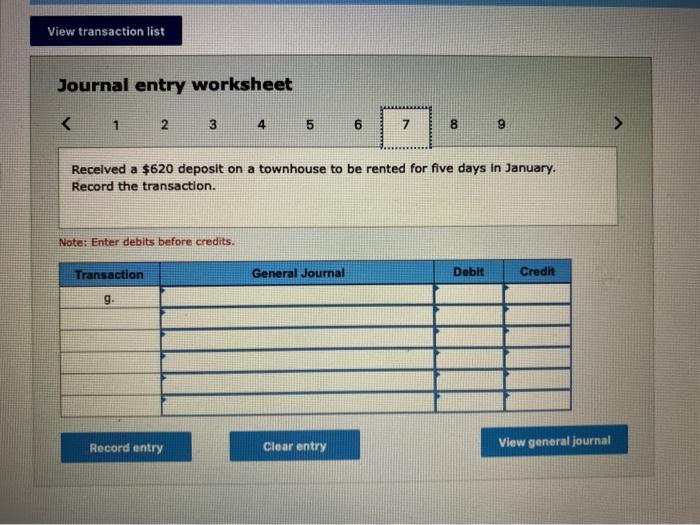

work Seved Help Pikes Peak is a ski resort in upstate New York. The company sells lift tickets, ski lessons, and ski equipment. It operates

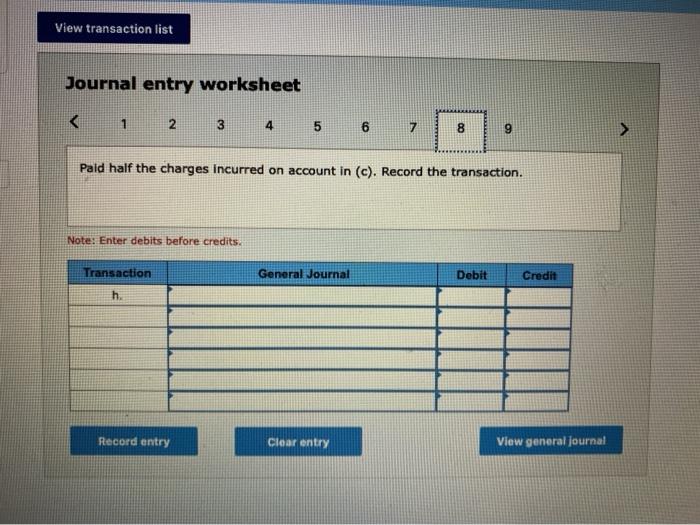

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

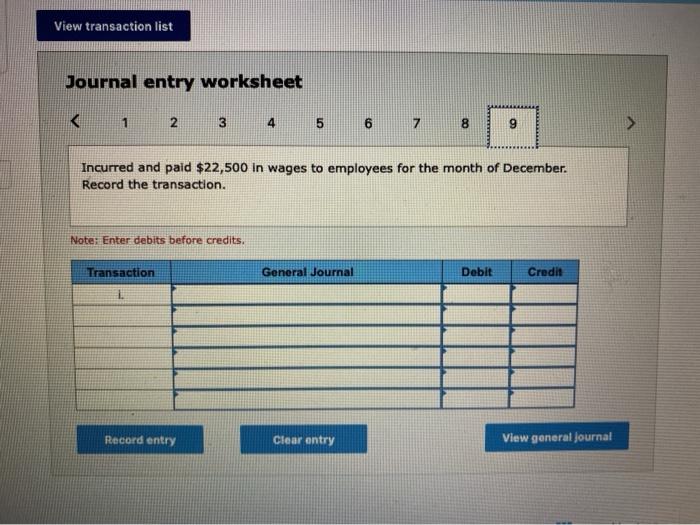

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started