Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Workers planning for their retirement should be aware that retirement benefits depend on age at retirem If a worker begins receiving benefits before his/her normal

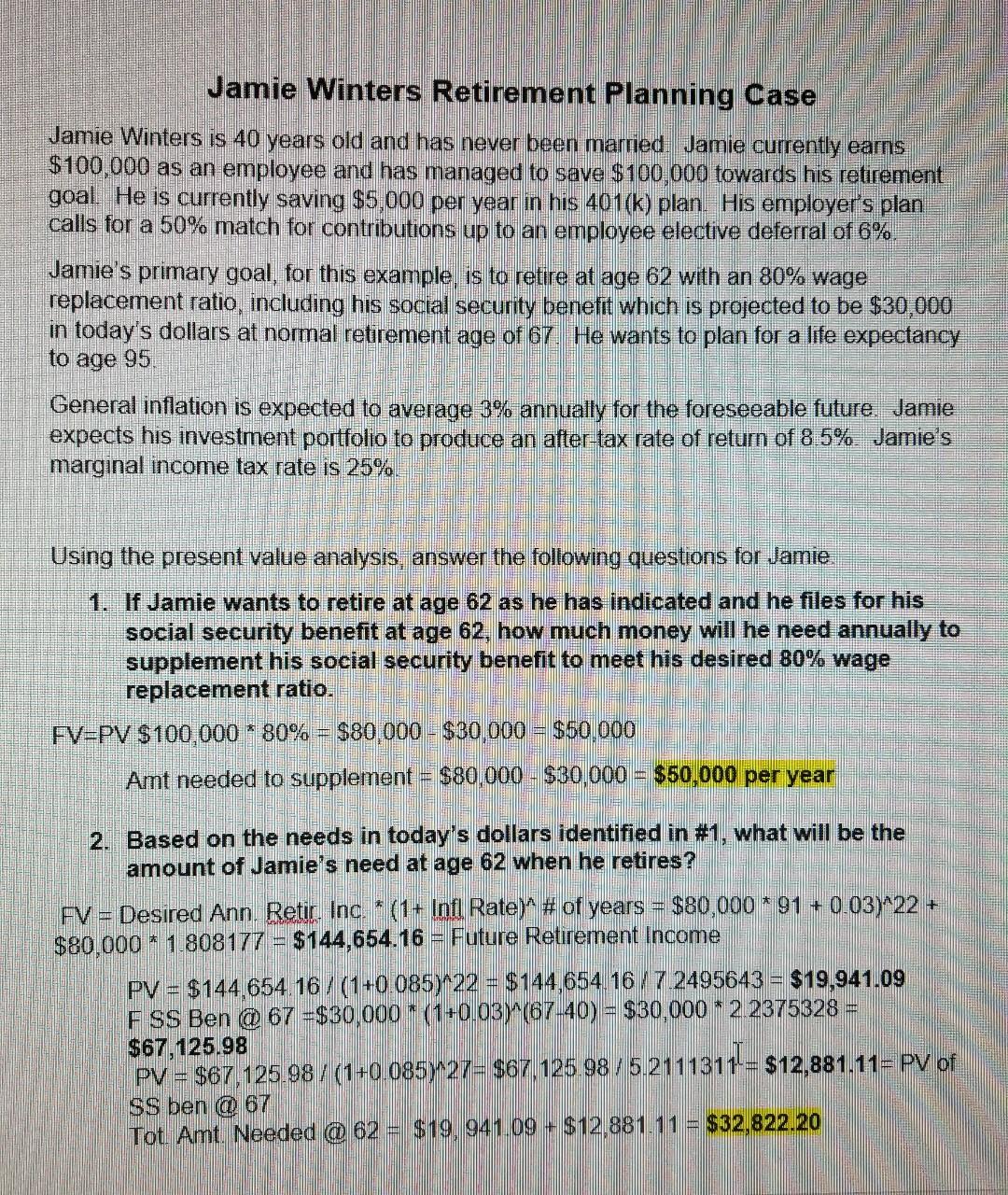

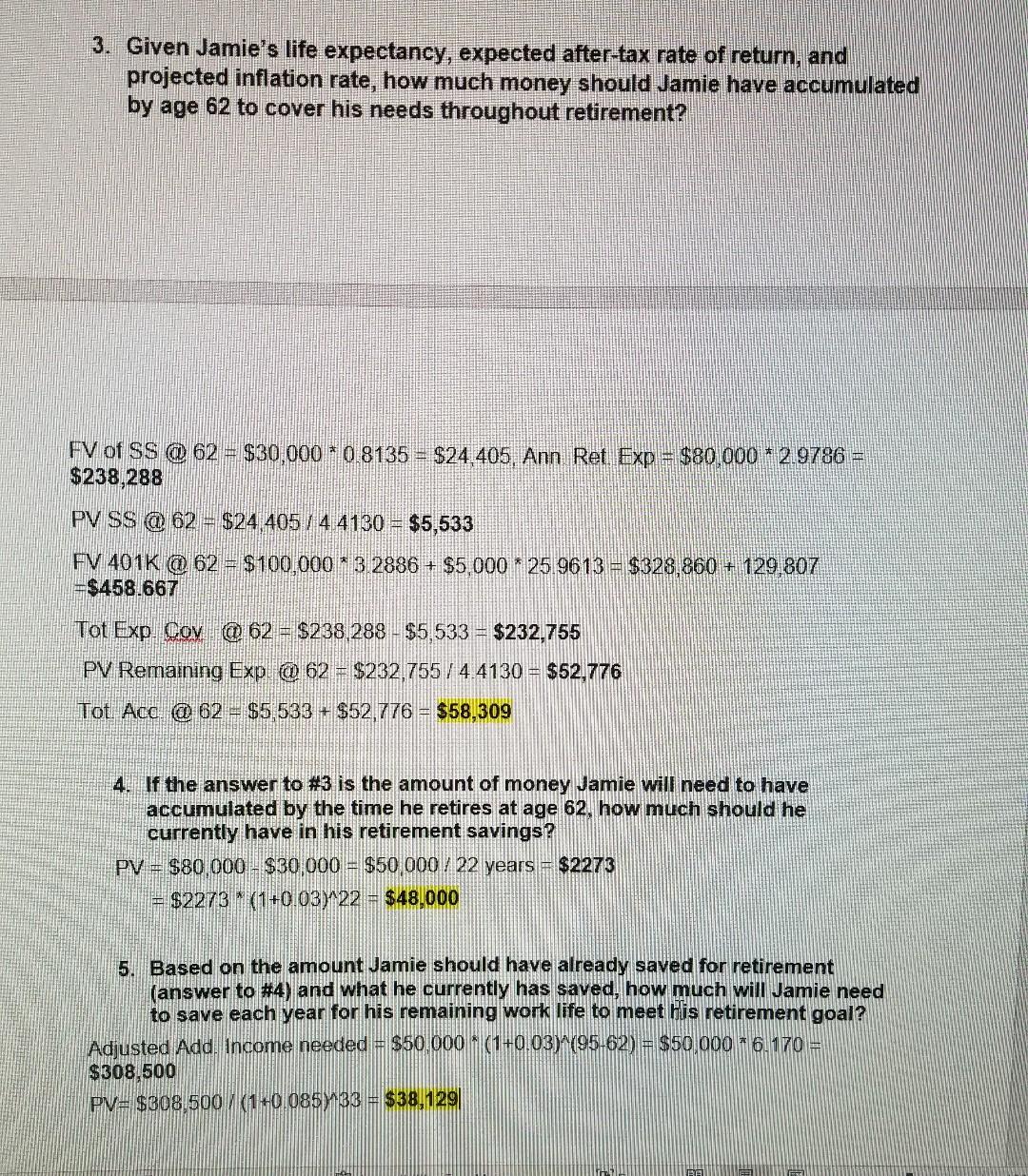

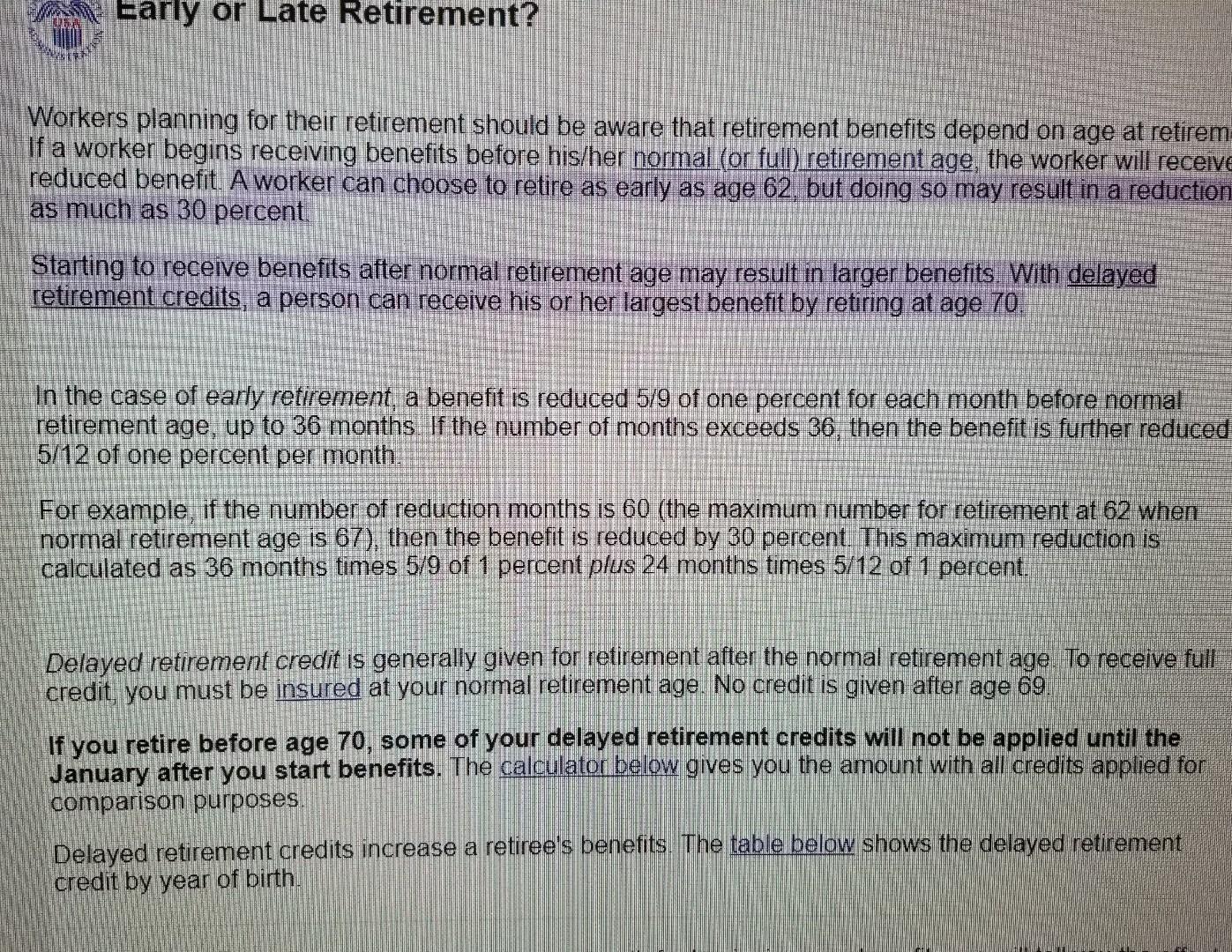

Workers planning for their retirement should be aware that retirement benefits depend on age at retirem If a worker begins receiving benefits before his/her normal (or full) retirement age, the worker will receivi reduced benefit. A worker can choose to retire as early as age 62, but doing so may result in a reduction as much as 30 percent Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70 . In the case of early refirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36 , then the benefit is further reduced 5/12 of one percent per month. For example, if the number of reduction months is 60 (the maximum number for retirement at 62 when normal retirement age is 67 ), then the benefit is reduced by 30 percent. This maximum reduction is calculated as 36 months times 5/9 of 1 percent plus 24 months times 5/12 of 1 percent: Delayed retirement credit is generally given for retirement after the normal retirement