Answered step by step

Verified Expert Solution

Question

1 Approved Answer

working. Martha is dependent on their income for support except for her $531 monthly Social Security benefit. opportunity to work toward her master's degree. They

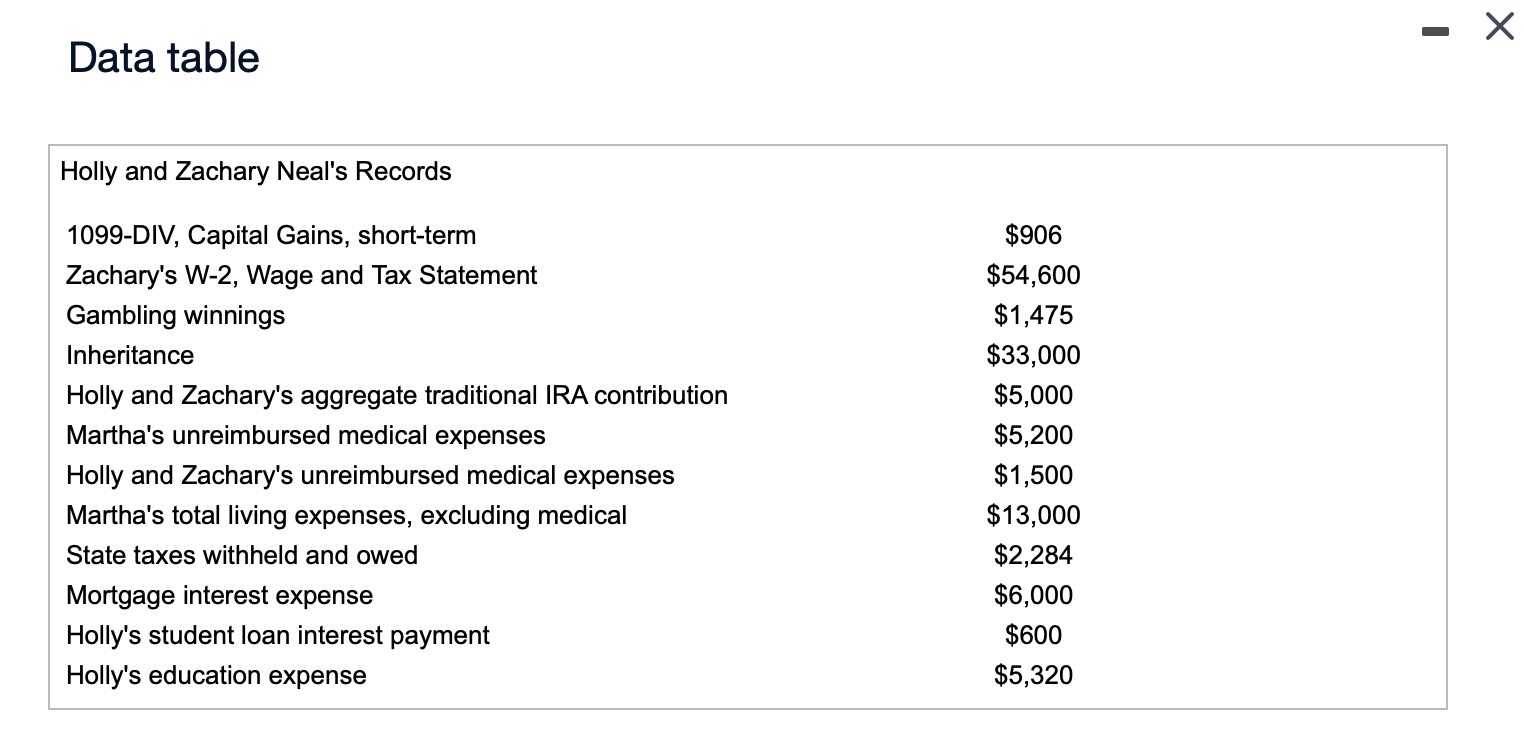

working. Martha is dependent on their income for support except for her $531 monthly Social Security benefit. opportunity to work toward her master's degree. They know they will file jointly but need your help preparing their tax return. They have gathered all of the appropriate records a. Are Martha's unreimbursed medical expense deductible on the Neals' tax return? Why or why not? b. Is Martha required to file a tax return? Why or why not? c. What tax advantage(s), attributable to Holly's education expenses, can the Neals include on their return? d. How much of the total medical expenses will the Neals be able to deduct on their taxes? a. On the Neals' tax return, Martha's unreimbursed medical expenses: (Select the best answer below.) A. are not deductible. Martha does not qualify as a dependent because she is not the child of Holly and Zachary. half of her own living expenses, and is a U.S. citizen. C. are not deductible even if Martha qualifies as a dependent. Zachary and Holly can only claim their own unreimbursed medical expenses. D. are deductible even though Martha does not qualify as a dependent because she provides less than half of her own living expenses and is a U.S. citizen. b. Is Martha required to file a tax return? Why or why not? (Select the best answer below.) filing a separate tax return. B. Martha qualifies as a dependent, but she is still required to file a separate tax return because she received money from Social Security. C. Martha qualifies as a dependent; therefore, no matter how much additional income she may have, she is not required to file a separate tax return. filing a separate tax return. d. Of the total unreimbursed medical expenses, the Neals will be able to deduct $ (Round to the nearest cent.) Data table

working. Martha is dependent on their income for support except for her $531 monthly Social Security benefit. opportunity to work toward her master's degree. They know they will file jointly but need your help preparing their tax return. They have gathered all of the appropriate records a. Are Martha's unreimbursed medical expense deductible on the Neals' tax return? Why or why not? b. Is Martha required to file a tax return? Why or why not? c. What tax advantage(s), attributable to Holly's education expenses, can the Neals include on their return? d. How much of the total medical expenses will the Neals be able to deduct on their taxes? a. On the Neals' tax return, Martha's unreimbursed medical expenses: (Select the best answer below.) A. are not deductible. Martha does not qualify as a dependent because she is not the child of Holly and Zachary. half of her own living expenses, and is a U.S. citizen. C. are not deductible even if Martha qualifies as a dependent. Zachary and Holly can only claim their own unreimbursed medical expenses. D. are deductible even though Martha does not qualify as a dependent because she provides less than half of her own living expenses and is a U.S. citizen. b. Is Martha required to file a tax return? Why or why not? (Select the best answer below.) filing a separate tax return. B. Martha qualifies as a dependent, but she is still required to file a separate tax return because she received money from Social Security. C. Martha qualifies as a dependent; therefore, no matter how much additional income she may have, she is not required to file a separate tax return. filing a separate tax return. d. Of the total unreimbursed medical expenses, the Neals will be able to deduct $ (Round to the nearest cent.) Data table Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started