Question

WORKING IS FOR DIFFERENNT Q BUT USE AS REFERNECE OcuPal is a firm that has two divisions: One division (Palantir) sells SaaS (software as a

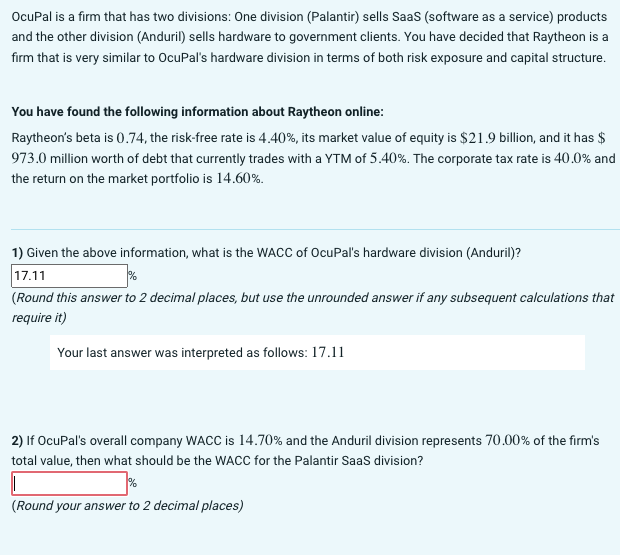

WORKING IS FOR DIFFERENNT Q BUT USE AS REFERNECE OcuPal is a firm that has two divisions: One division (Palantir) sells SaaS (software as a service) products and the other division (Anduril) sells hardware to government clients. You have decided that Raytheon is a firm that is very similar to OcuPal's hardware division in terms of both risk exposure and capital structure. You have found the following information about Raytheon online: Raytheon's beta is 0.74 , the risk-free rate is \4.40, its market value of equity is \\( \\$ 21.9 \\) billion, and it has \\( \\$ \\) 973.0 million worth of debt that currently trades with a YTM of \5.40. The corporate tax rate is \40.0 and the return on the market portfolio is \14.60. 1) Given the above information, what is the WACC of OcuPal's hardware division (Anduril)? \ (Round this answer to 2 decimal places, but use the unrounded answer if any subsequent calculations that require it) Your last answer was interpreted as follows: 17.11 2) If OcuPal's overall company WACC is \14.70 and the Anduril division represents \70.00 of the firm's total value, then what should be the WACC for the Palantir SaaS division? \ (Round your answer to 2 decimal places)

WORKING IS FOR DIFFERENNT Q BUT USE AS REFERNECE OcuPal is a firm that has two divisions: One division (Palantir) sells SaaS (software as a service) products and the other division (Anduril) sells hardware to government clients. You have decided that Raytheon is a firm that is very similar to OcuPal's hardware division in terms of both risk exposure and capital structure. You have found the following information about Raytheon online: Raytheon's beta is 0.74 , the risk-free rate is \4.40, its market value of equity is \\( \\$ 21.9 \\) billion, and it has \\( \\$ \\) 973.0 million worth of debt that currently trades with a YTM of \5.40. The corporate tax rate is \40.0 and the return on the market portfolio is \14.60. 1) Given the above information, what is the WACC of OcuPal's hardware division (Anduril)? \ (Round this answer to 2 decimal places, but use the unrounded answer if any subsequent calculations that require it) Your last answer was interpreted as follows: 17.11 2) If OcuPal's overall company WACC is \14.70 and the Anduril division represents \70.00 of the firm's total value, then what should be the WACC for the Palantir SaaS division? \ (Round your answer to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started