age. To receive full credit, you must be insured at your normal retirement age. No credit is given after age 69 . If you retire before age 70 , some of your delayed retirement credits will not be applied until the January after you start benefits. The calculator below gives you the amount with all credits applied for comparison purposes. Delayed retirement credits increase a retiree's benefits. The table below shows the delayed retirement credit by year of birth. Jamie Winters Retirement Planning Case Jamie Winters is 40 years old and has never been married. Jamie currently earns $100,000 as an employee and has managed to save $100,000 towards his retirement goal. He is currently saving $5,000 per year in his 401(k) plan. His employer's plan calls for a 50% match for contributions up to an employee elective deferral of 6% Jamie's primary goal, for this example, is to retire at age 62 with an 80% wage replacement ratio, including his social security benefit which is projected to be $30,000 in today's dollars at normal retirement age of 67 . He wants to plan for a life expectancy to age 95 General inflation is expected to average 3% annualy for the foreseeable future. Jamie expects his investment portfolio to produce an after-tax rate of retum of 85%. Jamie's marginal income tax rate is 25% Using the present value analysis, answer the following questions for Jamie 1. If Jamie wants to retire at age 62 as he has indicated and he files for his social security benefit at age 62 , how much money will he need annually to supplement his social security benefit to meet his desired 80% wage replacement ratio. FV=PV$100,00080%=$80,000$30,000=$50,000 Amt needed to supplement =$80,000$30,000=$50,000 per year 2. Based on the needs in today's dollars identified in #1, what will be the amount of Jamie's need at age 62 when he retires? FV= Desired Ann. Retir. Inc. (1+lnflRate)# of years =$80,00091+0.03)22+ $80,0001.808177=$144,654.16= Future Retirement Income PV=$144,654.16/(1+0.085)22=$144,654.16/7.2495643=$19,941.09FSSBen@67=$30,000(1+0.03)(6740)=$30,0002.2375328=$67,125.98PV=$67,125.98/(1+0.085)27=$67,125.98/5.2111311=$12,881.11=PVofSSben@67TotAmt.Needed@62=$19,941.09+$12.881.11=$32,822.20 Question \#1: First, social security benefits do not inflate if you take them early. They are reduced because you didn't wait until you full retirement age. per https://wwww.ssa.gov/oact/quickcalc/early late. html\#: \%:text=A\%20worker\%20can\%20choose\%20to,by\%20retiring\%20at\%20age\%2070. Since each problem builds off the previous one in this assignment, \#1 is very important. Let me know if that helps redirect your thinking for this problem. 3. Given Jamie's life expectancy, expected after-tax rate of return, and projected inflation rate, how much money should Jamie have accumulated by age 62 to cover his needs throughout retirement? FV of SS @62=$30,00008135=$24,405, Ann Ret Exp =$80,0002.9786= $238,288 PVSS@62=\$24.405/4.4130= $5,533 FV401K@62=\$100,000*32886+\$5,000*25.9613=\$328,860+129,807 =$458.667 Tot Exp. Cov @62=$238,288$5,533=$232,755 PV Remaining Exp @62=$232,755/4.4130=$52,776 Tot Acc @62=$5,533+$52,776=$58,309 4. If the answer to \#3 is the amount of money Jamie will need to have accumulated by the time he retires at age 62 , how much should he currently have in his retirement savings? PV=$80,000$30,000=$50,000/22years=$2273=$2273(1+0.03)2=$48,000 5. Based on the amount Jamie should have already saved for retirement (answer to \#4) and what he currently has saved, how much will Jamie need to save each year for his remaining work life to meet his retirement goal? Adjusted Add. Income needed =$50.000(1+0.03)(95.62)=$50.0006.170= $308,500 PV=$308,500(1+0.085)33=$38,129

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started