Answered step by step

Verified Expert Solution

Question

1 Approved Answer

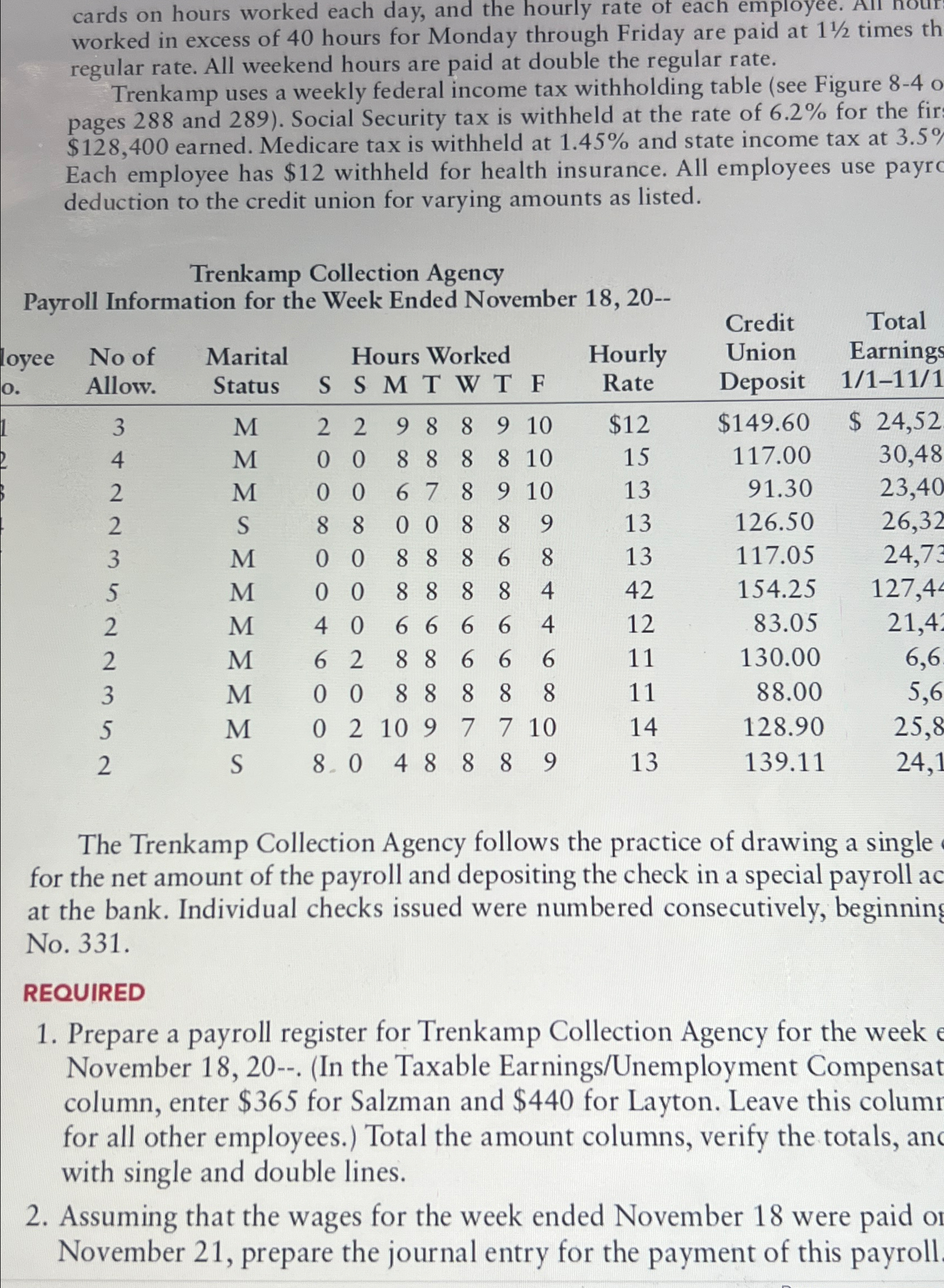

worked in excess of 4 0 hours for Monday through Friday are paid at 1 1 2 times th regular rate. All weekend hours are

worked in excess of hours for Monday through Friday are paid at times th regular rate. All weekend hours are paid at double the regular rate.

Trenkamp uses a weekly federal income tax withholding table see Figure pages and Social Security tax is withheld at the rate of for the fir $ earned. Medicare tax is withheld at and state income tax at Each employee has $ withheld for health insurance. All employees use payr deduction to the credit union for varying amounts as listed.

Trenkamp Collection Agency

Payroll Information for the Week Ended November

tabletableNo ofAllowtableMaritalStatusmedFtableHourlyRatetableCreditUnionDeposittableTotalEarningsM$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started