Answered step by step

Verified Expert Solution

Question

1 Approved Answer

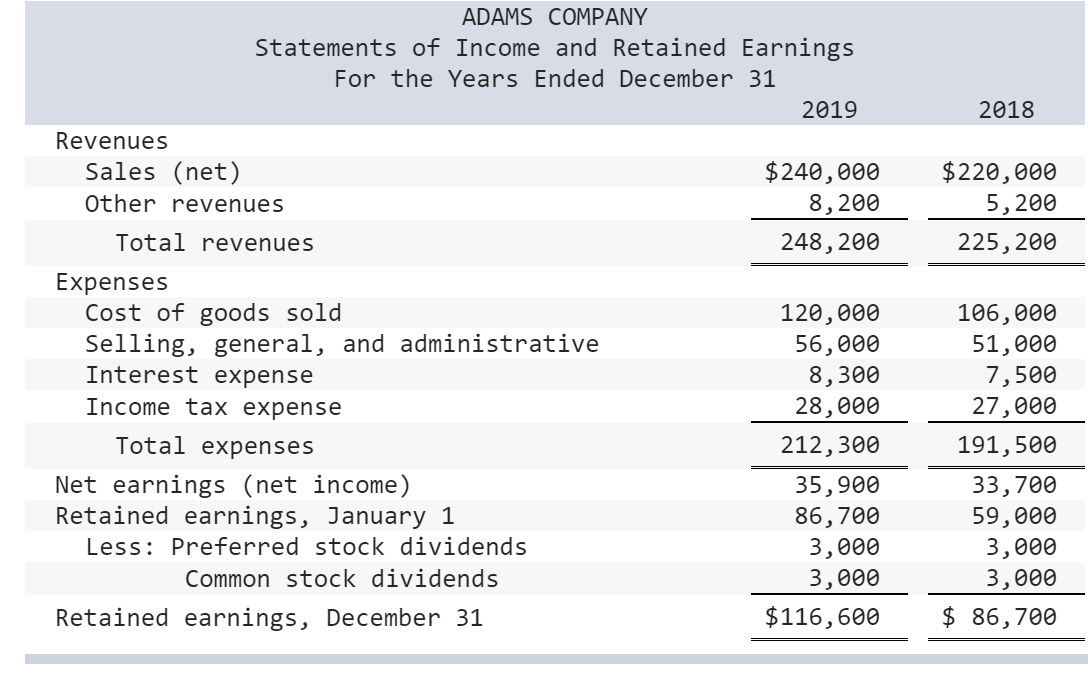

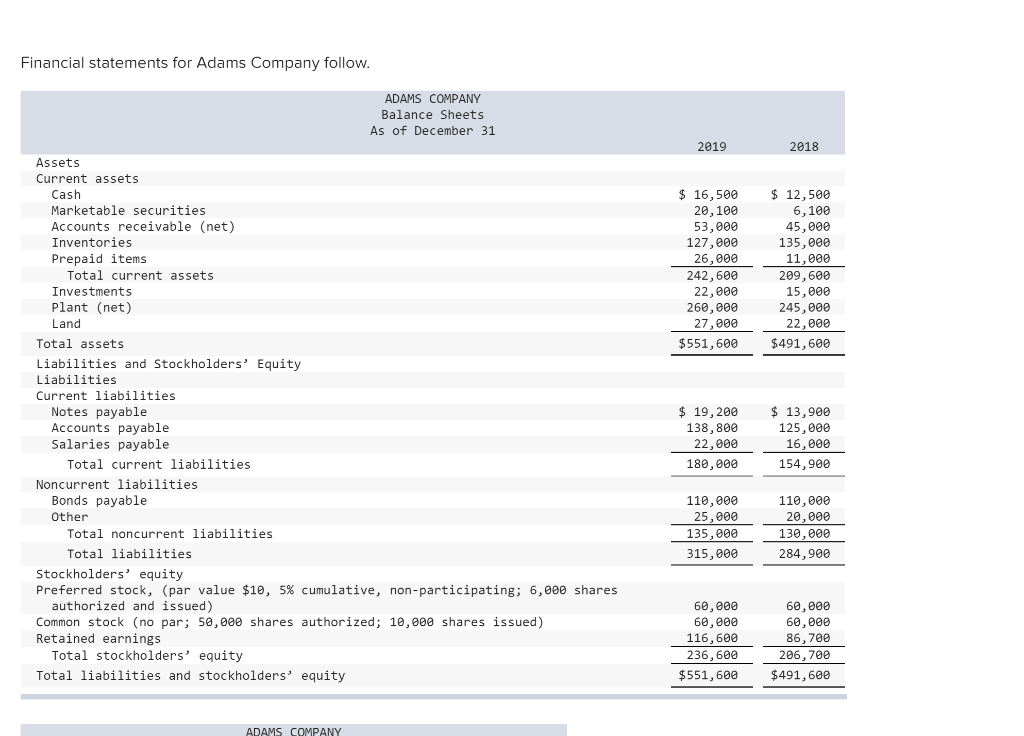

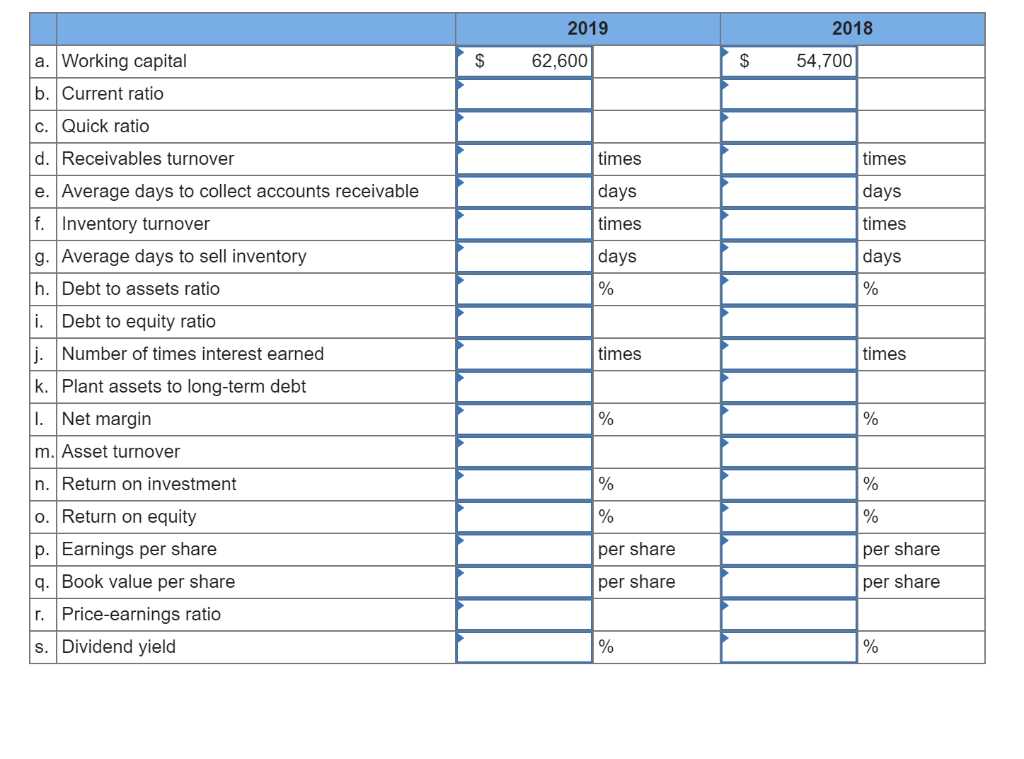

Working capital. Current ratio. (Round your answers to 2 decimal places.) Quick ratio. (Round your answers to 2 decimal places.) Receivables turnover (beginning receivables at

- Working capital.

- Current ratio. (Round your answers to 2 decimal places.)

- Quick ratio. (Round your answers to 2 decimal places.)

- Receivables turnover (beginning receivables at January 1, 2018, were $46,000). (Round your answers to 2 decimal places.)

- Average days to collect accounts receivable. (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.)

- Inventory turnover (beginning inventory at January 1, 2018, was $141,000). (Round your answers to 2 decimal places.)

- Number of days to sell inventory. (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.)

- Debt to assets ratio. (Round your answers to the nearest whole percent.)

- Debt to equity ratio. (Round your answers to 2 decimal places.)

- Number of times interest was earned. (Round your answers to 2 decimal places.)

- Plant assets to long-term debt. (Round your answers to 2 decimal places.)

- Net margin. (Round your answers to 2 decimal places.)

- Turnover of assets. (Round your answers to 2 decimal places.)

- Return on investment. (Round your answers to 2 decimal places.)

- Return on equity. (Round your answers to 2 decimal places.)

- Earnings per share. (Round your answers to 2 decimal places.)

- Book value per share of common stock. (Round your answers to 2 decimal places.)

- Price-earnings ratio (market price per share: 2018, $11.80; 2019, $12.60). (Round your intermediate calculations and final answer to 2 decimal places.)

- Dividend yield on common stock. (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started