Answered step by step

Verified Expert Solution

Question

1 Approved Answer

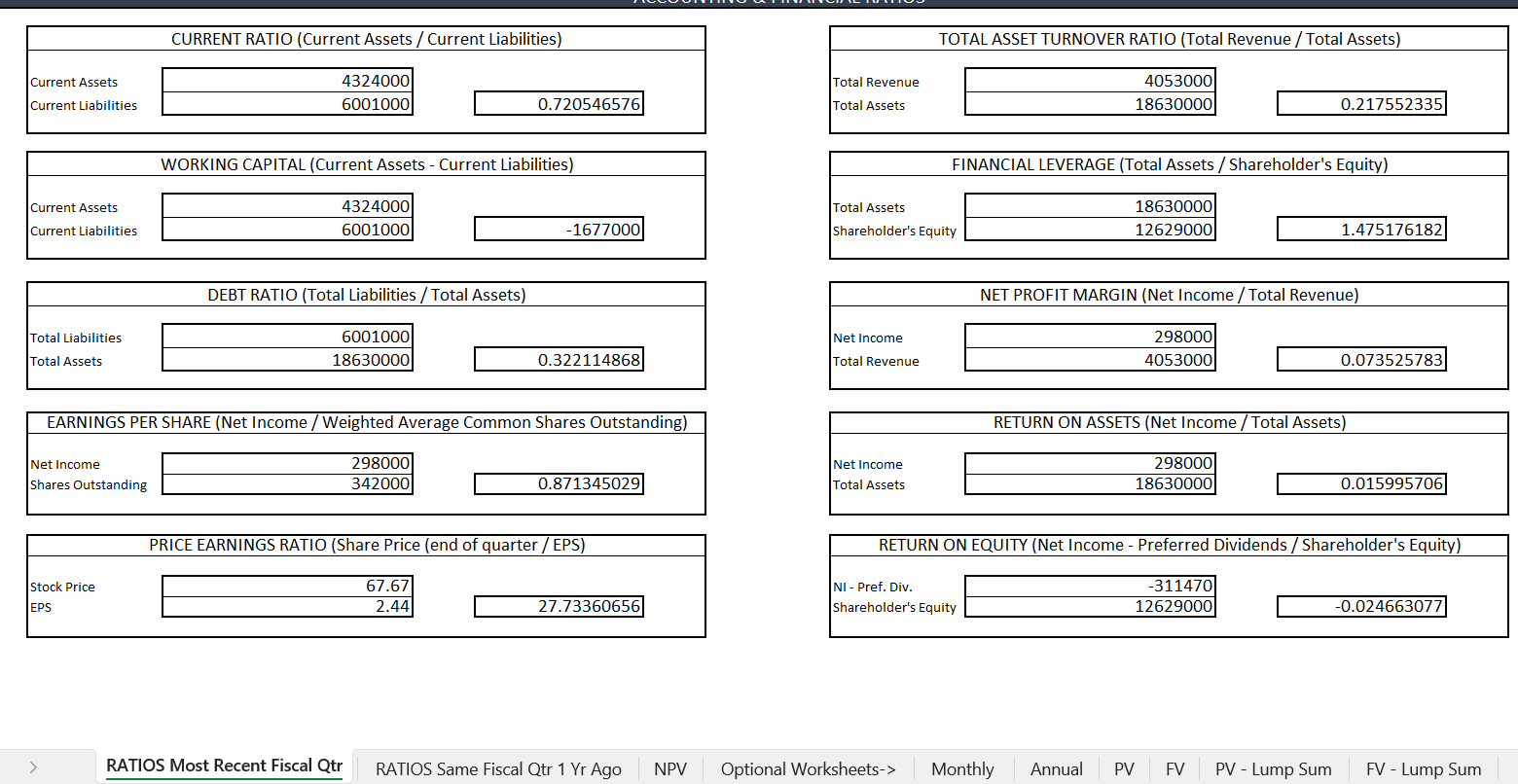

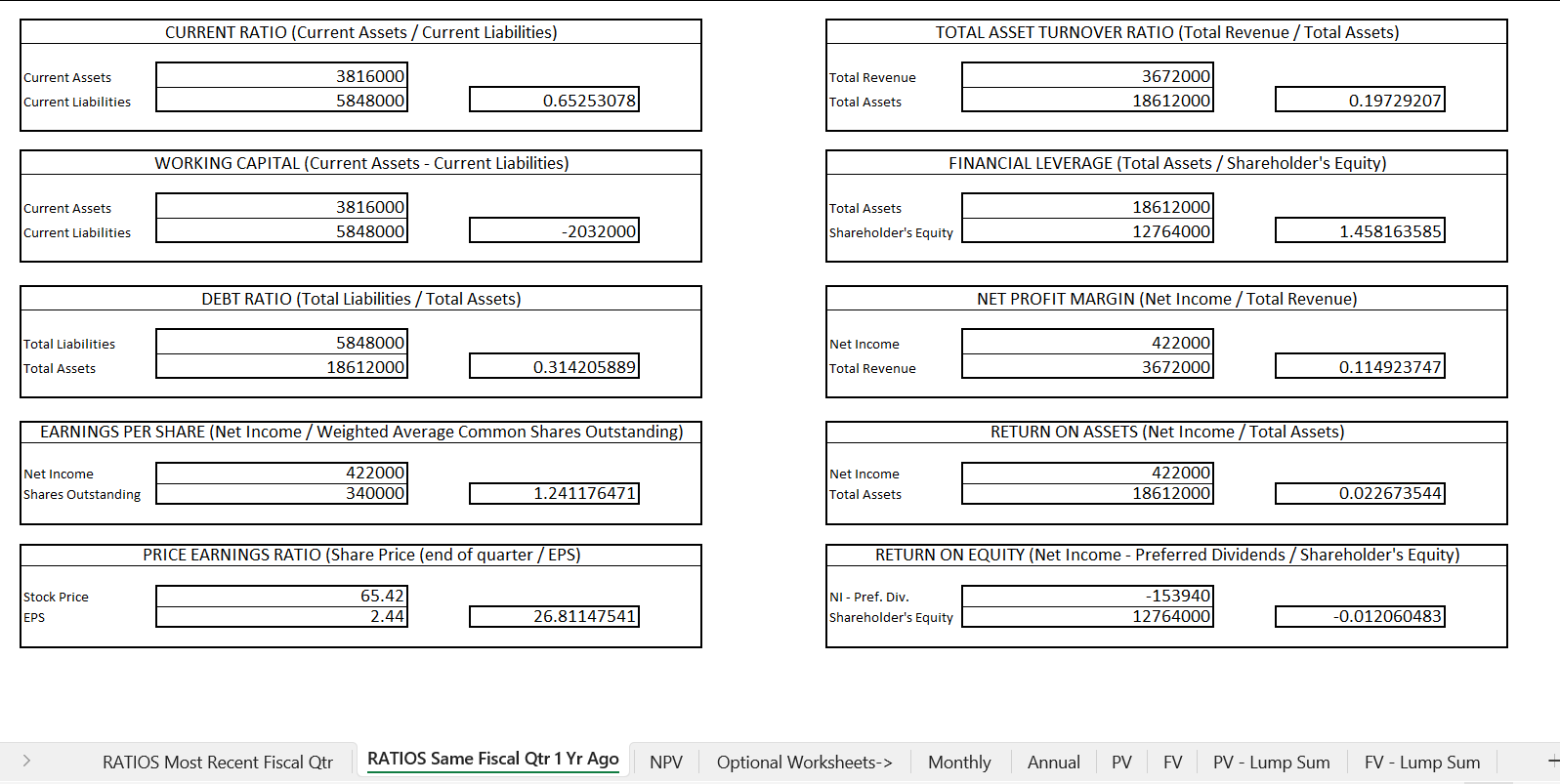

Working Capital Management: Explain the impact of working capital management on the business's operations. Provide examples to support your claims. Financing: Explain how a business

-

- Working Capital Management: Explain the impact of working capital management on the business's operations. Provide examples to support your claims.

- Financing: Explain how a business finances its operations and expansion.

- Short-Term Financing: Explain how potential short-term financing sources could help the business raise funds for improving its financial health. Base your response on the business's current financial information.

- Bond Investment: Discuss the risks and benefits of the business investing in a corporate bond. Include the necessary ethical factors, appropriate calculations, and examples to support your analysis. Use the Project Two Financial Assumptions document and the Bonds section of the Net Present Value (NPV) worksheet in the Project Two Financial Formulas workbook.

- Capital Equipment: Discuss the risks and benefits of the business investing in capital equipment. Include the necessary ethical factors, appropriate calculations, and examples to support your analysis. Use the Project Two Financial Assumptions document and the Equipment section of the Net Present Value (NPV) worksheet in the Project Two Financial Formulas workbook.

- Building: Discuss the risks and benefits of the business investing in a building. Include the necessary ethical factors, appropriate calculations, and examples to support your analysis. Use the Project Two Financial Assumptions document and the Building section of the NPV worksheet in the Project Two Financial Formulas workbook.

- Financial Evaluation: In this section of the report, you will determine which of the three available investments are good financing options and describe the business's likely future financial performance.

- Bond Investment: Determine if the bond investment is a good financing option for the business's financial health. Use your financial analysis and other financial information to support your claims.

- Capital Equipment: Determine if the capital equipment investment is a good financing option for the business's financial health. Use your financial analysis and other financial information to support your claims.

- Building: Determine if the building investment is a good financing option for the business's financial health. Use your financial analysis and other financial information to support your claims.

- Future Financial Considerations: Describe the business's likely future financial performance. Base your description on the business's current financial well-being and risk levels. Use financial information to support your claims.

I have attached picture of the calculations however i need help describing and answering what the results mean to the health of the company. I have also attached a copy of the parts a i am consumed by. please answer for kellogs company and use the numbers given from the spreadsheet imaniges to help.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started